Company Initiates Institutional ETH Accumulation Strategy

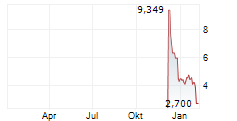

PALO ALTO, Calif., Aug. 12, 2025 /PRNewswire/ -- 180 Life Sciences Corp. (Nasdaq: ATNF), dba ETHZilla (the "Company", "180 Life Sciences" or "ETHZilla"), announced today that is has total holdings of 82,186 Ether ("ETH") at an average acquisition price of $3,806.71, which is now valued at approximately $349 million. In addition to the ETH, ETHZilla holds approximately $238 million in USD cash equivalents.

"At ETHZilla we have put over $350 million in capital to work since the PIPE transaction we completed last week, and have executed on our strategy to rapidly build a differentiated Ethereum treasury vehicle," said McAndrew Rudisill, Executive Chairman of the Company. "Importantly, we believe that this reserve of ETH will unlock cash flow for our shareholders as we seek to deliver on our on-chain yield generation program through our external asset manager Electric Capital."

Below is a summary of ETHZilla's current ETH position and key metrics as of August, 11, 2025, except for our shares outstanding which is as of August 5, 2025:

- Total ETH & ETH Equivalents Held: 82,186

- Total ETH & ETH Equivalents Held (USD): approximately $349 million

- Total USD Cash Equivalents: approximately $238 million

- Total Shares Outstanding: 154.032 million

The most recently purchased ETH is expected to be held long-term and staked to Electric Capital's own proprietary Ethereum network strategies to generate yield.

The Company will continue to provide updates to its Treasury and on chain yield generation strategies, through public releases and regulatory filing(s), as available.

About 180 Life Sciences (d/b/a ETHZilla)

The Company plans to rebrand as ETHZilla Corporation and has developed an institutional vehicle for Ether (ETH) accumulation. ETHZilla aims to become a benchmark for onchain treasury management among public companies. This strategy will be built for the Ethereum community, by the community.

Through its partnership with Electric Capital, ETHZilla's treasury strategy aims to pursue a differentiated yield generation program meant to outperform traditional ETH staking. The Company is supported by an executive team and DeFi Council that unites capital markets experts, prominent Ethereum engineers, top-tier DeFi founders, infrastructure pioneers and other ecosystem heavyweights.

The Company, originally formed as an innovative biotechnology company, has also been evolving its business towards software enabled gaming and entertainment. In addition to its newly disclosed ETH treasury strategy, and its plans to monetize its existing biotech assets, 180 Life Sciences continues to maintain and accelerate the deployment and development of its gaming initiatives.

Forward Looking Statements

This press release contains "forward looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding the expected timing and benefits of the previously disclosed PIPE offering, convertible note offering and related transactions, the expected timing and benefits of the Company's rebranding plans, expectations regarding the capitalization, resources and ownership structure of the Company, expectations with respect to future performance, and growth of the Company; the ability of the Company to execute its plans, the Company's plans to continue to purchase ETH, the Company's digital asset treasury strategy, the digital assets to be held by the Company, anticipated yield strategies, and future performance. Forward looking statements are subject to numerous risks and uncertainties, many of which are beyond the Company's control, and actual results may differ materially. Applicable risks and uncertainties include, among others, the risk that the proposed transactions described herein may not be completed in a timely manner or at all; failure to realize the anticipated benefits of the PIPE, convertible notes, and related transactions, including the Company's recent digital asset treasury strategy; the Company's ability to achieve profitable operations; fluctuations in the market price of ETH that will impact the Company's accounting and financial reporting; government regulation of cryptocurrencies and online betting; changes in securities laws or regulations; changes in business, market, financial, political and regulatory conditions; risks relating to the Company's outstanding convertible notes, including the Company's ability to repay such notes, covenants associated therewith and dilution caused by the conversion thereof into common stock, and security interests associated therewith; risks relating to the Company's operations and business, including the highly volatile nature of the price of Ether and other cryptocurrencies; the risk that the Company's stock price may be highly correlated to the price of the digital assets that it holds; risks related to increased competition in the industries in which the Company does and will operate; risks relating to significant legal, commercial, regulatory and technical uncertainty regarding digital assets generally; risks relating to the treatment of crypto assets for U.S. and foreign tax purpose, expectations with respect to future performance, growth and anticipated acquisitions; potential litigation involving the Company or the validity or enforceability of the intellectual property of the Company; global economic conditions; geopolitical events and regulatory changes; access to additional financing, and the potential lack of such financing; and the Company's ability to raise funding in the future and the terms of such funding, including dilution caused thereby, as well as those risks and uncertainties identified and those identified under the heading "Risk Factors" in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2024 and the Company's Quarterly Report on Form 10-Q for the quarter ended June 30, 2025, as well as the supplemental risk factors and other information the Company has or may file with the SEC, including those disclosed under Item 8.01 of the Current Reports on Form 8-K filed by the Company with the SEC on July 30, 2025 and August 11, 2025. Readers are cautioned not to place undue reliance on these statements. Investors should also be aware that under U.S. generally accepted accounting principles (GAAP), certain crypto assets must be measured at fair value, with changes recognized in net income for each reporting period. These fair value adjustments may cause significant fluctuations in the Company's balance sheet and income statement from period-to-period. In addition, for certain crypto assets, including ETH, which the Company holds, impairment charges may be required to be reported in net income if the market price of such assets (including ETH) falls below the cost basis at which those assets are carried on the balance sheet. Readers are encouraged to read the Company's filings with the SEC, available at www.sec.gov, for a discussion of these and other risks and uncertainties. The forward-looking statements in this press release speak only as of the date of this document, and the Company undertakes no obligation to update any forward-looking statements except as required by law. The Company's business is subject to substantial risks and uncertainties, including those referenced above. Investors, potential investors, and others should give careful consideration to these risks and uncertainties.

Media Contact:

Prosek Partners

pro- ETH @prosek.com

Investor Contact:

Prosek Partners

[email protected]

SOURCE 180 Life Sciences Corp.