From evolving household formations to rising wellness demands, America at Home Study offers data-backed and scalable solutions for a foundationally different housing market

SAN DIEGO, CA / ACCESS Newswire / August 20, 2025 / The America at Home Study today released wave four of its groundbreaking consumer research, offering the most comprehensive overview yet of the lasting changes U.S. households are navigating in terms of behavior, attitudes, and home preferences since the pandemic. As the first and only longitudinal, national survey of its kind - with nearly 16,000 respondents across all four waves since March 2020 - wave four provides an urgent and actionable assessment of an American housing landscape shaped by affordability pressures, changing household formations, and a mounting demand for wellness-supportive environments.

Conducted in April/May 2025, and this time in partnership with the Housing Innovation Alliance and the University of Pittsburgh's Mascaro Center for Sustainable Innovation, wave four of the study makes it clear that Americans are navigating a new housing reality. Financial concerns are escalating: 44% of respondents cite "economy/jobs" as their top concern (up 8% from wave three), followed by 27% who point to "housing costs/availability" (up 10%) and 23% who are worried about "higher interest/mortgage rates" (up 7%). Beyond economic anxiety, the data revealed that wellness - across financial, mental, emotional, physical, and environmental domains - continues to be the number one driver of housing decisions.

"Affordability is now the single biggest headwind for the housing industry, but that's only part of the story," said Teri Slavik Tsuyuki, Co-Founder of America at Home, Principal at tsk ink LLC, and Co-Chair of the Global Wellness Institute's Wellness Communities & Real Estate Initiative. "The real crisis is that we're building the wrong product. Homes and communities no longer match how Americans live. It's time for the industry to reckon with that disconnect, stop recycling outdated models, and start meeting consumers where they are right now."

While 94% of Americans still associate "home" with "safety," the meaning of home is growing more complex. Kantar - the world's leading market data and insights company, and a collaborator on the America at Home Study since wave two - brought the power of its MindBase® consumer attitudinal segmentation into the data, exploring post-pandemic consumer sentiment about home and community. The emotional connection to home remains strong, but Kantar's data reveals a major demographic shift: one- and two-person households now make up a majority (64%) of U.S. households. With smaller households and hybrid work now embedded in daily life, the demands on both home and community are changing. Americans are seeking flexible, multi-use spaces that offer enhanced wellness and opportunities for connection.

Building for a Market That Doesn't Exist

As the housing industry grapples with affordability, the problem is being exacerbated by irrelevance. Traditional models of homeownership are buckling under the weight of modern realities. Consumers have altered their aspirations, behaviors, and preferences, yet the homes being built don't reflect these changes.

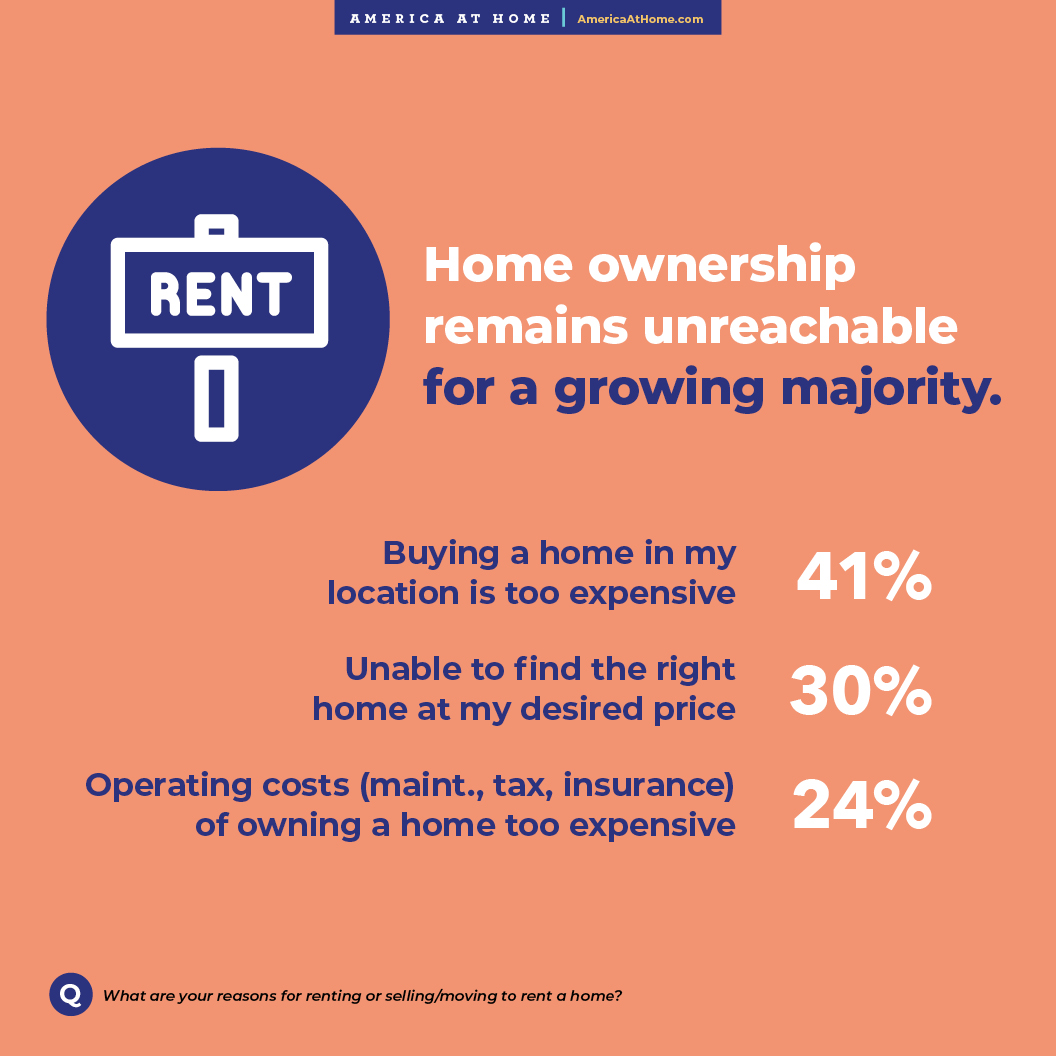

41% of Americans say it's too expensive to buy a home where they want to live

30% can't find the right home at the right price

24% cite ongoing home operating costs like insurance and utilities as a barrier to ownership

21% say that "home" now means "financial burden" (up from 14% in wave three)

30% feel less comfortable about making housing decisions today than in 2022

Nine percent of renters say they no longer aspire to own a home, and there has also been a 3% decline in those who associate "home" with "a place I own" (77%, down from 80%). This data points to a structural crisis. Traditional ownership paths are faltering, yet consumers are open to alternatives.

"Americans aren't giving up on the idea of home, but they're telling us the current system isn't working," said Nancy Keenan, Co-Founder of the America at Home Study and President and CEO of DAHLIN Architecture | Planning | Interiors. "Housing isn't only unaffordable at purchase - it's also unaffordable to live in. As household compositions change and families form later or remain smaller, the homes we're building remain unreachable for a growing majority. If the design doesn't match the needs of the population, then instead of creating housing we're just creating more barriers."

Homes Are Failing the Wellness Test

Wave four confirms that wellness is the top motivator driving housing decisions. However, satisfaction with wellness across all domains is slipping. Financial wellness shows the largest delta: while 87% say it's important, only 45% feel satisfied. This dissatisfaction also extends across mental, emotional, physical, spiritual, social, and environmental domains.

At the community level, wellness is also being redefined. For the first time, "walkability to coffee shops and casual eateries" (49%) has surpassed "trails" (48%) as a top desired feature. Health-related in-home features are gaining traction as well, with demand for whole-house water filtration systems jumping to 70% (up from 43%), and indoor air filtration now important to 69% of respondents (up from 48%). The leading motivation for respondents choosing these features was "improves my health and wellness" (60%, up from 43%).

"Wellness is no longer a perk - it's a baseline expectation," said Slavik-Tsuyuki. "We need homes and communities that support the whole human. Until we acknowledge wellness in all its dimensions, the delta between importance and satisfaction will continue to swell."

Smaller, Smarter, and More Flexible

Americans are not lowering their standards; they're simply reconfiguring them to match new realities. Willingness to accept tradeoffs in order to purchase a home has grown significantly from wave three to wave four:

40% smaller home (up from 21%)

33% smaller or no garage (up from 22%)

25% smaller room sizes (up from 16%)

50% rent-to-own model (up from 33%)

32% modular or manufactured home (up from 22%)

Even with financial constraints, the aspiration for ownership remains: 65% of non-owners say they intend to purchase a home within the next five years, but how they plan to get there looks very different than it did before.

"These aren't compromises," said Keenan. "They're the blueprint for a new kind of housing that actually fits how people live now. We've talked about this shift for years, but now the data confirms it. It's time to work with jurisdictions to make more livable, right-sized homes the norm."

The evolution of consumer priorities opens the door for emerging and established industry professionals to create new ways of developing scalable and sustainable solutions. Achieving this will require deeper collaboration between research, design, and construction, especially in dense urban settings where the challenges and opportunities converge.

"The features, such as home size and modularity, are in alignment with material and construction efficiency," said Melissa Bilec, PhD, co-director, Mascaro Center for Sustainable Innovation, George M. and Eva E. Professor of Civil and Environmental Engineering, University of Pittsburgh. "We are currently studying and assessing how to make these features work and potentially scale in an urban, infill setting."

Americans Know What They Want. They Just Can't Find it.

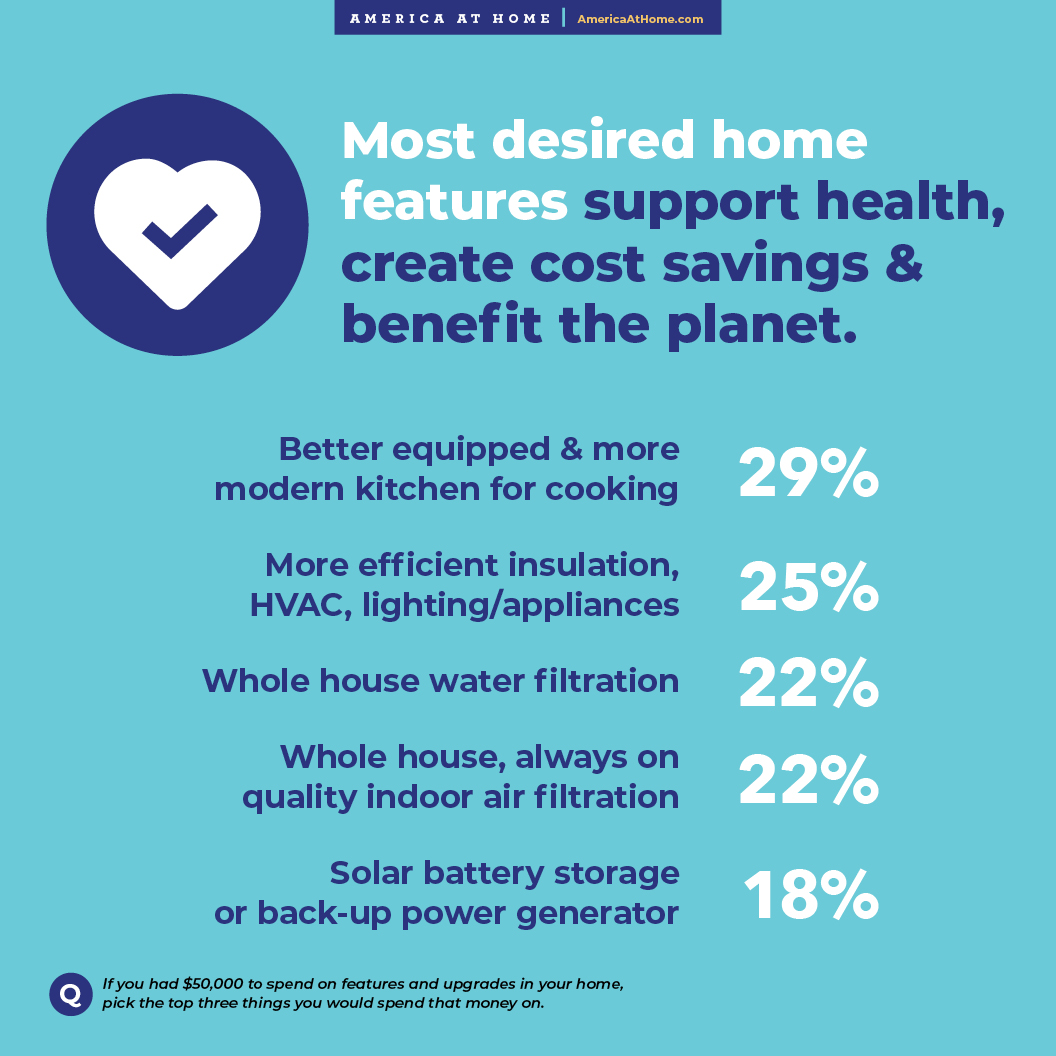

What Americans want from their homes is not extravagant or unattainable. The data shows they seek features that are functional, wellness-driven, and grounded in connection. The top features and upgrades that respondents said they would prioritize to spend money on include:

Better equipped and more modern kitchen for cooking (29%)

Energy efficiency: insulation, HVAC, lighting/appliances (25%)

Clean water: whole house water filtration system (22%)

Clean air: whole house, always on quality indoor air filtration (22%)

Solar battery storage or back-up power generator (18%)

These features speak to many concerns respondents noted throughout the survey, including ongoing home maintenance costs and wellness priorities. The most desired features they would be willing to pay for support their health, create cost savings, and lessen their environmental footprint.

Meanwhile, community amenity priorities reflect a longing for joy, health, and connection. The top five desired community features include:

Access to nature for outdoor activities (54%)

Walkability to coffee shops and casual eateries (49%)

Trails (48%)

Small neighborhood parks with seating and shade (45%)

Large park and event space with open fields and green areas (44%)

"Today's consumers are trading space for experience and connection," said Belinda Sward, Co-Founder of the America at Home Study and Founder of Strategic Solutions Alliance. "People are choosing the casual, welcoming atmosphere of a cozy coffee shop or café that encourages social interaction over invite-only clubhouses that sit empty. They're willing to trade home and yard size for parks, trails, and everyday places where they feel known. That sense of everyday connection to nature and neighbors drives values, belonging, and well-being while reinforcing their sense of safety - the primary way people define home. This is an opportunity for builders and developers to design human-scaled homes and communities that align with real demand and better fit the future."

Designing for a New Reality

Wave four underscores a defining moment for the housing industry. Financial realities, household compositions, and consumer values have undergone a seismic shift, but the industry is clinging to outdated assumptions about who we're building for and why. The America at Home Study offers a way to realign housing with the lives Americans are actually living, shaped by hybrid work, rising wellness expectations, and the urgent need for more attainable, flexible, and supportive living environments.

"If mortgage rates drop tomorrow, it still won't solve the real problem," said Slavik-Tsuyuki. "A majority of people don't want what we're building, and the American Dream no longer fits the mold we keep pushing. If the industry doesn't adapt, homeownership risks becoming a relic of the past. We're at an inflection point, and consumers are telling us what matters. It's time we start listening."

For more information on wave four and additional initiatives from America at Home, visit americaathome.com.

Link to infographics

About the America at Home Study

The America at Home Study was hosted online in four waves, revealing Americans' desire for home purchases, how they feel about and live in their homes, and what changes they'd like to see as a direct result of the COVID-19 pandemic. The first wave took place April 23-30, 2020, with a nationally representative sample of 3,001 consumers 25-74 years of age with household incomes of $50,000+. The second wave took place September 24-November 6, 2020, with 3,935 responses, and the third wave took place October 6-31, 2022, with 3,000 responses. The fourth wave took place April 19 - May 13, 2025, with 6,002 responses. The America at Home Study was spearheaded by community design and marketing expert Teri Slavik-Tsuyuki of tst ink, consumer strategist Belinda Sward of Strategic Solutions Alliance, and architect Nancy Keenan, president and CEO of DAHLIN. The second, third, and fourth waves were further enhanced with Kantar's MindBase®consumer attitudinal and generational segmentation, providing deeper insights across 12 unique consumer targets. americaathome.com

Contact

Katy Biggerstaff

NewGround PR & Media

kbiggerstaff@newgroundco.com

SOURCE: America at Home

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/real-estate/america-at-home-study-releases-wave-four-insights-new-data-reveals-housing-and-communit-1063176