PRESS RELEASE

European refiners may hold the key to scaling green hydrogen, says Wood Mackenzie

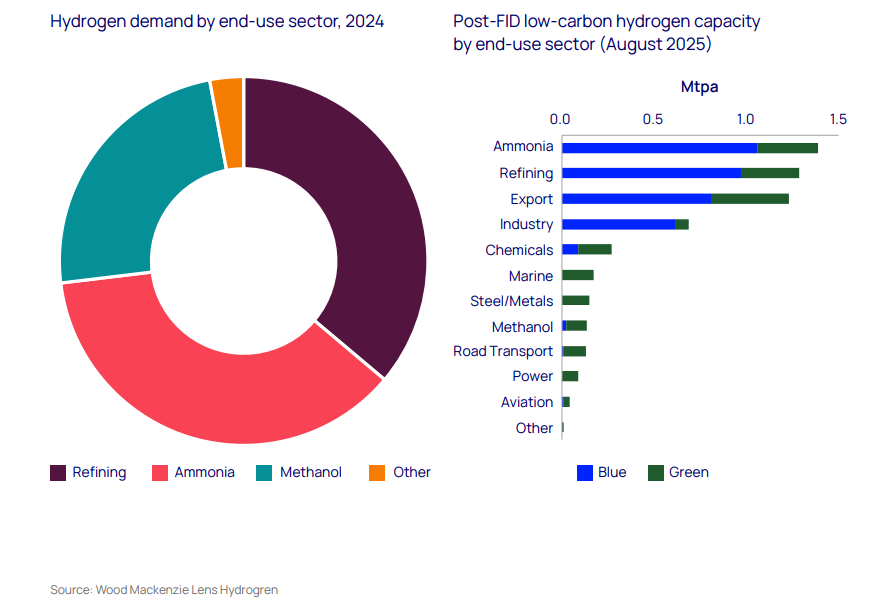

• Globally, refining currently accounts for 36% of all hydrogen demand

• EU regulations favor green over blue hydrogen

• Strong policy is needed to reach targets and costs must come down

• Marine and aviation sectors offer significant growth potential

LONDON/HOUSTON/SINGAPORE, 21 August 2025 - High costs have kept green hydrogen projects from taking off, but new regulations in the European Union's (EU) refining sector offers a solution to launching this carbon friendly technology at scale, according to a new Horizons report from Wood Mackenzie.

According to the report, "Isn't it ironic? How Europe's oil refiners could offer a route to scale up green hydrogen", European refiners are set to require ~0.5 million tonnes of green hydrogen annually by 2030 to comply with EU regulations, replacing about 30% of current CO2-emitting hydrogen production. Refining represents one of the largest hydrogen opportunities globally, which, alongside ammonia and methanol production, accounts for 98% of current demand.

The latest revision of the EU's Renewable Energy Directive (known as RED III), favors green hydrogen over blue hydrogen, helping to minimise the delays and cancellations now all too common when it comes to green hydrogen globally.

"European refiners are set to become significant producers or buyers of green hydrogen, initially to decarbonise the refining sector and its derivatives as fuel for marine and aviation," said Alan Gelder. "Numerous green hydrogen projects have already targeted the sector."

The report finds that of the 6 Mtpa of low-carbon hydrogen capacity that has taken a final investment decision (FID), European refineries have already committed more than US$5 billion of capital.

Refiners demonstrate strongest market appetite

Recent EU Hydrogen Bank auction results reveal refineries' commitment to green hydrogen adoption, with the sector showing the highest willingness to pay premium prices at an average levelised cost of hydrogen of US$9.23/kg - demonstrating their requirement to meet regulatory mandates. This compares favorably with Wood Mackenzie's asset-level modeling of refinery-targeted projects, which produces costs of US$7.04 to US$8.30/kg.

The encouraging market signals extend beyond pricing. Average green hydrogen costs dropped 18% in the latest EU auctions, with German bids falling more than 55%. However, progress remains uneven across the bloc, with slow national adoption of RED III legislation hampering project development in many member states.

Long-term growth lies in transport fuels

While refinery decarbonization offers the strongest near-term investment case, the marine and aviation sectors present massive long-term growth opportunities for green hydrogen derivatives. The EU's ReFuelEU Aviation framework alone requires sustainable aviation fuel to power 6% of the jet pool by 2030, with 1.2% coming from green hydrogen-based e-fuels.

By 2050, sustainable aviation fuel mandates could require 8 million tonnes of green hydrogen - representing a compound annual growth rate of over 15% for this sector alone. Similarly, Europe's FuelEU Maritime Regulation and the International Maritime Organization's Net Zero Framework are driving interest in hydrogen-derived marine fuels.

"The opportunities for low-carbon hydrogen have come full circle," said Murray Douglas, Vice President of Hydrogen Research at Wood Mackenzie. "The traditional sectors of refining, ammonia and methanol are showing the most progress, ahead of the many other new demand sectors being touted for hydrogen. Parts of the refining sector can be decarbonised quickly - and at an acceptable cost. But it requires policy intervention to lower green hydrogen production costs and increase the refineries' offtake."

Douglas added: "Marine and aviation hold much of the long-term potential for hydrogen derivatives, as these sectors are the most challenging to electrify. The challenge lies in competing fuels, the costs of production and the final shape of the policies providing support."

Policy gaps remain key barrier

Despite the progress, significant hurdles remain. Current EU policy requires RFNBOs to account for only 1% of transport sector energy use by 2030 - a modest target that reflects the challenges in expanding supply. Member states have been slow to transpose RED III into national legislation, creating regulatory uncertainty that has slowed project development across most of the EU.

The report concludes that while European refiners could play a critical role in scaling up the green hydrogen industry, success depends on continued cost reductions and stronger policy support to fully kick-start demand across the continent.

Read more here.

ENDS

For further information please contact Wood Mackenzie's media relations team:

Mark Thomton

+1 630 881 6885

Mark.thomton@woodmac.com

Hla Myat Mon

+65 8533 8860

hla.myatmon@woodmac.com

Chris Boba

+44 7408 841129

Chris.Boba@woodmac.com

Angelica Juarez

angelica.juarez@woodmac.com

The Big Partnership

You have received this news release from Wood Mackenzie because of the details we hold about you. If the information we have is incorrect you can either provide your updated preferences by contacting our media relations team. If you do not wish to receive this type of email in the future, please reply with 'unsubscribe' in the subject header. -

About Wood Mackenzie

Wood Mackenzie is the global insight business for renewables, energy and natural resources. Driven by data. Powered by people. In the middle of an energy revolution, businesses and governments need reliable and actionable insight to lead the transition to a sustainable future. That's why we cover the entire supply chain with unparalleled breadth and depth, backed by over 50 years' experience in natural resources. Today, our team of over 2,000 experts operate across 30 global locations, inspiring customers' decisions through real-time analytics, consultancy, events and thought leadership. Together, we deliver the insight they need to separate risk from opportunity and make bold decisions when it matters most. For more information, visit woodmac.com.