his press release contains forward-looking information that is based upon assumptions and is subject to risks and uncertainties as indicated in the cautionary note contained within this press release. All dollar amounts are in U.S. dollars.

Transaction Highlights

• Morgan Properties to acquire Dream Residential REIT in an all-cash transaction

• Unitholders to receive cash consideration of US$10.80 per Unit, representing a premium of 60% to the REIT's closing Trust Unit price on the TSX as of February 19, 2025, the day prior to Dream Residential REIT's announcement of a strategic review process

• Dream Residential REIT's board of trustees have unanimously approved the transaction and recommend that Unitholders vote in favour of the Transaction

• This Transaction represents the conclusion of the REIT's previously announced strategic review process

TORONTO--(BUSINESS WIRE)--DREAM RESIDENTIAL REAL ESTATE INVESTMENT TRUST (TSX: DRR.U, TSX: DRR.UN) ("Dream Residential REIT" or the "REIT") announced today that its board of trustees (the "Board") has completed its strategic review process (the "Strategic Review") and has entered into an arrangement agreement (the "Arrangement Agreement") with an affiliate of Morgan Properties, LP ("Morgan Properties") which is headquartered near Philadelphia PA, pursuant to which Morgan Properties will acquire the REIT in an all-cash transaction valued at approximately US$354 million (the "Transaction").

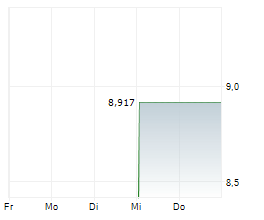

Under the terms of the Arrangement Agreement, Dream Residential REIT unitholders and DRR Holdings LLC Class B unitholders (collectively, the "Unitholders") will each receive cash consideration of US$10.80 per unit of the REIT ("Trust Unit") and per Class B unit of DRR Holdings LLC ("Class B Unit" and together with the Trust Units, the "Units"). The Transaction price represents a premium of 60% to the closing Trust Unit price on the TSX as of February 19, 2025, the last trading day prior to the announcement of the Strategic Review. Furthermore, the Transaction price represents an 18% premium to the closing Trust Unit price on the TSX as of August 20, 2025, the last trading day prior to the announcement of the Transaction.

"Following a comprehensive review, the Board has determined that the Transaction is in the best interest of the REIT," said Vicky Schiff, Chair of Dream Residential REIT's board of trustees. "We are pleased with today's announcement which will bring a successful conclusion to the REIT's Strategic Review. The Board is unanimously recommending that Unitholders vote in favour of the Transaction."

"We are pleased to conclude our Strategic Review with a Transaction that delivers immediate value to our Unitholders and supports the underlying value of the REIT's real estate," said Brian Pauls, Chief Executive Officer of Dream Residential REIT. "The Transaction provides our Unitholders with liquidity and value certainty."

"The Dream Residential REIT portfolio exemplifies the type of investment opportunity Morgan Properties excels in - leveraging our strong balance sheet, proven ability to deliver execution certainty, and deep expertise in acquiring large portfolio across numerous markets," said Jonathan and Jason Morgan, Co-Presidents of Morgan Properties. "Our team looks forward to welcoming these new communities, enhancing the physical assets, and providing best-in-class customer service for the residents."

Management and Advisory Services Separation

DRR Asset Management LP, a subsidiary of Dream Unlimited Corp. ("Dream"), and Pauls Realty Services, LLC, a subsidiary of Pauls Corp. ("Pauls"), have served, under an asset management agreement (the "Asset Management Agreement"), as the external asset managers of the REIT since inception. Dream and Pauls and their respective affiliates also provide certain administrative services to the REIT pursuant to respective services agreements (collectively, with the Asset Management Agreement, the "Services Agreements"). The Transaction requires the termination of the Services Agreements and certain other agreements which govern aspects of the relationship between Dream, Pauls and the REIT (the "Separation"). Dream and Pauls have agreed to the Separation in exchange for the payment of certain outstanding fees pursuant to the Services Agreements as well as a payment to account for wind-down costs that will be incurred by Dream and Pauls in connection with the Separation, which in total aggregate US$7.0 million (the "Separation Payment"). The Separation Payment has been approved by the independent trustees of the REIT.

Voting and Support Agreements

Each of the trustees and executive officers of the REIT, Dream, Pauls and certain affiliates of Dream and Pauls, has agreed to vote their Units, as applicable, in favour of the Transaction pursuant to voting and support agreements, subject to customary exceptions (the "Voting and Support Agreements"). The Units represented by the Voting and Support Agreements represent approximately 22.5% of the votes of all of the Units.

Transaction Details

The consummation of the Transaction will be subject to certain approvals at a special meeting of Unitholders, including by (i) at least 66 2/3% of the votes cast by Unitholders, voting together as a single class, and (ii) a simple majority of votes cast by Unitholders (excluding Dream, Pauls and their respective affiliates), voting together as a single class. In addition to approval by Unitholders, the Transaction is also subject to the receipt of court approval and other customary closing conditions for transactions of this nature.

The Transaction will be implemented by way of a plan of arrangement under the Business Corporations Act (Ontario), pursuant to which, among other things, Morgan Properties will acquire all of the assets and assume all of the liabilities of the REIT, the REIT will pay a special distribution and redeem all of its Trust Units for US$10.80 per Trust Unit in cash, and Morgan Properties will acquire all of the Class B Units for US$10.80 per Class B Unit in cash.

Dream Residential REIT will suspend its normal monthly distributions following the payment on November 15, 2025 of its October distribution. If the Transaction has not closed by November 18, 2025, and the conditions to closing of the Transaction have otherwise been satisfied or waived, the REIT may pay one additional monthly distribution.

The Arrangement Agreement provides for, among other things, customary representations, warranties and covenants, including customary non-solicitation covenants from Dream Residential REIT. The Arrangement Agreement also provides for the payment of a termination fee to Morgan Properties of US$8.6 million and a reverse termination fee of US$25.0 million to the REIT, if the Transaction is terminated in certain specified circumstances.

The Transaction is expected to close in late 2025 following satisfaction of all conditions to closing, provided that the Transaction will not close earlier than the date on which Morgan Properties obtains certain agency financing or December 18, 2025, whichever date is first. The Transaction is not subject to a financing condition.

The foregoing summary is qualified in its entirety by the provisions of the Arrangement Agreement, a copy of which will be filed on SEDAR+ at www.sedarplus.ca. Further information regarding the Transaction will be included in the REIT's management information circular expected to be mailed to Unitholders in September 2025. Copies of the Arrangement Agreement, the Voting and Support Agreements and the management information circular will be available on and under the REIT's profile on www.sedarplus.ca.

Board Recommendation and Fairness Opinion

The Dream Residential REIT Board, after receiving the unanimous recommendation of a committee of independent trustees of the REIT (the "Special Committee") and in consultation with its financial and legal advisors, has determined that the Transaction is in the best interests of Dream Residential REIT and fair to Unitholders (other than Dream, Pauls and their respective affiliates), and is recommending that Unitholders vote in favour of the Transaction.

TD Securities orally delivered a fairness opinion to the Board, stating that, as of August 20, 2025, and subject to the assumptions, limitations and qualifications that will be set forth in TD Securities' written fairness opinion, the consideration to be received by the Unitholders (other than Dream, Pauls and their respective affiliates) pursuant to the Transaction is fair, from a financial point of view, to the Unitholders (other than Dream, Pauls and their respective affiliates).

Advisors

TD Securities is acting as exclusive financial advisor to Dream Residential REIT in connection with the Transaction. Osler, Hoskin & Harcourt LLP and Clifford Chance US LLP are acting as legal counsel to the REIT in connection with the Transaction. Goodmans LLP is acting as legal counsel to the Special Committee in connection with the Transaction.

RBC Capital Markets is acting as exclusive financial advisor to Morgan Properties. Stikeman Elliott LLP and Blank Rome LLP are acting as legal counsel to Morgan Properties.

About Dream Residential REIT

Dream Residential REIT is an unincorporated, open-ended real estate investment trust established and governed by the laws of the Province of Ontario. The REIT owns a portfolio of garden-style multi-residential properties, primarily located in three markets across the Sunbelt and Midwest regions of the United States. For more information, please visit www.dreamresidentialreit.ca.

About Morgan Properties

Established in 1985 by Mitchell Morgan, Morgan Properties is a national real estate investment and management company headquartered in Conshohocken, Pennsylvania, with a corporate office in Rochester, New York. Jonathan and Jason Morgan represent the next-generation leaders growing the platform and overseeing the business operations. Morgan Properties and its affiliates pursue a diversified investment strategy focusing on multifamily common equity, commercial mortgage-backed B-Piece securities, preferred equity, and whole loans. Morgan Properties and its affiliates own and manage a multifamily portfolio comprising over 100,000 units across more than 360 communities in 22 states. The company is the nation's largest private multifamily owner and one of the top apartment owners in the country. Additionally, the company has made investments in commercial mortgage-backed B-Piece securities backed by over $40 billion in multifamily loans. With over 2,500 employees, Morgan Properties prides itself on its quick decision-making capabilities, strong capital relationships, and proven operational expertise. For more information, please visit www.morgan-properties.com.

Forward-looking information

This press release contains forward-looking information within the meaning of applicable securities legislation. Such forward-looking information includes, but is not limited to, information and statements concerning the Transaction and the terms thereof; the anticipated closing of the Transaction including the timing thereof; the expected monthly distributions by the REIT and the suspension thereof; and the payment of the Separation Payment. There can be no assurance that the proposed Transaction will be completed or that it will be completed on the terms and conditions contemplated in this news release. The proposed Transaction could be modified, restructured or terminated in accordance with its terms. Forward-looking information generally can be identified by the use of forward-looking terminology such as "will", "expect", "believe", "plan" or "continue", or similar expressions suggesting future outcomes or events. Forward-looking statements are based on information available at the time they are made, underlying estimates and assumptions made by management and management's good faith belief with respect to future events, performance and results. Such assumptions include, without limitation, expectations and assumptions concerning the market price of the Trust Units, the anticipated benefits of the Transaction to Unitholders, the receipt in a timely manner of court, unitholder and other approvals for the Transaction, and the availability of cash flow from operations to meet monthly distributions. Although Dream Residential REIT believes that the expectations and assumptions on which such forward-looking statements and information are based are reasonable, undue reliance should not be placed on the forward-looking statements and information because Dream Residential REIT cannot give assurance that they will prove to be correct. By its nature, such forward-looking information is subject to a number of risks and uncertainties, many of which are beyond Dream Residential REIT's control and could cause actual results to differ materially from those that are disclosed in or implied by such forward-looking information. These risks and uncertainties include, but are not limited to, risks inherent in the real estate industry; financing risks; inflation, interest and currency rate fluctuations; global and local economic and business conditions; risks associated with unexpected or ongoing geopolitical events; imposition of duties, tariffs and other trade restrictions; changes in law; tax risks; competition; environmental and climate change risks; insurance risks; cybersecurity; and public health crises and epidemics. All forward-looking information in this press release speaks as of the date of this press release. Dream Residential REIT does not undertake to update any such forward-looking information whether as a result of new information, future events or otherwise, except as required by law. Additional information about these assumptions, risks and uncertainties is contained in Dream Residential REIT's filings with securities regulators, including its latest Annual Information Form and Management's Discussion and Analysis. These filings are also available on the REIT's website at www.dreamresidentialreit.ca.

Contacts

For further information, please contact:

Dream Residential REIT

Brian Pauls

Chief Executive Officer

(416) 365-2365

bpauls@dream.ca

Derrick Lau

Chief Financial Officer

(416) 365-2364

dlau@dream.ca

Scott Schoeman

Chief Operating Officer

(303) 519-3020

sschoeman@dream.ca

Transaction Highlights

• Morgan Properties to acquire Dream Residential REIT in an all-cash transaction

• Unitholders to receive cash consideration of US$10.80 per Unit, representing a premium of 60% to the REIT's closing Trust Unit price on the TSX as of February 19, 2025, the day prior to Dream Residential REIT's announcement of a strategic review process

• Dream Residential REIT's board of trustees have unanimously approved the transaction and recommend that Unitholders vote in favour of the Transaction

• This Transaction represents the conclusion of the REIT's previously announced strategic review process

TORONTO--(BUSINESS WIRE)--DREAM RESIDENTIAL REAL ESTATE INVESTMENT TRUST (TSX: DRR.U, TSX: DRR.UN) ("Dream Residential REIT" or the "REIT") announced today that its board of trustees (the "Board") has completed its strategic review process (the "Strategic Review") and has entered into an arrangement agreement (the "Arrangement Agreement") with an affiliate of Morgan Properties, LP ("Morgan Properties") which is headquartered near Philadelphia PA, pursuant to which Morgan Properties will acquire the REIT in an all-cash transaction valued at approximately US$354 million (the "Transaction").

Under the terms of the Arrangement Agreement, Dream Residential REIT unitholders and DRR Holdings LLC Class B unitholders (collectively, the "Unitholders") will each receive cash consideration of US$10.80 per unit of the REIT ("Trust Unit") and per Class B unit of DRR Holdings LLC ("Class B Unit" and together with the Trust Units, the "Units"). The Transaction price represents a premium of 60% to the closing Trust Unit price on the TSX as of February 19, 2025, the last trading day prior to the announcement of the Strategic Review. Furthermore, the Transaction price represents an 18% premium to the closing Trust Unit price on the TSX as of August 20, 2025, the last trading day prior to the announcement of the Transaction.

"Following a comprehensive review, the Board has determined that the Transaction is in the best interest of the REIT," said Vicky Schiff, Chair of Dream Residential REIT's board of trustees. "We are pleased with today's announcement which will bring a successful conclusion to the REIT's Strategic Review. The Board is unanimously recommending that Unitholders vote in favour of the Transaction."

"We are pleased to conclude our Strategic Review with a Transaction that delivers immediate value to our Unitholders and supports the underlying value of the REIT's real estate," said Brian Pauls, Chief Executive Officer of Dream Residential REIT. "The Transaction provides our Unitholders with liquidity and value certainty."

"The Dream Residential REIT portfolio exemplifies the type of investment opportunity Morgan Properties excels in - leveraging our strong balance sheet, proven ability to deliver execution certainty, and deep expertise in acquiring large portfolio across numerous markets," said Jonathan and Jason Morgan, Co-Presidents of Morgan Properties. "Our team looks forward to welcoming these new communities, enhancing the physical assets, and providing best-in-class customer service for the residents."

Management and Advisory Services Separation

DRR Asset Management LP, a subsidiary of Dream Unlimited Corp. ("Dream"), and Pauls Realty Services, LLC, a subsidiary of Pauls Corp. ("Pauls"), have served, under an asset management agreement (the "Asset Management Agreement"), as the external asset managers of the REIT since inception. Dream and Pauls and their respective affiliates also provide certain administrative services to the REIT pursuant to respective services agreements (collectively, with the Asset Management Agreement, the "Services Agreements"). The Transaction requires the termination of the Services Agreements and certain other agreements which govern aspects of the relationship between Dream, Pauls and the REIT (the "Separation"). Dream and Pauls have agreed to the Separation in exchange for the payment of certain outstanding fees pursuant to the Services Agreements as well as a payment to account for wind-down costs that will be incurred by Dream and Pauls in connection with the Separation, which in total aggregate US$7.0 million (the "Separation Payment"). The Separation Payment has been approved by the independent trustees of the REIT.

Voting and Support Agreements

Each of the trustees and executive officers of the REIT, Dream, Pauls and certain affiliates of Dream and Pauls, has agreed to vote their Units, as applicable, in favour of the Transaction pursuant to voting and support agreements, subject to customary exceptions (the "Voting and Support Agreements"). The Units represented by the Voting and Support Agreements represent approximately 22.5% of the votes of all of the Units.

Transaction Details

The consummation of the Transaction will be subject to certain approvals at a special meeting of Unitholders, including by (i) at least 66 2/3% of the votes cast by Unitholders, voting together as a single class, and (ii) a simple majority of votes cast by Unitholders (excluding Dream, Pauls and their respective affiliates), voting together as a single class. In addition to approval by Unitholders, the Transaction is also subject to the receipt of court approval and other customary closing conditions for transactions of this nature.

The Transaction will be implemented by way of a plan of arrangement under the Business Corporations Act (Ontario), pursuant to which, among other things, Morgan Properties will acquire all of the assets and assume all of the liabilities of the REIT, the REIT will pay a special distribution and redeem all of its Trust Units for US$10.80 per Trust Unit in cash, and Morgan Properties will acquire all of the Class B Units for US$10.80 per Class B Unit in cash.

Dream Residential REIT will suspend its normal monthly distributions following the payment on November 15, 2025 of its October distribution. If the Transaction has not closed by November 18, 2025, and the conditions to closing of the Transaction have otherwise been satisfied or waived, the REIT may pay one additional monthly distribution.

The Arrangement Agreement provides for, among other things, customary representations, warranties and covenants, including customary non-solicitation covenants from Dream Residential REIT. The Arrangement Agreement also provides for the payment of a termination fee to Morgan Properties of US$8.6 million and a reverse termination fee of US$25.0 million to the REIT, if the Transaction is terminated in certain specified circumstances.

The Transaction is expected to close in late 2025 following satisfaction of all conditions to closing, provided that the Transaction will not close earlier than the date on which Morgan Properties obtains certain agency financing or December 18, 2025, whichever date is first. The Transaction is not subject to a financing condition.

The foregoing summary is qualified in its entirety by the provisions of the Arrangement Agreement, a copy of which will be filed on SEDAR+ at www.sedarplus.ca. Further information regarding the Transaction will be included in the REIT's management information circular expected to be mailed to Unitholders in September 2025. Copies of the Arrangement Agreement, the Voting and Support Agreements and the management information circular will be available on and under the REIT's profile on www.sedarplus.ca.

Board Recommendation and Fairness Opinion

The Dream Residential REIT Board, after receiving the unanimous recommendation of a committee of independent trustees of the REIT (the "Special Committee") and in consultation with its financial and legal advisors, has determined that the Transaction is in the best interests of Dream Residential REIT and fair to Unitholders (other than Dream, Pauls and their respective affiliates), and is recommending that Unitholders vote in favour of the Transaction.

TD Securities orally delivered a fairness opinion to the Board, stating that, as of August 20, 2025, and subject to the assumptions, limitations and qualifications that will be set forth in TD Securities' written fairness opinion, the consideration to be received by the Unitholders (other than Dream, Pauls and their respective affiliates) pursuant to the Transaction is fair, from a financial point of view, to the Unitholders (other than Dream, Pauls and their respective affiliates).

Advisors

TD Securities is acting as exclusive financial advisor to Dream Residential REIT in connection with the Transaction. Osler, Hoskin & Harcourt LLP and Clifford Chance US LLP are acting as legal counsel to the REIT in connection with the Transaction. Goodmans LLP is acting as legal counsel to the Special Committee in connection with the Transaction.

RBC Capital Markets is acting as exclusive financial advisor to Morgan Properties. Stikeman Elliott LLP and Blank Rome LLP are acting as legal counsel to Morgan Properties.

About Dream Residential REIT

Dream Residential REIT is an unincorporated, open-ended real estate investment trust established and governed by the laws of the Province of Ontario. The REIT owns a portfolio of garden-style multi-residential properties, primarily located in three markets across the Sunbelt and Midwest regions of the United States. For more information, please visit www.dreamresidentialreit.ca.

About Morgan Properties

Established in 1985 by Mitchell Morgan, Morgan Properties is a national real estate investment and management company headquartered in Conshohocken, Pennsylvania, with a corporate office in Rochester, New York. Jonathan and Jason Morgan represent the next-generation leaders growing the platform and overseeing the business operations. Morgan Properties and its affiliates pursue a diversified investment strategy focusing on multifamily common equity, commercial mortgage-backed B-Piece securities, preferred equity, and whole loans. Morgan Properties and its affiliates own and manage a multifamily portfolio comprising over 100,000 units across more than 360 communities in 22 states. The company is the nation's largest private multifamily owner and one of the top apartment owners in the country. Additionally, the company has made investments in commercial mortgage-backed B-Piece securities backed by over $40 billion in multifamily loans. With over 2,500 employees, Morgan Properties prides itself on its quick decision-making capabilities, strong capital relationships, and proven operational expertise. For more information, please visit www.morgan-properties.com.

Forward-looking information

This press release contains forward-looking information within the meaning of applicable securities legislation. Such forward-looking information includes, but is not limited to, information and statements concerning the Transaction and the terms thereof; the anticipated closing of the Transaction including the timing thereof; the expected monthly distributions by the REIT and the suspension thereof; and the payment of the Separation Payment. There can be no assurance that the proposed Transaction will be completed or that it will be completed on the terms and conditions contemplated in this news release. The proposed Transaction could be modified, restructured or terminated in accordance with its terms. Forward-looking information generally can be identified by the use of forward-looking terminology such as "will", "expect", "believe", "plan" or "continue", or similar expressions suggesting future outcomes or events. Forward-looking statements are based on information available at the time they are made, underlying estimates and assumptions made by management and management's good faith belief with respect to future events, performance and results. Such assumptions include, without limitation, expectations and assumptions concerning the market price of the Trust Units, the anticipated benefits of the Transaction to Unitholders, the receipt in a timely manner of court, unitholder and other approvals for the Transaction, and the availability of cash flow from operations to meet monthly distributions. Although Dream Residential REIT believes that the expectations and assumptions on which such forward-looking statements and information are based are reasonable, undue reliance should not be placed on the forward-looking statements and information because Dream Residential REIT cannot give assurance that they will prove to be correct. By its nature, such forward-looking information is subject to a number of risks and uncertainties, many of which are beyond Dream Residential REIT's control and could cause actual results to differ materially from those that are disclosed in or implied by such forward-looking information. These risks and uncertainties include, but are not limited to, risks inherent in the real estate industry; financing risks; inflation, interest and currency rate fluctuations; global and local economic and business conditions; risks associated with unexpected or ongoing geopolitical events; imposition of duties, tariffs and other trade restrictions; changes in law; tax risks; competition; environmental and climate change risks; insurance risks; cybersecurity; and public health crises and epidemics. All forward-looking information in this press release speaks as of the date of this press release. Dream Residential REIT does not undertake to update any such forward-looking information whether as a result of new information, future events or otherwise, except as required by law. Additional information about these assumptions, risks and uncertainties is contained in Dream Residential REIT's filings with securities regulators, including its latest Annual Information Form and Management's Discussion and Analysis. These filings are also available on the REIT's website at www.dreamresidentialreit.ca.

Contacts

For further information, please contact:

Dream Residential REIT

Brian Pauls

Chief Executive Officer

(416) 365-2365

bpauls@dream.ca

Derrick Lau

Chief Financial Officer

(416) 365-2364

dlau@dream.ca

Scott Schoeman

Chief Operating Officer

(303) 519-3020

sschoeman@dream.ca

View source version on businesswire.com: https://www.businesswire.com/news/home/20250820793387/en/

© 2025 Business Wire