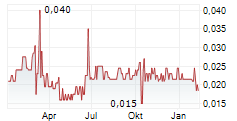

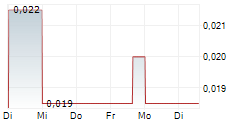

Toronto, Ontario--(Newsfile Corp. - August 22, 2025) - Quinsam Capital Corporation (CSE: QCA) ("Quinsam" or the "Company") is announcing its Q2/2025 results, with net loss of $0.2 million ($0.002 per share basic, $0.002 fully diluted) versus net loss of $0.4 million ($0.005 per share basic, $0.005 fully diluted) in Q2/2024. Investors can access the Company's full financial statements on sedarplus.ca.

"We obtained liquidity on one of our long-term private investments in the quarter," said Roger Dent, CEO. "We negotiated a transaction with Royalties Inc. to exchange our unlisted shares in Music Royalties for listed shares in Royalties Inc. Our timing here was fortuitous as Royalties Inc. prevailed in a legal claim shortly after we negotiated our trade. Our investment in Reeflex also commenced trading, although the share price change to date has been modest. We are optimistic about its prospects in the fall. Our loss in the quarter is related primarily to a decline in the value of our holdings in California Nanotechnologies."

In Quinsam's private securities portfolio, a number of liquidity events are pending. Peninsula (the US single family rental business) is making efforts to list in the coming months. Theracann, which we fully wrote off some years ago, is now nearing a listing as Beyond Farming through a merger with Sprout AI on the CSE. Electro Metals has announced its intent to list through a merger with BWR Exploration in the fall.

"At June 30, 2025, we continued to have net assets of approximately $0.10 per share outstanding," said Roger Dent, CEO. "Our shares continue to trade at a very steep discount from NAV. We also note that the total of our more liquid investments (including cash, public equities, and derivatives on public equities) is now approximately $0.06 per share, up from last quarter."

The search for a value creating transaction continues. We anticipate that it may take some time to find a suitable, value creating transaction. There have been relatively few companies undertaking new listings and our plan is to patiently wait for a high quality transaction. Further announcements will be made on the status of such steps, which are subject to all applicable shareholder and regulatory approvals.

Issuer Bid

In Q2/2025, the Company acquired 996,000 shares pursuant to its issuer bid to purchase up to 4,600,000 of its common shares that commenced on September 6, 2024 and will terminate on September 5, 2025, or on an earlier date in the event that the number of common shares sought in the bid has been repurchased. Total purchases pursuant to this bid are 3,951,000 shares.

Quinsam has repurchased and cancelled over 20 million shares since 2018 pursuant to its issuer bids.

Investor Call

An investor call will be held at 10:00 a.m. Eastern time on Monday, August 25, 2025 by Zoom:

Join Zoom Meeting

https://us02web.zoom.us/j/81334561687?pwd=ySZelaTdkamhNbXLaSq9e43PymuwVo.1

About Quinsam Capital Corporation

Quinsam is a merchant bank with a focus on "small cap" investments which it believes are undervalued. We do not invest on behalf of third parties or offer investment advice.

Generally, Quinsam does not believe that individual investments are material events. Quinsam may choose to announce certain investments once the company has finished buying its position because we feel that this information helps investors understand our decision making process. Generally, Quinsam does not announce the sale of investments.

For further information contact:

Roger Dent, CEO

(647) 993-5475

roger@quinsamcapital.com

This press release may contain forward-looking statements relating to anticipated future events, results, circumstances, performance, or expectations that are not historical facts but instead represent our beliefs regarding future events, which are inherently uncertain. Forward-looking statements can often, but not always, be identified by forward-looking words such as "anticipate", "believe", "continue", "expect", "goal", "plan", "intend", "estimate", "may", "project", "predict", "potential", "target", and "will" or similar words suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions or statements about future events or performance.

By their nature, forward-looking statements require making assumptions which include, among other things, that (i) Quinsam will have sufficient capital to effect its business strategies, (ii) the business strategies will produce the results intended by Quinsam, and (iii) the markets will react and perform in a manner consistent with the business strategies.

Forward-looking information involves known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated. Quinsam believes that the expectations reflected in the forward-looking information are reasonable, but no assurance can be given that these expectations will prove to be correct. Some risks and other factors that could cause actual results to differ materially from those expressed in forward-looking information in this press release include, but are not limited to: cannabis companies Quinsam has invested in obtaining and maintaining regulatory approvals including acquiring and renewing U.S. state, local or other licenses, and the uncertainty of existing protection from U.S. federal or other prosecution; regulatory or political change such as changes in applicable laws and regulations, including U.S. state-law legalization; market and general economic conditions of the cannabis sector or otherwise, interest rates, regulatory and statutory developments, the nature of the Company's investments, the available opportunities and competition for investments, the concentration of our investments in certain industries and sectors, reliance on key personnel, risks affecting investments, management of the growth of the Company, and exchange rate fluctuations and, in the case of the valuation creation strategies, the ability to complete divestitures of illiquid assets on terms which are economic or at all, to identify beneficial business opportunities, to secure or act on the identified business opportunities on terms which are economic or at all, and obtain all necessary shareholder and regulatory approvals. Readers are cautioned that the foregoing list of risks and factors is not exhaustive. Although Quinsam has attempted to identify factors that could cause actual events or results to differ materially from those described in forward-looking information, there may be factors that cause events or results to differ from those intended, anticipated, or estimated.

The forward-looking information contained herein is provided as at this date, based upon the opinions and estimates of management and information available to management as at this date. Quinsam does not undertake and specifically disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, unless required by applicable law. Readers are cautioned not to place undue reliance on forward-looking information contained herein.

NOT FOR DISSEMINATION IN THE UNITED STATES OR FOR DISTRIBUTION BY ANY UNITED STATES NEWS DISTRIBUTION SERVICE

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/263460

SOURCE: Quinsam Capital Corporation