Vancouver, British Columbia, Aug. 22, 2025 (GLOBE NEWSWIRE) -- St. James Gold Corp. (the "Company" or "St. James") (TSXV: LORD) (OTCQB: LRDJF) (FSE: BVU3) is pleased to announce that it has closed the Final Release and Settlement Agreement with Florin Resources Inc. ("Florin") originally announced on April 1, 2025 (the "Settlement Agreement"). Under the terms of the Settlement Agreement, the Company was reassigned two secured promissory notes of the Company held by Florin with a combined principal amount of $1,176,598.76 (the "Secured Promissory Notes").

The consideration for the settlement was as follows:

- The cash payment of $435,000 to Florin;

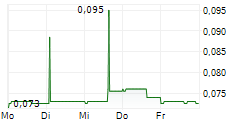

- The issuance of a total of 2,105,264 common shares of the Company for debt to Florin at a deemed price of $0.095 Per Share that closed concurrently with the Settlement Agreement;

- The Company removing its objection to the release to Florin of 850,000 common shares of the Company that were held in escrow by the Company's transfer agent; and

- The transferring of the Company's Quinn Lake Property to Florin.

As part of the Settlement Agreement, Florin agreed to participate as to 1,052,632 common shares in the Company's private placement announced December 27, 2024, at $0.095 per share, which closed concurrently with the closing of the Settlement Agreement.

Florin and certain former directors and officers of the Company also entered into a Mutual Non-Disparagement Agreement.

The Company has reassigned the principal amount if the Notes proportionately to the lenders who provided the $435,000 cash for closing and have agreed to hold the debt as long-term and unsecured.

The Settlement Agreement describes a release of all claims, bringing to an end this chapter of the Company's existence and allows the moving forward with development of its Grub Line Property in Newfoundland.

The Company thanks its shareholders for their long forbearance which the Company concluded this difficult period.

About St. James Gold Corp.

St. James Gold Corp. is a publicly traded company listed on the TSX Venture Exchange under the trading symbol "LORD", in the U.S. Market listed on OTCQB under "LRDJF" and on the Frankfurt Stock Exchange under "BVU3". The Company is focused on creating shareholder value through the discovery and development of economic mineral deposits by acquiring prospective exploration projects with well-delineated geological theories; integrating all available geological, geochemical, and geophysical datasets; and financing efficient exploration programs.

For more corporate information please visit: http://stjamesgold.com/

St. James Gold Corp.

For further information, please contact:

Tel: 1 (800) 278-2152

Email: info@stjamesgold.com

Forward Looking Statements

This news release contains forward-looking statements and forward-looking information within the meaning of Canadian securities laws (collectively, "forward-looking statements"). All other statements that are not historical facts, particularly statements that express, or involve discussions as to, expectations, beliefs, plans, objectives, assumptions or future events or performance of the Company. Often, but not always, forward-looking statements can be identified through the use of words or phrases such as "will likely result", "are expected to", "expects", "will continue", "is anticipated", "anticipates", "believes", "estimated", "intends", "plans", forecast", "projection", "strategy", "objective" and "outlook". Forward-looking statements contained in this news release are made based on reasonable estimates and assumptions made by management of the Company at the relevant time in light of its experience and perception of historical trends, current conditions and expected future developments, as well as other factors that are believed to be appropriate and reasonable in the circumstances. Forward-looking statements contained in this news release are made as of the date of this new release and the Company will not update any such forward-looking statements as a result of new information or if management's beliefs, estimates, assumptions or opinions change, except as required by law. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, the reader is cautioned not to place undue reliance on forward-looking statements.

Forward-looking statements involve known and unknown risks, uncertainties and other factors, many of which are beyond the Company's control, which could cause actual results, performance, achievements and events to differ materially from those that are disclosed or implied by such forward-looking statements. Such risks and uncertainties include, but are not limited to, the impact and progression of the COVID-19 pandemic and other factors outlines in the Company's Annual Information Form dated July 26, 2021 (the "AIF") filed under the Company's profile on SEDAR at www.sedar.com. The Company cautions that the list of factors and uncertainties described in its AIF on SEDAR are not exhaustive and other factors could materially affect its results.

New factors emerge from time to time, and its is not possible for the Company to consider all of them, or assess the impact of each such factor or to the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. Any forward-looking statements contained in this news release are expressly qualified in their entirety by this cautionary statement.

NEITHER THE TSX VENTURE EXCHANGE NOT ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONISBIULITY FOR THE ADEQUACY IR ACCURACY OF THIS RELEASE.