Following a landmark court ruling against the Department Of Labor, Duane Boise, CEO of MMJ International Holdings exposes the DEA's identical use of unconstitutional in house courts to paralyze medical cannabis research for Huntington's and Multiple Sclerosis patients.

WASHINGTON, DC / ACCESS Newswire / August 23, 2025 / A landmark Third Circuit Court of Appeals decision in July 2025 finally struck down the Department of Labor's (DOL) unconstitutional system of in-house courts. For the Marino family, fourth-generation New Jersey farmers, the justice came too late. After a nine-year nightmare where DOL agents acted as prosecutor, judge, and jury, their 125-year-old farm was auctioned off over a paperwork error and crippling fines.

Now, MMJ BioPharma Cultivation is sounding the alarm that the Drug Enforcement Administration (DEA) is running the very same unconstitutional playbook-this time to block critical medical research.

For seven years, MMJ has sought a DEA registration to grow FDA-compliant cannabis for clinical trials targeting Huntington's disease and Multiple Sclerosis. Instead, the company has been trapped in a rigged administrative process, precisely the kind the courts and the Department of Justice have now condemned.

Two Cases, One Unconstitutional Blueprint

The parallels between the Marino case and MMJ's ordeal reveal a pattern of bureaucratic abuse across federal agencies.

The Marino Case (DOL): A single mischecked box on a meal form triggered a decade-long legal siege, $550,000 in fines, and the destruction of a multi-generational family business.

The MMJ Case (DEA): Seven years of regulatory limbo, $20,000 per month in wasted facility costs, and thousands of patients denied access to potential life-altering medicine.

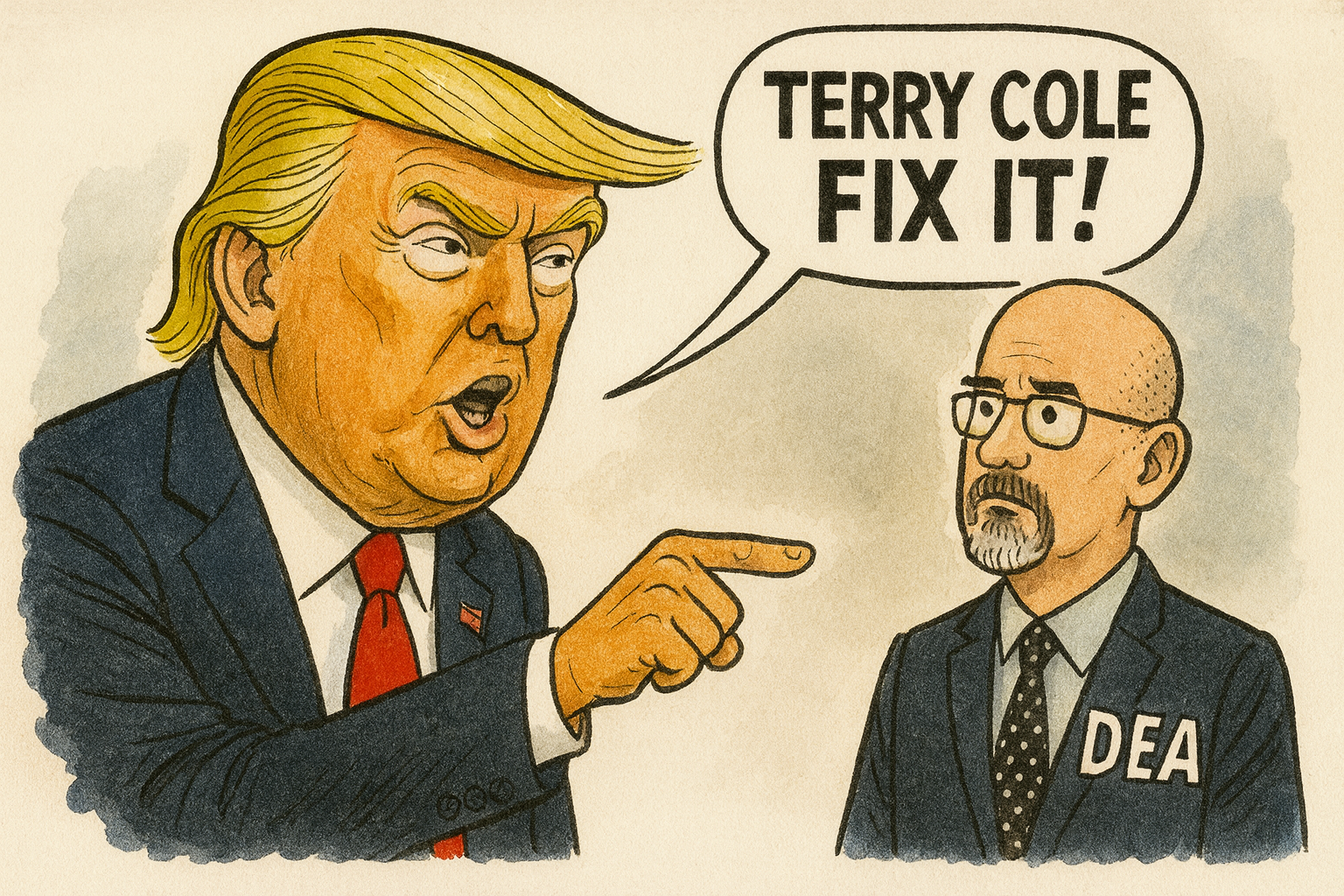

"Two federal agencies, one unconstitutional playbook-it crushed a family farm and is now paralyzing a biomedical company. Enough is enough," said Duane Boise, CEO of MMJ International Holdings. "DEA Administrator Terry Cole must end this immediately."

The DEA's Arbitrary and Moving Goalposts

MMJ's journey is a case study in regulatory obstruction, mirroring the arbitrariness condemned in the Marino ruling:

Invented Requirements: A DEA investigator demanded a $100,000 vault with specifications found nowhere in official regulations.

Shifting Frameworks: The DEA rejected a "bona fide supply agreement" MMJ crafted using the agency's own published framework.

Lost Opportunities: A potential $25 million NIH grant vanished after DOJ lawyers provided assurances that the NIH itself later contradicted.

The Human Cost: Patients Are Paying the Price

For the Marinos, the cost was measured in generations of lost livelihood. For MMJ, the cost is borne by patients suffering from debilitating neurological diseases who remain locked out of access to standardized, research-grade cannabis medicines.

"Justice delayed is justice denied," stated Boise. "Every day of obstruction is a day of suffering and lost hope for these patients."

The Law Has Changed. The DEA Has Not.

The legal foundation for the DEA's tactics has completely collapsed:

Jarkesy v. SEC (2024): The Supreme Court affirmed the right to a jury trial for defendants facing agency penalties.

Marino v. DOL (2025): The Third Circuit Court struck down the DOL's unconstitutional administrative law courts.

DOJ Concession (2025): The Justice Department itself admitted that the protections for administrative law judges are unconstitutional.

Yet, the DEA continues to cling to this collapsing system to obstruct medical innovation.

A Path Forward: MMJ's Call President Trump to Action

MMJ calls on DEA Administrator Terry Cole to:

Stay all administrative proceedings and move disputes to Article III courts.

Establish clear, workable, and public standards for research supply agreements.

Credit compliance investments already made by applicants instead of retroactively shifting rules.

Publish transparent, binding timelines for application reviews.

Submit DEA requirements to an independent review for rationality and fairness.

DEA TERRY COLE: A Moment for Leadership

After his family's victory, farmer Joe Marino stated, "We got our good name cleared, but more important than that, I know our case will help others down the road."

MMJ now seeks that same justice-not just for itself, but for the patients waiting for a chance at treatment. President Trump's championing of the Right to Try Act for terminal patients established a powerful precedent. His upcoming decision on marijuana presents a pivotal moment to demand the DEA stop playing judge and jury and finally let science serve the people.

MMJ is represented by attorney Megan Sheehan.

CONTACT:

Madison Hisey

MHisey@mmjih.com

203-231-8583

SOURCE: MMJ International Holdings

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/healthcare-and-pharmaceutical/this-dea-marijuana-story-is-so-bizarre-and-twisted-will-president-tru-1064555