Toronto, Ontario--(Newsfile Corp. - August 25, 2025) - AbraSilver Resource Corp. (TSX: ABRA) (OTCQX: ABBRF) ("AbraSilver" or the "Company") is pleased to announce assay results from three new drill holes from the ongoing Phase V exploration program at its wholly-owned Diablillos project in Argentina (the "Project").

The latest drill holes continue to expand the gold-bearing zone at Oculto East, intersecting consistent mineralization well beyond the current Mineral Resource outline. These results reinforce the potential for continued growth and highlight Oculto East as a key focus area in the current exploration program.

Highlight Drill Results

- DDH 25-060A: 60.0 metres ("m") grading 1.05 g/t gold from 230 metres, including:

- 17.0 m at 2.83 g/t gold

- 4.0 m at 6.68 g/t gold

- DDH 25-067: 16.0 m grading 1.74 g/t gold & 17.3 g/t silver from 245 metres

- DDH 25-068: 21.0 m grading 1.51 g/t gold & 49.5 g/t silver from 188 metres, and

- 64.0 m grading 0.54 g/t gold & 19.8 g/t silver from 314 metres,

Table 1 - Summary of Key Drill Intercepts: Oculto East

Intercepts greater than 25 gram-metres Au shown in bold text:

| Drill Hole | Area | From (m) | To (m) | Type | Interval (m) | Ag g/t | Au g/t |

| DDH-25-060A | Oculto East | 124.0 | 128.0 | Oxides | 4.0 | 58.5 | - |

| 134.0 | 136.0 | Oxides | 2.0 | 78.9 | - | ||

| 188.0 | 189.0 | Oxides | 1.0 | - | 0.76 | ||

| 209.0 | 214.0 | Oxides | 5.0 | - | 1.15 | ||

| 230.0 | 290.0 | Oxides | 60.0 | - | 1.05 | ||

| Including | 230.0 | 247.0 | Oxides | 17.0 | - | 2.83 | |

| Including | 230.0 | 234.0 | Oxides | 4.0 | - | 6.68 | |

| DDH-25-067 | Oculto East | 124.0 | 125.0 | Oxides | 1.0 | - | 0.62 |

| 167.0 | 170.0 | Oxides | 3.0 | 8.0 | 0.84 | ||

| 177.0 | 178.0 | Oxides | 1.0 | - | 1.17 | ||

| 245.0 | 261.0 | Oxides | 16.0 | 17.3 | 1.74 | ||

| 276.0 | 277.0 | Oxides | 1.0 | 10.7 | 0.83 | ||

| 286.0 | 292.0 | Oxides | 6.0 | 5.9 | 0.65 | ||

| DDH-25-068 | Oculto East | 188.0 | 209.0 | Oxides | 21.0 | 49.5 | 1.51 |

| 307.0 | 308.0 | Oxides | 1.0 | 17.7 | 1.37 | ||

| 314.0 | 378.0 | Oxides | 64.0 | 19.8 | 0.56 | ||

| Including | 342.0 | 346.0 | Oxides | 4.0 | 25.1 | 1.23 | |

| Including | 354.0 | 378.0 | Oxides | 24.0 | 11.2 | 0.90 |

Note: All results in this news release are rounded. Assays are uncut and undiluted. Widths are drilled widths, not true widths. True widths are unknown.

John Miniotis, President and CEO, commented, "We are very encouraged that our drilling continues to expand the footprint of the gold zone at Oculto East. These latest results demonstrate the continuity of mineralization well beyond the current open pit constrained Mineral Resource and further strengthens our confidence in the growth potential at Diablillos. With three rigs active, we remain focused on delivering additional Mineral Resource growth while advancing the Definitive Feasibility Study in parallel."

Dave O'Connor, Chief Geologist, commented, "These latest intercepts clearly demonstrate that gold mineralization extends further east than previously modeled. Our drilling continues to concentrate in this area to determine the full size and continuity of this expanding higher-grade gold zone."

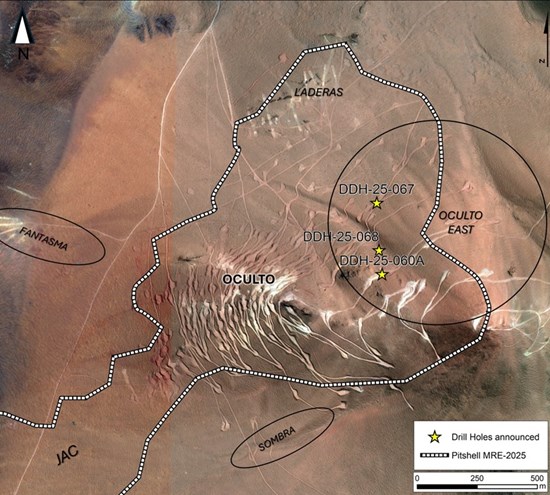

Figure 1 -Plan View of Drill Results

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11792/263657_489e76d844da088e_001full.jpg

Additional Details on Drill Results

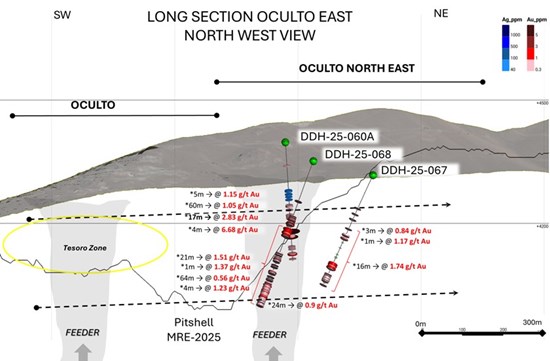

Hole DDH 25-060A was drilled more than 50 metres east of the current Mineral Resource boundary to test the width of the high-grade gold zone intersected in hole DDH 25-024 (31m @ 10.0 g/t Au). The hole intersected a broad zone of continuous gold mineralization, highlighted by 60.0 m grading 1.05 g/t gold, starting at 230 m down-hole. These results confirm that the gold zone extending eastwards from the Oculto deposit is very robust.

Hole DDH 25-067 located approximately 150 metres east of the current Mineral Resource boundary, intersected 16.0 m grading 1.74 g/t gold with 17.3 g/t silver, from 245 m down-hole. The intercept demonstrates the continuity of the gold-bearing system in the Oculto East area and shows the potential for a major eastwards extension of the Mineral Resource.

Hole DDH 25-068 located approximately 90 metres east of the current Mineral Resource open pit boundary, intersected 21.0 m grading 1.51 g/t gold with 49.5 g/t silver, from 188 m down-hole. This was followed by an additional 64.0 m grading 0.54 g/t gold with 19.8 g/t silver from 314 m down-hole. These results confirm the depth continuity of the mineralized system at Oculto East.

Figure 2 - Section Through Latest Drill Holes Looking Northwest

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11792/263657_489e76d844da088e_002full.jpg

Note: Widths are drilled widths, not true widths. True widths are unknown.

Phase V Exploration Update

The Company's ongoing 20,000-metre Phase V drill program is progressing well, with three active rigs. Drilling at Oculto East remains the top priority, where multiple step-out holes are being completed to further extend the gold zone beyond the existing Mineral Resource boundary. Results received to date confirm a broad zone of gold-dominant mineralization that extends at least 200 metres east of the current open pit boundary, underscoring the strong potential for further Mineral Resource expansion.

In parallel, the Company will shortly commence drilling a minimum of two deep holes at the nearby Cerro Blanco porphyry target, to test the promising copper-gold system. Together, these initiatives are designed to expand known mineralization at Oculto East while also testing new targets that could further enhance the overall scale of the Diablillos project.

Collar Data

| Hole Number | UTM Coordinates | Elevation | Azimuth | Dip | Depth (m) | Area | |

| DDH 25-060A | 720867 | 7199537 | 4,397 | 325 | -70 | 305 | Oculto East |

| DDH 25-067 | 720845 | 7199833 | 4,317 | 180 | -60 | 308 | Oculto East |

| DDH 25-068 | 720855 | 7199636 | 4,351 | 180 | -60 | 400 | Oculto East |

About Diablillos

The Diablillos property is located within the Puna region of Argentina, in the southern part of Salta Province along the border with Catamarca Province, approximately 160 km southwest of the city of Salta and 375 km northwest of the city of Catamarca. The property comprises 15 contiguous and overlapping mineral concessions acquired by AbraSilver in 2016. The project site has good year-round accessibility through a 150 km paved road, followed by a well-maintained gravel road, shared with other adjacent projects.

There are several known mineral zones on the Diablillos property. Approximately 150,000 m have been drilled to date, which has outlined multiple occurrences of epithermal silver-gold mineralization at Oculto, JAC, Laderas and Fantasma. Several satellite zones of silver/gold-rich epithermal mineralization have been located within a 500 m to 1.5 km distance surrounding the Oculto/JAC epicentre. In addition, a large porphyry complex is centered approximately 4 km northeast of Oculto which includes outcropping porphyry intrusions within a major zone of alteration, and associated gold rich epithermal mineralization.

Comparatively nearby examples of high sulphidation epithermal deposits include: La Coipa (Chile); Yanacocha (Peru); El Indio (Chile); Lagunas Nortes/Alto Chicama (Peru) Veladero (Argentina); and Filo del Sol (Argentina). The most recent Mineral Resource estimate for Diablillos is shown in Table 3:

Table 3 - Diablillos Mineral Resource Estimate - As of July 21, 2025

| Zone | Category | Tonnes (000 t) | Ag (g/t) | Au (g/t) | AgEq (g/t) | Contained Ag (000 Oz Ag) | Contained Au (000 Oz Ag) | Contained AgEq (000 Oz Ag) | |

| Tank Leach | Oxides | Measured | 26,545 | 119 | 0.71 | 183 | 101,564 | 604 | 156,487 |

| Indicated | 46,584 | 56 | 0.63 | 114 | 84,430 | 948 | 170,592 | ||

| Measured & | 73,129 | 79 | 0.66 | 139 | 185,994 | 1,553 | 327,078 | ||

| Indicated | |||||||||

| Inferred | 9,693 | 34 | 0.57 | 86 | 10,616 | 176 | 26,647 | ||

| Heap Leach | Oxides | Measured | 6,673 | 16 | 0.14 | 25 | 3,486 | 30 | 5,342 |

| Indicated | 24,102 | 12 | 0.17 | 23 | 9,163 | 133 | 17,506 | ||

| Measured & | 30,774 | 13 | 0.16 | 23 | 12,649 | 162 | 22,848 | ||

| Indicated | |||||||||

| Inferred | 10,024 | 9 | 0.20 | 21 | 2,811 | 64 | 6,850 | ||

| Total | Oxides | Measured | 33,218 | 98 | 0.59 | 152 | 105,050 | 634 | 161,829 |

| Indicated | 70,686 | 41 | 0.48 | 83 | 93,593 | 1,081 | 188,098 | ||

| Measured & | 103,904 | 59 | 0.51 | 105 | 198,643 | 1,715 | 349,927 | ||

| Indicated | |||||||||

| Inferred | 19,628 | 21 | 0.38 | 53 | 13,427 | 241 | 33,496 |

Footnotes for Tank Leach Resource:

- Mineral Resources are not Mineral Reserves and have not demonstrated economic viability.

- The formula for calculating AgEq is as follows: Silver Eq Oz = Silver Oz + Gold Oz x (Gold Price/Silver Price) x (Gold Recovery/Silver Recovery).

- The Mineral Resource model was populated using Ordinary Kriging grade estimation within a three-dimensional block model and mineralized zones defined by wireframed solids, which are a combination of lithology and alteration domains. The 1m composite grades were capped where appropriate.

- The Mineral Resource is reported inside a conceptual Whittle open pit shell derived using US$ 27.50/oz Ag price, US $2,400/oz Au price, 83% process recovery for Ag, and 87% process recovery for Au.

- The constraining open pit optimization parameters used were US $1.94/t mining cost, US $22.96/t processing cost, US $3.32/t G&A cost, and average 51-degree open pit slopes.

- The MRE has been categorized in accordance with the CIM Definition Standards (CIM, 2014).

- A Net Value per block [NVB] calculation was used to constrain the Mineral Resource, determine the "Benefits = Income-Cost", where, Income = [(Au Selling Price (US$/oz) - Au Selling Cost (USD/Oz)) x (Au grade (g/t)/31.1035)) x Au Recovery (%)] + [(Ag Selling Price (US$/oz) - Ag Selling Cost (USD/Oz)) x (Ag grade (g/t)/31.1035)) x Ag Recovery (%)] and Cost = Mining Cost (US$/t) + Process Cost (US$/t) + Transport Cost (US$/t) + G&A Cost (US$/t) + [Royalty Cost (%) x Income]

- The Mineral Resource is sub-horizontal with sub-vertical feeders and a reasonable prospect for eventual economic extraction by open pit and tank leach processing methods.

- In-situ bulk density were assigned to each model domain, according to samples averages for each lithology domain, separated by alteration zones and subset by oxidation.

- All tonnages reported are dry metric tonnes and ounces of contained gold are troy ounces.

- Mining recovery and dilution factors have not been applied to the Mineral Resource estimates.

- The Mineral Resource was estimated by Luis Rodrigo Peralta, B.Sc., FAusIMM CP (Geo), Independent Qualified Person under NI 43-101.

- Mr. Peralta is not aware of any environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues that could materially affect the potential development of the Mineral Resource.

- All figures are rounded to reflect the relative accuracy of the estimates. Minor discrepancies may occur due to rounding to appropriate significant figures.

Footnotes for Heap Leach Resource:

- Mineral Resources are not Mineral Reserves and have not demonstrated economic viability.

- The formula for calculating AgEq is as follows: Silver Eq Oz = Silver Oz + Gold Oz x (Gold Price/Silver Price) x (Gold Recovery/Silver Recovery).

- The Mineral Resource model was populated using Ordinary Kriging grade estimation within a three-dimensional block model and mineralized zones defined by wireframed solids, which are a combination of lithology and alteration domains. The 1m composite grades were capped where appropriate.

- The Mineral Resource is reported inside a conceptual Whittle open pit shell derived using US$ 27.50/oz Ag price, US $2,400/oz Au price, 80% process recovery for Ag, and 58% process recovery for Au.

- The constraining open pit optimization parameters used and overall operational cost of US $11.31/t.

- The MRE has been categorized in accordance with the CIM Definition Standards (CIM, 2014).

- A Net Value per block [NVB] calculation was used to constrain the Mineral Resource, determine the "Benefits = Income-Cost", where, Income = [(Au Selling Price (US$/oz) - Au Selling Cost (USD/Oz)) x (Au grade (g/t)/31.1035)) x Au Recovery (%)] + [(Ag Selling Price (US$/oz) - Ag Selling Cost (USD/Oz)) x (Ag grade (g/t)/31.1035)) x Ag Recovery (%)] and Cost = Mining Cost (US$/t) + Process Cost (US$/t) + Transport Cost (US$/t) + G&A Cost (US$/t) + [Royalty Cost (%) x Income]

- In-situ bulk density were assigned to each model domain, according to samples averages for each lithology domain, separated by alteration zones and subset by oxidation.

- All tonnages reported are dry metric tonnes and ounces of contained gold are troy ounces.

- Mining recovery and dilution factors have not been applied to the Mineral Resource estimates.

- The Mineral Resource was estimated by Mr. Peralta, B.Sc., FAusIMM CP (Geo), Independent Qualified Person under NI 43-101.

- Mr. Peralta is not aware of any environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues that could materially affect the potential development of the Mineral Resource.

- All figures are rounded to reflect the relative accuracy of the estimates. Minor discrepancies may occur due to rounding to appropriate significant figures.

QA/QC and Core Sampling Protocols

AbraSilver applies industry standard exploration methodologies and techniques, and all drill core samples are collected under the supervision of the Company's geologists in accordance with industry best practices. Drill core is transported from the drill platform to the logging facility where drill data is compared and verified with the core in the trays. Thereafter, it is logged, photographed, and split by diamond saw prior to being sampled. Samples are then bagged, and quality control materials are inserted at regular intervals at site; these include blanks and certified reference materials as well as duplicate core samples which are collected in order to assess sampling precision and reproducibility. Groups of samples are then placed in large bags which are sealed with numbered tags in order to maintain a chain-of-custody during the transport of the samples from the project site to the laboratory.

All samples are received by the ASA (Alex Stewart Argentina) preparation laboratory in Salta, where they are prepared, then the pulp sachet is directly dispatched to its facility in Mendoza, Argentina, where they are analyzed. All samples are analyzed using a multi-element technique consisting of a four-acid digestion followed by ICP/AES detection, and gold is analyzed by 50g Fire Assay with an AAS finish. Silver results greater than 100g/t are re-analyzed using four acid digestion with an ore grade AAS finish.

Qualified Persons

David O'Connor P.Geo., Chief Geologist for AbraSilver, is the Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects, and he has reviewed and approved the scientific and technical information in this news release.

About AbraSilver

AbraSilver is an advanced-stage exploration company focused on rapidly advancing its 100%-owned Diablillos silver-gold project in the mining-friendly Salta province of Argentina. The current Measured and Indicated Mineral Resource estimate for Diablillos (tank leach-only) consists of 73.1 Mt grading 79 g/t Ag and 0.66 g/t Au, containing approximately 186Moz silver and 1.6Moz gold, with significant further upside potential based on recent exploration drilling. The Company is led by an experienced management team and has long-term supportive shareholders. In addition, the Company has entered into an earn-in option and joint venture agreement with Teck on the La Coipita project, located in the San Juan province of Argentina. AbraSilver is listed on the Toronto Stock Exchange under the symbol "ABRA" and in the U.S. on the OTCQX under the symbol "ABBRF."

For further information please visit the AbraSilver Resource website at www.abrasilver.com, our LinkedIn page at AbraSilver Resource Corp., and follow us on X at www.x.com/abrasilver

Alternatively, please contact:

John Miniotis, President and CEO

info@abrasilver.com

Tel: +1 416-306-8334

Cautionary Statements

This news release includes certain "forward-looking statements" under applicable Canadian securities legislation. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. All statements that address future plans, activities, events or developments that the Company believes, expects or anticipates will or may occur are forward-looking information. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. When considering this forward-looking information, readers should keep in mind the risk factors and other cautionary statements in the Company's disclosure documents filed with the applicable Canadian securities regulatory authorities on SEDAR+ at www.sedarplus.ca. The risk factors and other factors noted in the disclosure documents could cause actual events or results to differ materially from those described in any forward-looking information. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Neither the TSX nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this news release

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/263657

SOURCE: AbraSilver Resource Corp.