TORONTO, Aug. 27, 2025 (GLOBE NEWSWIRE) -- Consolidated Lithium Metals Inc. (TSXV: CLM | FRA: Z36) ("CLM" or the "Company") is pleased to announce that it has entered into a non-binding letter of intent ("LOI") effective July 31, 2025, with SOQUEM Inc. ("SOQUEM"), a wholly owned subsidiary of Investissement Québec, pursuant to which (subject to completion of several conditions precedent) the Company may acquire an option to earn up to an 80% interest in the Kwyjibo Rare Earth Project (the "Project"), located 125 km northeast of the city of Sept-Îles, in the Côte-Nord region of Québec (the "Proposed Transaction").

Proposed Transaction Summary

Phase I - CLM to acquire a 60% undivided interest in Project

Pursuant to the terms of the LOI, CLM may earn a 60% interest in the Project and be appointed as its operator in exchange for payments and issuances of common shares of the Company totalling an aggregate of C$23.15m within five years following the closing date of the Proposed Transaction (the "Phase I Term"), allocated as follows (in each case subject to and in accordance with the rules and policies of the TSX Venture Exchange ("TSXV")):

- C$5.65m in cash to SOQUEM;

- C$5.50m payable to SOQUEM in common shares of the Company, at a deemed price per share to be mutually agreed by the parties; and

- C$12.00m invested in the Project to advance the following key stages of the Project's development:

- Negotiation and ratification of an impacts and benefits agreement with the Innu of Takuaikan Uashat mak Mani-utenam;

- Metallurgical study to confirm environmental viability of extraction and processing of rare earth in the region of the Project;

- Environmental permitting from the Bureau d'accélération de projets;

- Initiation of at least a 5,000m drilling campaign for potential expansion of Project's resources; and

- Initiation of a bankable feasibility study to evaluate the technical and economic viability of the Project (the "Feasibility Study").

- Negotiation and ratification of an impacts and benefits agreement with the Innu of Takuaikan Uashat mak Mani-utenam;

Phase II - CLM to acquire an additional 20% undivided interest in the Project, for a total of 80%

Following completion of Phase I, CLM may earn an additional 20% interest in the Project (for a total of 80%) in exchange for payments or issuances of common shares of the Company totalling an aggregate of an additional C$22.00m within three years following completion of the Phase I Term, allocated as follows (in each case subject to and in accordance with the rules and policies of the TSXV):

- C$4.50m in cash to SOQUEM;

- C$4.50m payable to SOQUEM in common shares of the Company, at a deemed price per share to be mutually agreed by the parties; and

- C$13.00m invested in the Project to advance the following Project milestones:

- Completion of the Feasibility Study;

- Access road construction;

- Electrical transmission line construction;

- Underground mine construction; and

- Processing Facility construction.

- Completion of the Feasibility Study;

The LOI also contemplates the following:

- SOQUEM has granted CLM a legally binding exclusivity period respecting the Project, ending on October 31, 2025;

- CLM shall be entitled to enter into discussions with SOQUEM and Investissement Québec to acquire the remaining 20% interest in the Project; and

- CLM anticipates financing the Proposed Transaction through a combination of internal and external project financing resources, the support of existing shareholders, and the assistance of financial advisors.

Throughout Phases I and II, CLM expects to act as Project operator in collaboration with SOQUEM. CLM anticipates that the definitive agreement respecting the Proposed Transaction (the "Definitive Agreement") shall be negotiated and executed on or before the end of the Exclusivity Period, being October 31, 2025.

About the Project

The Project consists of mining claims, applications, leases or other forms of mineral rights hosting an Iron Oxide Copper Gold (IOCG)-style mineral system with significant rare earth enrichment, particularly neodymium (Nd), praseodymium (Pr), dysprosium (Dy), Yttrium (Y) and terbium (Tb).

The Project is located near established infrastructure, including the QNS&L rail line and the Port of Sept-Îles, and the Company believes it can benefit from access to Québec's hydroelectric power grid.

SOQUEM has conducted extensive exploration, geophysics, and metallurgical test work to date, which the Company believes establishes a foundation for the advancement towards feasibility.

Management Commentary

Richard Quesnel, CEO of CLM, commented:

"This LOI with SOQUEM represents a unique opportunity to potentially partner with a Québec government-backed entity on what we believe to be one of the province's most strategically important rare earth assets. With a forecasted demand increase for NdPr and heavy rare earths, we anticipate that the Project positions CLM as a potential key supplier to North American and European supply chains. The phased earn-in structure described in the LOI ensures disciplined capital allocation as we advance this Project toward development."

The Proposed Transaction is an arm's length transaction for the purposes of the policies of the TSXV and remains subject to several closing conditions including, without limitation, (a) execution of a Definitive Agreement between the parties, (b) the receipt by the Company of all necessary corporate and regulatory approvals, including the approval of the TSXV, (c) each party's representations and warranties in the Definitive Agreement being true and correct in all aspects as of the closing date, and (d) each party satisfying its covenants and obligations as contained in the Definitive Agreement. There can be no guarantees that the Proposed Transaction will be completed as contemplated or at all. The Proposed Transaction is anticipated to close on or before October 31, 2025.

Qualified Person

The scientific and technical information contained herein has been reviewed and approved by Mr. Jean Lafleur, P. Geo./ géo. (OGQ, #833), Technical Advisor to the Company, who is a "Qualified Person" as defined in National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

About Consolidated Lithium Metals Inc.

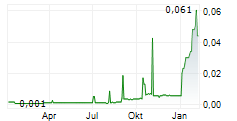

Consolidated Lithium Metals Inc. is a Canadian junior mining exploration company trading under the symbol "CLM" on the TSX Venture Exchange and "Z36" on the Frankfurt Stock Exchange. The Company is focused on the exploration and development of critical mineral projects in stable jurisdictions. The Company is committed to supporting the energy transition through the responsible development of critical mineral supply chains.

About SOQUEM

SOQUEM, a subsidiary of Investissement Québec, is dedicated to exploring, discovering and developing mining properties in Québec. SOQUEM also contributes to maintaining strong local economies. Proud partner and ambassador for the development of Québec's mineral wealth, SOQUEM relies on innovation, research, and strategic minerals to be well positioned for the future.

For more information:

Rene Bharti, Vice President Corp. Dev.

Email | info@consolidatedlithium.com

Phone: +1 (647) 965 2173

Website: www.consolidatedlithium.com

Cautionary Statements

This press release contains "forward-looking information" within the meaning of applicable Canadian securities laws. Forward-looking information includes, but is not limited to, statements with respect to: the Proposed Transaction, including finalizing the business terms of the agreement, successfully negotiating the Definitive Agreement, and closing the transaction, as well as the anticipated timing of each, and other matters related thereto; the Company's plan, expectations, and beliefs respecting the Project, including planned exploration programs, studies, and expenditures, potential development timelines, and the strategic importance of the Project; and future demand for rare earth elements.

Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved".

Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to differ materially, including risks related to: the ability of the Company and SOQUEM to finalize the Definitive Agreement on acceptable terms; the Company's ability to fund earn-in expenditures; regulatory approvals, including respecting permits and approval of the TSXV of the Proposed Transaction; commodity prices and demand; exploration and development risks; environmental and social risks; community and Indigenous relations; general business, economic, competitive, political, social, and market conditions; accidents, labour disputes and shortages and other risks of the mining industry.

Although the Company has attempted to identify the important factors that could cause actual results to differ materially from those contained in the forward-looking information, and believes the expectations expressed in such forward-looking information are reasonable, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information or expectations will prove to be correct, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. Forward-looking information is provided as of the date of this release, and the Company does not undertake any obligation to update or revise such information except as required by law.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.