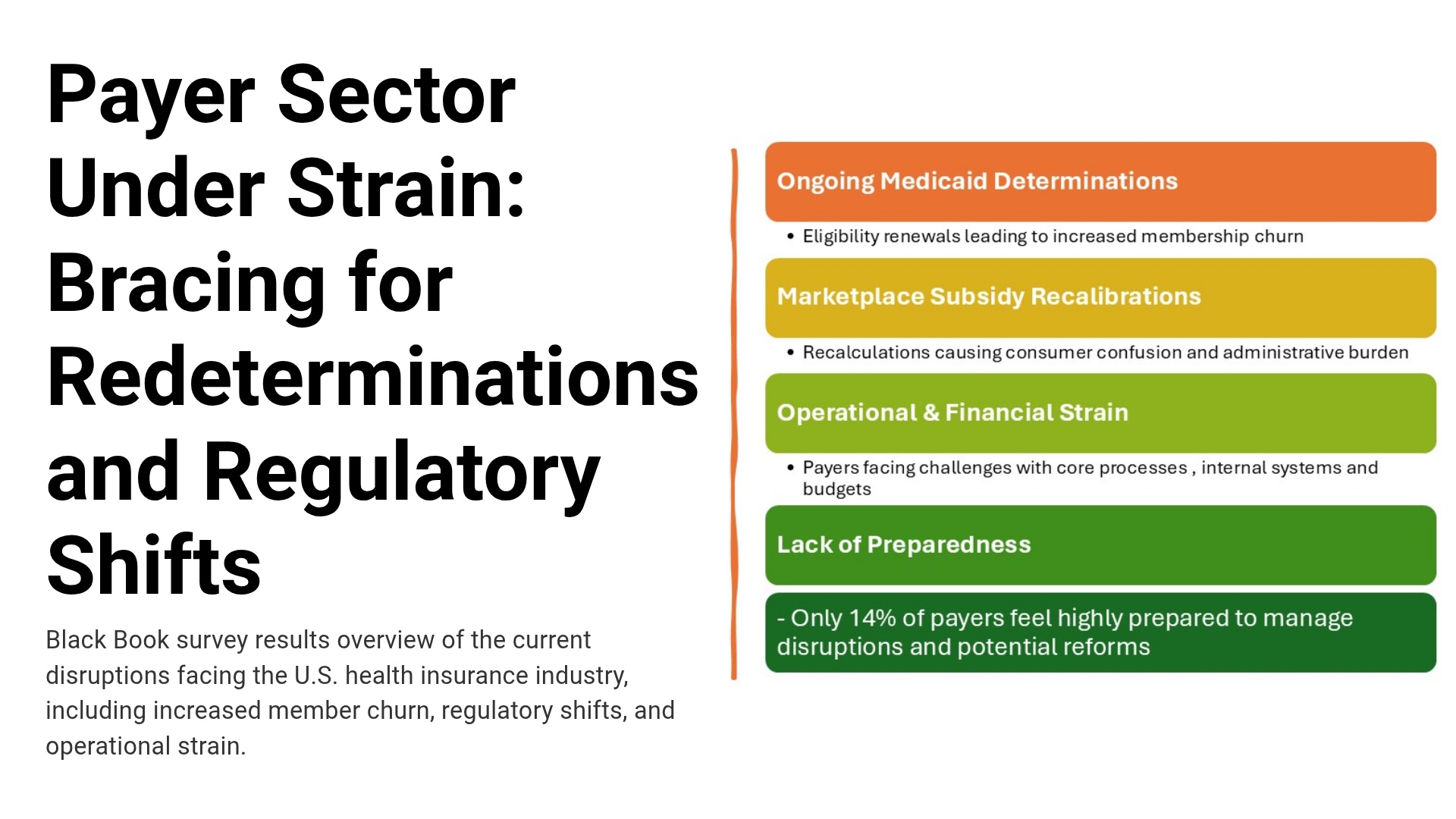

New Black Book flash survey of 227 payer leaders (Aug 10-20, 2025; ±5.2%) finds rising churn (68%), call/portal surges (72%), 2026 budget risk (55%), and only 14% reporting high readiness.

WASHINGTON, DC / ACCESS Newswire / August 27, 2025 / U.S. health insurers are already feeling the ripple effects of ongoing Medicaid redeterminations and Marketplace subsidy recalibrations, according to new research from Black Book. Findings point to escalating operational and financial strain across payer organizations well before additional reforms under consideration in Washington become law.

Early Signals of Market Volatility

Between August 10-20, 2025, Black Book conducted a flash survey of 227 qualified payer executives and operational leaders representing commercial insurers, Medicaid managed care organizations, and Marketplace plan administrators nationwide. The survey, statistically valid at the 95% confidence level (±5.2%), found:

68% of Medicaid-focused payers report increased member churn since July due to ongoing eligibility renewals.

72% cite sharp spikes in call center and portal traffic tied to consumer eligibility concerns.

61% say core processes and internal systems are not yet fully ready for revised subsidy reconciliation rules.

55% expect negative financial effects on their 2026 budgets from related administrative overhead.

Only 14% feel "highly prepared" to manage both current disruptions and potential future reforms.

"These disruptions are no longer hypothetical," said Doug Brown, Founder of Black Book Research. "We are watching in real time as eligibility changes and subsidy recalculations create immediate churn, higher costs, and mounting consumer confusion. The fall of 2025 is a stress test that payers cannot afford to fail."

A Payer Sector Under Pressure

Respondents describe an industry balancing immediate consumer support with longer-term uncertainty. Many organizations report short-term measures-expanded member communications, concierge lines, and targeted outreach to at-risk populations, while questioning their sustainability if churn persists. Compliance leaders highlight exposure to penalties for mishandled redeterminations; CFOs increasingly rank policy volatility among their top risk factors for 2026 planning.

What to Watch Next (Near-Term, Operations-First)

Member experience pressure: spikes in calls, grievances, appeals, and grace-period complexities as households cycle through eligibility decisions.

Administrative load: higher rework on enrollment and premium billing, plus reconciliation clean-up as subsidy determinations settle.

Network and access dynamics: provider directory accuracy and authorization workflows strained by frequent coverage changes.

Financial forecasting: harder-to-predict risk pools and MLR implications as churn alters population mix.

Black Book's 18-Point Payer Preparedness KPI Framework

To benchmark readiness without prescribing any particular solution set, Black Book has introduced an 18-point framework that payers can use to score current state and track improvement over time. Each KPI is scored on a 10-point scale and rolled into a composite by domain.

Regulatory & Compliance Preparedness

Timeliness of rule adoption

Accuracy of eligibility/redetermination processes

Audit and reporting capabilities

Governance and risk management

Operations & Systems Readiness

Enrollment and claims accuracy under changing rules

Integration and workflow automation for eligibility/renewals

Preparedness for subsidy recalculations and reconciliations

Continuity planning for rapid regulatory shifts

Member & Provider Engagement

Clarity and reach of communications (digital, SMS, call center)

Multilingual and accessibility compliance

Provider network awareness of policy changes

Dedicated outreach to vulnerable populations

Financial & Strategic Planning

Budgeting for compliance and administrative overhead

Forecast accuracy for churn and risk pool dynamics

Leadership alignment on reform strategy

Investment in analytics and scenario planning

Methodology

Black Book surveyed 227 qualified payer leaders across commercial, Medicaid, and Marketplace lines from Aug 10-20, 2025. Results are representative of the national payer base and are valid at 95% confidence (±5.2%). No vendors were named or evaluated in this study.

About Black Book Research

Since 2011, Black Book has surveyed nearly 3.5 million healthcare stakeholders to deliver unbiased, vendor-agnostic insights on payer operations and healthcare market change. Executives, boards, and policymakers rely on Black Book's research methodology and KPI frameworks to benchmark preparedness and performance through periods of transition. Download payer industry reports at www.blackbookmarketresearch.com.

Contact Information

Press Office

research@blackbookmarketresearch.com

8008637590

SOURCE: Black Book Research

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/healthcare-and-pharmaceutical/3-in-4-payers-already-under-strain-as-medicaid-redeterminations-bite-1064867