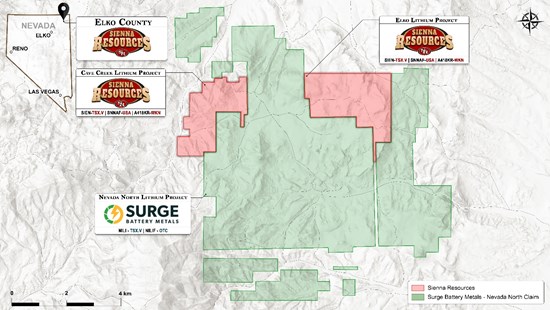

Vancouver, British Columbia--(Newsfile Corp. - August 28, 2025) - Sienna Resources Inc. (TSXV: SIEN) (OTCID: SNNAF) (FSE: A418KR) (the "Company" or "Sienna") is pleased to announce that it has entered into an options agreement to acquire a 100% interest in the Cave Creek Lithium Project, in Elko County, Nevada (the "Project"). This strategic property consists of 61 contiguous claims totalling approximately 1,230 acres and is positioned directly on the western border of Surge Battery Metals' ("Surge") Nevada North Lithium Project - a rapidly emerging, high-grade lithium claystone discovery. Surge recently reported an updated Inferred Resource of 8.65 million tonnes of lithium carbonate equivalent (LCE) (see Surge Battery Metals news release dated July 24, 2025). With Cave Creek bordering this significant lithium deposit, Sienna is targeting the same lithium-bearing stratigraphy that underpins one of the most exciting new lithium discoveries in North America.

Surge's Nevada North project has attracted widespread attention due to its significant lithium grades, including reported drill hole intercepts of 42.7 metres averaging 4,067 ppm lithium, with peak values of 8,070 ppm lithium. Its 2025 Preliminary Economic Assessment (PEA) outlines a long-life operation extracting 205 million tonnes of mineralized material over 42 years, with peak production of 109,100 tonnes of LCE per year. These results underscore the massive potential of lithium-rich claystone deposits in this region.

Sienna's Cave Creek Project, while geologically independent from its nearby Elko Lithium Project, is ideally located to benefit from the proven mineralization trend extending from Surge's property. With growing global demand for domestic lithium supply and advancements in clay-hosted lithium extraction technologies, Sienna is well-positioned to contribute meaningfully to the U.S. critical minerals supply chain.

Jason Gigliotti, President of Sienna Resources Inc., stated, "This new acquisition positions Sienna as one of the largest landholders in this rapidly emerging lithium district. Surge Battery Metals has delineated one of the highest-grade lithium deposits in the United States, and our newly acquired Cave Creek Project directly borders their property - potentially along the same mineralized trend. Lithium prices are currently trading at year-to-date highs, and there has been a marked resurgence of interest in lithium equities. With just over 25 million shares outstanding, Sienna offers shareholders substantial upside leverage to any exploration success on the ground. We believe the renewed focus on lithium will only accelerate as broader markets begin to grasp the explosive growth potential tied to self-driving technologies and robotics-sectors heavily reliant on lithium-ion batteries. Management is confident that Sienna is entering the early stages of a major news flow and marketing cycle, and we want our shareholders to clearly understand our commitment to building long-term value."

Figure 1

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/854/264244_d3000601e4cefbdd_002full.jpg

Pursuant to the terms of the option agreement, Sienna shall have the exclusive right and option to earn a 100-per-cent interest in the property from the owner by issuing a total of three million common shares (subject to a four-month hold) and one million five hundred thousand transferable share purchase warrants exercisable at fourteen cents per share for five years, and by making cash payments totaling $53,000 as set out below:

(a) Paying the Optionor $30,000, and issuing the Optionor 2,000,000 common shares and 1,000,000 share purchase warrants within five (5) days of TSX Venture Exchange ("Exchange") approval;

(b) Paying the Optionor $13,000, and issuing the Optionor 500,000 common shares and 250,000 share purchase warrants prior to the date that is four (4) months from the date of Exchange approval; and

(c) Paying the Optionor $10,000, and issuing the Optionor 500,000 common shares and 250,000 share purchase warrants prior to the date that is eight (8) months from the date of Exchange approval.

1) Sienna also agrees to pay any annual taxes and fees to maintain the claims listed in Schedule "A" (the "Claims") and supply proof of payment to the Owner.

2) Sienna also agrees to pay any maintenance fees due during the due diligence process and if no agreement is reached, the Owner agrees to reimburse Sienna the balance of any fees paid to maintain the Claims.

3) Upon fulfilling the obligations set out above, Sienna will acquire 100% right, title, and interest in and to the Property subject only to:

(a) a 1.5% Net Smelter Return ("NSR"), (as more particularly described in "Schedule B" attached to the option agreement) to the Owner provided that Sienna shall have the right to purchase 0.75% NSR for $500,000 at any time up to commencement of production; and

(b) Providing the Owner written notice of its intention to exercise its option pursuant to the option agreement.

This option agreement is subject to TSX Venture Exchange approval.

Qualified Person

Dr. Scott Jobin-Bevans (Ph.D., P.Geo.), a qualified person (QP) as defined by National Instrument 43-101, has reviewed and approved the scientific and technical disclosure contained within this news release.

Contact Information

Tel: 1604-646-6900

www.siennaresourcesinc.com

"Jason Gigliotti"

President

Sienna Resources Inc.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/264244

SOURCE: Sienna Resources Inc.