28.8.2025 09:21:33 CEST | RTX | Quarterly report

Nørresundby, Denmark, 28 August 2025

Announcement no. 15/2025

SOLID REVENUE AND PROFITABILITY LEADS TO CONFIDENCE IN CURRENT GUIDANCE

"I am pleased to report continued strong momentum in Q3, driven primarily by the Enterprise segment, where we see solid and consistent demand, particularly from long-term customers and the retail sub-segment. We are also seeing steady progress in our Healthcare segment, where RTX products remain critical components in advanced patient monitoring systems.

Although short order cycles continue to limit forecast visibility, demand patterns across quarters are becoming more stable. We are increasing our efforts to follow ongoing market dynamics and trends, in order to better align with customer expectations and evolving market demands.

At the end of June, we raised our full-year guidance, as strong Q3 result became evident and several orders for Q4 were secured. U.S. tariffs continue to create uncertainty, and we are working closely with our large international customers to find the best solutions.

With strong expertise and a global customer base, the Company has a solid foundation. By expanding our footprint and focusing on strategic priorities, we are reinforcing our ability to drive sustainable growth and long-term value."

Henrik Mørck Mogensen, CEO

FINANCIAL HIGHLIGHTS

- Revenue for Q3 2024/25 increased by 3.5% year on year to 146.9 DKKm, compared to 141.9 DKKm in Q3 2023/24. Adjusted for currency effects, revenue for the quarter increased by 9.9%. For the first nine months of 2024/25, revenue rose by 16.7% year on year to 407.3 DKKm, and by 18.0% when adjusted for currency effects.

- Gross margin reached 51.7% for Q3 2024/25, and 50.7% for the first 9M 2024/25. Gross margin improved due to a favourable product mix and higher revenue from the Healthcare segment.

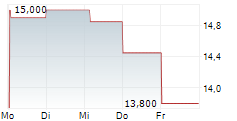

- EBITDA reached 15.0 DKKm for Q3 2024/25, and 22.2 DKKm for 9M 2024/25 (Q3 2023/24: 9.4 DKKm, 9M: -20.1 DKKm).

GUIDANCE

On 23 June 2025, RTX adjusted the guidance for 2024/25, and with the announcement of this interim report the intervals are narrowed by raising the lower range of EBITDA and EBIT by 10 DKKm:

- Revenue DKK 530 to 560 million (from DKK 490 to 530 million)

- EBITDA DKK 25 to 35 million (from DKK 0 to 20 million)

- EBIT DKK -5 to 5 million (from DKK -35 to -15 million)

BUSINESS HIGHLIGHTS

- Continued strong performance in Enterprise segment driven mainly by customers in the retail sector and long-term customers demand across applications.

- The Healthcare segment delivered solid revenue growth, driven by sales of RTX products used in patient monitoring systems.

- While the order horizon remains short and creates uncertainty in our forecast, we see more stable and even demand patterns between quarters.

- Reduction in inventory from 74.1 DKKm in Q2 to 56.5 DKKm in Q3, mainly due to reduction in component inventory.

- Increase in guidance for the financial year 2024/25 was communicated on 23 June 2025.

RTX A/S

HENRIK SCHIMMELL HENRIK MØRCK MOGENSEN

Chair CEO

Investor and analyst conference call

On Friday 29 August 2025 at 10:15 CET, RTX will hold a conference call for investors and analysts hosted by Danske Bank. To register for the conference call, please e-mail vonh@danskebank.dk.

Enquiries and further information:

CEO Henrik Mørck Mogensen, tel +45 96 32 23 00

CFO Mille Tram Lux, tel +45 96 32 23 00

Contacts

- Henrik Mørck Mogensen, CEO, RTX A/S, +45 96322300, hmm@rtx.dk

- Mille Tram Lux, CFO, +45 96322300, mtl@rtx.dk

About RTX

RTX innovates, designs, and manufactures wireless communication solutions within Enterprise, Healthcare, and ProAudio. Working in close partnership with our customers, we offer customized, 'turn-key', end-to-end solutions with full product lifecycle management designed to make a difference in the market. We are a global company employing 300+ people at our locations in Denmark, Hong Kong, Romania and USA.