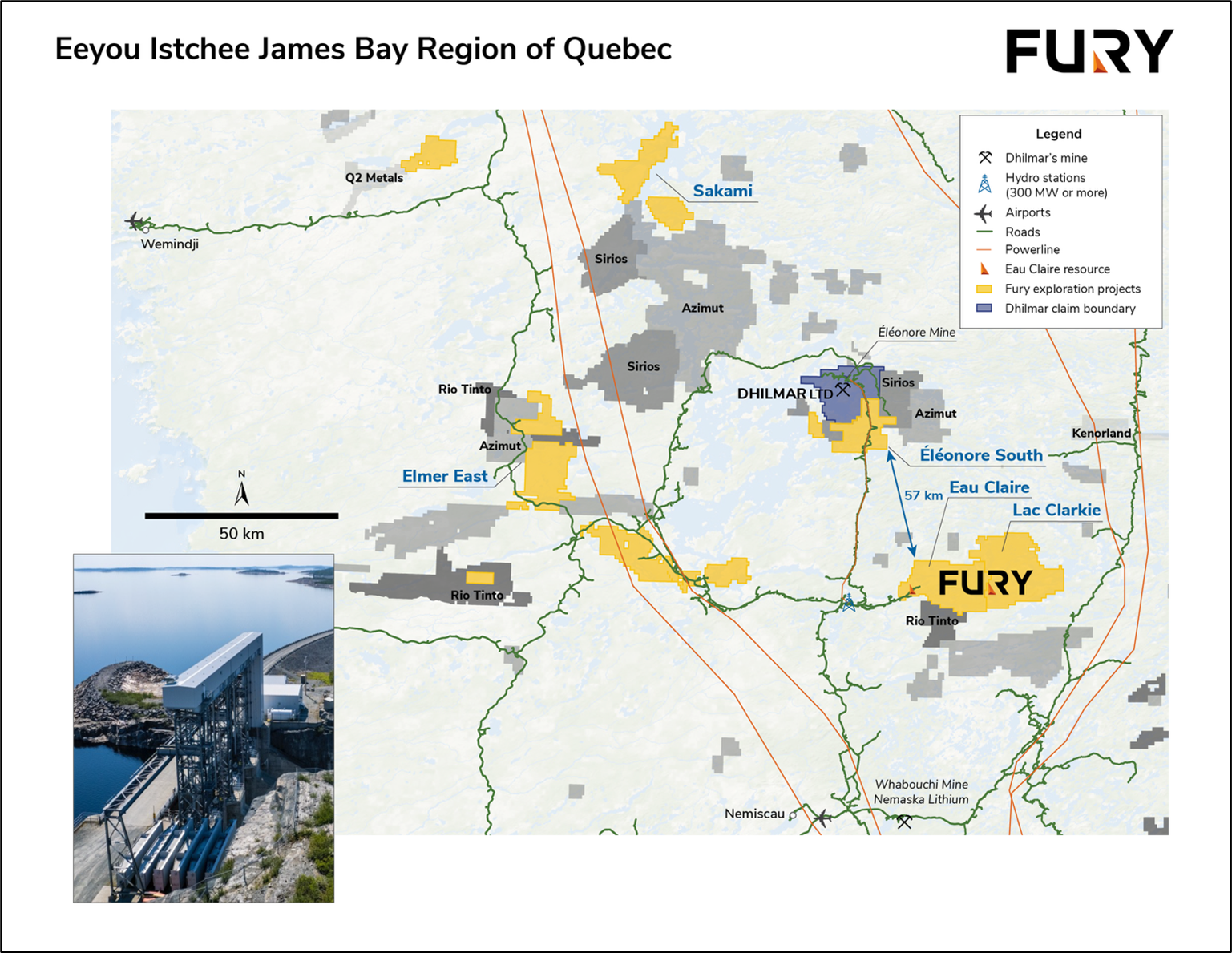

TORONTO, Sept. 02, 2025 (GLOBE NEWSWIRE) -- Fury Gold Mines Limited (TSX and NYSE American: FURY) ("Fury" or the "Company") is pleased to announce results from a preliminary economic assessment (PEA) for the high-grade Eau Claire deposit located in the Eeyou Istchee Territory of the James Bay region of Quebec. The PEA represents an initial conceptual evaluation of the economic potential of Eau Claire's mineral resources and was prepared in accordance with National Instrument 43-101 ("NI 43-101") by SGS Geological Services. All dollar amounts are in Canadian dollars unless otherwise specified.

Three scenarios, all based on the same mine plan, were evaluated, each returning an after-tax net present value at a 5% discount rate ("NPV5") and after-tax internal rate of return ("IRR") at a gold price of US$2,400 per ounce ("oz"):

- Full standalone operation with all processing on site (the "Base Case")

- After-tax NPV5 of $554M and after-tax IRR of 41%

- Hybrid case starting with two years of toll milling, followed by full standalone crushing, milling, and processing on site (the "Hybrid Case"):

- After-tax NPV5 of $610M and after-tax IRR of 53%

- Full toll milling scenario, processing mineralized material off-site at a third-party facility (the "Toll Milling Case"):

- After-tax NPV5 of $639M and after-tax IRR of 84%

Highlights

- Total recovered gold production of 834koz gold at an average diluted head grade of 4.46 g/t gold.

- Average annual production projected to be approximately 76k oz gold over an 11-year life of mine ("LOM") at an all-in sustaining cost ("AISC") of US$1,140/oz for the Base Case; US$1,153/oz for the Hybrid Case, and US$1,170/oz of gold for the Toll Milling Case.

- Low initial capital expenditures ("CapEx") ranging from $117M in the Toll Milling Case to $217M in the Base Case.

- Rapid after-tax payback period of 2.5, 1.5, and 1.1 years based on the three cases, respectively.

- 76% of the ounces within the PEA mine plan are currently in the Measured and Indicated resource category, demonstrating a timely pathway to a prefeasibility study ("PFS") with minimal conversion drilling required.

"The Eau Claire PEA scenarios each demonstrate an exceptional internal rate of return and net present value," commented Tim Clark, CEO of Fury. "The results validate our belief that the market has significantly undervalued the project within Fury's broader asset portfolio. With strong infrastructure in place, including access to hydro power and roads, combined with favourable metallurgy, Eau Claire stands out as a highly attractive development opportunity with substantial exploration upside, presently hosting a combined Eau Claire and Percival resource of 6.39 Mt at 5.64 g/t gold containing 1.16Moz gold Measured and Indicated plus 5.45 Mt at 4.13 g/t gold containing 723koz gold Inferred."

PEA Summary

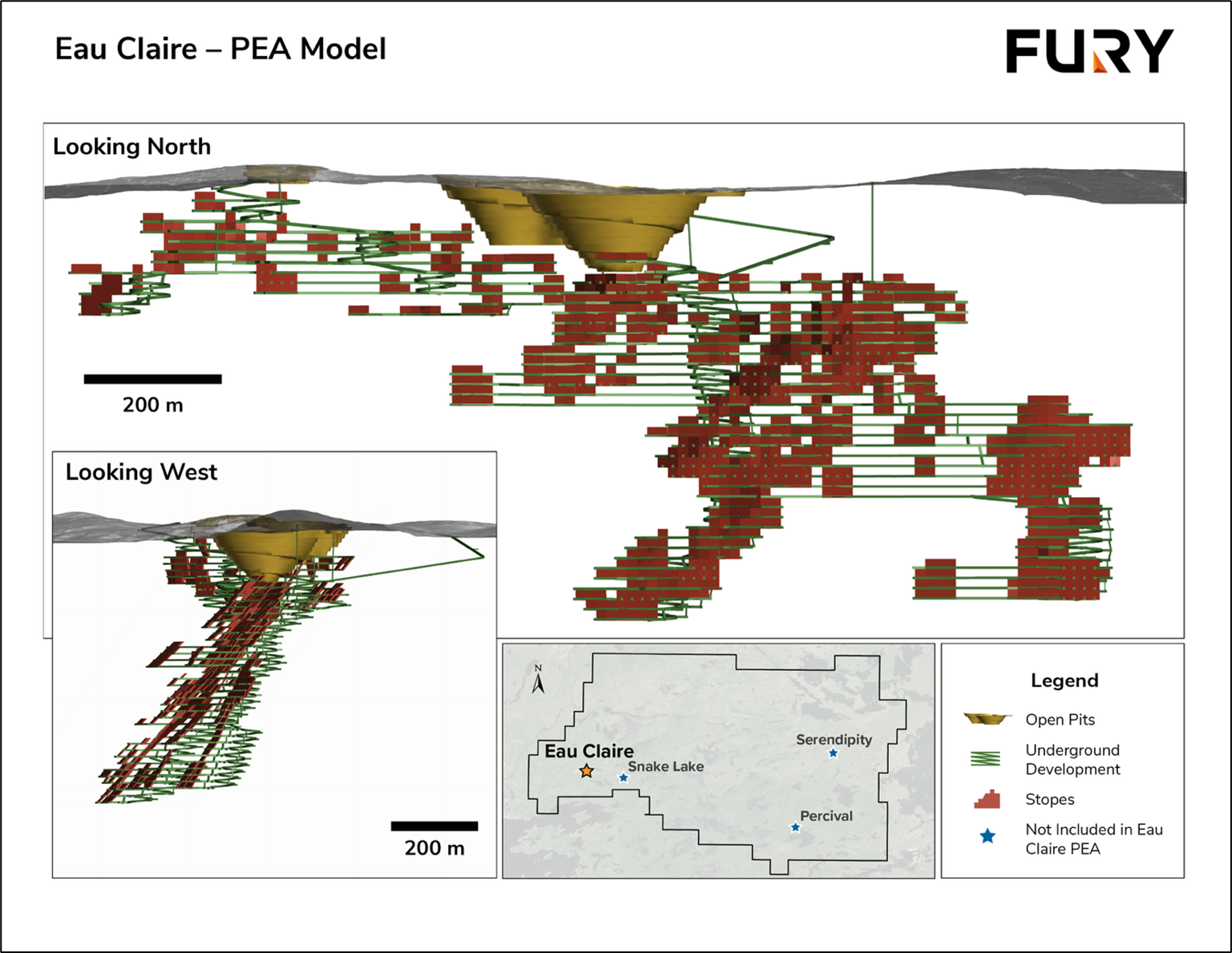

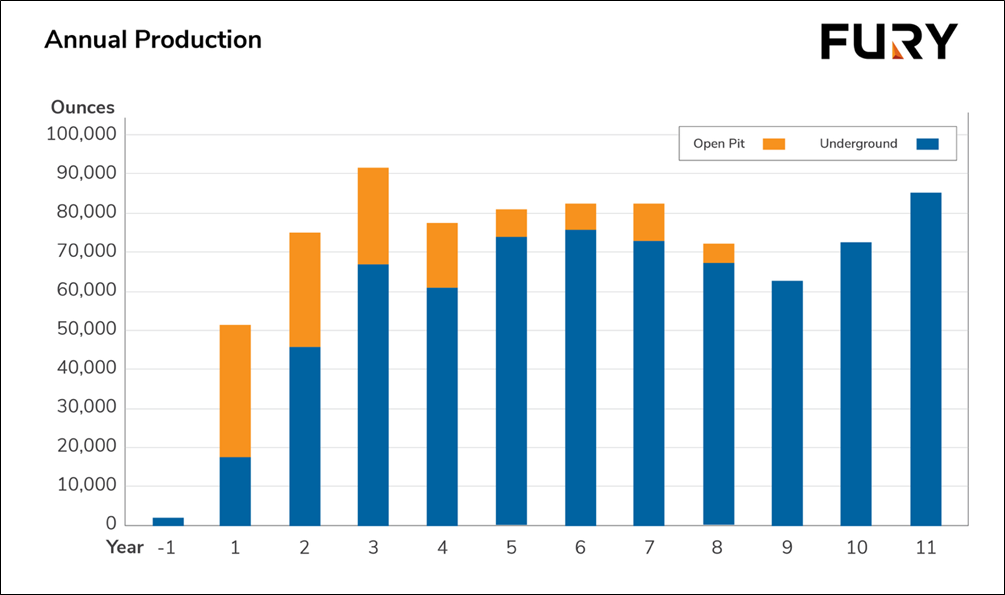

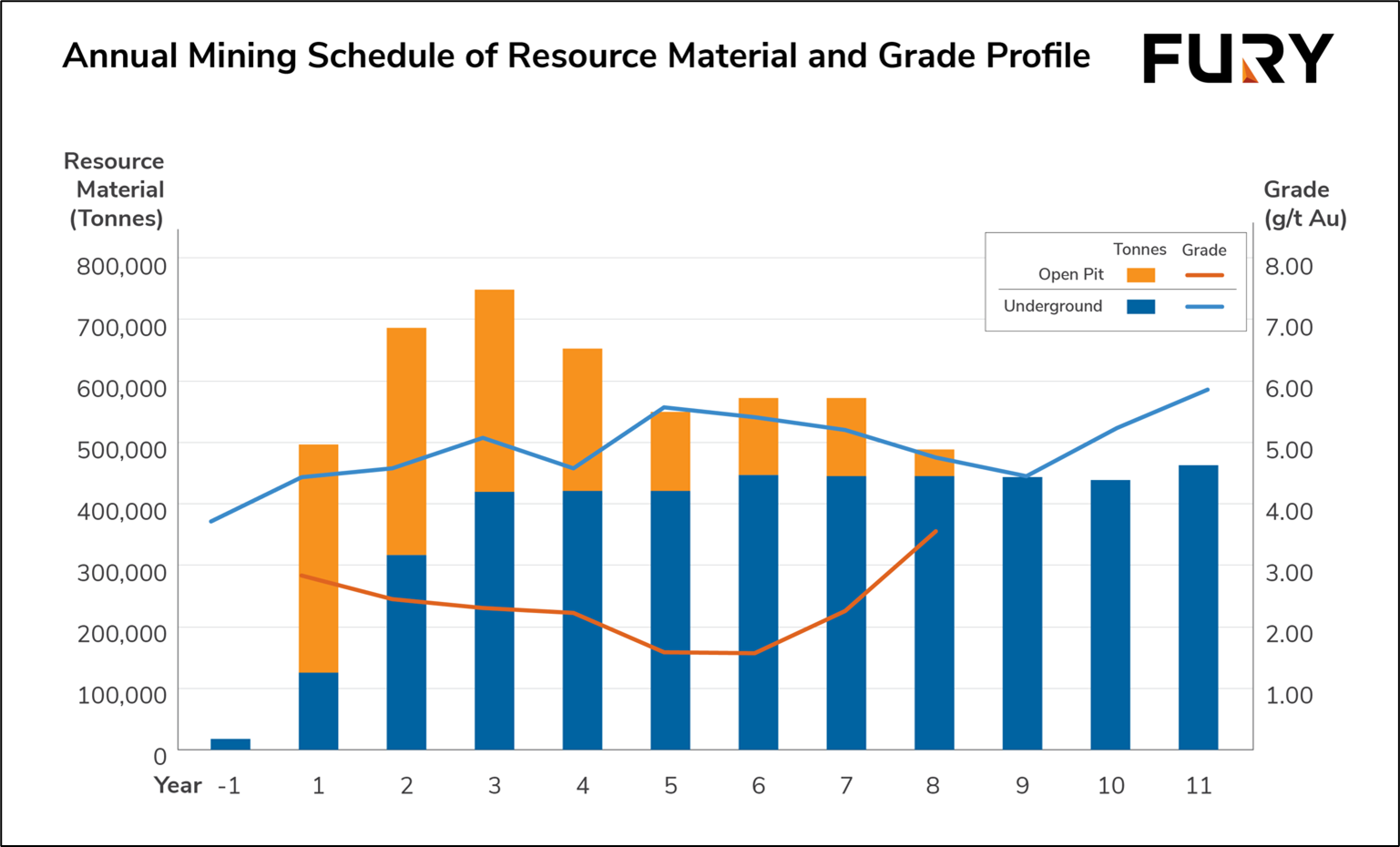

The PEA contemplates a primary underground mining operation complemented by 2 small open pits. Production from the underground ("UG") mine will start in year minus 1 with a small bulk sample, with full UG operations continuing through to year 11. In total, the underground would produce 702koz gold at an average diluted head grade of 5.22 g/t gold from 4.40Mt of material (Table 1 and Figures 1 and 2). The conventional open pits ("OP") will operate for 8 years, recovering a total of 132koz gold at an average diluted grade of 2.50 g/t gold from 1.73Mt of material (Table 1 and Figures 1 and 2). Total taxes payable over LOM at the study gold price range between $348M and $311M for the Base and Toll Milling, respectively.

Table 1: Eau Claire PEA Key Economic Assumptions and Results

| Production | ||||

| PEA Life of Mine (LOM) | Years | 11 | ||

| LOM Production Resource Tonnes | Tonnes | 6.1M | ||

| LOM diluted head grade | g/t Au | 4.46 | ||

| Average Diluted Grade (OP) | g/t Au | 2.5 | ||

| Average Diluted Grade (UG) | g/t Au | 5.22 | ||

| Average Gold Recovery | % | 95 | ||

| Contained Gold | oz | 878,281 | ||

| Recovered Gold | oz | 834,367 | ||

| Average Annual production | oz | 75,852 | ||

| OP LOM Strip Ratio | 7.73 | |||

| Capital Costs | ||||

| Base Case | Hybrid | Toll Milling | ||

| Initial CapEx (incl UG development) | C$ | $217M | $216M | $117M |

| Sustaining Capital | C$ | $66M | $66M | $66M |

| Contingency included in Capital | C$ | $36M | $36M | $10M |

| Total Capital | C$ | $283M | $282M | $184M |

| Total Operating Costs | C$ | $1,019M | $1,036M | $1,153M |

| Cash Costs (LOM) | USD/oz | $892 | $906 | 1,009 |

| AISC (LOM)1 | USD/oz | $1,140 | $1,153 | $1,170 |

| Financial Summary | ||||

| Gold Price | USD | $2,400 | ||

| Exchange Rate | USD/C$ | 0.73 | ||

| After-Tax NPV(5%) | C$ | $554M | $610M | $639M |

| After-Tax IRR | % | 41 | 53 | 84 |

| After-Tax Payback | Years | 2.5 | 1.5 | 1.15 |

- AISC is calculated as the sum of treatment and refining charges, onsite operating costs, sustaining capital costs, and closure costs, divided by the quantity of ounces sold.

Figure 1: Long Section and Cross Section views of the proposed Eau Claire OP and UG mine plan.

The PEA is subject to a number of assumptions and risks, including, among others, that all required permits and other rights will be obtained in a timely manner, that development of the Eau Claire deposit will have the support of the First Nations, stakeholders, and government, and that geotechnical, hydrogeological, and metallurgical assumptions will be confirmed. The Company has not confirmed whether any toll milling arrangements will be reached with any facility within a reasonable distance from the project. The Toll milling assumptions used in the PEA includes provision for on-site crushing, an on-site sample tower, one-way 205 km road haulage, and toll milling costs with life of mine costs ranging between $61.89/tonne and $58.21/tonne for the Hybrid and Toll Milling Cases, respectively.

Figure 2: Annual Gold Production

Eau Claire Mineral Resource Estimate

The PEA is based on the current Mineral Resource Estimate for Eau Claire with an effective date of May 10, 2024, and is reported using a gold price of US$1,900/oz (Table 2), see Eau Claire NI43-101 report titled "Mineral Resource Estimate Update for the Eau Claire Project, Eeyou Istchee James Bay Region of Quebec, Canada" dated June 25, 2024 filed under Fury's profile on SEDAR+.

"When Fury acquired the Eau Claire project in October 2020, we saw a clear pathway for the existing deposit to grow significantly and the potential to define additional deposits within the project area through systematic, disciplined exploration. The steepening of the vein model in the eastern portion of the Eau Claire deposit has opened additional targets throughout the resource area itself and bodes well for the next stage of the project. This PEA will act as a road map for further growth and derisking of not only the Eau Claire Deposit itself, but the entire 55,000-hectare land package," stated Bryan Atkinson, SVP of Exploration at Fury.

Table 2: Mineral Resource Estimate for the Eau Claire Deposit

| Category | Tonnes | Au g/t | Contained Au (oz) | |

| Open Pit (base case cut-off grade of 0.5 g/t Au) | Measured | 1,157k | 5.19 | 193k |

| Indicated | 1,291k | 4.19 | 174k | |

| Measured & Indicated | 2,448k | 4.66 | 367k | |

| Inferred | 69k | 4.39 | 10k | |

| Underground (base case cut-off grade of 2.5 g/t Au) | Measured | 455k | 6.9 | 101k |

| Indicated | 3,490k | 6.17 | 692k | |

| Measured & Indicated | 3,945k | 6.25 | 793k | |

| Inferred | 2,566k | 6.08 | 502k | |

| Combined Open Pit and Underground | Measured | 1,612k | 5.67 | 294k |

| Indicated | 4,781k | 5.64 | 866k | |

| Measured & Indicated | 6,393k | 5.65 | 1,160k | |

| Inferred | 2,635k | 6.04 | 512k |

| (1) | The effective date of the Eau Claire project Mineral Resource Estimates ("MREs"), including the Eau Claire and Percival deposit estimates, is May 10, 2024. | |

| (2) | The Mineral Resource Estimates were estimated by Maxime Dupéré, B.Sc., géo. of SGS Geological Services and is an independent Qualified Person as defined by NI 43-101. | |

| (3) | The classification of the current Mineral Resource Estimates into Measured, Indicated and Inferred mineral resources is consistent with current 2014 CIM Definition Standards - For Mineral Resources and Mineral Reserves. | |

| (4) | All figures are rounded to reflect the relative accuracy of the estimate and numbers may not add due to rounding. | |

| (5) | The mineral resources are presented undiluted and in situ, constrained by continuous 3D wireframe models, and are considered to have reasonable prospects for eventual economic extraction. | |

| (6) | Mineral resources which are not mineral reserves do not have demonstrated economic viability. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that most Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration. | |

| (7) | The Project mineral resource estimates are based on a validated database which includes data from 1202 surface diamond drill holes totalling 406,431 m, and 426 surface channels (Eau Claire deposit) for 1,345 m. The resource database totals 273,402 drill hole assay intervals representing 267,721 m of data and 2,254 channel assays for 1,316 m. | |

| (8) | The MRE for the Eau Claire deposit is based on 280 three-dimensional ("3D") resource models representing the 450, 850 and hinge zones. The MRE for the Percival deposit is based on 29 3D resource models representing high grade and lower grade halo zones. | |

| (9) | Grades for Au were estimated for each mineralization domain using 1.0 metre capped composites assigned to that domain. To generate grade within the blocks, the inverse distance cubed (ID3) interpolation method was used for all domains of the Eau Claire deposit and ID2 for Percival deposit. An average density value was assigned to each domain. | |

| (10) | Based on the location, surface exposure, size, shape, general true thickness, and orientation, it is envisioned that parts of the Eau Claire and Percival deposits may be mined using open-pit mining methods. In-pit mineral resources are reported at a base case cut-off grade of 0.5 g/t Au. The in-pit resource grade blocks are quantified above the base case cut-off grade, above the constraining pit shell, below topography and within the constraining mineralized domains (the constraining volumes). | |

| (11) | The pit optimization and base-case cut-off grade consider a gold price of $1,900/oz and considers a gold recovery of 95%. The pit optimization and base case cut-off grade also considers a mining cost of US$2.80/t mined, pit slope of 55° degrees, and processing, treatment, refining, G&A and transportation cost of USD$19.00/t of mineralized material. | |

| (12) | The results from the pit optimization, using the pseudoflow optimization method in Whittle 4.7.4, are used solely for the purpose of testing the "reasonable prospects for economic extraction" by an open pit and do not represent an attempt to estimate mineral reserves. There are no mineral reserves on the Property. The results are used as a guide to assist in the preparation of a Mineral Resource statement and to select an appropriate resource reporting cut-off grade. A Whittle pit shell at a revenue factor of 0.52 was selected as the ultimate pit shell for the purposes of this mineral resource estimate. | |

| (13) | Based on the size, shape, general true thickness, and orientation, it is envisioned that parts of the Eau Claire and Percival deposits may be mined using underground mining methods. Underground mineral resources are reported at a base case cut-off grade of 2.5 g/t Au. The mineral resource grade blocks were quantified above the base case cut-off grade, below surface/pit surface and within the constraining mineralized wireframes (considered mineable shapes). Based on the size, shape, general thickness, and orientation of the mineralized structures, it is envisioned that the deposits may be mined using a combination of underground mining methods including sub-level stoping (SLS) and/or cut and fill (CAF) mining. | |

| (14) | The underground base case cut-off grade of 2.5 g/t Au considers a mining cost of US$65.00/t mined, and processing, treatment, refining, G&A and transportation cost of USD$19.00/t of mineralized material. | |

| (15) | The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues. | |

Mining

The Eau Claire deposit extends over 1.4 km along a northwest-southeast trend. It consists primarily of a series of en echelon quartz-tourmaline veins, with individual veins reaching up to 1 metre (m) in thickness. This moderately dipping vein system outcrops at surface and extends to depths beyond 600 m. The mineralized widths, including closely stacked veins and mineralized alteration haloes, range from 1.8 m to 12 m, with an average thickness of approximately 3.0 m.

Given its vein-like nature and vertical extent, underground mining is considered the most suitable extraction method, except for the portion near the surface that will be mined by open pit. The selected approach for this study proposes a hybrid mining approach that combines longitudinal longhole stoping for the underground portion with backfill and conventional open-pit mining (Table 3). In the underground operation, all material will be hauled to surface using a fleet of 40-tonne underground trucks via a ramp, at a rate of 1,200 tonnes per day ("tpd") once the mine reaches full production. The PEA is based on contract mining.

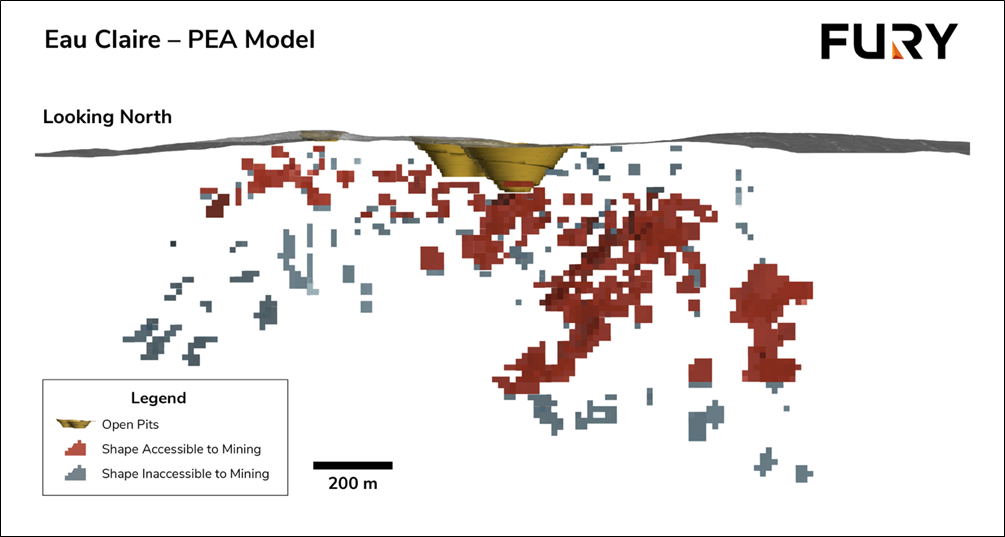

Parameters used to optimize OP and UG mineability of the Eau Claire resource are summarized in Table 3 and Figure 3. The OP and UG optimization parameters utilized resulted in a potentially mineable portion of the resource shown in Table 4 and Figure 3.

Table 3: Mining Parameters

| Open Pit | Underground | |

| Methodology | Conventional | Longitudinal Longhole Stoping |

| Dimensions | Block Sizes: 5x5x5 m | Minimum Mining Width: 1.8 m |

| Sublevel Interval 15 m | ||

| Stope Length 15 m | ||

| Overall Pitwall Slope: 55 degrees | Minimum Stope Dip 45 Degrees | |

| Dilution | 5% Dilution Factor | Dilution - 1.0 m Total |

Table 4: Potentially Mineable Portion of the Resource

| Category | Tonnes | Diluted Au g/t | Contained Ounces Au (oz) | |

| Underground | Measured Resource | 549k | 4.83 | 85k |

| Indicated Resource | 2,711k | 5.11 | 446k | |

| Measured & Indicated | 3,260k | 5.06 | 531k | |

| Inferred Resource | 1,143k | 5.68 | 209k | |

| In-pit | Measured Resource | 1,292k | 2.55 | 106k |

| Indicated Resource | 423k | 2.40 | 33k | |

| Measured & Indicated | 1,715k | 2.51 | 139k | |

| Inferred Resource | 12k | 1.59 | 597 | |

Figure 3: Eau Claire PEA Model.

On-Site Mineral Processing and Metallurgical Testing

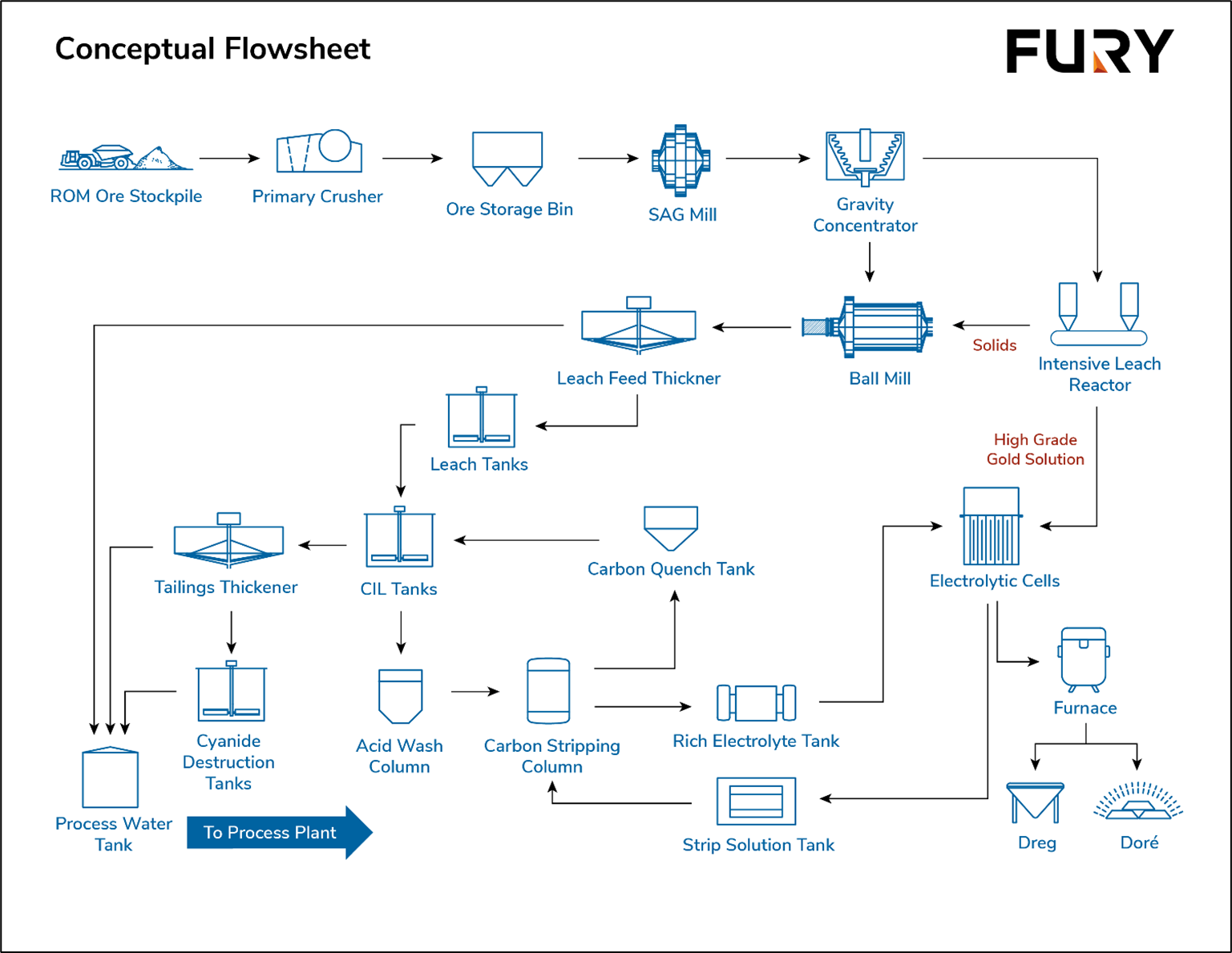

Metallurgical test programs conducted on the Eau Claire Project have demonstrated that the ore is amenable to a gravity plus cyanidation carbon-in-leach ("CIL") processing strategy, achieving consistently high gold recoveries and confirming the robustness of the selected flowsheet.

Overall gold recoveries of 96%-98% were achieved under optimized cyanidation conditions, with rapid leaching kinetics (within 8 to 24 hours), moderate reagent consumption 1.25 kg/t NaCN, and minimal preg-robbing risk. Gravity recovery tests ("GRG") showed a GRG value of 39%, with bulk gravity separation recovering 24% of the gold, underscoring the importance of including a gravity circuit as a primary step in the flowsheet. For the purposes of the PEA, a conservative global gold recovery of 95% was assumed.

Comminution testing yielded a Bond Ball Mill Work Index (BWI) of 11.2 kWh/t, classifying the ore as moderately soft and suitable for conventional grinding circuits with low energy requirements. Environmental assessments confirmed that the tailings are non-acid-generating (NP/AP = 3.4), with strong alkaline buffering, low metal mobility, and negligible leaching risks. These findings support the safe re-use of tailings as backfill under both neutral and acidic conditions, complying with Canadian and international environmental standards.

Based on the test work results, the recommended flowsheet for Eau Claire includes primary gravity recovery using Knelson and Mozley units, followed by cyanidation of gravity tailings in a CIL circuit. Elution, electrowinning, and doré smelting are proposed for final gold recovery (Figure 3). Further work is recommended to fine-tune cyanide and lime dosages, optimize pre-aeration time, assess CIL vs. carbon-in-pulp ("CIP") performance, and characterize preg-robbing potential across variable ore types. Overall, the metallurgical performance supports a robust and economically viable gold recovery strategy for the Eau Claire Project.

Given the relatively conventional processing and recoveries of the Eau Claire mineralization, recoveries of 95% were assumed for the toll milling included in the Hybrid and Toll Milling Cases. Further test work to determine the actual recoveries at existing mills in the region is required.

Figure 4: Conceptual Flow Sheet for the Eau Claire Deposit.

Figure 5: Annual Mining Schedule of Resource Material and Grade Profile

Infrastructure

The infrastructure required for the Eau Claire Project will include:

- Haulage roads and site roads;

- Two portals and ventilation raises;

- Waste dump and overburden stockpile;

- Sampling tower (Toll Milling Case);

- Overall water management plan;

- Water management structures;

- Electrical site reticulation; and

- Warehouse, offices, facilities, weighing scale, and other services.

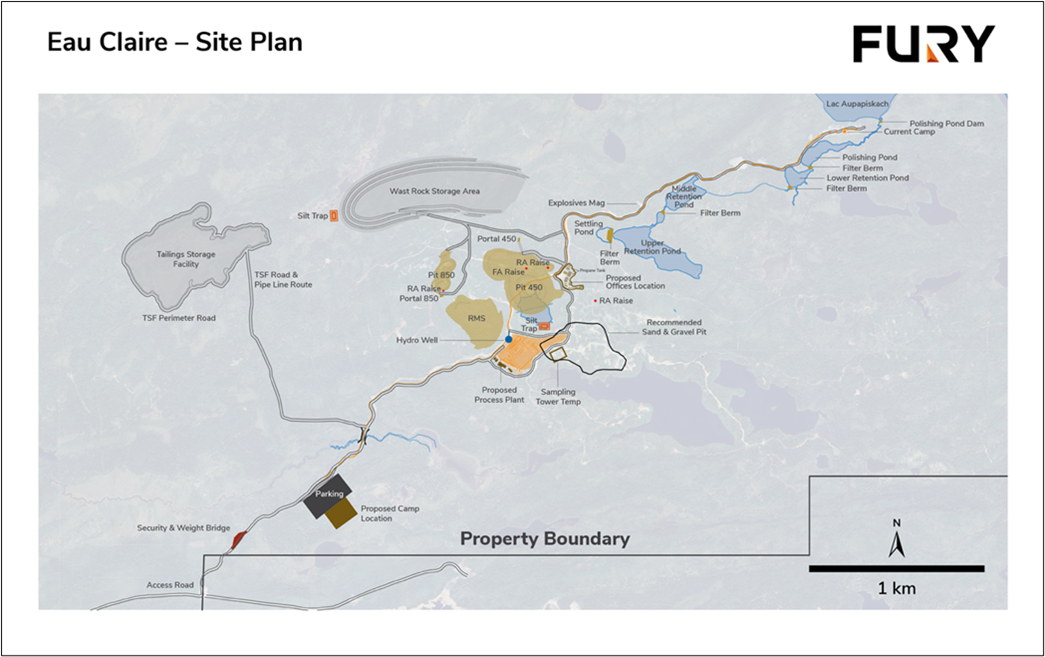

The property is accessible, year-round, by the Route du Nord an all-season gravel road extending from the town of Chibougamau to the Cree village of Nemaska (and onto Hydro Québec's installation at EM-1). Road access to the project involves crossing the Eastmain Reservoir and the EM-1 spillway via an all-season road installed and maintained by Hydro Québec. Access beyond the Hydro Quebec spillway is along a 6 km long resource road maintained by the Company. An existing 40-person camp is operational but is planned for relocation to add capacity.

The main infrastructure will be located on the east side of the pits, and a planned process plant platform is to be located south of the pits. The waste rock stockpile with a capacity of 17 Mt will be located on the north side of the pits, which is sufficient to accommodate waste from the pits and underground waste from development. A haul road is planned to connect the pits to the waste stockpile, overburden stockpile, process plant, and tailings storage facility (Figure 6).

Figure 6: Haul road connecting the pits to the waste stockpile, overburden stockpile, process plant, and tailings storage facility.

Tailings Management

For the on-site process milling option in the Base and Hybrid Cases, the Tailings Storage Facility ("TSF") design will take advantage of the existing topographic and ground conditions in the western part of the Project site. In a TSF, the percentage of tailings used for underground backfill can vary significantly, but it is common to see a range from 25% to 75% being backfilled underground, while the remainder is stored on the surface. This percentage is influenced by factors like specific mine needs, capacity of the underground workings, and characteristics of the tailings and waste rock.

The Eau Claire TSF is initially designed with a capacity of 880,000 cubic metres. Further study will be undertaken for the use of the tailings as backfill material for the underground stopes to reduce the tailings footprint. A tailings deposit basin will be created by building a perimeter road and berm at an elevation of 248 masl. The process plant tailings will be pumped to the TSF through an approximate 2 km pipeline and will be thickened before deposition. The reclaimed water system will consist of a reclaim barge equipped with reclaim water pumps.

Power Infrastructure

The power demand of the overall Eau Claire site is approximately 9.3 MW. Electricity will be supplied to the site at a voltage level of 120 kV originating from the nearby Hydro-Quebec substation, approximately 18 km away.

At site, the substation will lower the incoming voltage (120 kV from Hydro-Québec) to 4.16 kV using a main transformer, rated 120kV - 5 kV, 10/12.5 MVA, and will supply power to all operations on site.

Figure 7: Eau Claire location and infrastructure.

Capital and Operating Cost Estimates

The initial capital is estimated to range between $117M and $217M with an additional $66M in sustaining capital (Table 4). The PEA is based on contract mining. Operating costs were developed from unit costs for projects of a similar scale in Canada (Table 5).

Table 5: Capital and Operating Cost Summary

| Input | Base Case | Hybrid | Toll Milling | |||

| Initial Capital | ||||||

| Pre-Production Engineering & Design | $9M | $9M | $2M | |||

| Process Plant | $86M | $86M | ||||

| Tailings | $5M | $5M | ||||

| Site Facilities | $16M | $17M | $17M | |||

| Power Line from Quebec Hydro 18 km | $13M | $13M | $13M | |||

| Surface Support Equipment | $2.3M | $2.3M | $2.3M | |||

| OP Mining | $549k | $549k | $549k | |||

| UG Non-Development Capital | $6.4M | $6M | $6M | |||

| UG Development Capital | $66M | $66M | $66M | |||

| Non-Mining Development Contingency | $10M | $10M | $10M | |||

| Pre-Production G&A | $3M | |||||

| Initial Capital Sub-total | $217M | $216M | $117M | |||

| Sustaining Capital | ||||||

| OP Mining | $155k | $155k | $155k | |||

| UG Non-Development Capital | $240k | $245k | $245k | |||

| UG Development Capital | $61M | $61M | $61M | |||

| Site Closure | $5M | $5M | $5M | |||

| Sustaining Capital Sub-total | $66M | $66M | $66M | |||

| Total Capital Costs | $283M | $282M | $184M | |||

| Operating Costs | ||||||

| OP Direct Mining Costs | $86M | $86M | $86M | |||

| UG Direct Mining Costs | $504M | $504M | $504M | |||

| Indirect Mining Costs | $70M | $70M | $70M | |||

| Process Costs | $212M | $224M | $360M | |||

| Site G&A | $148M | $153M | $133M | |||

| Total Operating Costs | $1,019M | $1,036M | $1,153M | |||

| OP Cost per Resource Tonne | $49.64 | $49.64 | $49.64 | |||

| UG Cost per Resource Tonne | $114.50 | $114.50 | $114.50 | |||

| LOM Process Cost per Resource Tonne | $34.64 | $36.56 | $58.80 | |||

| LOM G&A per Resource Tonne | $24.10 | $24.93 | $21.77 | |||

| AISC USD/oz1 | $1,140 | $1,153 | $1,170 | |||

- AISC is calculated as the sum of treatment and refining charges, onsite operating costs, sustaining capital costs, and closure costs, divided by the quantity of ounces sold.

- Values may not add due to rounding.

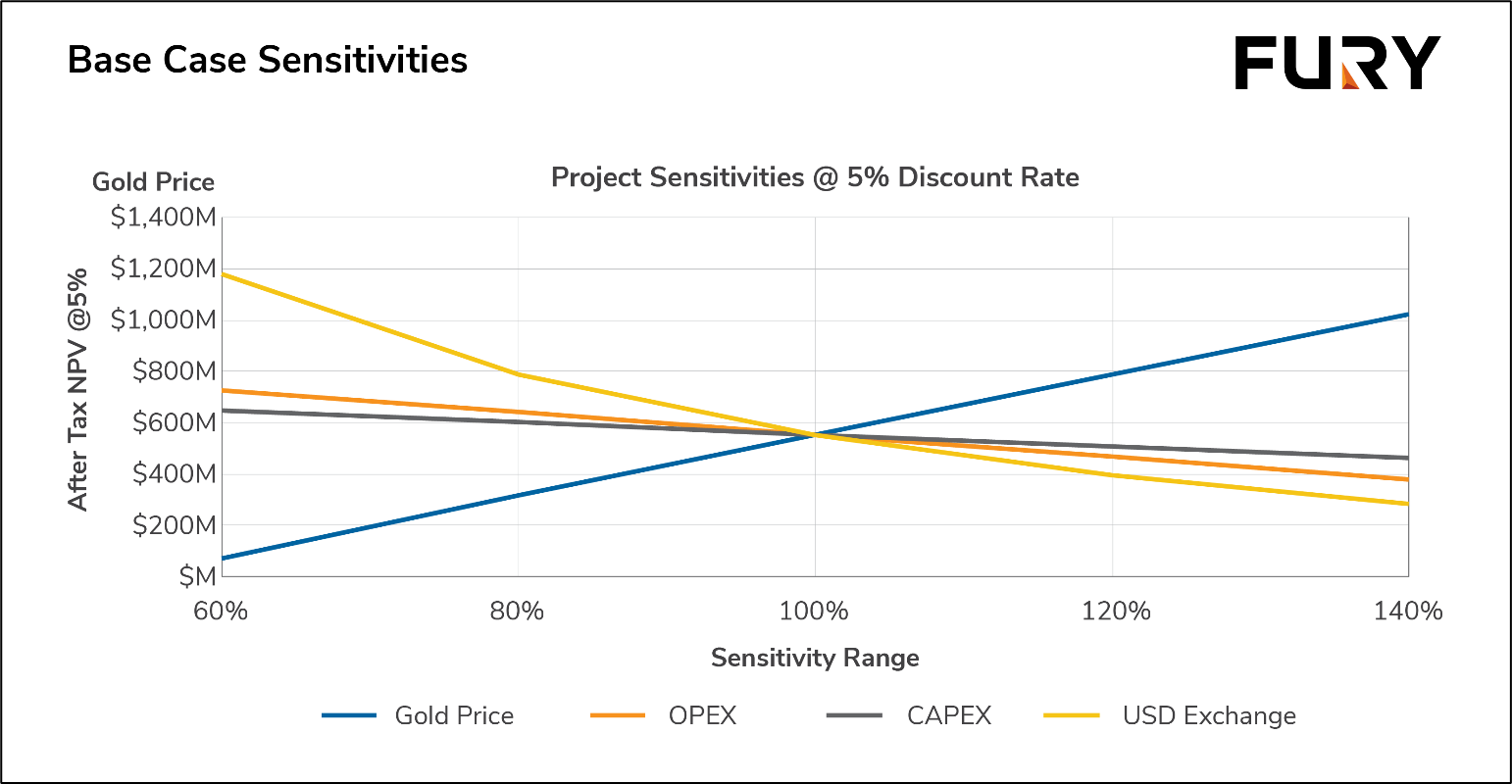

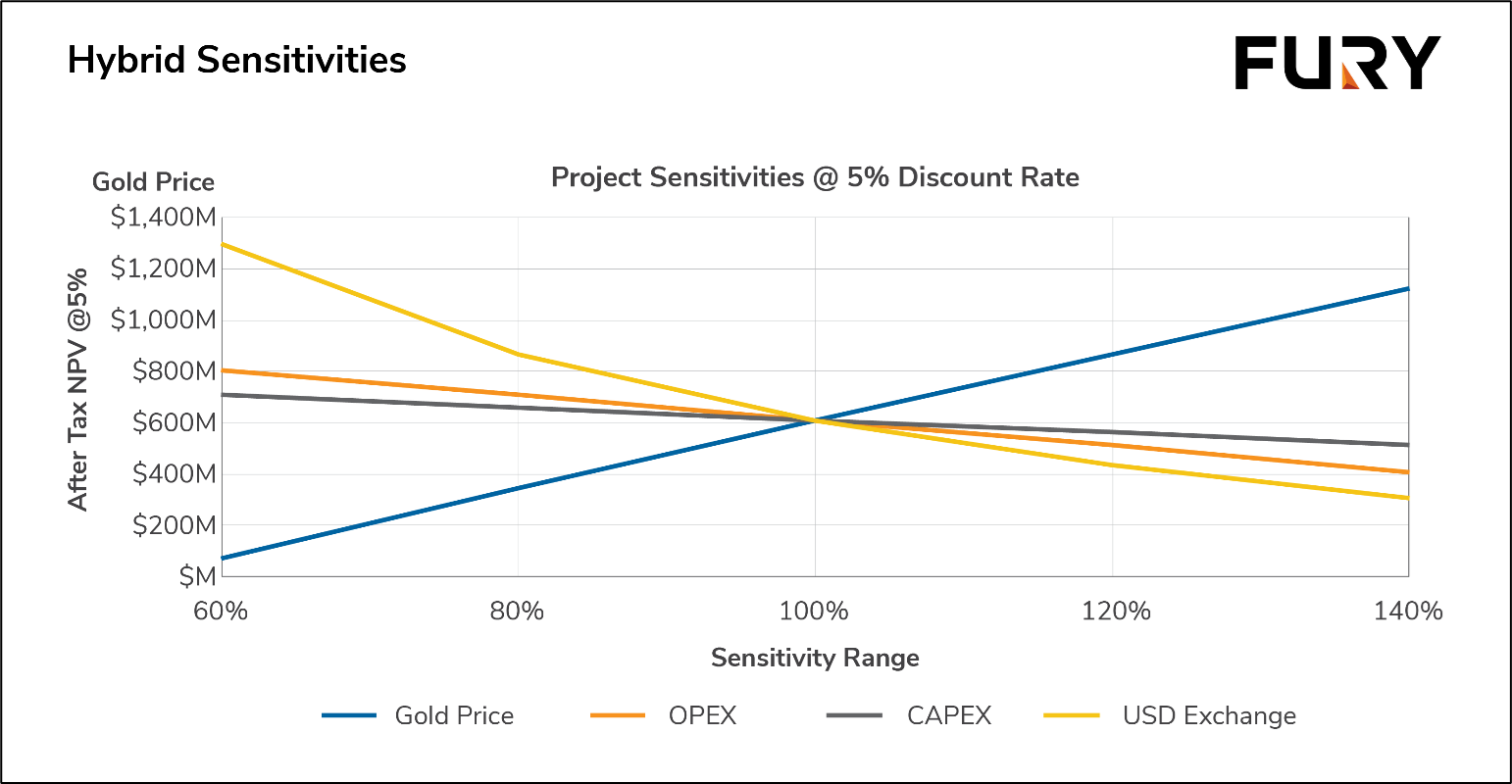

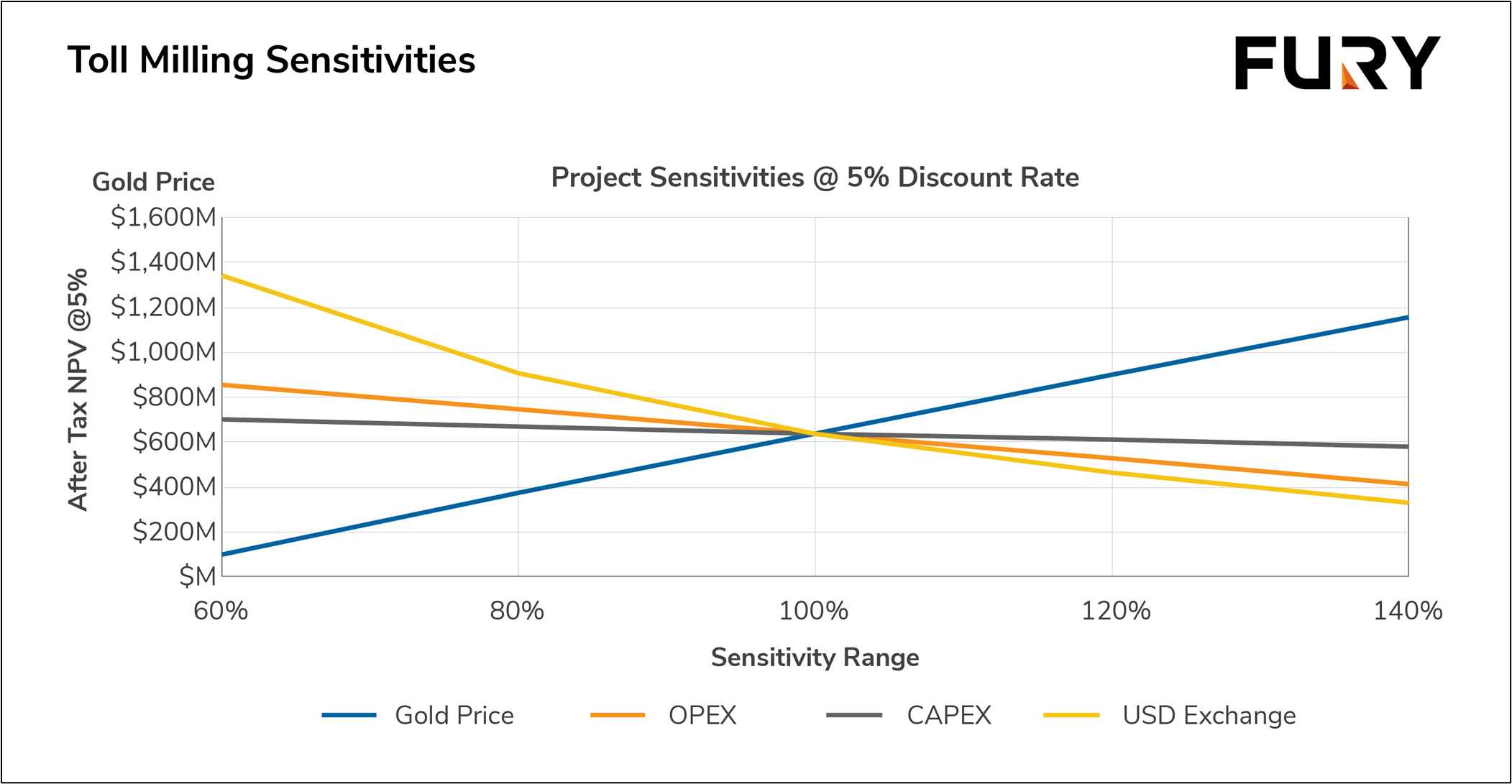

Economic Sensitivities

The PEA provides an after-tax NPV5 of $554M, an IRR of 41% and a payback period of 2.5 years with the Base Case scenario; an after-tax NPV of $610M, an IRR of 53% and a payback period of 1.5 years from production with the Hybrid Case and; an after-tax NPV of $639M, an IRR of 84% and a payback period of 1.1 years from production with the Toll Milling Case both at a gold price of US$2,400/oz (Table 6).

Table 6: Sensitivity Analysis

| NPV5 to Gold Price Sensitivities | |||

| Gold Price (US$) | Base Case | Hybrid Case | Toll Milling Case |

| $1,440 (-40%) | $70M | $72M | $96M |

| $1,920 (-20%) | $318M | $346M | $375M |

| $2,400 (Study Price) | $554M | $610M | $639M |

| $2,880 (+20%) | $787M | $867M | $897M |

| $3,360 (+40%) | $1,020M | $1,124M | $1,154M |

Figure 8: Base Case Sensitivities.

Figure 9: Hybrid Case Sensitivities.

Figure 10: Toll Milling Case Sensitivities.

Environmental and Permitting

The Eau Claire project will be subject to a provincial Environmental and Social Impact Assessment ("ESIA") procedure governed under the 1975 James Bay and Northern Quebec Agreement ("JBQNA"). This process is administered through a Cree-Quebec framework involving two main oversight bodies: the Evaluation Committee ("COMEV"), which screens the project and determines the ESIA scope, and the Review Committee ("COMEX"), which evaluates the ESIA, conducts public consultation, and makes recommendations. The final decision is issued by Quebec's Ministry of Environment, Fight Against Climate Change, Wildlife and Parks ("MELCCFP"). Cree representatives participate in both COMEV and COMEX, highlighting the Nation's formal role in the review process.

Eau Claire will likely not trigger a federal Impact Assessment as the proposed production capacity is under the 5,000 tpd threshold set out in the Physical Activities Regulations (SOR/2019-285, Schedule, Section 18(b)).

Preliminary environmental baseline monitoring began in 2022 at Eau Claire; detailed work will commence at the time a decision is made to advance the project through a pre-feasibility study.

Indigenous and Community Relations

Fury is committed to working with Indigenous peoples and communities to build and maintain effective, lasting, and mutually beneficial relationships. To achieve this commitment, we strive for relationships based on transparency, mutual respect, and trust.

The Company recognizes the unique legal and constitutional rights of Indigenous peoples and seeks to

understand and respect their history, customs, beliefs, and traditions. This recognition and respect are integrated into our business approach and the way we operate. Fury actively engages with Indigenous communities through collaborative discussions and by identifying opportunities in employment, training, education, and business development. Approximately 25% of the project team is made up of members from local Indigenous groups, and two of the Company's primary contractors are First Nations-owned companies.

Since acquiring the Eau Claire project in 2020, Fury has prioritized early and ongoing engagement with Indigenous groups and stakeholders. This includes sharing project updates, creating opportunities for feedback, and supporting community involvement.

The Company's Indigenous Relations Policy is guided by principles of respect, partnership, and cultural understanding and reflects Fury's commitment to working within Canada's legal framework and the spirit of the United Nations Declaration on the Rights of Indigenous Peoples (UNDRIP).

The Company recognizes that our ability to contribute is linked to the development of effective, positive, and respectful relationships, and to foster these relationships, we are working in the spirit of partnership

and cooperation to enhance our understanding of each of the Indigenous communities and groups we engage with. Fury continues to support Indigenous Communities through jobs, training, contracting opportunities, and sponsorship of local events.

Eau Claire Deposit Next Steps

Fury's focus going forward at Eau Claire will be on

- Continued resource expansion;

- Improving continuity of resource ounces outside of the PEA mineable portion of the resource; and

- Continued work on vein geometries to further improve economics on the project.

Additionally, the company will continue to advance the Eau Claire deposit through environmental baseline as directed by COMEV, tailings, metallurgical, and geotechnical test work.

Figure 11: Eau Claire Resource Long Section Looking North. The inset depicts the improved geometry of modelled veins within the eastern portion of the resource.

The PEA is preliminary in nature in that it includes 24% Inferred Mineral Resources, which are considered too speculative geologically to have the economic considerations applied to them that would enable them to be characterized as mineral reserves, and there is no certainty that the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

The Company will file the PEA on SEDAR+ at www.sedarplus.ca within 45 days in accordance with NI 43-101.

The foregoing technical information contained in this news release has been prepared in accordance with the Canadian regulatory requirements set out in National Instrument 43-101 (Standards for Disclosure for Minerals Projects) and reviewed on behalf of the Company by:

William van Breugel, P. Eng. of SGS Geological Services, an independent Qualified Person as defined by NI 43-10, having responsibility for the project economics including capital expenditures, operating expenditures, financials and sensitivities.

Johnny Canosa, P. Eng. of SGS Geological Services, an independent Qualified Person as defined by NI 43-10, having responsibility for the mining methods, infrastructure, and environment, permitting & social or community impact. Johnny Canosa, P. Eng., conducted a site visit to the Eau Claire Property on November 14-15, 2024.

Henri Gouin, P. Eng. of SGS Geological Services, an independent Qualified Person as defined by NI 43-10, having responsibility for the underground mining planning and schedule.

Joseph Keane, P. E. of SGS Geological Services, an independent Qualified Person as defined by NI 43-10, Processing and Metallurgy.

The May 2024 Mineral Resource Estimate has been prepared by Maxime Dupéré, P. Geo., Geologist with SGS Geological Services, a "qualified person" within the meaning of Canadian mineral projects disclosure standards instrument 43-101.

About Fury Gold Mines Limited

Fury Gold Mines Limited is a well-financed Canadian-focused exploration company positioned in two prolific mining regions across Canada and holds an 11.8 million common share position in Dolly Varden Silver Corp (approximately 13.5% of issued shares). Led by a management team and board of directors with proven success in financing and advancing exploration assets, Fury intends to grow its multi-million-ounce gold platform through rigorous project evaluation and exploration excellence. Fury is committed to upholding the highest industry standards for corporate governance, environmental stewardship, community engagement and sustainable mining. For more information on Fury Gold Mines, visit www.furygoldmines.com.

For further information on Fury Gold Mines Limited, please contact:

Margaux Villalpando, Investor Relations

Tel: (844) 601-0841

Email: info@furygoldmines.com

Website: www.furygoldmines.com

Neither the TSX nor its Regulations Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this news release.

Forward-Looking Statements and Additional Cautionary Language

This release includes certain statements that may be deemed to be "forward-looking statements" within the meaning of applicable securities laws, which statements relate to the future exploration operations of the Company and may include other statements that are not historical facts. Forward-looking statements contained in this release primarily relate to statements that may suggest that economic analyses for the Eau Claire Gold Project and its potential for development and expansion, the anticipated IRR and NPV for the project, capital and operating costs, processing and recover estimates and strategies, proposed mining method and development plans, mineral resource estimates and statements as to managements expectations with respect to, among other things, the matters and activities contemplated in this news release.

Although the Company believes that the assumptions and expectations reflected in those forward-looking statements were reasonable at the time such statements were made, there can be no certainty that such assumptions and expectations will prove to be materially correct. Mineral exploration is a high-risk enterprise.

Readers should refer to the risks discussed in the Company's Annual Information Form and MD&A for the year ended December 31, 2024, and subsequent continuous disclosure filings with the Canadian Securities Administrators available at www.sedarplus.ca and the Company's Annual Report available at www.sec.gov. Readers should not place heavy reliance on forward-looking information, which is inherently uncertain.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/4e4d17f4-0b70-47c0-b216-d5b9c8581ecf

https://www.globenewswire.com/NewsRoom/AttachmentNg/534bcfba-0934-4f66-a0e6-8c4a34506d42

https://www.globenewswire.com/NewsRoom/AttachmentNg/26fbcf44-9738-44ff-89d4-e221f76d14ad

https://www.globenewswire.com/NewsRoom/AttachmentNg/976a0f02-5423-40d9-883b-6b5d46f86ad9

https://www.globenewswire.com/NewsRoom/AttachmentNg/065abd2c-7dc9-4eb9-8d44-0c4efdae987f

https://www.globenewswire.com/NewsRoom/AttachmentNg/6e68acfd-4cdc-4467-b76e-d60b25b70d58

https://www.globenewswire.com/NewsRoom/AttachmentNg/36149efb-c417-477c-b979-06c70bc3b069

https://www.globenewswire.com/NewsRoom/AttachmentNg/8a04763c-80df-4995-a4af-4b77eb45c821

https://www.globenewswire.com/NewsRoom/AttachmentNg/811446b9-8f98-424e-9b46-4da150e663a7

https://www.globenewswire.com/NewsRoom/AttachmentNg/8ce6473f-40b7-4f2b-ac08-a73ca28b4629

https://www.globenewswire.com/NewsRoom/AttachmentNg/da4308bb-53d2-4064-bb8e-498ff3cd32b7