MIAMI, FL / ACCESS Newswire / September 2, 2025 / Diveroli Investment Group ("DIG") announced today that it has accumulated a 9.48% position in Wheeler Real Estate Investment Trust, Inc. (NASDAQ:WHLR) and filed a Schedule 13D with the SEC.

Together with its affiliates, DIG has substantial interests in commercial real estate, and its interest was piqued by WHLR's portfolio of retail properties and blue chip tenants. The group believes Wheeler is deeply undervalued considering it controls more than $600 million in total assets and the majority of its debt does not come due until 2031 or later.

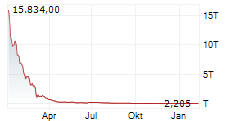

As further validation of the Company's underlying value, DIG highlights that while Wheeler's current market capitalization is approximately $3 million, its most recent balance sheet shows total assets exceeding liabilities by more than $90 million - almost 30 times greater than its public market valuation. At the same time, WHLR controls a ~7.5 million square foot portfolio of grocery-anchored retail centers across the Mid-Atlantic, Southeast, and Northeast, which remains more than 90% leased and continues to generate durable cash flows with meaningful growth potential.

"WHLR trades like a penny stock but controls more than half a billion in real estate," said Aharon Diveroli, CIO at DIG. "With fundamentals improving and strong political tailwinds suggesting rate cuts, we see significant upside as a real potential."

The White House has pushed for monetary easing, with many top analysts now expecting the Federal Reserve to begin rate cuts in September - which, in DIG's opinion, creates a strong tailwind for REITs like WHLR.

Among the multiple catalysts for rerating: capital structure simplification; portfolio resilience due in part to blue chip tenants with long-term leases like Food Lion, Kroger, Aldi, and Dollar Tree; and the aforementioned Federal Reserve rate cuts, which could drive lower financing costs and higher property valuations.

About Diveroli Investment Group

Diveroli Investment Group (or "DIG") is a Miami-based, family-run investment firm that pursues value creation through opportunities in public and private companies. The firm focuses on sectors where technological change, operational inflection points, or strategic under-appreciation create significant upside potential.

To learn more about Diveroli Investment Group's investment philosophy and current areas of focus, please visit: www.investdig.com

Investor & Media Relations

Avigail Diveroli, Communications Director

Diveroli Investment Group

Email: avigail@investdig.com

Website: www.investdig.com

Important Additional Information and Where to Find It

The views expressed in this press release reflect the personal opinions of the authors or speakers and are based solely on publicly available information believed to be reliable at the time of publication. This communication is not a recommendation to buy, sell or exchange any securities, and it does not constitute an offer to sell or buy or the solicitation of an offer to buy or sell any securities. Information about Wheeler Real Estate Investment Trust, Inc. is available at the SEC's website at www.sec.gov. We are not broker-dealers or registered investment advisors. Although we possess WHLR shares, we may buy or sell shares at any time without notice.

Any statements about valuation, performance, or outlook are personal opinions and should not be construed as facts. Always conduct your own due diligence and consult a licensed financial advisor before making investment decisions. Compensation may have been provided to third parties involved in the creation or promotion of this content. All material is for informational and educational purposes only.

SOURCE: Diveroli Investment Group

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/banking-and-financial-services/diveroli-investment-group-files-13d-on-wheeler-reit-highlights-major-1066834