Nasdaq Copenhagen

Nikolaj Plads 6

DK-1067 Copenhagen K

Copenhagen, 4 September 2025

ANNOUNCEMENT no. 14/2025

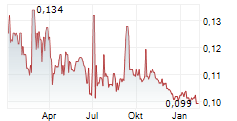

CeMat A/S - Next Phase of Residential Project "Moje Bielany". Upward revision of 2025 net result forecast from DKK 41-43 million to DKK 52-54 million for the year 2025

CeMat obtained a new binding individual zoning decision for a residential development on a 7,022 sqm plot. This plot is part of a larger 21,648 sqm site for the next phase of "Moje Bielany". According to the new zoning decision and initial analyses, the site has the potential to accommodate between 108-111 residential units, with a total usable area ranging from 5,400 to 5,556 sqm.

Based on the newly issued individual zoning decision, the Cushman & Wakefield report gave the re-zoned property an "as is" fair value of DKK 21.2 million (2024 report: DKK 7.9 million). As a result of this increase in property value, an additional DKK 13.3 million will be recognised in the company's financial results for 2025. This positive impact includes revaluation of plot for the next phase of "Moje Bielany" (DKK 13.2 million) and part of a road plot (DKK 0.1 million).

The new decision and the resulting property valuation will have a positive impact on the Company's results for 2025. Accordingly, CeMat is upgrading the forecasts previously presented in the H1 report. The Company now expects a positive net result of DKK 52-54 million for 2025, compared to the DKK 41-43 million announced in the H1 2025 report.

All other aspects of the financial outlook for 2025 remain unchanged relative to the H1 report:

- Consolidated EBITDA for the CeMat Group has been upgraded and is expected to be DKK 37-39 million in 2025;

- EBITDA from the development segment is expected to be DKK 30-32 million in 2025, out of the total result of DKK 37-39 million predicted for residential project "Moje Bielany 1"

- EBITDA from the property rental business is projected to reach DKK 6.5-7 million;

This positive net result of DKK 52-54 million is the figure before any changes in valuation for the remaining investment property are taken into account.

It should be emphasized that this is the third planning decision obtained in 2025. In addition to the current 'Moje Bielany 1' project, the Company's development pipeline comprises 235-238 residential units as well as a self-storage facility, all scheduled for completion by the end of 2028.

Thanks to the issued decision, we are also updating the company's portfolio for the years 2025-2028:

[SEE IMAGE OF THE PORTFOLIO IN THE ATTACHED ANNOUNCEMENT]

Please note that the valuation of the investment property could change the result significantly because the market value depends on many factors, some of which are outside the company's control.

The forward-looking statements in this communicate reflect the Management's current expectations for certain future events and financial results. Forward-looking statements are inherently subject to uncertainty, and the actual results may therefore differ materially from expectations.

Factors that may cause actual results to deviate materially from expectations include, but are not limited to, general economic developments, the international and regional situation, developments in the financial markets and changes in legislation, demand for the Group's services and competition.

The guidance is based on an exchange rate of DKK 177/PLN 100

Cemat A/S

Frede Clausen

Chairman of the Board

This announcement has been prepared in a Danish-language and an English-language

version. In case of doubt, the Danish version prevails.