MDNI Group announced the launch of its comprehensive real estate development model that leverages deep industry networks and integrated services to identify and execute strategic property acquisitions throughout Los Angeles.

LOS ANGELES, CA / ACCESS Newswire / September 4, 2025 / MDNI Group announced the launch of its comprehensive real estate development model that leverages deep industry networks and integrated services to identify and execute strategic property acquisitions throughout Los Angeles. The newly formed company group combines deal sourcing, entitlement and construction expertise, financial operations, and legal counsel under one roof to capitalize on off-market opportunities across single-family, multifamily, and hotel development sectors.

The company's formation addresses a fundamental problem in traditional real estate development, where firms typically coordinate between multiple external partners for construction, legal work, financing, and project management. MDNI Group's founders saw this fragmented approach creating delays, communication gaps, and missed opportunities, especially in a fast-moving market like Los Angeles.

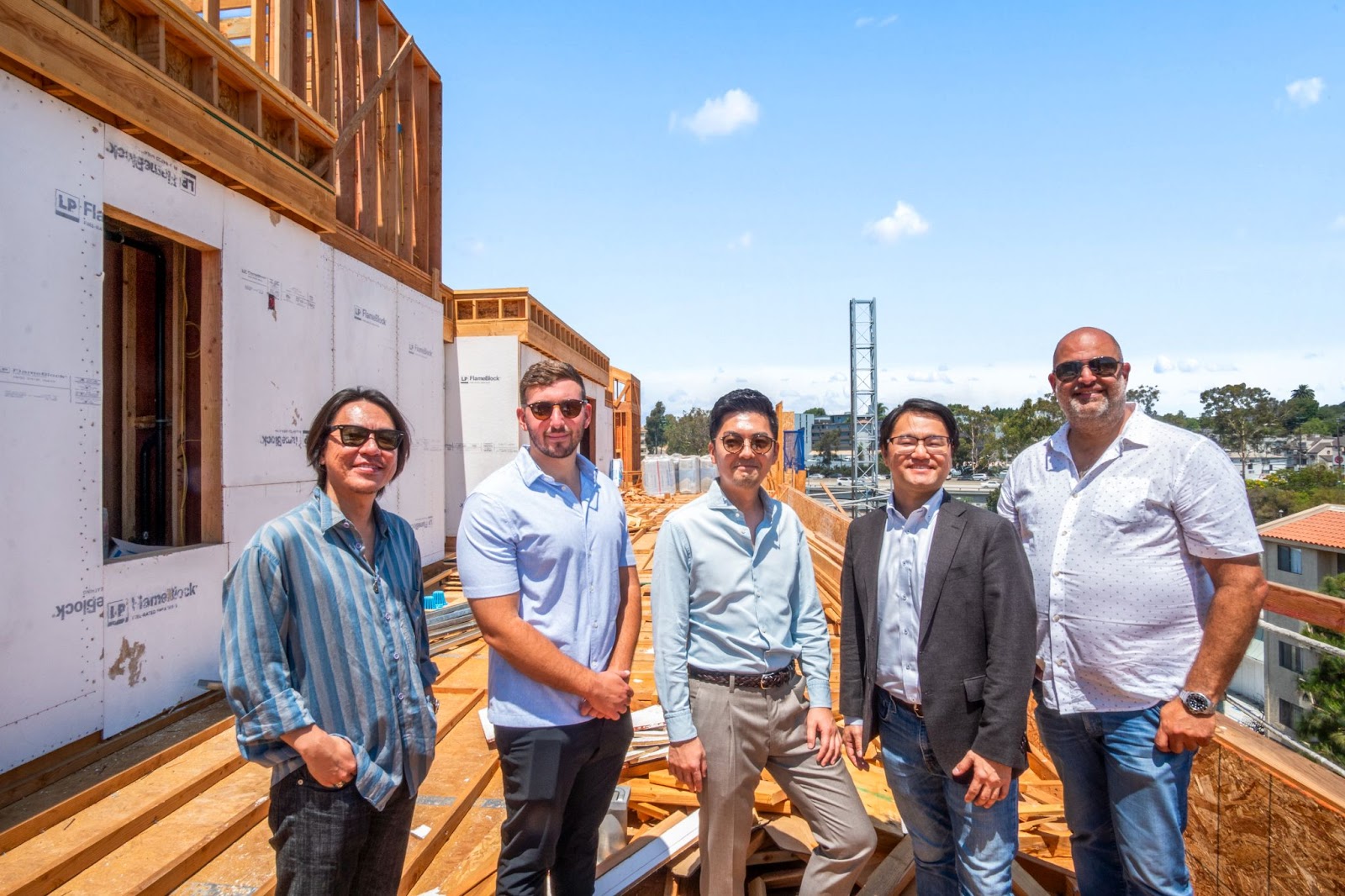

MDNI Group launches with significant scale already established, including over 4,000 units entitled across more than 50 projects, 600 units currently under construction, 51 units in active development, and a team of more than 80 across divisions and group companies. The company has completed over 1,500 projects and currently manages approximately $60 million in assets, with partnerships established with prominent industry figures, including a billion-dollar real estate investment firm founder.

The leadership team reflects MDNI's integrated approach, combining deep operational experience with sophisticated financial expertise. Managing Partner David Hirsch brings decades of construction and development experience, having completed over 3,000 single-family home projects and maintaining general contracting licenses across multiple states, with a background that includes managing over a billion dollars in construction projects and extensive experience with both ground-up development and complex rehabilitation projects.

Managing Partner Naohiro Nishida, on the other hand, brings a background from Japan's financial sector, where he worked at one of the country's largest investment securities firms. Nishida's experience in international capital markets and securities provides MDNI Group with sophisticated financial capabilities, particularly in structuring deals for international investors and navigating cross-border investment complexities, enabling the company to offer specialized services like foreign exchange hedging and construction loan facilitation that many cannot provide.

This integrated model allows MDNI Group to identify and act on opportunities that might be difficult for traditional developers to execute. Through active involvement in entitlement processes across dozens of properties simultaneously, the company maintains relationships with property owners that provide early access to potential deals before they reach the broader market. This network also enables MDNI to obtain information on distressed development projects on a priority basis.

"Most development firms often lose opportunities because they need time to coordinate between multiple providers," said Naohiro Nishida, Managing Partner of MDNI Group. "Our model allows us to evaluate opportunities quickly and move to acquisition because we have construction expertise, legal counsel, and financing capabilities already integrated."

The company has also developed capabilities specifically for international investors seeking direct exposure to Los Angeles real estate, offering services that address common barriers such as currency risk and construction financing access. This allows international investors to participate directly in individual projects rather than through funds with multiple fee layers.

"Our integrated approach particularly benefits affordable housing development, where regulatory complexity and financing requirements often create challenges for traditional developers," said Kevin Ninomiya, General Counsel at MDNI Group. "We can navigate local regulations and entitlement processes more efficiently because we have all the necessary expertise within a single platform."

MDNI Group operates across multiple property types, including single-family homes, multifamily developments, and hotel projects, providing flexibility to adapt to changing market conditions while maintaining consistent deal flow.

To learn more about MDNI Group, visit mdnigroup.com

About MDNI Group

MDNI Group is a comprehensive real estate development company that leverages deep industry networks and integrated services to identify and execute strategic property acquisitions throughout Los Angeles. The company and its group companies combine deal sourcing, entitlement and construction expertise, financial operations, and legal counsel under one roof to capitalize on off-market opportunities across single-family, multifamily, and hotel development sectors.

Media Contact

Organization: MDNI Group

Contact Person Name: David Hirsch

Website: https://mdnigroup.com/

Email: info@midosdevelopment.com

City: Los Angeles

State: California

Country: United States

SOURCE: MDNI Group

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/industrial-and-manufacturing/mdni-group-launches-integrated-development-model-leveraging-deep-indus-1069145