Austral Gold has repaid in full a US$2,000,000 loan plus accrued interest of US$133,000 to Inversiones Financieras del Sur SA ("IFISA").

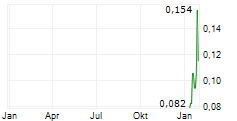

Repayment made through transfer of a portion of the loan collateral in ASX-listed Unico Silver shares held by Austral Gold Canada Limited, at a closing price of A$0.48 per share as of 5 September 2025.

Shareholder approval for pledging Unico Shares, and if required, disposal of the Unico Shares to IFISA obtained under ASX Listing Rule 10.1 at AGM on 29 May 2025.

Loan fully extinguished; 13,392,948 Unico Shares released from collateral obligations.

Sydney, Australia--(Newsfile Corp. - September 7, 2025) - Established gold producer Austral Gold Limited (ASX: AGD) (TSXV: AGLD) (OTCQB: AGLDF) ("Austral" or the "Company") advises that it has repaid a US$2,000,000 loan plus accrued interest of US$133,000, provided by IFISA under a loan agreement dated 25 September 2024 (the "Loan Agreement"). Repayment was effected through the transfer of an equivalent value in shares of Unico Silver Limited ("Unico Silver"). IFISA is the Company's largest shareholder, and two of the Company's Directors, Mr Eduardo Elsztain and Mr Saul Zang, are also directors and shareholders of IFISA.

The key terms of this related party transaction were initially disclosed in the Company's announcement of 26 September 2024, which noted that up to 20,190,791 Unico Silver shares (the "Unico Shares") held by Austral Gold Canada Limited ("AGCL"), a wholly-owned subsidiary of the Company, would be pledged as collateral, subject to shareholder approval.

The Loan Agreement provided the Company with the option to repay the loan, in whole or in part, by transferring Unico Shares. In accordance with ASX Listing Rule 10.1, shareholder approval for pledging the Unico Shares, and if required, disposal of the Unico Shares to IFISA was obtained on a "majority of the minority" basis at the Company's Annual General Meeting held on 29 May 2025.

The Company has now repaid the loan in full through the disposal of the Unico Shares to IFISA. As a result, the loan is fully extinguished, and no further security obligations remain.

The number of Unico Shares disposed to IFISA was calculated pursuant to a formula included in the Loan Agreement, and, accordingly, AGCL transferred to IFISA 6,797,843 Unico Shares at a share price of A$0.48 per Unico Share.

About Austral Gold

Austral Gold is a growing gold and silver mining producer building a portfolio of quality assets in the Americas based on three strategic pillars: production, exploration and equity investments. Austral continues to lay the foundation for its growth strategy by advancing its attractive portfolio of producing and exploration assets.

For more information, please visit the Company's website at www.australgold.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Release approved by the Company's Chief Executive Officer of Austral Gold, Stabro Kasaneva.

For additional information, please contact:

| David Hwang | Jose Bordogna |

| Joint Company Secretary | Chief Financial Officer and Joint Company Secretary |

| Austral Gold Limited | Austral Gold Limited |

| david@confidantpartners.com | jose.bordogna@australgold.com |

| +61 433 292 290 | +61 466 892 307 |

Forward-Looking Statements

Statements in this news release that are not historical facts are forward-looking statements. Forward-looking statements are statements that are not historical, and consist primarily of projections - statements regarding future plans, expectations and developments. Words such as "expects", "intends", "plans", "may", "could", "potential", "should", "anticipates", "likely", "believes" and words of similar import tend to identify forward-looking statements. The forward-looking statement in this news release is "Austral continues to lay the foundation for its growth strategy by advancing its attractive portfolio of producing and exploration assets".

All of these forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those expressed or implied, including, without limitation, uncertainty of exploration programs, development plans and cost estimates, commodity price fluctuations; political or economic instability and regulatory changes; currency fluctuations, the state of the capital markets especially in light of the effects of the novel coronavirus, uncertainty in the measurement of mineral resources and reserves and other risks and hazards related to the exploration of a mineral property, and the availability of capital. You are cautioned that the foregoing list is not exhaustive of all factors and assumptions which may have been used. Austral cannot assure you that actual events, performance or results will be consistent with these forward-looking statements, and management's assumptions may prove to be incorrect. Austral's forward-looking statements reflect current expectations regarding future events and operating performance and speak only as of the date hereof and Austral does not assume any obligation to update forward-looking statements if circumstances or management's beliefs, expectations or opinions should change other than as required by applicable law. For the reasons set forth above, you should not place undue reliance on forward-looking statements.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/265475

SOURCE: Austral Gold Limited