TORONTO, ON / ACCESS Newswire / September 8, 2025 / Jaguar Mining Inc. ("Jaguar" or the "Company") (TSX:JAG) is pleased to announce a comprehensive five-year exploration plan (the "Plan") designed to expand its gold resources and support future production growth. This initiative has been developed to systematically explore the Company's extensive mineral tenements in Brazil, with a focus on both expanding existing deposits and identifying new prospective targets.

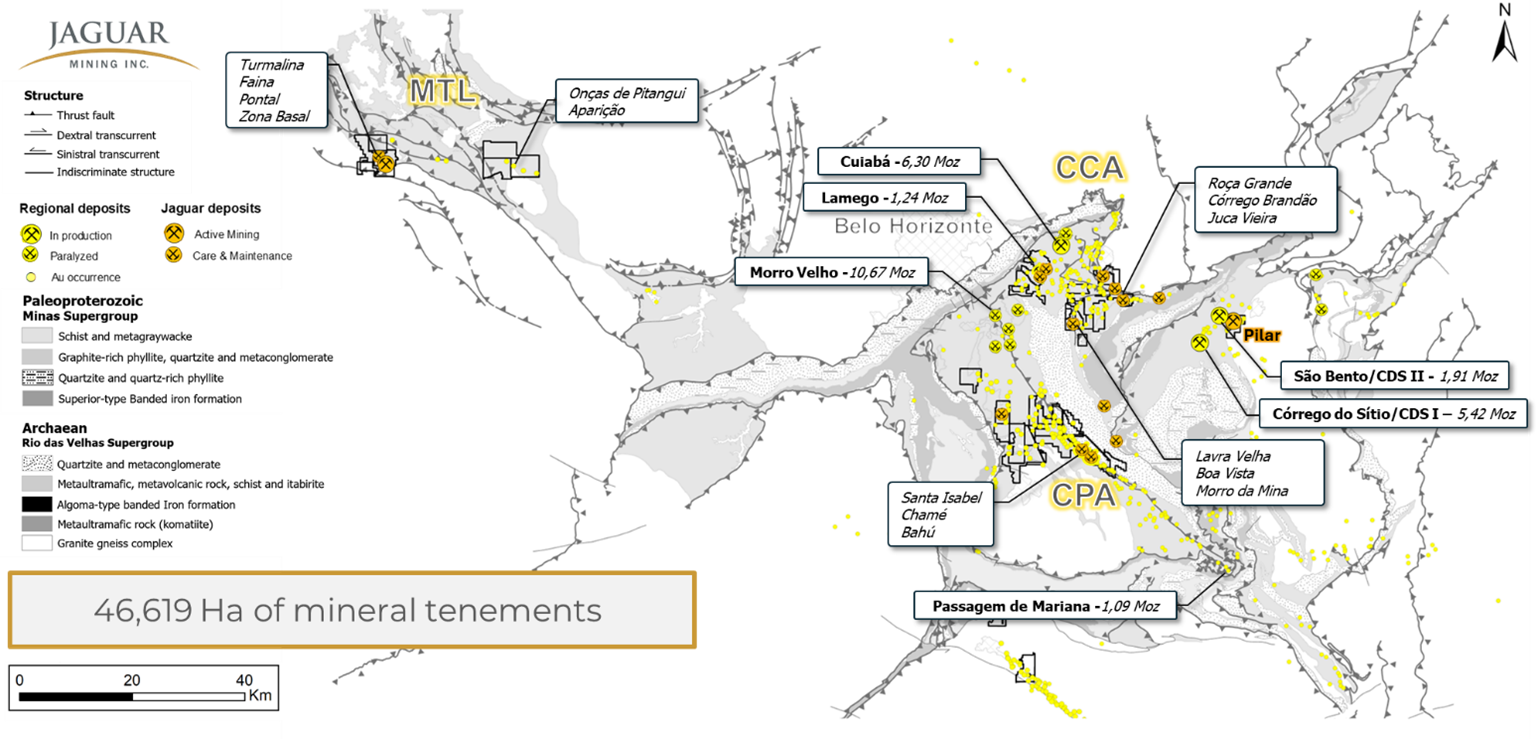

The plan encompasses all 46,619 hectares of the Company's mineral rights, with exploration efforts concentrated on the most prospective areas to advance opportunities that could support future resource growth and production potential.

Key Highlights of the Five-Year Exploration Plan:

Significant Gold Endowment Potential: This initiative is designed to investigate a total gold endowment ranging between 4-7 million ounces across all projects, underscoring the scale of potential within the Company's land package.

Proposed Drilling Campaign: Between 2026 and 2030, the plan is to complete approximately 222,000 meters of drilling. This extensive program will be critical to expanding and defining the Company's gold resources at least at the inferred category.

Strategic Project Focus: The plan outlines targeted exploration across key project areas, ensuring resources are allocated to the most prospective targets with the greatest potential to advance toward development:

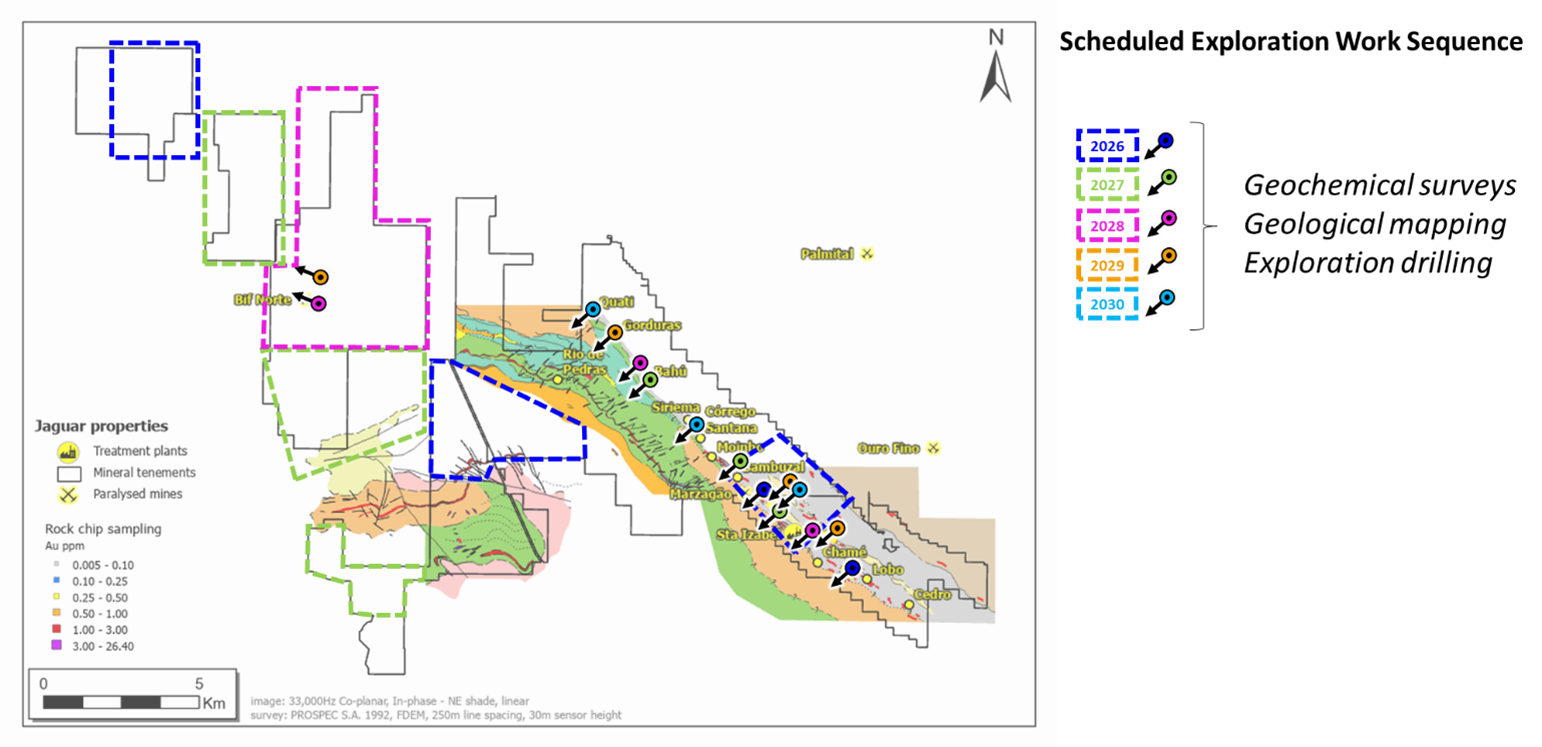

Paciência Complex: Exploration will focus on extending known mineralization at Santa Isabel, Marzagão (underground) and Chamé, including testing deep extensions and pursuing new discoveries such as Bahú and BIF North. The Chamé project alone carries an estimated upside potential of 325,000-520,000 ounces, supported by 6,175 meters of drilling scheduled to begin in 2025.

Caeté Complex - Roça Grande Project: Exploration will focus on areas of established potential, including Boa Vista and Morro da Mina, alongside regional reconnaissance work at Sabará Extension, Lavra Velha, and Zé Firme.

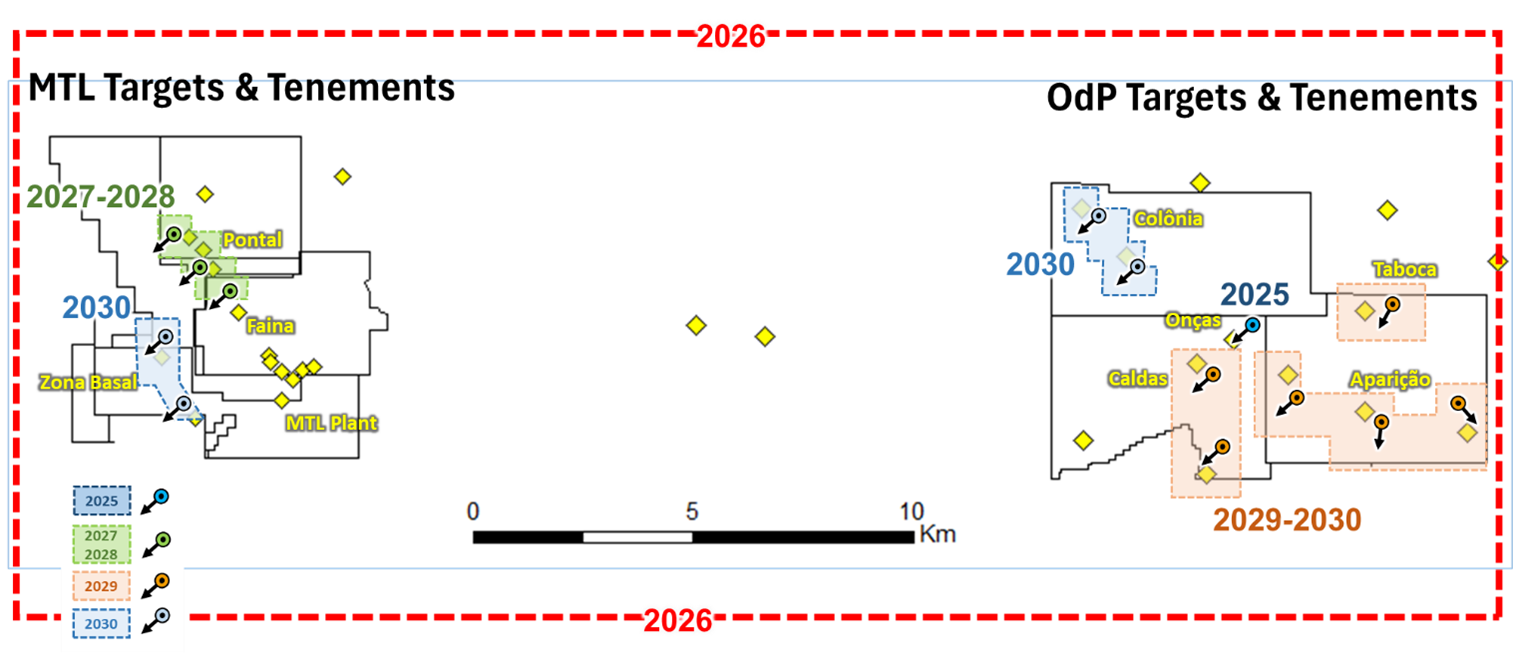

MTL Complex: Exploration will focus on the Pontal project, with the goal of fully assessing all opportunities within the area. Drilling of approximately 11,000 meters could support an estimated upside potential of 134,000-400,000 ounces.

Onças de Pitangui Project: Exploration will focus on infill drilling, alongside exploration at Aparição, Caldas, and Taboca targets, supporting overall resource growth.

Systematic Exploration Approach: This plan outlines a methodical sequence of work, including comprehensive geological mapping, geochemical surveys, and extensive exploration drilling. This approach is designed to ensure efficiency and maximize the probability of new discoveries and resource upgrades.

Environmental Stewardship: All exploration activities will adhere strictly to environmental regulations, including ongoing environmental licensing processes (Simplified Environmental Licensing - LAS, and Environmental Impact Assessment studies - EIA), reflecting the Company's commitment to responsible mining practices.

Team and Technology: The plan incorporates a robust exploration team of experienced geologists and technical personnel, supported by advanced exploration techniques and integrated data systems to optimize results.

The execution of this five-year plan will include defining key targets, reviewing geological and drilling work, preparing detailed forecasts and budgets, and ensuring timely approvals to support operational actions. This structured framework is designed to deliver consistent progress and measurable results, creating a significant opportunity to unlock value across the Brazilian tenements. The Company is confident that these efforts will expand the resource base, accelerate growth, and further strengthen its position as a leading gold producer in Brazil's prolific Iron Quadrangle.

CAUTIONARY STATEMENT: The potential ounce quantities are conceptual in nature. There has been insufficient exploration to define a mineral resource. It is uncertain if further exploration will result in the delineation of a mineral resource.

Luis Albano Tondo, Chief Executive Officer of Jaguar Mining, commented: "This plan reflects our commitment to systematically assess the significant geological potential within our portfolio. Our objective is to convert this potential into defined resources, supporting a sustainable production growth pipeline. It combines geological expertise with advanced exploration techniques to advance our next generation of gold mines."

Armando Massucatto, Exploration Manager for Jaguar Mining, added: "Jaguar's mineral rights are strategically located in the Iron Quadrangle, one of Brazil's most prolific gold districts. Our approach was developed using geological, geochemical, and geophysical mapping data compiled and ranked over recent years. This rigorous process identified targets with the greatest potential for exploration success and economic viability. Executing this strategy will strengthen our position in Brazil's exploration landscape, increase mineral resources and drive true organic growth for the Company."

Figure 1: Distribution of five-years targets in the Iron Quadrangle, highlighting the main mineral deposits.

Figure 2: Sketch of the planned sequence of exploration work at the Paciência Complex over the next five years.

Figure 3: Sketch of the planned sequence of exploration work at the MTL Complex and Onças de Pitangui Project over the next five years.

Qualified Person

Scientific and technical information contained in this press release has been reviewed and approved by Armando José Massucatto, PhD, FAusIMM, Exploration Manager, who is also an employee of Jaguar Mining Inc. and is a "qualified person" as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101").

The Iron Quadrangle

The Iron Quadrangle has been an area of mineral exploration dating back to the 16th century. The discovery in 1699-1701 of gold contaminated with iron and platinum-group metals in the southeastern corner of the Iron Quadrangle gave rise to the name of the town Ouro Preto (Black Gold). The Iron Quadrangle contains world-class multi-million-ounce gold deposits such as Morro Velho, Cuiabá, and São Bento. Jaguar holds the second largest gold land position in the Iron Quadrangle with over 46,000 hectares.

About Jaguar Mining Inc.

Jaguar Mining Inc. is a Canadian-listed junior gold mining, development, and exploration company operating in Brazil with three gold mining complexes and a large land package with significant upside exploration potential from mineral claims. The Company's principal operating assets are located in the Iron Quadrangle, a prolific greenstone belt in the state of Minas Gerais and include the MTL complex (Turmalina mine and plant) and Caeté complex (Pilar and Roça Grande mines, and Caeté plant). The Roça Grande mine has been on temporary care and maintenance since April 2019. The Company also owns the Paciência complex (Santa Isabel mine and plant), which had been on care and maintenance since 2012 and is under review to restart in 2026. Additional information is available on the Company's website at www.jaguarmining.com.

For further information please contact:

Luis Albano Tondo

Chief Executive Officer

Jaguar Mining Inc.

luis.albano@jaguarmining.com

+55 31 99959 6337

Marina de Freitas

Interim Chief Financial Officer

marina.freitas@jaguarmining.com.br

+55 31-98463-5344

Forward-Looking Statements

Certain statements in this news release constitute "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking statements and information are provided for the purpose of providing information about management's expectations and plans relating to the future. All of the forward-looking information made in this news release is qualified by the cautionary statements below and those made in our other filings with the securities regulators in Canada. Forward-looking information contained in forward-looking statements can be identified by the use of words such as "are expected", "is forecast", "is targeted", "approximately", "plans", "anticipates", "projects", "continue", "estimate", "believe" or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved. All statements, other than statements of historical fact, may be considered to be or include forward-looking information. This news release contains forward-looking information regarding, among other things, management's objectives, strategies, beliefs and intentions (including, without limitation, the Company's above-stated objectives of expanding its resource base, accelerating growth, strengthening its position in Brazil's Iron Quadrangle, converting geological potential into defined resources and supporting a sustainable production growth pipeline), the Company's ability to advance its projects, the nature, focus, timing and potential results of the Company's exploration, development, prospecting and other mining activities in 2025 and beyond, the timing and ability of the Company to recommence operations at its MTL complex following the slump at its Satinoco dry tailings pile, the future stability of the aforementioned tailings pile and safety of the Turmalina mine, and any information and statements related to expected growth, sales, production (including, without limitation, the cost, timing and amount of any future production), ore grades, tonnes milled, recovery rates, cash operating costs, definition/delineation drilling, capital expenditures, and the costs and timing of developing projects and new deposits. The Company has made numerous assumptions with respect to forward-looking information contained herein, including, among other things: assumptions about the future and long-term stability of the Satinoco tailings pile; there will be no unforeseen adverse weather events or other external factors that could impact the Company's plans and objectives including, without limitation, those relating to the Company's exploration, development and mining activities, as well as its recovery and remediation efforts; the estimated timeline for the development of the Company's mineral properties; the supply and demand for, and the level and volatility of the price of, gold; currency fluctuations; estimated capital requirements; the accuracy of reserve and resource estimates and the assumptions on which the reserve and resource estimates are based; the receipt of necessary permits; market competition; ongoing relations with employees and impacted communities; political and legal developments in any jurisdiction in which the Company operates being consistent with its current expectations, and any changes to general business and economic conditions. Forward-looking information involves a number of known and unknown risks and uncertainties, including among others: the risk of Jaguar not meeting its plans and estimated timelines regarding the Company's exploration, development and mining activities, operations and financial performance; uncertainties with respect to the price of gold, labour disruptions, mechanical failures, increases in costs (for environmental, weather-related, regulatory or any other reasons), environmental compliance and change in environmental legislation and regulation, weather delays and delays due to natural disasters, power disruptions, procurement and delivery of parts and supplies; uncertainties inherent to capital markets in general (including the sometimes volatile valuation of securities and an uncertain ability to raise new capital) and other risks inherent to the gold exploration, development and production industry (including, without limitation, risks associated with environmental hazards, tailings dam failures, industrial accidents, workplace safety problems, unusual or unexpected geological formations, pressures, cave-ins, flooding, chemical spills, procurement fraud and gold bullion thefts and losses, and the risk of inadequate insurance, or the inability to obtain insurance, to cover these risks), which, if incorrect, may cause actual results to differ materially from those anticipated by the Company and described herein. Accordingly, readers should not place undue reliance on forward-looking information.

For additional information with respect to these and other factors and assumptions underlying the forward-looking information made in this news release, see the Company's most recent Annual Information Form and Management's Discussion and Analysis, as well as other public disclosure documents that can be accessed under the issuer profile of "Jaguar Mining Inc." on SEDAR+ at www.sedarplus.com. The forward-looking information set forth herein reflects the Company's reasonable expectations as at the date of this news release and is subject to change after such date. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. The forward-looking information contained in this news release is expressly qualified by this cautionary statement.

SOURCE: Jaguar Mining, Inc.

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/metals-and-mining/jaguar-mining-inc.-announces-five-year-exploration-plan-to-unlock-gold-potential-1069648