Outokumpu Corporation

Press release/Investor news

September 9, 2025 at 9.00 am EEST

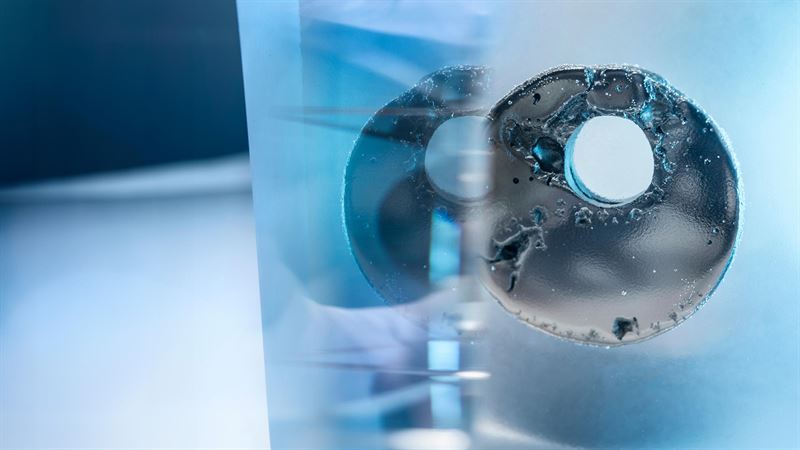

Chromium metal produced in Outokumpu's R&D lab.

Outokumpu and Boston Metal sign a Memorandum of Understanding to optimize metals production

Outokumpu, the global leader in sustainable stainless steel, today announced it has signed a Memorandum of Understanding (MoU) with Boston Metal, a technology company redefining global metals production, to enhance the production of critical carbon-free metals vital for industries such as defense and aerospace.

Under the MoU, the companies intend to initiate a joint development project related to the use of Outokumpu's high-quality chromium material in critical components of Boston Metal's proprietary Molten Oxide Electrolysis (MOE) technology* and to further improve Outokumpu's operations' efficiency and circularity.

As part of the agreement, the two companies will focus on the following business and technology evaluations:

- Boston Metal will evaluate and test their MOE technology with the aim of further improving side-stream recycling within Outokumpu's operations and improving Outokumpu's overall circularity approach.

- Outokumpu will provide chrome-oxide and chromium feedstock which originated from their Kemi mine in Finland to Boston Metal with the aim to help expand and further secure the supply chain for its inert anode-an essential component of MOE for Green Steel.

"I'm extremely excited about the upcoming project with Boston Metal. This is a collaboration that can take the Outokumpu proprietary technology, announced at the company's Capital Markets Day in early June 2025, into new heights and that provides a testing platform for Boston Metal's MOE technology on side streams in the stainless-steel industry. The joint development showcases our ability and commitment to drive our newly announced EVOLVE strategy for 2026-2030 forward," says Stefan Erdmann, Chief Technology Officer at Outokumpu.

Boston Metal MOE Cell.

Boston Metal's MOE technology electrifies metals production, directly eliminating carbon emissions and enabling a zero-carbon pathway when paired with renewable energy. The company is currently commissioning its first commercial plant in Brazil for the production of high-value critical metals, such as niobium and tantalum. In parallel, the modular MOE technology is being scaled for high-volume applications, like iron and steel.

"By working with industry leader Outokumpu to explore multiple possibilities involving the chromium metal supply chain, Boston Metal will be better positioned to deliver a sustainable and profitable pathway to unlock new economic opportunities across the metals industry. We welcome the opportunity to deploy our MOE technology to help bring value to Outokumpu's operations and advance sustainable metals production," says Adam Rauwerdink, SVP of Business Development at Boston Metal.

Read more:

To learn more about Outokumpu's new strategy, EVOLVE, to drive growth and shareholder value, read more here. Please find more information on Boston Metal's critical metals business here.

*) Molten Oxide Electrolysis (MOE) technology

About Boston Metal

Boston Metal is redefining global metals production with its patented Molten Oxide Electrolysis (MOE) platform technology. MOE produces steel without carbon emissions and recovers valuable metals from mining waste, delivering a sustainable and profitable pathway to unlock new economic opportunities, enable industrial onshoring and accelerate a commercially driven transition to cleaner industry. Backed by visionary investors and led by a world-class team, Boston Metal is headquartered in Woburn, Massachusetts and has a wholly owned subsidiary in Brazil. Learn more about Boston Metal's MOE platform technology at www.bostonmetal.com.

For more information:

Investors: Ulla Paajanen, SVP, IR and Strategic Advisory, tel. +358 40 763 8767

Outokumpu media: Päivi Allenius, SVP - Communications and Brand, tel. +358 40 753 7374, or Outokumpu media desk, tel. +358 40 351 9840, e-mail media(at)outokumpu.com

V2 Communications for Boston Metal: bostonmetal@v2comms.com

Outokumpu is accelerating the green transition as the global leader in sustainable stainless steel. Our business is based on the circular economy: our products are made from 95% recycled materials, which we then turn into fully recyclable stainless steel. This steel is utilized in various applications across society, including infrastructure, mobility, and household appliances. We are committed to 1.5°C target to mitigate climate change, and with up to 75% lower carbon footprint than the industry average, we support our customers to reduce their emissions. Together, we are working towards a world that lasts forever. Outokumpu Corporation employs approximately 8,700 professionals in close to 30 countries, with headquarters in Helsinki, Finland and shares listed in Nasdaq Helsinki. Read more: www.outokumpu.com