HIGHLIGHTS:

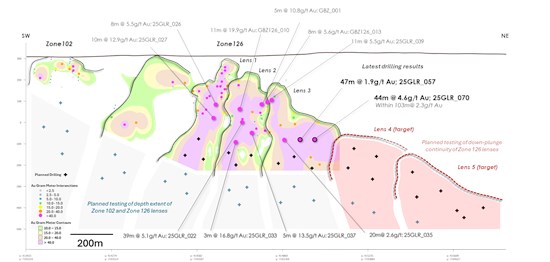

New Third Lens discovery extended: Step out drilling returned further thick, high-grade mineralisation from the Third Lens:

44m at 4.6g/t gold from 475m (25GLR070)

Within a broader zone of 103m at 2.3g/t gold

One of the thickest bulk-style underground results to date

47m at 1.9g/t gold from 451m (25GLR057)

Targeting model validated: Results provide further validation of Benz's exploration strategy, which has now successfully delivered two new lenses along the Zone 126 trend

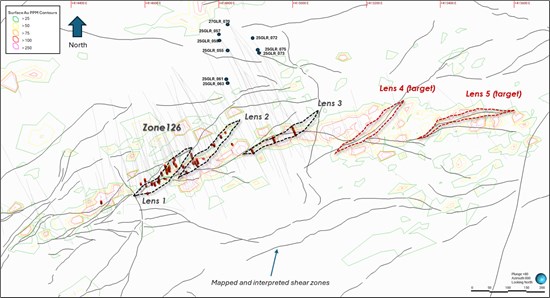

New lenses emerging: Structural targeting derived from surface mapping of outcrop has successfully predicted the location of the existing 3 gold lenses and identified a further 2 potential lenses along strike under strong geochemistry anomalies that remain untested below shallow drilling

Depth extension untested: Lenses 1-3 all remain open at depth, highlighting significant opportunity to further add high grade ounces

System-scale potential: The Zone 126 trend represents less than one-third of the total mineralised corridor at Glenburgh, with strong potential for additional parallel "blind discoveries" to be made

Drilling now underway to test these high-potential positions, fully funded with third rig already mobilised with the fourth to arrive in the next couple of weeks

Vancouver, British Columbia--(Newsfile Corp. - September 10, 2025) - Benz Mining Corp (TSXV: BZ) (ASX: BNZ) ("Benz" or the "Company") is pleased to report further strong results from ongoing drilling at the Zone 126 prospect within the Glenburgh Gold Project in Western Australia.

Figure 1 Long section view looking north of Zone 126 trend. Proposed drilling demarcated by crosses. Current release results in larger bold black text. Previous results released on 6 November 2024, 3 April 2025, 28 April 2025, 30 June 2025, 31 July 2025 and 20 August 2025.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1818/265983_cfe1fdba34eeca6a_001full.jpg

Zone 126 - An Evolving Multi-Lens Gold System

Zone 126 continues to establish itself as one of the most exciting underground growth opportunities at the Glenburgh Gold Project. The latest step-out drilling confirms the Third Lens as a thick, high-grade body of mineralisation, further supported by a pipeline of emerging targets.

Importantly, Zone 126 is no longer a single high-grade shoot, but a multi-lens system extending over more than one kilometre in strike, with each lens open at depth and providing room for significant growth.

Benz's exploration targeting model - built on systematic structural mapping before drilling - has now successfully delivered two new lenses and defined the potential positions of the fourth and fifth lenses. Interpreted secondary shear zones transect the main mineralised horizon (see Figure 2 below), contributing to the formation of higher-grade gold lenses within a broader lower grade halo of gold up to 100m in width. This structural architecture controls gold enrichment within Zone 126 and provides high-conviction drilling targets further along the NE trend of mineralisation.

Figure 2 Plan view collar map for holes reported in this release. Lenses 1-3 represent discoveries where secondary shear zones transect the main mineralised horizon. Targets for Lenses 4 and 5 are defined at locations where mapped shear zones are interpreted to intersect the horizon in a similar manner

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1818/265983_cfe1fdba34eeca6a_002full.jpg

Ongoing Drilling

Drilling continues at Zone 126 with one RC drill rig following up and extending recent +40 gram metre results drilled by Benz in 2025 including:

- 44m at 4.6 g/t gold (25GLR 070)

- 47m at 1.9 g/t gold (25GLR 057)

- 11m at 19.9g/t gold (GBZ126 010)

- 39m at 5.1g/t gold (25GLR 022)

- 10m at 12.9g/t gold (25GLR 027)

- 10m at 6.1g/t gold (25GLR 033)

- 11m at 5.5 g/t gold (25GLR 039)

- 20m at 2.6 g/t gold (25GLR 035)

- 5m at 13.5 g/t gold (25GLR 037)

Drilling will continue to define and extend the existing lenses as well as targeting potential new lenses 4 and 5 (see Figure 2 above) along strike.

Outside of the Zone 126 trend, two drill rigs continue to agressively drill out the bulk tonnage potential of Apollo Icon trend with a fourth rig on its way to start to scout out new exciting targets along the 18km Glenburgh Gold Corridor.

Benz CEO, Mark Lynch-Staunton, commented:

"The latest results from the Third Lens at Zone 126 highlight just how thick this system can get. Intercepts such as 44 metres at 4.6 grams per tonne gold speak directly to the bulk underground potential we are uncovering - this is shaping into a much more extensive system.

"Importantly, our structural modelling has identified the potential target positions of the fourth and fifth lenses, where secondary shear zones cut through the prospective mineralised horizon. We've already mapped these zones, projected their plunge to the northeast, and drilling is now targeting them.

"Every hole we drill is part of a bigger picture - building our confidence in Zone 126 as an evolving, multi-lens, kilometre scale gold system. With three rigs now on site, and a fourth to arrive shortly, we're accelerating exploration across the Zone 126 trend, which itself represents less than one-third of the known mineralised corridor at Glenburgh. The potential for additional parallel lenses is high, and we're testing that aggressively.

"Zone 126 is proving to be an exceptional discovery, and we're only just starting to uncover its full scale."

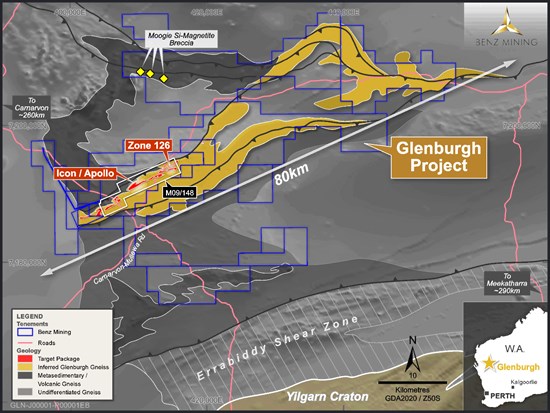

Glenburgh - A New Frontier Gold District

The 100%-owned Glenburgh Gold Project is rapidly emerging as a new frontier gold district with multi-million-ounce potential. Located in Western Australia's Gascoyne region, Glenburgh hosts an 18-20 kilometre mineralised corridor anchored by the large-scale Icon-Apollo trend and the high-grade Zone 126 system.

Glenburgh's unique combination of thick, bulk-style gold mineralisation (Icon-Apollo) and multiple high-grade underground lenses (Zone 126) positions it as a rare opportunity in the Australian gold sector. With gold prices at record levels, the ability to develop both large-scale open pit and underground operations offers exceptional leverage and growth potential.

Figure 3 Glenburgh Project geology overview.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1818/265983_cfe1fdba34eeca6a_003full.jpg

This announcement has been approved for release by the Board of Benz Mining Corp.

For more information please contact:

Mark Lynch-Staunton

Chief Executive Officer

Benz Mining Corp.

E: mstaunton@benzmining.com

T: +61 8 6143 6702

About Benz Mining Corp.

Benz Mining Corp. (TSXV: BZ) (ASX: BNZ) is a pure-play gold exploration company dual-listed on the TSX Venture Exchange and Australian Securities Exchange. The Company owns the Eastmain Gold Project in Quebec, and the recently acquired Glenburgh and Mt Egerton Gold Projects in Western Australia.

Benz's key point of difference lies in its team's deep geological expertise and the use of advanced geological techniques, particularly in high-metamorphic terrane exploration. The Company aims to rapidly grow its global resource base and solidify its position as a leading gold explorer across two of the world's most prolific gold regions.

The Glenburgh Gold Project features a Historical (for the purposes of NI 43-101) Mineral Resource Estimate of 16.3Mt at 1.0 g/t Au (510,100 ounces of contained gold)1. A technical report prepared under NI 43-101- Standards of Disclosure for Mineral Projects (NI 43-101) titled "NI 43-101 Technical Report on the Glenburgh - Egerton Gold Project, Western Australia" with an effective date of 16 December 2024 has been filed with the TSX Venture Exchange and is available under the Company's profile at www.sedarplus.ca.

The Eastmain Gold Project in Quebec hosts a Mineral Resource Estimate dated effective May 24, 2023 and prepared in accordance with NI 43-101 and JORC (2012) of 1,005,000 ounces at 6.1g/t Au2, also available under the Company's profile at www.sedarplus.ca, showcasing Benz's focus on high-grade, high-margin assets in premier mining jurisdictions.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1818/265983_cfe1fdba34eeca6a_004full.jpg

For more information, please visit: https://benzmining.com/.

Qualified Person's Statement (NI 43-101)

The disclosure of scientific or technical information in this news release is based on, and fairly represents, information compiled by Mr Mark Lynch-Staunton, who is a Qualified Person as defined by NI 43-101 and a Member of Australian Institute of Geoscientists (AIG) (Membership ID: 6918). Mr Lynch-Staunton has reviewed and approved the technical information in this news release. Mr Lynch-Staunton owns securities in Benz Mining Corp.

Historical Mineral Resource Estimates

All mineral resource estimates in respect of the Glenburgh Gold Project in this news release are considered to be "historical estimates" as defined under NI 43-101. These historical estimates are not considered to be current and are not being treated as such. These estimates have been prepared in accordance with the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves prepared by the Joint Ore Reserves Committee of the Australasian Institute of Mining and Metallurgy, Australian Institute of Geoscientists and Minerals Council of Australia (JORC Code) and have not been reported in accordance with NI 43-101. A qualified person (as defined in NI 43-101) (Qualified Person) has not done sufficient work to classify the historical estimates as current mineral resources. A Qualified Person would need to review and verify the scientific information and conduct an analysis and reconciliation of historical data in order to verify the historical estimates as current mineral resources.

Forward-Looking Statements

Statements contained in this news release that are not historical facts are "forward-looking information" or "forward-looking statements" (collectively Forward-Looking Information) as such term is used in applicable Canadian securities laws. Forward-Looking Information includes, but is not limited to, disclosure regarding the exploration potential of the Glenburgh Gold Project and the anticipated benefits thereof, planned exploration and related activities on the Glenburgh Gold Project. In certain cases, Forward-Looking Information can be identified by the use of words and phrases or variations of such words and phrases or statements such as "anticipates", "complete", "become", "expects", "next steps", "commitments" and "potential", in relation to certain actions, events or results "could", "may", "will", "would", be achieved. In preparing the Forward-Looking Information in this news release, the Company has applied several material assumptions, including, but not limited to, that the accuracy and reliability of the Company's exploration thesis in respect of additional drilling at the Glenburgh Gold Project will be consistent with the Company's expectations based on available information; the Company will be able to raise additional capital as necessary; the current exploration, development, environmental and other objectives concerning the Company's Projects (including Glenburgh and Mt Egerton Gold Projects) can be achieved; and the continuity of the price of gold and other metals, economic and political conditions, and operations.

Forward-looking information is subject to a variety of risks and uncertainties and other factors that could cause plans, estimates and actual results to vary materially from those projected in such forward-looking information. Factors that could cause the forward-looking information in this news release to change or to be inaccurate include, but are not limited to, the early stage nature of the Company's exploration of the Glenburgh Gold Project, the risk that any of the assumptions referred to prove not to be valid or reliable, that occurrences such as those referred to above are realized and result in delays, or cessation in planned work, that the Company's financial condition and development plans change, and delays in regulatory approval, as well as the other risks and uncertainties applicable to the Company as set forth in the Company's continuous disclosure filings filed under the Company's profile at www.sedarplus.ca and www.asx.com.au. Accordingly, readers should not place undue reliance on Forward-Looking Information. The Forward-looking information in this news release is based on plans, expectations, and estimates of management at the date the information is provided and the Company undertakes no obligation to update these forward-looking statements, other than as required by applicable law.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ACCURACY OR ADEQUACY OF THIS RELEASE.

Appendix 1: Collar Table. Coordinates system: GDA94/MGA Zone 50

| Hole number | Easting | Northing | Elevation | Dip | Azimuth | End Depth (m) |

| 25GLR_055 | 414830 | 7193943 | 327 | -60 | 145 | 700 |

| 25GLR_057 | 414798 | 7193986 | 325 | -58 | 138 | 684 |

| 25GLR_059 | 414805 | 7193971 | 326 | -62.9 | 129 | 654 |

| 25GLR_061 | 414821 | 7193865 | 322 | -60 | 147 | 354 |

| 25GLR_063 | 414823 | 7193863 | 323 | -50 | 147 | 366 |

| 25GLR_070 | 414831 | 7194013 | 321 | -50 | 126 | 678 |

| 25GLR_072 | 414891 | 7193971 | 327 | -68 | 127 | 720 |

| 25GLR_075 | 414914 | 7193945 | 329 | -58.3 | 136 | 441 |

| 25GLR_073 | 414912 | 7193945 | 329 | -56 | 151 | 408 |

Appendix 2: Significant Intercepts Tables.

High Grade Intercepts: A nominal 1 g/t Au lower cut off has been applied to results, with up to 10m internal dilution included unless otherwise stated.

| Hole ID | From (m) | To (m) | Au (ppm) | Length (m) |

| 25GLR_070 | 433 | 450 | 1.27 | 17 |

| 25GLR_070 | 475 | 519 | 4.60 | 44 |

| 25GLR_070 | 530 | 536 | 1.26 | 6 |

| 25GLR_055 | 335 | 344 | 1.37 | 9 |

| 25GLR_055 | 370 | 378 | 2.50 | 8 |

| 25GLR_063 | 158 | 160 | 2.47 | 2 |

| 25GLR_072 | 713 | 715 | 1.49 | 2 |

| 25GLR_061 | 289 | 295 | 1.32 | 6 |

| 25GLR_059 | 556 | 564 | 2.30 | 8 |

| 25GLR_057 | 451 | 468 | 1.41 | 17 |

| 25GLR_057 | 474 | 498 | 2.73 | 24 |

| 25GLR_075 | 363 | 374 | 1.52 | 11 |

Bulk potential intercepts reported with a nominal 1g/t Au lower cut off with no maximum internal dilution length applied.

| Hole ID | From (m) | To (m) | Au (ppm) | Length (m) | Comment |

| 25GLR_070 | 475 | 598 | 1.86 | 123 | Including 103m at 2.3g/t Au |

| 25GLR_057 | 451 | 498 | 1.94 | 47 |

Appendix 3: JORC Tables

JORC Code, 2012 Edition - Table 1 report template

Section 1 Sampling Techniques and Data

(Criteria in this section apply to all succeeding sections)

| Criteria | Commentary |

| Sampling techniques |

|

| Drilling techniques |

|

| Drill sample recovery |

|

| Logging |

|

| Sub-sampling techniques and sample preparation |

|

| Quality of assay data and laboratory tests |

|

| Verification of sampling and assaying |

|

| Location of data points |

|

| Data spacing and distribution |

|

| Orientation of data in relation to geological structure |

|

| Sample security |

|

| Audits or reviews |

|

Section 2 Reporting of Exploration Results

(Criteria listed in the preceding section also apply to this section)

| Criteria | Commentary |

| Mineral tenement and land tenure status |

|

| Exploration done by other parties |

|

| Geology |

|

| Drill hole Information |

|

| Data aggregation methods |

|

| Relationship between mineralisation widths and intercept lengths |

|

| Diagrams |

|

| Balanced reporting |

|

| Other substantive exploration data |

|

| Further work |

|

1 Indicated: 13.5Mt at 1.0g/t Au for 430.7koz; Inferred: 2.8Mt at 0.9g/t Au for 79.4koz. See Historical Mineral Resource Estimates, below

2 Indicated: 1.3Mt at 9.0g/t Au for 384koz; Inferred: 3.8Mt at 5.1g/t Au for 621koz

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/265983

SOURCE: Benz Mining Corp.