Sales: €258m (-1.0% at constant exchange rates)

Essential products sales: €165m (+4.2% at constant exchange rates)

Net income, Group share: €25m (9.7% of sales)

EBITDA: €53m (20.4% of sales)

Cash flow generation: €51m

Regulatory News:

The Board of Directors of Vetoquinol SA (Paris:VETO), meeting on September 9, 2025, approved the financial statements for the first half of the 2025 financial year. The limited review report on the financial statements as of June 30, 2025, was issued by the Statutory Auditors.

Vetoquinol's sales amounted to €258 million for the first six months of fiscal year 2025.

Sales of Essentials products amounted to €165 million, up 4.2% at constant exchange rates, representing 64% of the Group's sales for H1 2025, compared with 60% in H1 2024. Essentials continue to grow at a sustained pace.

On a reported basis, the 2.6% decline in sales compared with the previous fiscal year reflects the continued simplification of Complementary products, mainly in Europe and in the Americas excluding the US, for a negative impact of €5 million in H1, as well as a negative currency impact of €4.2 million, mainly in the Americas outside the United States and Asia Pacific/rest of the world. Net of these two items, Vetoquinol's sales increased by 0.9% over the half-year.

First-half 2025 sales in Europe amounted to €128.9 million. Sales in the Americas excluding the United States declined by 2.7% at constant exchange rates. The Asia-Pacific/rest of the world region recorded a solid growth of 7.2% at constant exchange rates. The United States posted a rebound in Q2 2025.

Sales of companion animals products (€186 million) accounted for 72% of the group's total sales. Sales of farm animals products amounted to €72 million, or 28% of sales.

Gross margin on purchases was 75.8%, up from the previous fiscal year. This increase is due to the growth in the share of Essentials products in revenue, as well as a rise in selling prices of more than 2%. These factors more than offset the increase in the cost of raw materials and outsourced manufacturing.

External expenses were down 8.3% (vs. +20.8% in H1 2024), representing a decrease of €5.0 million, taking into account a currency impact of €-0.9 million on other external expenses and charges, as well as a decrease in marketing expenses in H1 2025.

Personnel expenses increased by €3.3 million. Total headcount remained stable: 2,497 employees as of June 30, 2025 vs. 2,501 as of December 31, 2024.

Depreciation and amortization charges related to the application of IFRS 16 resulted in a depreciation charge of €3.1 million for the period (€3.0 million at the end of June 2024).

EBIT before amortization of intangible assets from acquisitions amounted to €41.8 million for the period ended June 30, 2025, representing 16.2% of sales.

The Group's operating income amounted to €34.9 million (13.5% of revenue), up 9.1%.

Income tax expense for H1 2025 amounted to €-10.8 million (vs. €-11.2 million in H1 2024). The apparent tax rate was 30.2% (vs. 32.0% at the end of June 2024). Restated for tax friction and the non-recognition of certain deferred tax assets, it was 26.9% at the end of June 2025.

Vetoquinol's EBITDA amounted to €52.6 million at June 30, 2025, representing 20.4% of sales

Vetoquinol's net income amounted to €25.1 million, representing 9.7% of revenue for H1 2025, up 5.3% compared to the same period last year.

The Vetoquinol Group posted a positive net cash position of €164 million (including IFRS 16 for €13.8 million), after taking into account dividend payments, increased working capital, CAPEX and share buybacks.

The Vetoquinol Group has solid fundamentals (operating profitability, cash flow generation, and equity) to continue its development strategy and has the means to finance its external growth ambitions.

The presentation of the 2025 half-year results and the half-year financial statements brochure are available on the company's website: https://vetoquinol.com/fr/investisseurs

Next publication: Q3 2025, October 28, 2025

ABOUT VETOQUINOL

Vetoquinol is a leading international player in animal health, with operations in Europe, the Americas, and Asia/Pacific.

Independent and a pure player, Vetoquinol innovates, develops, and markets veterinary medicines and non-medicated products for farm animals (cattle, pigs) and companion animals (dogs, cats).

Since its creation in 1933, Vetoquinol has combined innovation and geographic diversification. The strengthening of the product portfolio and acquisitions in high-potential territories have ensured hybrid growth for the Group. As of June 30, 2025, Vetoquinol employed 2,497 people.

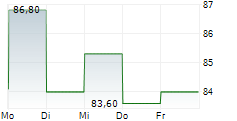

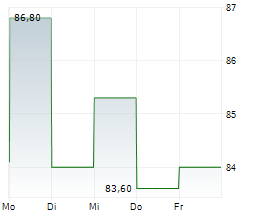

Vetoquinol has been listed on Euronext Paris since 2006 (ticker symbol: VETO).

The Vetoquinol share is eligible for the French PEA and PEA-PME personal equity plans.

APPENDIX

SALES

€m | 2025 | 2024 | Change based on published data | Change at constant exchange rates |

Sales Q1 | 130.6 | 133.6 | -2.3 | -2.1% |

Sales Q2 | 127.0 | 130.8 | -2.9 | +0.1% |

Sales H1 | 257.6 | 264.4 | -2.6% | -1.0% |

SALES BY STRATEGIC TERRITORY

€m | 2025 | 2024 | Change based on published data | Change at constant exchange rates |

Europe | 128.9 | 131.6 | -2.0% | -2.5% |

Americas excluding the USA | 34.8 | 39.0 | -10.8% | -2.7% |

USA | 52.8 | 54.4 | -2.9% | -2.0% |

Asia Pacific Rest of the world | 41.2 | 39.5 | +4.3% | +7.2% |

Sales at end of June | 257.6 | 264.4 | -2.6% | -1.0% |

SUMMARY INCOME STATEMENT

€m | 30/06/2025 | 30/06/2024 | Change |

Total sales of which Essential products | 257.6 165.3 | 264.4 160.1 | -2.6% +4.2% |

EBIT

as a of total sales | 41.7 16.2 | 38.5 14.6 | +8.3% |

Net income Group share as a of total sales | 25.1 9.7 | 23.8 9.0 | +5.3% |

EBITDA as a of total sales | 52.6 20.4 | 45.0 17.0 | +16.9% |

EBITDA RECONCILIATION

€m | 30/06/2025 | 30/06/2024 |

Net income before equity method | 25.1 | 23.8 |

Income tax expense | 10.8 | 11.2 |

Net Financial income/expense | (1.0) | (2.0) |

Provisions recognized in other operating income and expenses |

| (1.0) |

Provisions and write backs | 1.2 | (2.9) |

Depreciation and amortization (including IFRS 16) | 16.5 | 15.9 |

EBITDA | 52.6 | 45.0 |

ALTERNATIVE PERFORMANCE INDICATORS

Vetoquinol Group management believes that these indicators, which are not defined by IFRS, provide additional information that is relevant to shareholders in their analysis of the Group's underlying trends, performance and financial position. These indicators are used by management to analyze performance.

Essentials products: The products referred to as "Essentials" comprise veterinary drugs and non-medical products sold by the Vetoquinol Group. They are existing or potential market-leading products designed to meet the daily requirements of vets in the companion animal or farm animal sector. They are intended for sale worldwide and their scale effect improves their economic performance.

Constant exchange rates: Application of the previous period's exchange rates to the current financial year, all other things remaining equal.

Organic growth: Organic growth refers to growth in Vetoquinol's sales due to an increase in sales volume and/or prices in year N compared with year N-1, at constant exchange rates and scope of consolidation.

EBIT before amortization of acquired assets: This KPI isolates the non-cash impact of depreciation charges on intangible assets arising from mergers and acquisitions.

Net cash and cash equivalents: Net cash corresponds to cash and cash equivalents after deduction of bank overdrafts and bank loans in compliance with IFRS 16.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250911766212/en/

Contacts:

FOR FURTHER INFORMATION, PLEASE CONTACT:

VETOQUINOL

Investor Relations

Fanny Toillon

Tel.: +33 (0)3 84 62 59 88

relations.investisseurs@vetoquinol.com