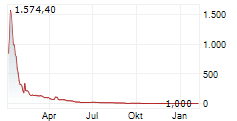

NAPLES, Fla. And CAMBRIDGE, United Kingdom, Sept. 17, 2025 (GLOBE NEWSWIRE) -- CDT Equity Inc. (Nasdaq: CDT) ("CDT" or the "Company") today announced the strategic acquisition of 8.65252366 Bitcoin ("BTC") for an aggregate purchase price of $1,000,000 (inclusive of fees and expenses), at an average acquisition price of $115,285 per BTC.

By incorporating Bitcoin into its treasury reserve strategy, CDT aims to strengthen its financial position and reinforce balance sheet resilience, while aligning with the accelerating institutional adoption of digital assets within a regulatory environment that is progressively enabling broader acceptance.

"We are pleased to execute the definitive step in our cryptocurrency-based treasury reserve strategy, which is designed to diversify the Company's balance sheet and reinforce its innovation-led business model," said James Bligh, Chief Financial Officer of CDT. "We continue to evaluate our asset allocation to optimise our treasury portfolio and shareholder returns."

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of the federal securities laws. All statements other than statements of historical facts contained in this press release, including statements regarding CDT's future results of operations and financial position, CDT's business strategy, prospective product candidates, product approvals, research and development costs, timing and likelihood of success, plans and objectives of management for future operations, future results of current and anticipated studies and business endeavours with third parties, and future results of current and anticipated product candidates, are forward-looking statements. These forward-looking statements generally are identified by the words "believe," "project," "expect," "anticipate," "estimate," "intend," "strategy," "future," "opportunity," "plan," "may," "should," "will," "would," "will be," "will continue," "will likely result," and similar expressions. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including, but not limited to; the inability to maintain the listing of CDT's securities on Nasdaq; the ability to recognize the anticipated benefits of the business combination completed in September 2023, which may be affected by, among other things, competition; the ability of the combined company to grow and manage growth economically and hire and retain key employees; the risks that CDT's product candidates in development fail clinical trials or are not approved by the U.S. Food and Drug Administration or other applicable authorities on a timely basis or at all; changes in applicable laws or regulations; the possibility that CDT may be adversely affected by other economic, business, and/or competitive factors; and other risks and uncertainties to be identified in the proxy statement/prospectus (as amended and supplemented) relating to the business combination completed in September 2023, including those under "Risk Factors" therein, and in other filings made by CDT with the U.S. Securities and Exchange Commission. Moreover, CDT operates in a very competitive and rapidly changing environment. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and some of which are beyond CDT's control, you should not rely on these forward-looking statements as predictions of future events. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and except as required by law, CDT assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. CDT gives no assurance that it will achieve its expectations.

Investors & Media:

info@cdtequity.com