VANCOUVER, British Columbia, Sept. 18, 2025 (GLOBE NEWSWIRE) -- COLLECTIVE METALS INC. (CSE: COMT | OTC: CLLMF | FSE: TO1) (the "Company" or "Collective") is pleased to announce that it has signed a non-binding Letter of Intent (the "LOI"), dated September 17, 2025, with Standard Uranium (Saskatchewan) Ltd. and Standard Uranium Ltd. (collectively, the "Optionors"). Pursuant to the LOI and subject to the entry into of a definitive agreement by the Company and the Optionors in connection thereof, the Company would be granted an option (the "Option") to acquire a seventy-five percent (75%) interest in the 4,002-hectare Rocas project, located in the eastern Athabasca Basin region (the "Project").

Rocas Uranium Project Highlights:

- Prime Location - More than 7.5 km of exploration strike length along a strong NE-SW magnetic low trend coincident with EM conductors and cross-cutting faults, providing shallow drill targets south of Key Lake.

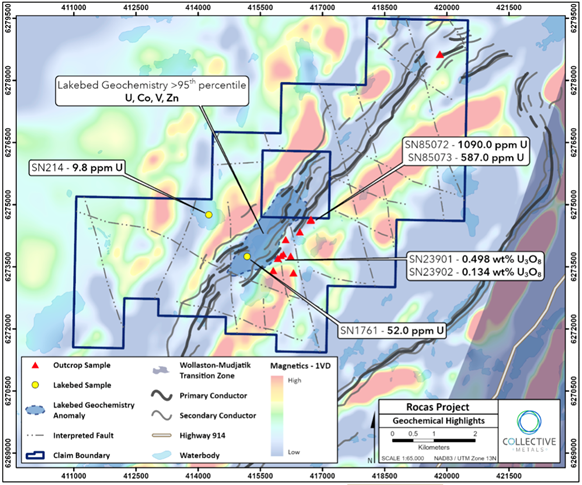

- Uranium at Surface - Mineralized outcrop grab samples along approximately 900 metres of strike length, grading up to 0.50 wt.% U3O8 and never drill tested1 (Please see Figure 2).

- New Uranium Targets - Results from a high-resolution ground gravity survey completed in 2024 highlight potential alteration halos and high-priority exploration targets along well defined structural corridors.

Christopher Huggins, Chief Executive Officer of the Company, commented, "We are thrilled to announce the acquisition of the Rocas Uranium Project. Located in the renowned Athabasca Basin which plays a major role in Canadian uranium exploration and production. With more than 7.5 kilometres of strike length, uranium mineralization identified at surface, and newly defined high-priority exploration targets, we are fortunate to be able to further investigate the Project."

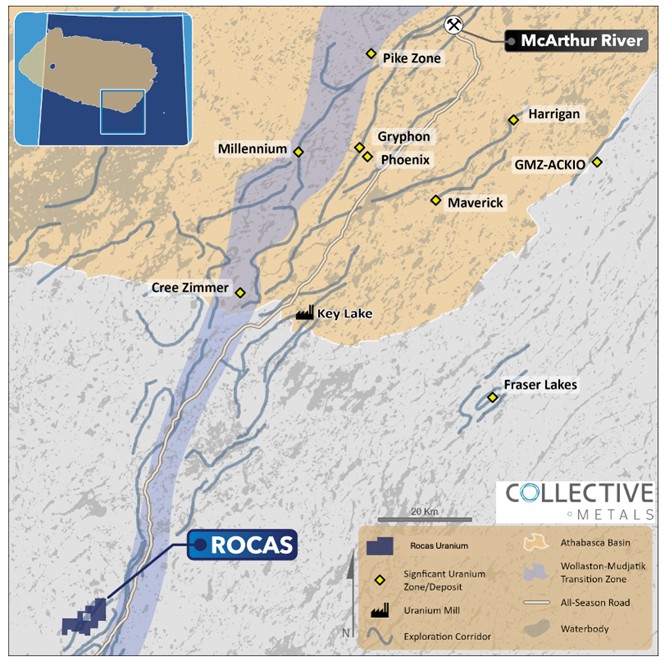

Figure 1. Regional map of Standard Uranium's Rocas Project. The Project is located 75 kilometers southwest of the Key Lake Mine and Mill facilities along Highway 914.

About the Rocas Project

The Project comprises 4,002 hectares, located 75 kilometers southwest of the Key Lake Mine and Mill facilities along Highway 914, and approximately 72 kilometers south of the present-day margin of the Athabasca Basin. The Project covers 7.5 kilometres of a northeast trending magnetic low/electromagnetic ("EM") conductor corridor which hosts several uranium showings, including historical mineralized outcrop grab samples along approximately 900 metres of strike length, grading up to 0.50 wt.% U3O8.1 Notably, none of the historical uranium occurrences have been drill-tested.

Historical airborne EM work in 2017 defined conductive trends on the Project west of and sub- parallel to the Key Lake Road shear zone, corresponding with favourable metasedimentary basement lithologies. Multiple parallel conductors, offsets, and termination points indicate the trend widening and potential cross-cutting structures. Additionally, a 2007 field sampling program identified anomalous lakebed geochemical anomalies that statistically rank as greater than 95th percentile U, Co, V, and Zn along the conductor corridor, including high U/Th ratios.2

Figure 2. Geophysical map of the Rocas Project highlighting EM conductors, faults, historical uranium showings, and anomalous lakebed geochemistry.

2024 Ground Gravity Survey

The Optionors contracted MWH Geo-Surveys (Canada) Ltd. to complete a high-resolution ground gravity survey along known conductive exploration trends on the Project. The surveys are designed to aid in the identification of potential zones of hydrothermal alteration of host rocks associated with uranium mineralization events.

The gravity surveys across the conductive structural corridors improve definition of drill targets for future exploration programs. Convolutions Geoscience have completed detailed inversion and 3D modeling, which will provide additional vectoring layers for future drill programs. Value-added products include 3D density inversions, depth slices, modeling interpretation, and expert recommendations.

Four new drill target zones have been identified on the Project, outlined via the confluence of low gravity anomalies, historical surface mineralization, lakebed geochemical anomalies, EM conductors, and crosscutting fault zones.

Proposed Option Agreement Terms

Subject to the Company and the Optionors entering into a definitive agreement reflecting the terms and conditions as outlined in the LOI, the Option would be exercisable by the Company completing cash payments and share issuances, and incurring the following exploration expenditures on the Project as follows:

| Consideration Payments | Consideration Shares | Exploration Expenditures | Operator Fees | ||||

| Year 1 | $50,000 | $250,000 | $1,500,000 | 10% | |||

| Year 2 | $50,000 | $250,000 | $1,500,000 | 12% | |||

| Year 3 | $125,000 | $225,000 | $1,500,000 | 12% | |||

| Total | $225,000 | $725,000 | $4,500,000 | ||||

3-Year Earn-In Option

Prior to exercise of the Option, the Optionors will act as the operator of the Project and will be entitled to charge a 10% fee on expenditures in Year 1, increasing to 12% in Year 2 and Year 3. Following successful completion of the obligations of the Option (i.e., at the end of Year 3), the Company will acquire a 75% equity in the Property, with the Optionors retaining 25% as well as a 2.5% net smelter returns royalty on the Project, of which 1.0% may be purchased back at any time for a one-time cash payment of $1,000,000.

The parties intend on forming an unincorporated joint venture for the further development of the Project.

The LOI is non-binding at this time and the grant of the Option remains subject finalisation and execution of definitive documentation. No finders' fee is payable by the Company in connection with the Option.

References

1 Mineral Assessment Report 74B09-0007: Uranex Ltd., 1977 & SMDI# 2465: https://mineraldeposits.saskatchewan.ca/Home/Viewdetails/2465

2 Mineral Assessment Report 74B09-0032: Forum Uranium Corp., 2007

Qualified Person Statement

The scientific and technical information contained in this news release has been reviewed, verified, and approved by Sean Hillacre, P.Geo., President and VP Exploration of Standard Uranium and a "qualified person" as defined in NI 43-101 - Standards of Disclosure for Mineral Projects.

Historical data disclosed in this news release relating to sampling results from previous operators are historical in nature. Neither the Company nor a qualified person has yet verified this data and therefore investors should not place undue reliance on such data. The Company's future exploration work may include verification of the data. The Company considers historical results to be relevant as an exploration guide and to assess the mineralization as well as economic potential of exploration projects.

About Collective Metals

Collective Metals Inc. (CSE: COMT | OTC: CLLMF | FSE: TO1) is a resource exploration company specializing in critical and precious metals exploration in North America.

Social Media

| X | @COMT_metals |

| Collective Metals Inc | |

| Collective Metals Inc |

ON BEHALF OF COLLECTIVE METALS INC.

Christopher Huggins

Chief Executive Officer

T: 604-968-4844

E: chris@collectivemetalsinc.com

Forward Looking Information

This news release includes certain "Forward-Looking Statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" under applicable Canadian securities laws. When used in this news release, the words "anticipate", "believe", "estimate", expect", "target", "plan", "forecast", "may", "would", "could", "schedule" and similar words or expressions, identify forward-looking statements or information.

Forward-looking statements and forward-looking information relating to any future mineral production, liquidity, enhanced value and capital markets profile of Collective, future growth potential for Collective and its business, and future exploration plans are based on management's reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management's experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of lithium and other metals; costs of exploration and development; the estimated costs of development of exploration projects; Collective's ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

This news release contains "forward-looking information" within the meaning of the Canadian securities laws. Statements, other than statements of historical fact, may constitute forward looking information and include, without limitation, statements with respect to the LOI; the Option and the entering into of a definitive agreement between the Company and the Optionors; the potential benefits of acquiring an interest in the Project; the Project and its mineralization potential; the Company's objectives, goals or future plans with respect to the Project; the commencement of drilling or exploration programs in the future; the anticipated results of any drilling or exploration programs conducted in the future; and the completion of the Option. With respect to the forward-looking information contained in this news release, the Company has made numerous assumptions regarding, among other things, the geological, metallurgical, engineering, financial and economic advice that the Company has received is reliable and are based upon practices and methodologies which are consistent with industry standards. While the Company considers these assumptions to be reasonable, these assumptions are inherently subject to significant uncertainties and contingencies. Additionally, there are known and unknown risk factors which could cause the Company's actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information contained herein. Known risk factors include, among others: fluctuations in commodity prices and currency exchange rates; uncertainties relating to interpretation of well results and the geology, continuity and grade of lithium and other metal deposits; uncertainty of estimates of capital and operating costs, recovery rates, production estimates and estimated economic return; the need for cooperation of government agencies in the exploration and development of properties and the issuance of required permits; the need to obtain additional financing to develop properties and uncertainty as to the availability and terms of future financing; the possibility of delay in exploration or development programs or in construction projects and uncertainty of meeting anticipated program milestones; uncertainty as to timely availability of permits and other governmental approvals; increased costs and restrictions on operations due to compliance with environmental and other requirements; increased costs affecting the metals industry and increased competition in the metals industry for properties, qualified personnel, and management. All forward-looking information herein is qualified in its entirety by this cautionary statement, and the Company disclaims any obligation to revise or update any such forward-looking information or to publicly announce the result of any revisions to any of the forward-looking information contained herein to reflect future results, events or developments, except as required by law.

The Canadian Securities Exchange (CSE) does not accept responsibility for the adequacy or accuracy of this release.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/e7cf95e0-f34a-4d91-b45e-479104ebeda6

https://www.globenewswire.com/NewsRoom/AttachmentNg/6e46f3af-5ef7-4fa0-a6e7-610a32137f16