Permitting Marks Key Milestone in Securing a Strategic U.S. Supply of Tungsten and Gold

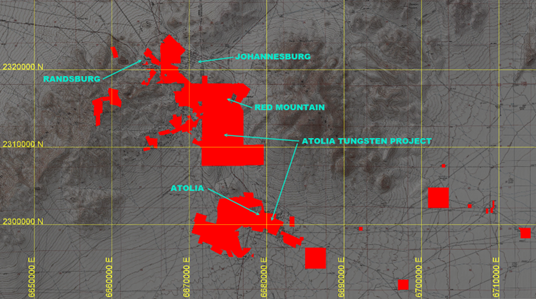

RANDSBURG, CA / ACCESS Newswire / September 18, 2025 / SB&N Mining Properties LLC (B&N) has engaged EnviroMINE, Inc. (EnviroMINE) to manage permitting for its Atolia Tungsten Project in southeastern California, which contains 33.8 million pounds of tungsten trioxide (WO3) and 104,000 ounces of gold in two placer deposits.

The project benefits from vested mining rights (VRD) on patented claims, which allow mining and processing of tungsten- and gold-bearing alluvium. This first phase of permitting covers patented claims, with potential expansion onto adjoining unpatented claims.

Permitting

EnviroMINE will prepare the required Reclamation Plan and work with county and state regulators. With vested rights in place, land-use permitting is not required, reducing review to reclamation issues only. Permit approval is expected within 12-24 months.

EnviroMINE has previously led environmental work for B&N's Kelly Southwest, Black Hawk, and Kelly North drilling programs and maintains strong working relationships with regulatory agencies.

"The Atolia Tungsten Project's vested rights give it a unique advantage," said Travis Jokerst, Vice President of EnviroMINE. "Our role is to move permitting forward so the project can rapidly transition from planning to production."

Tungsten Market

Tungsten's exceptional hardness, density, and high melting point make it essential for aerospace, defense, energy, and medical applications. Uses include cutting tools, drills, lighting, X-ray tubes, electrical contacts, heating elements, armor-piercing ammunition, surgical instruments, and aerospace components.

The U.S. currently has no primary tungsten production; nearly all supply is imported, largely from China. Recent Chinese export restrictions have tightened supply and increased prices, spurring U.S. initiatives to develop domestic sources.

The Atolia district is the fourth-largest historic tungsten producer in the U.S., with 23.9 million pounds WO3 produced - 98% from what is now B&N property. Significant placer resources remain, positioning Atolia as a strategic domestic source.

Atolia Tungsten Project

The project consists of two tungsten- and gold-bearing placers:

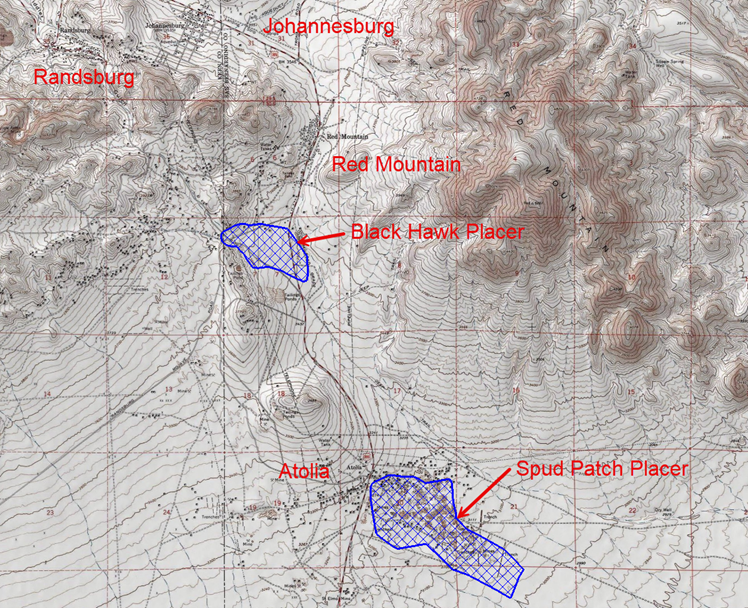

Black Hawk Placer - Discovered in the 1950s, hosting 16.4 million pounds WO3 (scheelite) and 88,000 oz gold. Formed by erosion of tungsten-6 and gold-bearing veins from the Stringer Mining District.

Spud Patch Placer - Discovered in 1904 and mined during WWI and WWII, with 17.4 million pounds WO3 and 16,000 oz gold. Named for large "potato-sized" scheelite chunks historically recovered.

Mining & Processing

Initial mining will begin at Black Hawk following permit approval, expected as early as one year. Conventional open-pit methods will be used, requiring no blasting. Placer material will be excavated, processed through a portable wash plant, and concentrated for scheelite recovery, with gold recovered onsite as a byproduct. Dewatered tailings will be placed back into mined pits. Once mining is completed at Black Hawk, the wash plant will be moved to Spud Patch to repeat the process.

Exploration & Expansion

B&N is also advancing exploration across the Atolia district to expand resources, including:

Drilling at the historic Union and Amity mines.

District-wide soil sampling.

Drilling of tungsten and gold anomalies identified by sampling.

This work targets extensions of known high-grade veins and potential undiscovered lode and placer resources.

"Advancing the Atolia Tungsten Project will strengthen U.S. tungsten self-sufficiency," said Sam Shoemaker, Project Manager with the John T. Boyd Company. "The placer deposits are low cost to develop, easily processed, and environmentally clean."

"The start of permitting underscores B&N's commitment to redeveloping the Rand Mining District and supplying critical minerals," said Robert Binkele, Managing Member of B&N. "We intend to become the largest tungsten producer in the United States."

Qualified Person

Sam Shoemaker, MMSA, SME Registered Member, of the John T. Boyd Company, has reviewed and approved the technical content of this release in accordance with NI 43-101.

About B&N Mining Properties LLC

B&N is revitalizing the historic Rand Mining District, advancing projects in gold, silver, and tungsten.

The company has reported:

Atolia Tungsten Project - 33.8 million pounds WO3 and 104,000 oz gold

Kelly Southwest - 306,000 oz gold

Recent 22,000-foot drill program at Black Hawk and Kelly North, with assays pending for updated resource estimates.

B&N also controls the Kelly Mine (20 million oz historic silver production), several historic gold mines with 300,000 oz combined production, and holdings at Cerro Gordo, Skidoo, Wild Rose, Silver Mountain, and Lake Isabella.

Contact Information

Robert Binkele

Manager

info@bnmininginc.com

760-409-7117

SOURCE: B&N Mining, Inc.

Related Images

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/business-and-professional-services/bandn-mining-properties-llc-begins-production-permitting-for-33.-1074362