NORTHAMPTON, MA / ACCESS Newswire / September 22, 2025 / Key Findings from the AI-Enhanced Industry Study

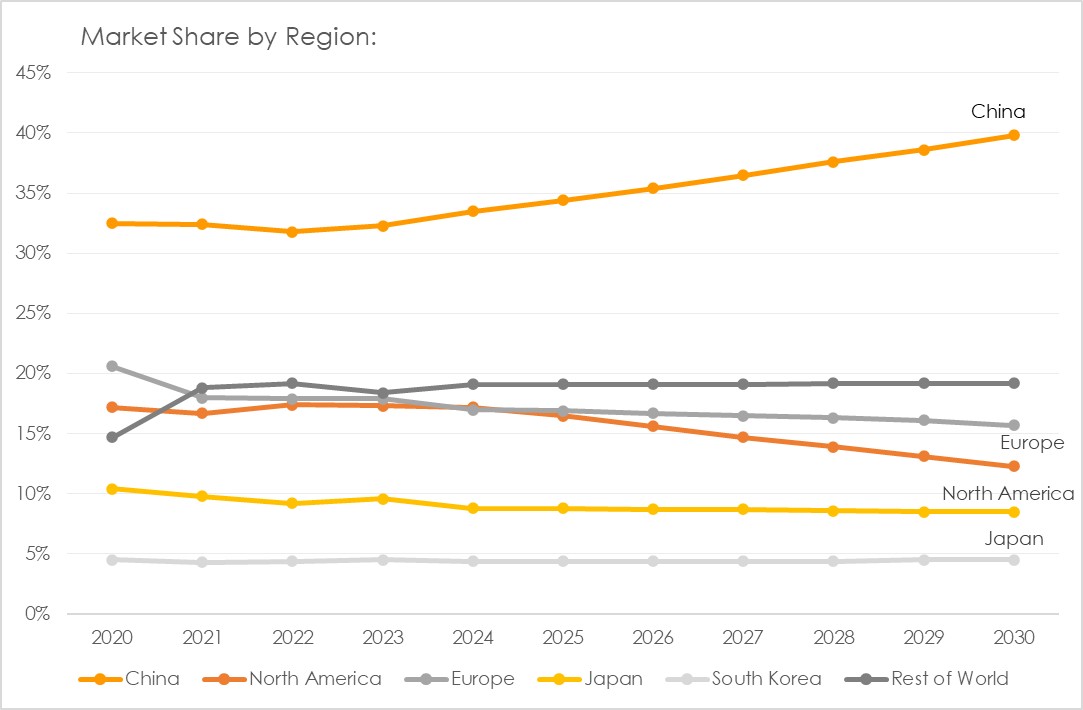

The global car industry is at an inflection point with the transition to electrification of power trains as and AI system integration. The next 5 years will determine what players will thrive or disappear, with new entrances mixing up established powerhouses. A comprehensive forecasting analysis of the global automotive industry suggests significant shifts in market dynamics through 2030, with China set to increase its share of global vehicle production from over 30% to nearly 40%, while traditional companies (and countries) are facing a variety of transition challenges.

Major Market Shifts Expected

The study, which is based on historic and present data of 21 major automotive companies using advanced AI forecasting methods, projects divergent paths for different regions:

Chinese dominance is expanding: China's vertically integrated approach-from lithium processing to battery manufacturing to final assembly-creates cost advantages and supply chain resilience that is difficult to replicate. The country's coordinated industrial policy, the large number of engineers and infrastructure investments are expected to help China to capture the largest share of industry growth.

US manufacturers under pressure: American car makers are looking at the possibility of further decline in sales, revenues, and profitability, attributed to slow electric vehicle adoption, supply chain uncertainties and lack of competitiveness in export markets.

Europe - fragile stability: European producers are expected to maintain relatively stable positions, with premium brands providing pricing power and margin protection against low-cost competition.

Methodology and Scope

The forecasting model integrates multiple analytical approaches including S-curve modelling, linear trend analysis, mean reversion models, and machine-learning tools. The analysis incorporates historical performance data, brand power metrics, consumer perceptions, and adaptation speeds across the industry.

Tesla Valuation Concerns

The analysis raises significant questions about market valuations, particularly regarding Tesla, which is currently valued at more than $1.1 trillion despite selling fewer than 2 million vehicles compared to Toyota's 10 million units. The study suggests Tesla is currently overvalued by roughly 900% based on traditional automotive industry metrics.

Technology Transition Impact

The next five years will likely determine which companies successfully navigate the transition from combustion-engines to integrated electric cars, and which companies become casualties or winners of technological and market disruption, as the industry faces its most significant transformation since the advent of mass production.

Read more here: Changing seat: competitiveness-based forecasting the car industry

Limitations and Assumptions

The forecast assumes no major geopolitical destabilisation or climate-related supply chain disruptions, acknowledging that unforeseeable events are not included in the modelling.

This analysis provides insights for investors, industry stakeholders, and policymakers as the automotive sector undergoes its most dramatic restructuring in over a century.

About SolAbility

SolAbility is an ESG consultancy and research think-tank, publisher of the Global Sustainable Competitiveness Index, and has designed ESG system that have made clients Global DJSI leaders.

Global automotive market share by producing country/region

View additional multimedia and more ESG storytelling from SolAbility on 3blmedia.com.

Contact Info:

Spokesperson: SolAbility

Website: https://www.3blmedia.com/profiles/solability-sustainable-intelligence

Email: info@3blmedia.com

SOURCE: SolAbility

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/business-and-professional-services/modelling-the-automotive-industry-2030-china-increases-dominance-1076624