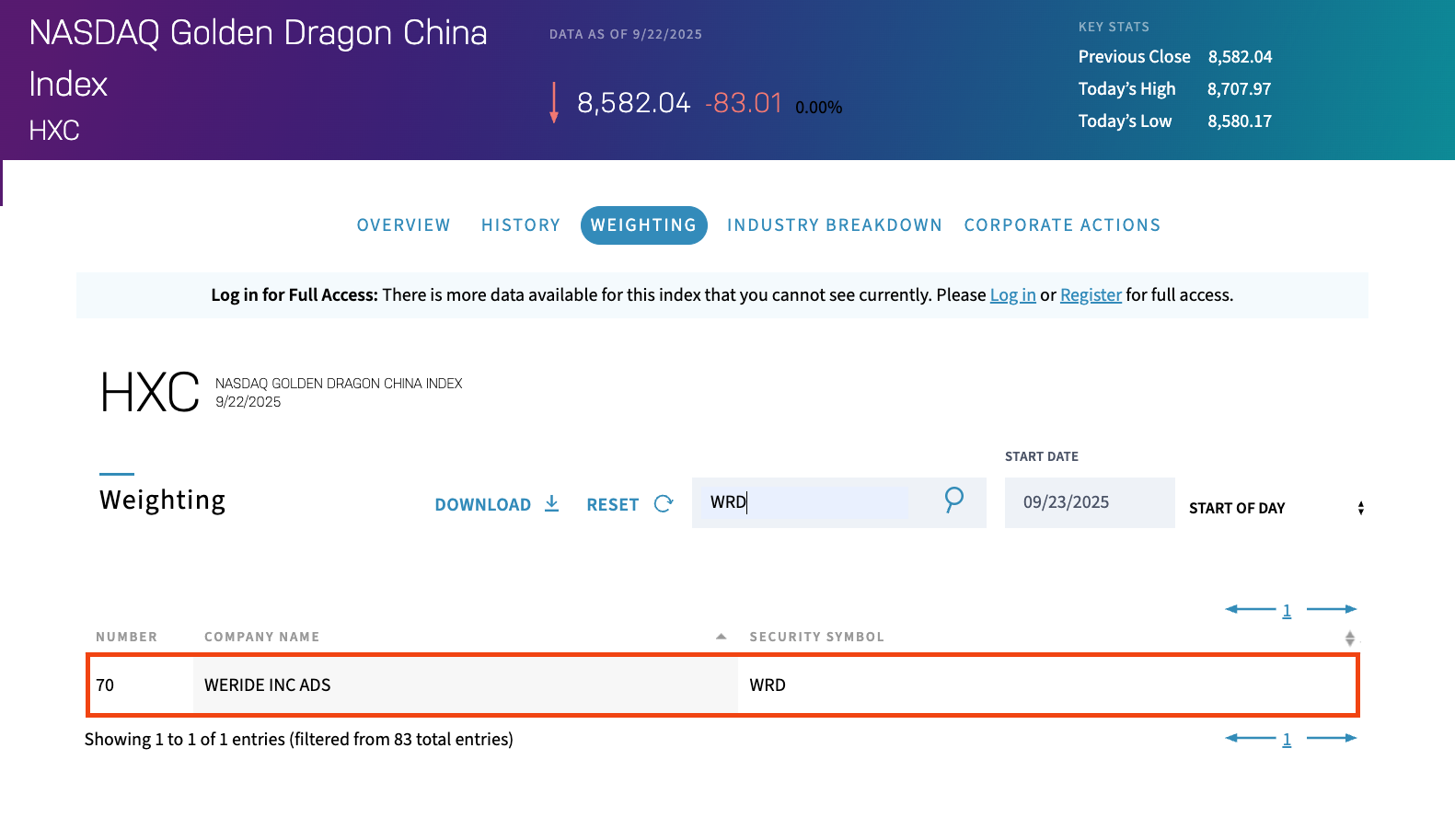

NEW YORK, Sept. 23, 2025 (GLOBE NEWSWIRE) -- WeRide (Nasdaq: WRD), a global leader in autonomous driving technology, has been included in the Nasdaq Golden Dragon China Index (Nasdaq: HXC). By being part of this key benchmark for US-listed Chinese companies, WeRide is expected to gain greater visibility among investors, strengthen its capital markets position, and reinforce its role as a global leader in autonomous driving.

WeRide has been included in the Nasdaq Golden Dragon China Index

WeRide's inclusion in the Nasdaq Golden Dragon China Index is expected to deliver several key benefits: 1. Investment funds tracking the index will automatically allocate WeRide shares in their portfolios, providing long-term support to the company; 2. With the index followed closely by institutional investors, WeRide is expected to attract increased attention from this investor segment, potentially enhancing market activity; 3. It will strengthen WeRide's brand image among global investors, potential clients, and partners, supporting its international business expansion.

The Nasdaq Golden Dragon China Index is a market capitalization-weighted index that is adjusted periodically. It comprises Chinese companies listed in the United States, aiming to provide global investors with an avenue to invest China's economy. Following the addition of WeRide, the index now includes 83 Chinese constituent stocks, such as Alibaba, JD.com, and NetEase.

Over the past six months, the index has trended upwards, reaching its highest level since February 2022, reflecting growing optimism in global capital markets regarding the fundamentals and valuation recovery of Chinese companies. Against this backdrop of improving investor sentiment toward US-listed Chinese stocks and the index's current bullish cycle, WeRide's inclusion stands out as a significant milestone.

WeRide was officially listed on the Nasdaq Stock Exchange on October 25, 2024, becoming the world's first publicly listed Robotaxi company. Today, the company conducts testing or operations across more than 30 cities in 11 countries, accumulating over 2,200 days of global autonomous operations.

Recent milestones highlight WeRide's rapid global expansion:

- September 22, 2025 - Partnered with Grab to launch Ai.R, Grab's first consumer-facing autonomous vehicle service in Singapore.

- September 19, 2025 - WeRide's Robobus received Belgium's first Level 4 test permit, making WeRide the only company worldwide with products holding autonomous driving permits in seven countries (Belgium, China, France, UAE, Saudi Arabia, Singapore, and the US).

- July 23, 2025 - Launched Saudi Arabia's first Robotaxi pilot service in Riyadh.

- May 6, 2025 - WeRide and Uber announced an expanded partnership to bring Robotaxis to 15 additional cities over the next five years, aiming for large-scale deployment across Europe, the Middle East, and other international markets.

This global expansion has fueled strong growth. In Q2 2025, WeRide reported revenue of US$17.8 million, up 60.8% year-on-year (YoY), with Robotaxi revenue surging 836.7% YoY to US$6.4 million.

About WeRide

WeRide is a global leader and a first mover in the autonomous driving industry, as well as the first publicly traded Robotaxi company. Our autonomous vehicles have been tested or operated in over 30 cities across 11 countries. We are also the first and only technology company whose products have received autonomous driving permits in seven markets: China, Belgium, France, Singapore, Saudi Arabia, the UAE, and the US. Empowered by the smart, versatile, cost-effective, and highly adaptable WeRide One platform, WeRide provides autonomous driving products and services from L2 to L4, addressing transportation needs in the mobility, logistics, and sanitation industries. WeRide was named in Fortune Magazine's 2025 Future 50 list.

Media Contact

pr@weride.ai

Safe Harbor Statement

This press release contains statements that may constitute "forward-looking" statements pursuant to the "safe harbor" provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as "will," "expects," "anticipates," "aims," "future," "intends," "plans," "believes," "estimates," "likely to," and similar statements. Statements that are not historical facts, including statements about WeRide's beliefs, plans, and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. Further information regarding these and other risks is included in WeRide's filings with the U.S. Securities and Exchange Commission. All information provided in this press release is as of the date of this press release. WeRide does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/15a8eb72-b9eb-4721-b556-9335d187dce4