Toyota, State Grid, and Samsung are listed as the top three; the national brand loyalty of China continues to grow

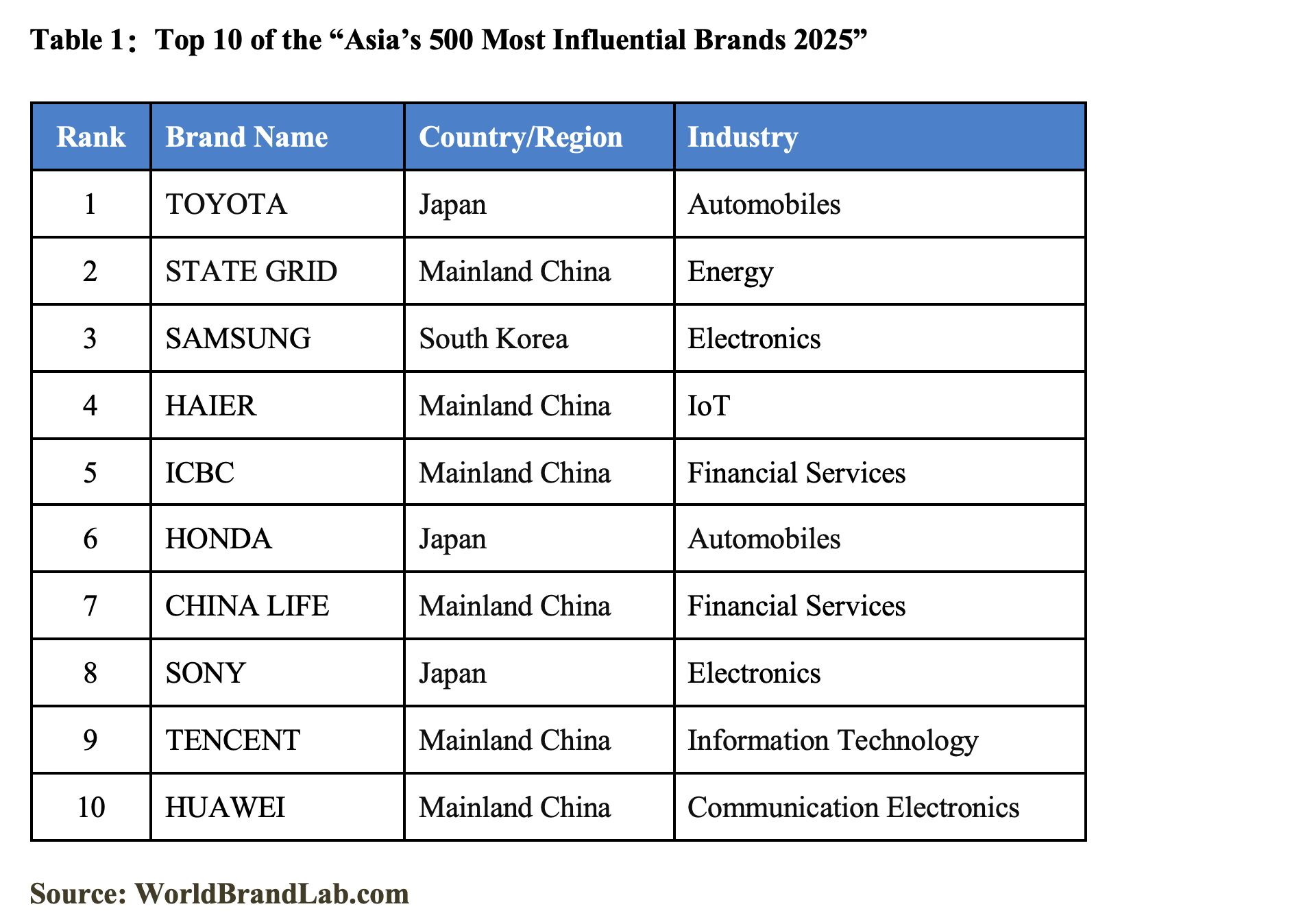

NEW YORK CITY, NY / ACCESS Newswire / September 23, 2025 / The Asia Brand Summit was held in Hong Kong on September 24 by World Brand Lab. The Asia's 500 Most Influential Brands of 2025 list (20th edition) was released at the summit, with top brands from 20 countries and regions making the list. Toyota, State Grid, and Samsung are listed as the top three influencers. Haier, ICBC, Honda, China Life, Sony, Tencent, and Huawei are also listed in the top ten. China, Japan, and South Korea are the three countries with the most selected brands. Steve Woolgar, Emeritus Professor of Marketing at University of Oxford, John Deighton, Emeritus Professor of Business Administration at Harvard Business School, J. Miguel Villas-Boas, Professor of Marketing Strategy at the University of California, Berkeley, and Sara Kim, Professor of Marketing at the University of Hong Kong, participated in the summit and delivered keynote speeches.

The selection criterion for list is Asian brand influence. Dr. Steve Woolgar, Chairman of the World Brand Lab Academic Committee, explained that the basic indicators include market share, brand loyalty, and Asian leadership. Brand loyalty is measured using rating data from iTrust Rating, while Asian leadership, particularly ESG scores, is referenced from SuperFinance's ESG database. The 2025 list includes brands selected from 20 countries and regions. China has 217 brands, ranking first among all countries; of these, 178 are from mainland China. Japan ranked second with 129 brands, while South Korea ranked third with 45 brands. Professor Woolgar noted that in the Asian market, the focus should be on China rather than India, as foreign brands investing in China can gain more returns due to China's strong infrastructure, large middle class, and well-established supply chain system. Among the Chinese brands that performed well are State Grid, Haier, Wuliangye, China Southern Power Grid, Tsingtao Beer, Changhong, Tongwei, Bosideng, Feihe, Zoomlion, JOMOO, King Long, Erdos, DoubleStar, Yanjing, and GCL.

This year's list includes brands from 40 industries. Financial services is the largest industry with 71 brands. The second to fifth most represented sectors are information technology (49), media (44), food and beverage (41), and automobiles (28). In the list, Moutai, Wuliangye, and Tsingtao Beer ranked as the top three brands in the food and beverage sector, and these brands already have significant global influence.

The World Brand Lab has conducted consumer loyalty surveys across Asian countries for 13 consecutive years. Japanese consumers continue to have the highest national brand loyalty at 84%. South Korea ranks second. Mainland Chinese consumers' enthusiasm for local brands continues to rise, growing from 36% more than a decade ago to 71% this year, ranking third. There are 32 new brands on the list this year. Among them, mainland China has the largest number of new brands, with 11.

The topic for this year's Asia Brand Summit is "How can Asian brands harness AI-driven marketing strategies to thrive amidst global tariff barriers?" Dr. John DEIGHTON, Emeritus Professor of Business Administration at Harvard Business School, noted that for Asian brands there is no single way to respond to US protectionist policies. Facing the paradox of the US economy, Asian brands should focus on what they can do: hope for the best but plan for the worst. Three dimensions of a "Plan for the Worst" strategy stand out. First, Asian brands should be fast to apply their skills with creators and influencers and match the personality of the brand with creator teams for upper-funnel communication. Second, use the power of retail integration to build direct-to-consumer distribution channels and database marketing. Third, brands should use AI for market segmentation and targeting to drive lower-funnel messaging that maps to each customer's readiness to buy.

Dr. J. Miguel BOAS, Professor of Marketing Strategy at the University of California, Berkeley, asserts that as technology capabilities evolve, firms face the marketing challenges of how to articulate evolving value propositions and how to identify emerging market opportunities. To address these challenges companies may want to reallocate their assets to the markets in which they are more productive. In Asia, India's productivity is significantly lower than China's. For entrepreneurs, the developments in AI create threats for the current way of doing business but also present opportunities. For example, large language models (LLM) may allow firms to do market research and construct perceptual maps in a more efficient way, in ways that are similar to traditional methods.

Dr. Sara KIM, Professor of Marketing at the HKU Business School, argues that in the face of global tariff barriers, Asian brands should enhance production management to reduce costs and inventory risks, and implement agile supply chain strategies. By partnering with domestic manufacturers, brands can foster local economies while optimizing production efficiencies. Additionally, several companies are expanding their business into the AI sector, enhancing brand value through AI-enabled product innovation that caters to evolving consumer preferences. For Asian brands currently in the ascendant phase of globalization, their ability to effectively absorb, utilize, and lead AI-driven transformations will largely determine their future influence in the global market.

Dr. Steve WOOLGAR, Emeritus Professor of Marketing at the University of Oxford and Chairman of the Academic Committee of World Brand Lab, believes that global trade environment is facing unprecedented uncertainty. Escalating tariffs, particularly from the United States on Asian imports, have increased export costs, restricted market access, and intensified geopolitical tensions. AI is becoming the underlying force reshaping the global business landscape. From product development and supply chain management to market insights and customer interaction, AI is no longer just a technological tool, but a core engine that directly determines a company's competitiveness.

Dr. Haisen DING of University of Oxford, founder of World Executive Group and World Brand Lab, believes that technological changes are accelerating the reshaping of the global brand competition landscape. Increasingly stringent tariff reviews target not only final products but also component origins and intellectual property. At this time, Asian brands should shift from passive to active, using blockchain and AI-driven digital traceability systems to ensure supply chain transparency and reduce the risk of country-of-origin fraud, thereby maintaining market access. Furthermore, Asian brands can invest in AI and automation to achieve efficient production and personalized customization, offsetting price disadvantages and shifting towards high-value-added markets.

World Brand Lab, wholly owned by the leading digital technology and strategic consulting company World Executive Group, is an international brand value research institution, founded on the initiative of and first chaired by Professor Robert Mundell, winner of the 1999 Nobel Prize in Economics. The current chair is Professor Steve Woolgar from the University of Oxford. The experts and consultants of World Brand Lab come from Harvard University, Yale University, MIT, Columbia University, University of Oxford, University of Cambridge, INSEAD and other top universities around the world. Its research results have become an important basis for intangible asset valuation in the process of M&A of many enterprises. The Asia's 500 Most Influential Brands list has been published annually since 2006.

Contact Information

Jason Wang

Media Manager

info@worldbrandlab.com

212-208-1429

SOURCE: World Brand Lab

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/business-and-professional-services/world-brand-lab-releases-asias-500-most-influential-brands-of-20-1077294