Vancouver, British Columbia--(Newsfile Corp. - September 24, 2025) - Perseverance Metals Inc. ("Perseverance" or the "Company") is pleased to announce that it has completed its previously announced non-brokered offerings of subscription receipts and flow-through units for aggregate gross proceeds of C$3,569,731 and received conditional approval from the TSX Venture Exchange (the "TSXV") for the imminent listing of its common shares (the "Shares").

Go-Public Financing

The Company has marked a significant milestone in the public listing process by closing a non-brokered private placement of subscription receipts (the "SR Offering) and of units (the "Unit Offering") for aggregate gross proceeds of C$3,569,731 which, in addition to the C$4,618,869 raised in the Company's initial financing in connection with the listing process (see PMI News Release June 26 2025), results in total gross go-public proceeds of C$8,188,869 - over C$2,000,000 oversubscribed.

Notably, the Offerings included pro-rata strategic investments from existing shareholders Teck Resources Limited ("Teck"), a leading Canadian resource company, Altius Minerals Corp. ("Altius"), a diversified minerals royalty company and the Company's partner on the Voyageur project, and SIDEX ("SIDEX"), a resource-focused fund in Québec. Details on the SR Offering and Unit Offering are provided below.

TSXV Listing

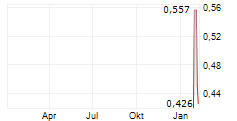

Perseverance is also pleased to announce that it has received conditional approval for the listing of its Shares on the TSXV. Pending final approval, the Company will be listed as a Tier 2 issuer on the TSXV under the symbol "TSXV:PMI". The completion of the SR Offering and Unit Offering moves the Company toward listing, and the Company hopes to announce details on the initial trading date of the Shares in the coming days.*

"We're thrilled with the support we've received from investors, particularly our peers in the mining community - many of whom have joined us as foundational shareholders," said John Foulkes, President of Perseverance Metals. "The strong demand for the Perseverance Metals go-public financing is a powerful endorsement of our vision and the quality of our critical mineral assets and team."

Details on Subscription Receipt Offering

In connection with the SR Offering, on September 5, 2025 the Company issued:

3,167,323 subscription receipts (the "HD Subscription Receipts") at a price of C$0.60 per HD Subscription Receipt for gross proceeds of C$1,900,394;

1,148,110 flow-through subscription receipts (the "FT Subscription Receipts") at a price of C$0.65 per FT Subscription Receipt for gross proceeds of C$746,271; and

586,666 flow-through subscription receipts (the "CFT Subscription Receipts" and collectively with HD Subscription Receipts and FT Subscription Receipts, the "Subscription Receipts") as part of a charity arrangement at a price of C$0.92 per CFT Subscription Receipt for gross proceeds of C$539,733.

* There can be no assurance as to if, or when, the Shares will be listed or traded on the TSXV or any other stock exchange.

Each Subscription Receipt will be exchanged, without payment of any additional consideration and without any further action by the holders thereof, into one unit (a "SR Unit") upon the satisfaction of the Escrow Release Conditions (defined below). Each SR Unit will be comprised of one Share and one-half of one common share purchase warrant (each whole warrant, a "Warrant"). The Shares and Warrants underlying the FT Subscription Receipts and the CFT Subscription Receipts will each qualify as a "flow-through share" as defined in s. 66(15) of the Income Tax Act (Canada) (the "Act").

Each Warrant will entitle the holder thereof to purchase one additional Share at an exercise price of $0.90 for a period of three years from the date of issuance. The expiry date of the Warrants will be subject to acceleration such that, should the closing price of the Shares on any Canadian stock exchange equal or exceed $1.20 for ten consecutive trading days, the Company, within 15 business days of such event, shall be entitled to accelerate the expiry date of the Warrants to a date that is 30 calendar days from the date that notice of such acceleration is given via news release, with the new expiry date specified in such news release (the "Acceleration Clause").

The aggregate gross proceeds from the SR Offering will be held in escrow until the satisfaction of the following "Escrow Release Conditions": (i) the Company obtaining the receipt for its final prospectus which it intends to file with certain securities regulatory authorities in Canada; and (ii) the receipt of confirmation from the TSXV that the Company has met all requirements for listing its Shares on the TSXV, subject to the exchange of the Subscription Receipts into SR Units. If the Escrow Release Conditions are not satisfied by the escrow release deadline, as provided in the Subscription Receipt certificates, the Subscription Receipts will be cancelled and the proceeds from the SR Offering will be returned to the Subscription Receipt holders.

The net proceeds from the sale of the HD Subscription Receipts will be directed towards advancing the Company's Lac Gayot, Voyageur and Armit Lake Projects, fees related to the Company's TSXV listing, and for administrative and general corporate purposes.

The gross proceeds from the sale of the FT Subscription Receipts and CFT Subscription Receipts will be used to incur eligible "Canadian exploration expenses" that will qualify as "flow-through critical mineral mining expenditures" as such terms are defined in the Act (the "Qualifying Expenditures") on the Lac Gayot Project in Québec, and/or the Armit Lake Project in Ontario. All Qualifying Expenditures will be renounced in favour of the subscribers effective December 31, 2025.

In connection with the SR Offering, the Company expects to issue 28,245 finder's warrants (the "Finder's Warrants") and pay commissions of C$17,980 to certain finders upon satisfaction of the Escrow Release Conditions. Each Finder's Warrant will entitle the holder thereof to purchase an additional Share at a price of C$0.60 for a period of 24 months from the date of issuance, subject to the Acceleration Clause.

Details on Unit Offering

On September 24, 2025, the Company completed the Unit Offering, pursuant to which the Company raised gross proceeds of C$383,333 through the sale of 416,666 units ("CFT Units") issued at a price of C$0.92 per CFT Unit. Each CFT Unit was comprised of one Share and one whole Warrant. The Shares and Warrants comprising the CFT Units will each qualify as a "flow-through share" as defined in s. 66(15) of Act.

The gross proceeds from the sale of the CFT Units will be used to incur Qualifying Expenditures on the Lac Gayot Project in Québec, and/or the Armit Lake Project in Ontario. All Qualifying Expenditures will be renounced in favour of the subscribers effective December 31, 2025.

All securities issued pursuant to the Unit Offering are subject to a hold period pursuant to Canadian securities laws.

The securities offered pursuant to the SR Offering and Unit Offering have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or any U.S. state securities laws, and may not be offered or sold in the United States or to, or for the account or benefit of, United States persons absent registration or any applicable exemption from the registration requirements of the U.S. Securities Act and applicable U.S. state securities laws. This news release does not constitute an offer to sell or a solicitation of an offer to buy any securities in the United States, or in any jurisdiction in which such offer, solicitation or sale would be unlawful.

About Perseverance Metals

Perseverance Metals' critical minerals project portfolio is strategically positioned in key North American Ni-Cu-Co-PGE and hard rock lithium regions, including Québec's prolific James Bay district and Michigan's Mid-Continent Rift.

Our strict science-driven approach and extensive track record of discovery, coupled with an industry-leading team armed with next-generation exploration tools, provide us with a distinct competitive advantage. This offers a unique opportunity for investors to be part of multiple discoveries, the advancement of significant critical mineral deposits, and the development of a portfolio poised for strategic industry consolidation, all vital for the clean energy transition and the creation of new mining districts.

Perseverance's exploration assets include: i) the Lac Gayot high-grade Ni-Cu-Co-PGE and lithium pegmatite project, which covers the entirety of the Venus Greenstone Belt in Québec, featuring multiple, very high grade Ni-Cu-Co-PGE showings and numerous large spodumene-bearing pegmatites with consistent high lithium grades in channel sampling; ii) the Voyageur Ni-Cu-Co-PGE project which covers 680km2 of the Upper Peninsula in Michigan, 65 kilometres west of the only producing nickel mine in the United States, and; iii) the Armit Lake Ni-Cu-Co project, which is the consolidated and underexplored western half of the nickel- and gold-rich Savant Lake Greenstone Belt in Ontario.

Additional information about Perseverance Metals can be found at perseverancemetals.com.

On Behalf of the Board,

Michael J. Tucker

CEO and Director

FOR FURTHER INFORMATION PLEASE CONTACT:

| Perseverance Metals Inc. Michael J. Tucker, CEO +1 (778) 834-3528 mtucker@perseverancemetals.com | Perseverance Metals Inc. John Foulkes, President +1 (604) 614-2999 jfoulkes@perseverancemetals.com |

Forward-Looking Statements

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. "Forward-looking information" includes, but is not limited to, statements with respect to the activities, events or developments that the Company expects or anticipates will or may occur in the future, including expectations regarding the Company's use of the proceeds raised under the SR Offering and Unit Offering, expectations relating to the Company's ability to incur and/or renounce Qualifying Expenditures within the timeframes anticipated by management or at all, expectations that the listing of the Shares on the TSXV will be completed in the timeframe and on the terms as anticipated by management, expectations that the Company will receive all requisite regulatory approvals, and expectations regarding the satisfaction of the Escrow Release Conditions and exchange of the Subscription Receipts into SR Units, issuance of the Finder's Warrants and payment of the finders' commission.

Generally, but not always, forward-looking information and statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved" or the negative connation thereof.

Such forward-looking information and statements are based on numerous assumptions, including among others, that the Company will be able to use the proceeds from the sale of the Subscription Receipts as anticipated by management, that the Company will be able to incur and renounce the Qualifying Expenditures within the timeframes anticipated by management, that the listing of the Shares on the TSXV will be completed in the timeframe and on the terms as anticipated by management, that the Escrow Release Conditions will be satisfied prior to the escrow release deadline, that the exchange of the Subscription Receipts into SR Units, issuance of the Finder's Warrants and payment of the finders' commission as expected by management, and that the Company will receive all requisite regulatory approvals associated with its public listing. While the Company is committed to completing the TSXV listing process, there can be no assurance that the listing will be approved in a timely fashion or at all.

Although the assumptions made by the Company in providing forward-looking information or making forward-looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's plans or expectations include risks that the Company is not able to use the proceeds from the sale of the Subscription Receipts as anticipated by management, risks that the Company will not be able to incur and renounce the Qualifying Expenditures within the timeframes anticipated by management or at all, risks that the Escrow Release Conditions will not be satisfied prior to the deadline or at all, risks that the listing of the Shares on the TSXV is not completed in the timeframe and on the terms as anticipated by management or at all, and risks that the Company does not receive the requisite regulatory approvals necessary to complete its public listing.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or implied by forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/267733

SOURCE: Perseverance Metals Inc.