Enter's Series A represents the largest investment ever made in an AI-focused company in Latin America

SÃO PAULO, Sept. 24, 2025 (GLOBE NEWSWIRE) -- Brazil has nearly 80 million active lawsuits - eight times the U.S. - with labor claims alone costing companies billions of dollars annually. Free digital filings have fueled an avalanche of consumer cases against banks, retailers and airlines that elsewhere would be resolved by routine customer support.

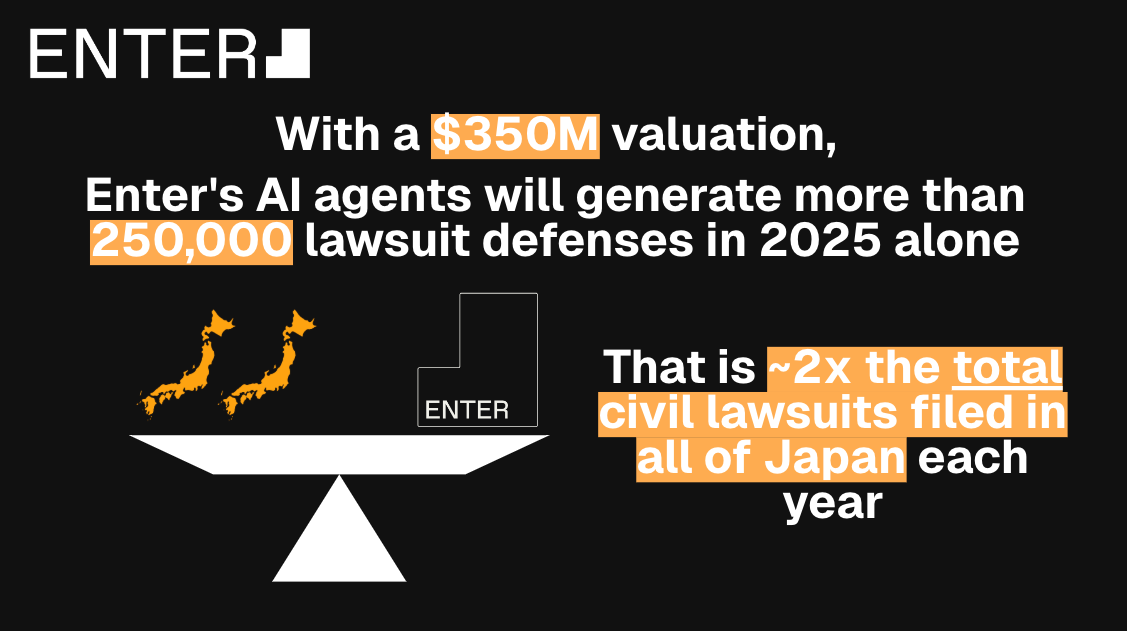

Confronted with this reality, Mateus Costa-Ribeiro became Brazil's youngest practicing lawyer at 18, graduated from Harvard Law, passed the New York Bar at 20, and left a full-ride Stanford MBA to build Enter, an AI platform designed to help enterprises manage litigation at scale. That convergence of founder and problem has now drawn Silicon Valley investors Founders Fund and Sequoia back to Brazil to co-lead Enter's $35M Series A at a $350M valuation, the largest investment in an AI-focused company in Latin America to date.

Mateus co-founded Enter with Michael Mac-Vicar, former CTO of Wildlife Studios, and Henrique Vaz, a Harvard colleague who rose from intern to CMO at Wildlife before leading product at Enter.

"We've built a platform that already delivers direct cost savings for the largest enterprises in Latin America. Solving this in Brazil, the most complex legal ecosystem in the world, proves that our technology can scale globally," said Mateus.

Enter's AI agents support lawyers across the full lifecycle of a lawsuit: case intake, fraud detection, settlement recommendations, drafting defenses, and interpreting rulings. Human lawyers review and refine the AI's output, producing faster and stronger results.

"Enter has the potential to be a global leader in legal AI, led by a founder with a deep personal connection to the industry," said Matias Van Thienen, partner at Founders Fund. "Excess litigation is a more urgent problem in Brazil than anywhere else, and Enter's vertically integrated approach not only solves pain for enterprises but also alleviates a systemic drag on the economy."

In 2025 alone, Enter expects to process more than 250,000 new cases - a figure that, to put it in perspective, is almost double the number of civil lawsuits filed each year in Japan. Its impact is tangible: higher win rates in court and millions of dollars in savings for the companies that rely on its platform. Clients include Brazil's largest banks such as Itaú and Santander, retail giants like Mercado Livre and global technology leaders like Nubank and Airbnb.

Managing high-volume consumer lawsuits is only the first step. Enter is now expanding into complex labor disputes and developing predictive AI to recommend the most effective evidence, precedents and arguments, redefining how AI shapes legal strategy.

"Enter is tackling a critical problem in a large market, giving them a strong entry point to become the leading Enterprise AI company in Latin America. Their broader impact could help reshape the region's business landscape and fuel economic growth," said Konstantine Buhler, Partner at Sequoia Capital.

This round marks a decisive step toward redefining how Latin American companies foster productivity with AI, driving both efficiency and legal security at scale.

Contact:

Guilherme Grupenmacher, Chief of Staff

+12154501017 pr@getenter.ai

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/e592ccca-3b2f-4b04-8414-c417a36fe00b