Oscillate Plc - Kalahari Copper Limited acquisition expanded to include prospective copper portfolio in Namibia and Updated Heads of Terms

PR Newswire

LONDON, United Kingdom, September 25

Oscillate PLC

("Oscillate" or the "Company")

25 September 2025

Kalahari Copper Limited acquisition expanded to include

prospective copper portfolio in Namibia

Updated Heads of Terms

Highlights

- Revised acquisition terms will see Oscillate acquire Kalahari Copper Limited's Namibian copper portfolio, as well as the Botswanan copper portfolio as previously announced

- Oscillate to become one of the largest acreage holders in the Kaoko Basin in Namibia, which is the interpreted extension of the Central African Copper Belt

- Recent drilling campaigns in Namibia have confirmed multiple prospect finds with intersects of high-grade copper and silver mineralisation and a plethora of other exciting copper exploration opportunities

News Announcement

OSCILLATE PLC, which is focused on building a mid-cap copper and future metals developer, is pleased to announce that it has agreed revised terms for the acquisition deal with Kalahari Copper Limited announced in July 2025. The Company has now entered into a new, non-binding Heads of Terms agreement to acquire the entire issued share capital of Kalahari Copper Limited ("Kalahari Copper").

The updated terms, once met, will give Oscillate a pathway to obtain 100% ownership of Kalahari Copper's Namibian Copper Project, which comprises of four licences (of which two licences are in the process of being renewed) in the highly prospective Kaoko Basin, an emerging copper belt in Africa, as well as a pathway to obtain 100% ownership of Kalahari Copper's Botswanan Copper Project, which incorporates 17 highly prospective licences (which have been granted or which have been applied to be transferred to Kalahari Copper) in the Kalahari Copper Belt and the Bushman Lineament.

Oscillate CEO, Robin Birchall, commented:

"The revised terms outline a deal which is a potential game-changer for Oscillate and which would be a major step forward in our strategy of building a leading mid-cap copper and future metals exploration and development company. As a result of this acquisition, we will be one of the largest landholders in two exciting areas for sedimentary hosted copper exploration, being the Kaoko Basin in Namibia and the Kalahari Copper Belt in Botswana. There are known mineral discoveries in both the Namibian and Botswanan licence areas. What makes the Namibian assets especially exciting is that they are significantly further advanced than those in Botswana, with development grade copper identified across multiple prospects further to the recent drilling programmes in 2024.

We will now be working to rapidly conclude the binding agreements and ultimately complete this acquisition, subject to the satisfactory completion of all required transaction terms. As part of this deal it is also our intention to graduate to the AIM market to allow the Company better access to capital going forward and to give shareholders access to better liquidity."

About the Namibian Copper Project

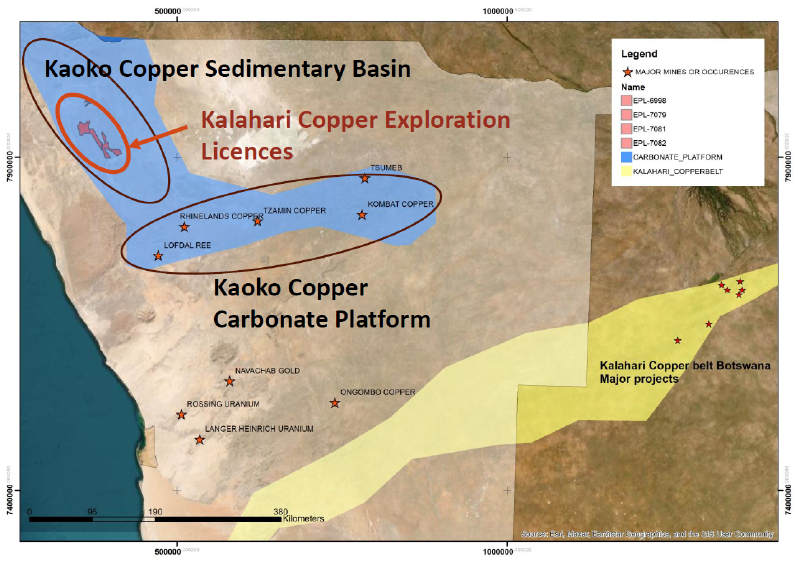

The proposed acquisition of Kalahari Copper and its Namibian Copper Project would give Oscillate a 100%-ownership of four highly prospective copper and silver exploration tenements, assuming that the applications for two licences are renewed. Completion of the acquisition of the four licences would cover 1,106km2, establishing Oscillate as one of the largest acreage holders in the Kaoko Basin.

Figure 1: Location of the Kalahari Copper exploration licences in Namibia.

This emerging copper region is the interpreted extension of the Central African Copper Belt that runs through Zambia and the Democratic Republic of Congo and is home to a significant number of major and high-grade producing copper mines. The Kaoko Basin and the Central African Copper Belt have important geological similarities and stratigraphic correlations, with both basins expected to host significant stratabound (sediment-hosted) copper and silver deposits.

Kalahari Copper has completed more than 8,000 metres of drilling over a series of campaigns to date, with multiple intersections demonstrating copper ("Cu") mineralisation on multiple prospects, occurring from surface. The table below summarises a few such intersections from the 2024 campaign.

EPL number | Hole number | Prospect name | From (m) | To (m) | Cu% |

7081* | OPR002 | Omatapati | 80 | 100 | 1.2 |

7081* | OPR001 | Omatapati | 52 | 56 | 1.1 |

7081* | OPR001 | Omatapati | 72 | 74 | 1.9 |

7082 | ONR019 | Ondera | 45 | 46 | 1.4 |

*Licence is in the process of being renewed and is subject to approval

About the Botswana Copper Project

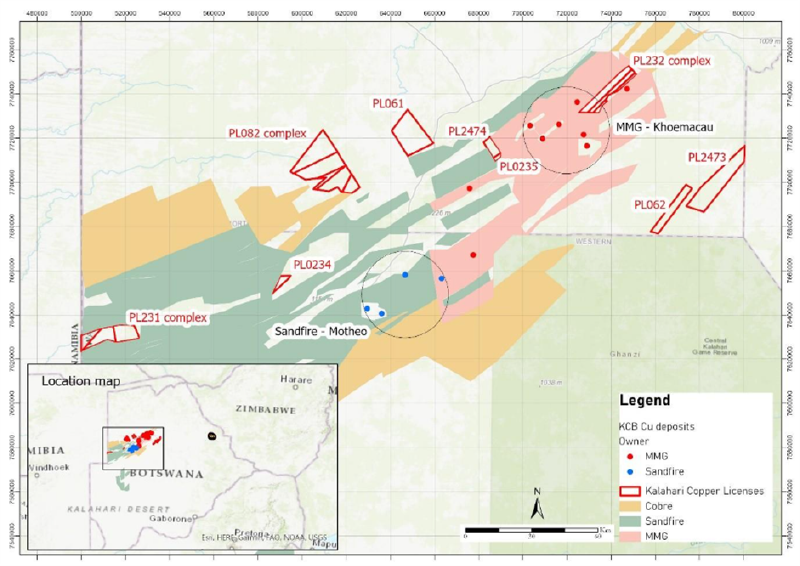

As previously announced, the acquisition will also give Oscillate the opportunity for 100%-ownership of highly prospective copper and silver exploration tenements and one of the largest tenement packages in the KCB, assuming that all applications are transferred.

The KCB is considered to be one of the world's most prospective areas for new sediment-hosted copper discoveries by the US Geological Survey. It cemented its position as an emerging major copper producing district in 2023 further to the acquisition of the Khoemacau Copper Mine and exploration assets by MMG Ltd ("MMG") for US$1.9 billion. Sandfire Resources Limited ("Sandfire") has also established producing operations, with the Motheo mine commencing production in record time.

The KCB licences consist of three highly strategic project areas along strike, and adjacent to, operating mines and development assets owned by major copper producers, positioning Oscillate as a significant player in the region with high-potential exploration assets.

Figure 2: Location of the Kalahari Copper exploration licences in the KCB.

Within the KCB licences, the Company will target unexplored basin margins and strike extension of known deposits with what the Company believes to be ideal geological positions for sedimentary copper. The PL85 licence, which is located in the Bushman Lineament and not shown in the map above, is also adjacent to the previously producing Kopano copper mine in this region.

As part of the Company's due diligence process, Oscillate will not be relying on the historical drilling data for licence PL232 in the KCB, and does not recommend that investors rely on this data, and will be carrying out its own exploration work to establish the mineralised contact for this prospect, which is adjacent to MMG's Khoemacau producing copper mine.

Updated Heads of Terms

Having completed the first phase of due diligence, the Company made the non-refundable payment of £500,000 to Kalahari Copper as outlined in the announcement on 9 July 2025. In agreement with Kalahari Copper, some of these funds have been allocated to the work programmes and licence renewals required for the Nambian and Botswanan Copper Projects in 2025.

Kalahari Copper is undertaking a reorganisation pursuant to which a newly incorporated company in the BVI ("Seller") will be incorporated and be the holding company of Kalahari Copper and whose sole assets will be the shares in Kalahari Copper.

Oscillate has been offered an extended exclusivity period which expires on 31 October 2025, with a view to signing and exchanging the share purchase agreement ("SPA") by this date. Subject to the due diligence and restructuring, the consideration payable by Oscillate, upon signing of the SPA, will be such number of Ordinary Shares in Oscillate which will equate to 30% of Oscillate's issued and outstanding Ordinary Shares.

As in the original heads of terms, the consideration still includes the right to acquire additional Ordinary Shares for nil consideration, to maintain a 30% holding up to the point of Oscillate listing on a more senior stock exchange (subject to a minimum fundraise and calculated before the issue of Ordinary Shares for such fundraise). The Seller shall have the right but not the obligation to appoint two Directors to Oscillate's Board of Directors following execution of the SPA and shall retain this right for so long as it retains in excess of 20% of Oscillate's issued share capital and the right to appoint one Director for so long as it holds less than 20% but more than 10% of Oscillates issued share capital. The Seller will also be given the right to subscribe for its pro rata shares in any future fundraise for so long as it holds more than 10% of Oscillate' s issued share capital.

In addition, and subject to sufficient capital being raised upon moving to a more senior exchange, the terms include a payment of £2.0 million in cash to the Seller within 10 business days of relisting; this has increased from the £1.5 million in cash previously agreed, due to the inclusion of the Namibian Copper Project.

The original series of further milestone payments of £1.5 million each due upon an initial Maiden JORC Resource, publication of a Pre-Feasibility Study and upon Final Investment Decision will apply to the Botswanan Licences and separately and additionally to the Namibian licences as well.

The Anti-Embarrassment Fee Oscillate had also agreed to grant the Seller, in the event that the licences are on-sold, has been increased from three years to five years due to the addition of the Namibian licences and covers all the licences. The net smelter royalty of 1.9% will now be granted in respect of copper sold from any of the Namibian and any of the Botswanan licences. Oscillate has an option to buy back the royalty in each country, which it can exercise at any time after the delivery of a Definitive Feasibility Study on the specific licence or licences in question for the amount determined by an independent valuation expert. In addition to the original contingent fee payable by Oscillate of 80% of the net proceeds or a contingent US$2.5 million fee that may become payable in the future by Sandfire, Oscillate has also agreed that in the event that licence 7081 (assuming it is reissued) is disposed to a named party within 18 months of the closing of the transaction it will make an additional payment of 60% of the net proceeds from such sale.

In additional consideration for the Namibian licences, Oscillate has agreed that it will grant the Seller two options, each over 3% of the capital of the Company post capital raise upon flotation on a more senior stock exchange. The first option for 3% is at par value and has a term of three years from completion of the transaction. The second option for 3% is also at par value and has a term of five years from completion and is exercisable following the publication of the first Maiden JORC Report of Measured and Indicated Resources produced by the Oscillate on any of the Namibian licences.

The proposed transaction is conditional, inter alia, on the following:

- the reorganisation of Kalahari Copper to introduce the Seller;

- the satisfactory completion of due diligence;

- the execution of a binding SPA and Royalty Agreements;

- any third party, regulatory or tax consents, waivers or approvals necessary;

- the passing at a general meeting of the Company of the resolutions to approve any other matters such as the authority to allot the Consideration Shares; and

- other customary conditions including without limitation there being no material adverse change to the Company or its business or any to the mining, exploration or reconnaissance or similar permits held by either of Kalahari Copper's Botswanan Company or the Namibian Company.

The Directors of the Company accept responsibility for the contents of this announcement.

Enquiries:

Oscillate PLC | Company | Robin Birchall | + 44 (0) 7711 313 019 robinbirchall@oscillateplc.com |

| IR | Cathy Malins | +44 (0) 7876 796 629 |

Tavistock Communications | PR | Charles Vivian Eliza Logan | +44 (0) 20 7920 3150 oscillate@tavistock.co.uk |

Peterhouse Capital Limited | Aquis Growth Market Corporate Adviser |

| +44 (0) 20 7220 9795 |

SP Angel

| Broker | Richard Morrision Charlie Bouverat Devik Mehta | +44 (0) 20 3470 0470 |

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES OF ARTICLE 7 OF THE MARKET ABUSE REGULATION (EU) 596/2014 AS IT FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018, AS AMENDED.

About Oscillate

OSCILLATE PLC is focused on unlocking value across a high-potential portfolio to become a leading mid-cap copper and future metals developer.

By securing exploration and development assets in the upcoming copper belts of Namibia, Botswana and Côte d'Ivoire, the Company will be strategically positioned to capitalise on the rising demand for sustainable copper and associated metals, driven by the global energy transition and the need for responsible, independent supply chains.

These regions remain relatively under-explored in contrast to their high potential. Oscillate is applying modern and rigorous exploration techniques, as well as the depth of experience of its management team, in order to systematically evaluate and develop these prospective opportunities to the benefit of all its stakeholders.

The Company is listed on the UK's AQSE Growth Market Exchange under the ticker AQSE: MUSH.