Toronto, Ontario--(Newsfile Corp. - September 25, 2025) - Signature Resources Ltd. (TSXV: SGU) (OTCQB: SGGTF) (FSE: 3S30) ("Signature" or the "Company") is pleased to provide the proposed diamond drill hole ("DDH") program to be completed in the fall of 2025. It is contemplated that the Company would drill six DDH's for approximately 3,000 metres ("m"). One of the key findings from the NI 43-101 technical report published July 31,2025 was the deposit remained open laterally along the East/West trend and at depth. The Company has defined this drill program based upon the modeling work culminating from historical drilling results and areas of interest defined by geophysical work looking at the strong correlation of mineralization with high chargeability and low resistivity. The targets identified for the upcoming program are considerably larger than the ones associated with drilling done to date (see figures below).

"The Company remains focused on completing fundamental work that will continue to demonstrate the potential of significantly expanding the mineral resource of the Lingman Lake Property. The 3D IP survey identified anomalies which correlated to known mineralized zones. To this end, part of the drill program will test the West Zone 590 metres west of DDH LM24-13 and 14 which were the most westerly holes drilled in 2024, and to a vertical depth of up to 475 m. This work is another example of the thorough fundamental work that has been undertaken to prove the potential of the Lingman Lake Deposit which will also assist with vectoring regional targets."

-J. Dan Denbow, CFA - President, CEO and Director

The Company is also announcing that it is undertaking a non-brokered private placement of flow-through units ("FT Units") and non-flow-through Units ("NFT Units") for gross proceeds of up to C$3,000,000 (the "Offering"). It is anticipated that insiders will subscribe for at least 20% of the offering.

3D Alpha IP and Mag Surveys

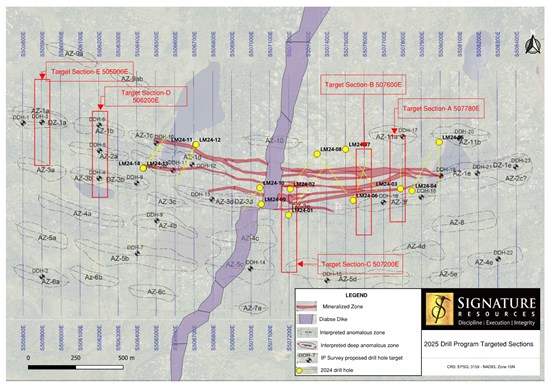

A geophysical interpretation report was produced by Simcoe Geoscience Limited December 18, 2021, that identified a number of anomalies based upon the analysis of a 3D Alpha IP - Wireless Time Domain Distributed Induced Polarization & Ground Magnetic Survey. The survey comprised an area of 3 km (east/west) by 1.6 km (north/south) and to a depth of 600 m covering the main area surrounding the Lingman Lake Mine. As a result of the 2024 drill program and with on-going geological model refinement, correlation with the 3D IP Survey has identified many areas of opportunity; laterally along the currently defined mineralized zones and untested areas north and south of the currently defined mineralized zones. The objective of the survey was to map the chargeability, resistivity and total magnetic field intensity responses associated with disseminated and sub-massive sulphides associated with structurally controlled gold mineralization similar to historic West, North, Central, South and the 11650N zones documented on the property. Figure 1 shows the plan view of the of the anomalous zones identified in the surveys as well as the location of five sections the company is targeting for our 2025 drill program to test these zones.

Figure 1. Geophysical Interpretation Plan with Mineralized Zones

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8296/267845_24abb62f04568b85_001full.jpg

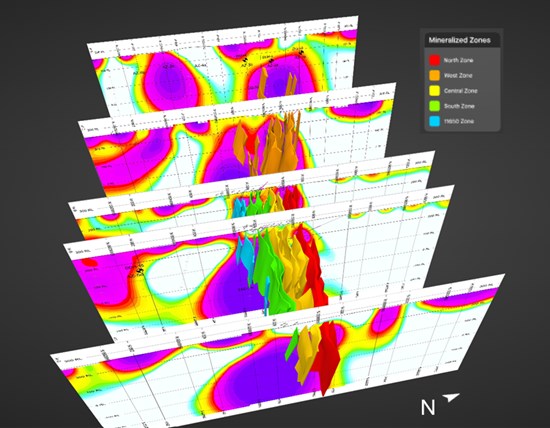

The 3D view in Figure 2 is a selection of Resistivity sections and the relation to the modeled gold zones. There is a high correlation with the low resistivity anomaly near surface and the identified gold mineralization. As can be seen from the figure, the deeper occurrences of the large low resistivity anomaly are largely untested by drilling and occur across the Lingman Lake Deposit. The first section in the graphic (Target Section-A 5057800E) is where the Company plans to drill two deeper holes, the North, Central and South Gold Zones have been identified near surface. The last section in the view (Target Section-D 506200E) is targeting the untested West Zone strike extension which can be seen is lined up to intersect this section.

Figure 2. 3D View of Sections with Showing Gold Mineralization Zones

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8296/267845_24abb62f04568b85_002full.jpg

2025 Fall Drilling Program

For the past two years the Company has been focused on upgrading our historical database through digitizing our data, increased mapping of the area and overall improving our ability to deliver better identification and delineation of the mineralized zone. The 2024 drill program was purpose built for the completion of the Company's initial mineral resource estimate delivered earlier this year. Signature is now able to combine all the historical data, resource modeling and the geophysical work from the 3D Alpha IP study to improve targeting along trend and at depth. The objective of the fall program is to continue extending the resource along the east-west strike and to test the extent of mineralization at depth below the currently defined resource.

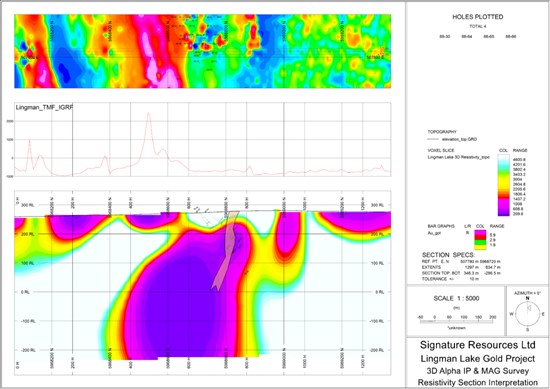

Figure 3. Target Section A 507780E

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8296/267845_24abb62f04568b85_003full.jpg

Target Section-A (507780E) is located at the east end of the Lingman Lake gold zones and slices anomaly AZ 3f, being 400 m long, more or less in the middle of it. High chargeability is associated with low resistivity where the North Zone anomaly converges at depth with the larger IP feature just as in the above section 507600E. Two holes along a drill fence are planned. One hole will be about 500 m in length drilled to vertical depth of 410 m below surface, designed for a separation from 88-76 of about 90 m. The other hole will be about 600 m in length. to vertical depth of 490 m with a separation from the previous mentioned hole of about 215 m.

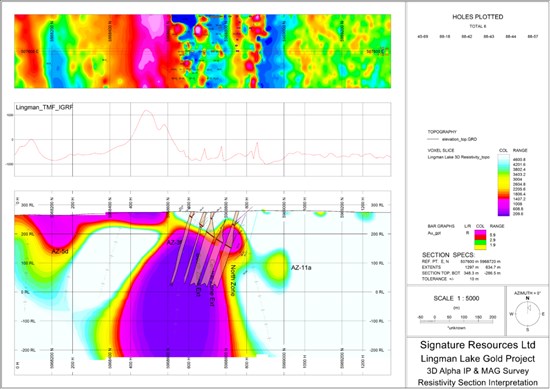

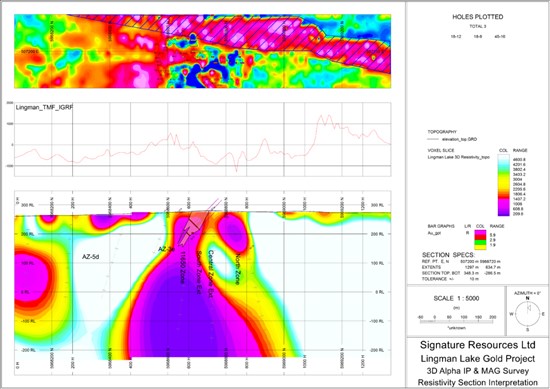

Figure 4. Target Section B 507600E

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8296/267845_24abb62f04568b85_004full.jpg

Section 507600E is in the area of the merging of the South, Central and North Zones as well as the convergence of IP zones both in chargeability and resistivity. It also the area of the significant mineralization encountered in drill holes LM 24-06 and 07. High chargeability is associated with low resistivity are define anomalous area AZ-3f. A hole of 500 m to 550 m is planned to intersect the down dip extensions of all of the zone with South Zone expected at 220 m vertical depth and the North Zone at 325 m vertical depth.

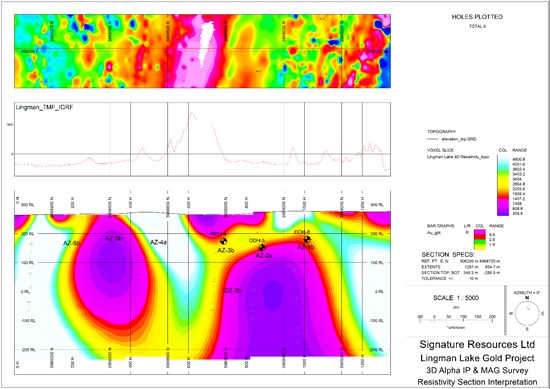

Figure 5. Target Section C 507200E

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8296/267845_24abb62f04568b85_005full.jpg

The anomalous zone AZ-3a to 3b correlates with the 11650 and South Zone mineralized shear-alteration structures. The IP responses consist of high chargeability, low resistivity and moderate to high magnetic susceptibility. The South Zone in the area of this section has a horizontal width at and near surface exceeding 50 m. A 600 m drill hole is planned for this section to intersect the 11650, South, Central and North Zones. The hole will likely be planned to hit the South Zone at a vertical depth of 190 m and the North Zone at a vertical depth of 300 m.

Figure 6. Target Section D 506200E

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8296/267845_24abb62f04568b85_006full.jpg

Several shallow drill targets (AZ-1b, 2a and 3b and DZ-2) occur near the top edge of anomaly interest which has moderate IP responses that are more similar to observations in the Central Zone east of the diabase dike. Drill holes LM24-13 and 14 which are located 230 m east of this section likely intersected the near surface expression of the anomaly. The elevation (275 m depth) of Deep zone (DZ-3b) and target Az-2a are planned to be tested by a 500 m drill hole.

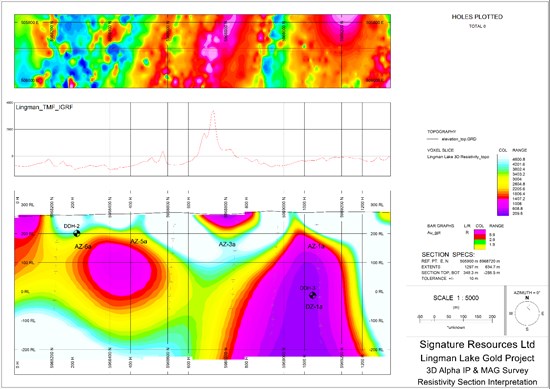

Figure 7. Target Section E 505900E

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8296/267845_24abb62f04568b85_007full.jpg

The anomalous zone AZ-1a to 1e correlate with North Zone and West Zone shear alteration-structures with AZ-1a located at the western end of the zone. The anomaly of interest in Section 505900E is Anomaly AZ-1a with a deep zone (DZ-1a) drill target. The anomaly is interpreted to be an area of high chargeability with low resistivity and strong magnetic susceptibility response situated along the northwestern strike extension of the West Zone. This section is situated 590 m northwest of drill holes LM24-13 and 14. A 500 m drill hole will be designed to intersect the target at a vertical depth of 290 m.

Equity Financing

The Company is offering a non-brokered private placement of FT Units and NFT Units for gross proceeds of up to C$3,000,000 (the "Offering"). It is anticipated that insiders will subscribe for at least 20% of the offering.

Each FT Unit is being offered at $0.06 and is comprised of one share of common stock of the Company ("Common Share") and one half of one Common Share purchase warrant ("Warrant"). Each whole Warrant will be exercisable for one additional Common Share ("Warrant Share") at a price of $0.10 per Warrant Share for a period of 12 months following the date of issuance. Each NFT Unit is being offered at C$0.055 per share and is comprised of one share of common stock of the Company ("Common Share") and one half of one Common Share purchase warrant ("Warrant"). Each whole Warrant will be exercisable for one additional Common Share ("Warrant Share") at a price of $0.10 per Warrant Share for a period of 12 months following the date of issuance. All securities issued pursuant to this proposed private placement will be subject to the Exchange Hold Period and legend accordingly.

The net proceeds from the Offering will be used for the 2025 fall drilling program, loan repayment and general working capital purposes. It is expected that over half of the proceeds will be used for the drilling program and the remainder for the loan repayment and general working capital purposes including accrued invoices to a non-arm's length party. The Company may pay up to 7% of the gross proceeds as finders fees. None of the proceeds will be used for investor relations service providers.

Amended Related Party Loan

The Company also announces that it has amended the loan agreement with a related party to provide interim funding for general corporate activities dated January 2, 2025. The loan maturity date has been extended to October 30, 2025. The loan is provided on a non-cost basis to the Company with no interest, finder's fees or bonuses payable to the lender.

The Company anticipates repaying the loan through future equity financings. The company confirms that the loan agreement meets the exemption requirements and complies with TSXV Policy 5.9 and MI61-101. The transaction remains subject to the approval of the TSX Venture Exchange.

Video Presentation

The company will conduct a video presentation hosted by Renmark Financial Communications on Tuesday September 30, 2025 at 2 PM EDT to provide more details on the planned drill program, the incorporation of the IP Survey in the drill program design and answer shareholder questions. Interested parties can at register here for the video presentation.

Qualified Person

The scientific and technical content of this press release have been reviewed and approved by Mr. Walter Hanych, P. Geo, consultant and Head Geologist, is a Qualified Persons under NI 43-101 regulations.

Quality Assurance and Quality Control

The Geophysical Interpretation Report of the 3D Alpha IP- Wireless Time Domain Distributed Induced Polarization and Ground Magnetic Surveys was completed by Riaz Mizra, M.Sc., P. GEO Director and Geoscientist of Simcoe Geoscience Limited. Infield QA/QC and data processing occurred daily with Simcoe's proprietary software. Data was reviewed daily for QA/QC at the end of the survey data before survey lines were moved to new locations. The entire grid data file is processed for QA/QC before exporting to run model inversions.

About Signature Resources Ltd.

The Lingman Lake gold property (the "Property") consists of 1,274 single-cell and 13 multi-cell staked claims, four freehold fully patented claims and 14 mineral rights patented claims totaling approximately 24,821 hectares. The Property includes what has historically been referred to as the Lingman Lake Gold Mine, an underground substructure consisting of a 126.5-metre shaft, and 3-levels at depths of 46-metres, 84-metres and 122-metres. There has been over 43,222 metres of drilling done on the Property and four 500-pound bulk samples that averaged 19 grams per tonne of gold. In November 2023, Wataynikaneyap Power energized a new 115kV high tension transmission line within 40 km of the historic Lingman Lake Mine (https://www.wataypower.ca/).

To find out more about Signature, visit www.signatureresources.ca or contact:

Dan Denbow

Chief Executive Officer

(800) 259-0150

info@signatureresources.ca

or contact :

Renmark Financial Communications Inc.

John Boidman: jboidman@renmarkfinancial.com

Tel: (416) 644-2020 or (212) 812-7680

www.renmarkfinancial.com

Cautionary Notes

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

This news release contains forward-looking statements which are not statements of historical fact. Forward-looking statements include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as "believes", "anticipates", "expects", "estimates", "may", "could", "would", "will", or "plan". Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management's expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes, but is not limited to, the Company's objectives, goals or future plans, statements, exploration results, potential mineralization, the estimation of mineral resources, exploration and mine development plans, timing of the commencement of operations and estimates of market conditions and risks associated with infectious diseases and global geopolitical events. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to changes in general economic and financial market conditions, failure to identify mineral resources, failure to convert estimated mineral resources to reserves, the inability to complete a feasibility study which recommends a production decision, the preliminary nature of metallurgical test results, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, inability to fulfill the duty to accommodate First Nations and other indigenous peoples, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, capital and operating costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry, and those risks set out in the Company's public documents filed on SEDAR+. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/267845

SOURCE: Signature Resources Ltd.