Vancouver, British Columbia--(Newsfile Corp. - September 26, 2025) - Badlands Resources Inc. (TSXV: BLDS) (FSE: B7Q) ("Badlands" or the "Company") announces that it has entered into a property purchase agreement dated September 24, 2025 (the "Purchase Agreement") with Laxmi Resources Inc. ("Laxmi") pursuant to which the Company will acquire a 100% interest in the Goliath property, located in Atikwa Lake Area Townships, Kenora Mining Division, Ontario (the "Goliath Property") for cash consideration of $200,000 (the "Transaction").

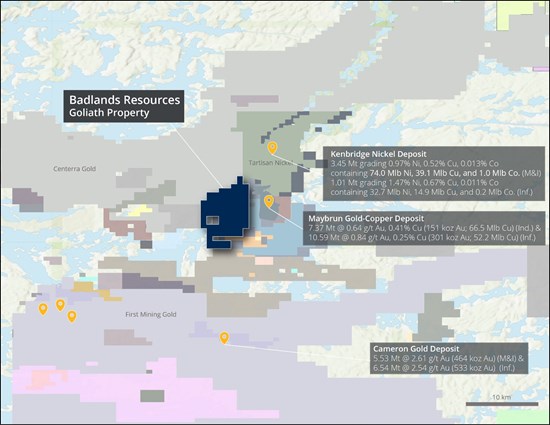

Figure 1. Badlands Resources' Goliath Property, highlighting regional ownership and adjacent deposits.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4317/268133_3cc4a97914cb3b7c_001full.jpg

About the Goliath Property

The Goliath Property is an early-stage exploration project located in the Atikwa Lake area of the Kenora Mining Division, northwestern Ontario. The project covers 97 contiguous single-cell mining claims totaling approximately 2,050 ha and lies approximately 70 km southeast of Kenora, accessible by road via Highway 71 and Maybrun Road.

Strategically positioned within the prolific Kakagi-Rowan Lakes greenstone belt on the western margin of the Wabigoon Subprovince, Goliath is prospective for multiple mineralization styles including copper-gold in pillowed mafic volcanic flows and nickel-copper sulfides in mafic to ultramafic intrusions.

The Goliath Property is situated in a prospective district, adjacent to the past-producing Maybrun copper-gold mine and near the Kenbridge nickel and Cameron gold deposits, all of which host NI 43-101 compliant resources:

- Maybrun (Cu-Au):

- Ind.: 7.37 Mt @ 0.64 g/t Au, 0.41% Cu (151 koz Au; 66.5 Mlb Cu)

- Inf.: 10.59 Mt @ 0.84 g/t Au, 0.25% Cu (301 koz Au; 52.2 Mlb Cu)1

- Kenbridge (Ni-Cu-Co):

- M&I: 3.45 Mt @ 0.97% Ni, 0.52% Cu, 0.013% Co (74.0 Mlb Ni; 39.1 Mlb Cu; 1.0 Mlb Co)

- Inf.: 1.01 Mt @ 1.47% Ni, 0.67% Cu, 0.011% Co (32.7 Mlb Ni; 14.9 Mlb Cu; 0.2 Mlb Co)2

- Cameron (Au):

- M&I: 5.53 Mt @ 2.61 g/t Au (464 koz Au)

- Inf.: 6.54 Mt @ 2.54 g/t Au (533 koz Au)3

The resources referenced at nearby deposits are drawn from publicly available technical reports. The presence of mineral resources on adjacent or nearby properties is not necessarily indicative of mineralization on the Goliath Property.

In connection with the Purchase Agreement, the Company will assume Laxmi's obligation to pay a 2% net smelter return royalty (the "Royalty") to Blackwidow Geological Services Inc. ("Blackwidow"), with the Company retaining the right to buy back one-half of the Royalty (1%) for an aggregate payment to Blackwidow of $1,000,000.

The Transaction is subject to customary closing conditions, including acceptance by the TSX Venture Exchange (the "TSXV"). The Transaction is not an "arm's-length transaction" and therefore constitutes a "reviewable transaction" pursuant to TSXV Policy 5.3 as Nav Dhaliwal, Executive Chairman and a director of the Company, is an insider of Laxmi. No finders' fees will be paid in connection with the Transaction.

The technical content of this news release has been reviewed and approved by Devin Pickell, P.Geo., consultant to the Company and a Qualified Person pursuant to National Instrument 43-101.

Termination of Rett Option

The Company also announces that it has terminated its option to acquire mineral claims located in Thunder Bay, Ontario, known as the Rett Property. No fees were paid in connection with the termination.

On Behalf of the Board of Directors

BADLANDS RESOURCES INC.

R. Dale Ginn, President and CEO

For further information, please contact:

R. Dale Ginn

Tel: 604-678-5308 | dale@rsdcapital.com

Or visit our website: www.badlandsresources.com

Neither the TSXV nor its Regulation Services Provider (as such term is defined in policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note regarding Forward-Looking Statements

This press release contains "forward-looking information" and "forward-looking statements" within the meaning of applicable securities legislation. The forward-looking statements herein are made as of the date of this press release only, and the Company and Laxmi do not assume any obligation to update or revise them to reflect new information, estimates or opinions, future events or results or otherwise, except as required by applicable law. Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "expects", "is expected", "budgets", "scheduled", "estimates", "forecasts", "predicts", "projects", "intends", "targets", "aims", "anticipates" or "believes" or variations (including negative variations) of such words and phrases or may be identified by statements to the effect that certain actions "may", "could", "should", "would", "might" or "will" be taken, occur or be achieved. These forward-looking statements include, among other things, statements relating to the completion of the Transaction, including TSXV approval and the closing of the Transaction.

Such forward-looking statements are based on a number of assumptions of the management of the Company and the management of Laxmi, including, without limitation, that the parties will obtain all necessary corporate and regulatory approvals and consents required for the completion of the Transaction, including TSXV approval, and the other conditions to the completion of the Transaction will be fulfilled.

Additionally, forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of the Company or Laxmi to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: the conditions to the consummation of the Transaction may not be satisfied, the Transaction may involve unexpected costs, liabilities or delays; the failure of the Company and Laxmi to obtain all requisite approvals for the Transaction, including the approval of the TSXV, and the completion of the Transaction may be adversely impacted by changes in legislation, changes in TSXV policies, political instability or general market conditions.

Such forward-looking information represents the best judgment of the management of the Company and the management of Laxmi based on information currently available. No forward-looking statement can be guaranteed and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements or information. Neither the Company, nor Laxmi, nor any of their representatives make any representation or warranty, express or implied, as to the accuracy, sufficiency or completeness of the information in this press release. Neither the Company, nor Laxmi, nor any of their representatives shall have any liability whatsoever, under contract, tort, trust or otherwise, to you or any person resulting from the use of the information in this press release by you or any of your representatives or for omissions from the information in this press release.

1 O'Flaherty, M., O'Flaherty, K Shaft & Tunnel, 2009: Technical Report on the Atikwa Lake (Maybrun) Copper-Gold Property, District of Kenora, Ontario, Canada, August, 2009

2 Tartisan Nickel Corp. NI 41-101 Technical Report, Preliminary Economic Assessment of the Kenbridge Nickel Project, Kenora Ontario, August 26, 2022

3 First Mining Finance Corp. NI 41-101 Technical Report on the Cameron Gold Deposit, Ontario, Canada, January 17, 2017

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/268133

SOURCE: Badlands Resources Inc.