Richmond Hill Resources Plc - Proposed Admission to Trading on AIM, Proposed Acquisition of Bulawayo & Placing, Notice of GM Update re Suspension

PR Newswire

LONDON, United Kingdom, September 29

Richmond Hill Resources Plc

("Richmond Hill " or the "Company")

Proposed Admission to Trading on AIM

Proposed Acquisition of Bulawayo & Placing

Notice of GM

Update re Suspension

Richmond Hill (AQSE: SHNJ), is pleased to announce the publication of its Admission Document in respect of its proposed admission of its ordinary shares ("Ordinary Shares") to trading on the AIM Market ("AIM") of the London Stock Exchange ("Admission") and cancellation of the admission of its Ordinary Shares to trading on the Aquis Growth Market ("Cancellation").

Highlights

- Publication of the Admission Document and lifting of the Company's suspension

- Proposed acquisition of the entire issued share capital of Bulawayo CC Ventures Limited

- Placing to raise £1.4 million at 1 pence per share

- Admission of the enlarged ordinary share capital to trading on AIM expected to commence on 15 October 2025

- Proposed sub-division and re-designation of the Company's Ordinary Shares ("Share Reorganisation") to be approved at a general meeting ("General Meeting");

- Notice of General Meeting

Update re Suspension

As a consequence of an Admission Document having been posted to shareholders, the Company has requested that trading in the Company's Ordinary Shares is resumed. The Company expects resumption of trading in the Company's Ordinary Shares to occur at 8:00am on 29 September 2025. To allow the Share Reorganisation to occur, subject to the passing of the Resolutions at the GM, the Company's shares will be suspended from trading on AQSE with effect from 8:00am on 14 October 2025 prior to the withdrawal from trading on AQSE on 15 October 2025.

Notice of General Meeting

A General Meeting of the Company to approve the Proposals has been convened for 11 a.m. on 13 October 2025 at the offices of Hill Dickinson LLP, The Broadgate Tower, 20 Primrose Street, London, EC2A 2EW. If the resolutions put to the General Meeting are approved by shareholders, it is expected that the enlarged ordinary share capital will be admitted to trading on AIM and dealings in the Company's shares will commence on or around 15 October 2025.

Further information on the Proposals, timetable, statistics and the letter from the Chairman is set out below and contained in the Admission Document which is available on Richmond Hill's website: https://www.richmondhillresources.com/

This announcement contains inside information for the purposes of the UK Market Abuse Regulation and the Directors of the Company are responsible for the release of this announcement.

For further information, please contact:

The Company Ryan Dolder

| rdolder@roguebaron.com |

Peterhouse Capital Limited (AQSE Corporate Adviser and Broker)

| +44 (0) 20 7469 0936 |

Clear Capital Limited (Joint Broker) Bob Roberts

| +44 (0) 20 3869 6080 |

Cairn Financial Advisers (Nominated Adviser subject to Admission) Ludovico Lazzaretti / James Western

| Tel: +44 (0)20 7213 0880

|

Forward Looking Statements

This announcement contains forward-looking statements relating to expected or anticipated future events and anticipated results that are forward-looking in nature and, as a result, are subject to certain risks and uncertainties, such as general economic, market and business conditions, competition for qualified staff, the regulatory process and actions, technical issues, new legislation, uncertainties resulting from potential delays or changes in plans, uncertainties resulting from working in a new political jurisdiction, uncertainties regarding the results of exploration, uncertainties regarding the timing and granting of prospecting rights, uncertainties regarding the Company's ability to execute and implement future plans, and the occurrence of unexpected events. Actual results achieved may vary from the information provided herein as a result of numerous known and unknown risks and uncertainties and other factors.

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

| 2025 |

Publication of this document | 26 September |

Latest time and date for receipt of Forms of Proxy | 11 a.m. on 9 October |

Time and date of the General Meeting | 11 a.m. on 13 October |

Last day for dealings in the Existing Ordinary Shares on AQSE | 13 October |

Admission becomes effective and dealings in the Enlarged Share Capital expected to commence on AIM | 8.00 a.m. on 15 October |

CREST accounts expected to be credited (where applicable) in respect of New Shares | 8.00 a.m. on 15 October |

Definitive share certificates in respect of New Shares expected to be despatched in respect Admission | Week commencing 20 October |

Each of the times and dates in the above timetable is subject to change. All references are to London time unless otherwise stated. Temporary documents of title will not be issued.

PLACING AND ADMISSION STATISTICS

Placing Price | 1 pence |

Number of Existing Ordinary Shares in issue at the date of this document | 104,649,639 |

Number of Placing Shares to be issued pursuant to the Placing | 140,000,000 |

Estimated gross proceeds of the Placing | £1,400,000 |

Estimated net proceeds of the Placing (excluding VAT) | £760,000 |

Number of Fee Shares to be issued on Admission | 7,970,168 |

Number of Conversion Shares to be issued on Admission | 18,963,351 |

Number of Consideration Shares to be issued on Admission | 315,000,000 |

Enlarged Share Capital (number of Ordinary Shares in issue following Admission)* | 586,583,158 |

Market capitalisation of the Company on Admission at the Placing Price* | approximately £5.9 million |

Percentage of the Enlarged Share Capital represented by the Placing Shares* | 23.87% |

Percentage of the Enlarged Share Capital represented by the Consideration Shares* | 53.70% |

Number of Options over new Ordinary Shares on Admission | 32,262,071 |

Number of Warrants over new Ordinary Shares on Admission | 148,451,409 |

Fully Diluted Enlarged Share Capital on Admission* | 767,296,638 |

TIDM | RHR |

ISIN | GB00BNTBWF32 |

LEI | 2138009XFT53PKLIH113 |

SEDOL | BNTBWF3 |

*"Enlarged Share Capital" means the issued share capital of the Company immediately following Admission, comprising the Existing Ordinary Shares and the New Shares. The Company intends to launch a Retail Offer following publication of this document. Any Retail Offer Shares to be issued will be in addition to the Enlarged Share Capital and are therefore excluded from the statistics set out in this document. A further announcement will be made in due course.

PART I - LETTER FROM THE CHAIRMAN

Richmond Hill Resources PLC

(incorporated in England and Wales under the Companies Act 2006 with registered no. 11726624)

Directors: | Registered Office: |

Hamish Harris (Non-Executive Chairman, to be re-appointed as Chief Executive Officer) | 78 Pall Mall, St James's |

* Proposed Director from Admission

To: Shareholders and, for information only, holders of options over Ordinary Shares

26 September 2025

Dear Shareholder,

Proposed acquisition of the entire issued share capital of Bulawayo CC Ventures Ltd

Proposed disposal of the Company's existing subsidiaries

Placing of 140,000,000 new Ordinary Shares of £0.001 at 1 pence per Ordinary Share

Proposed Cancellation of Admission to trading on the AQSE Growth Market

Admission of the Enlarged Share Capital to trading on AIM

Share Capital Reorganisation

Rule 9 Waiver

Notice of General Meeting

1. Introduction

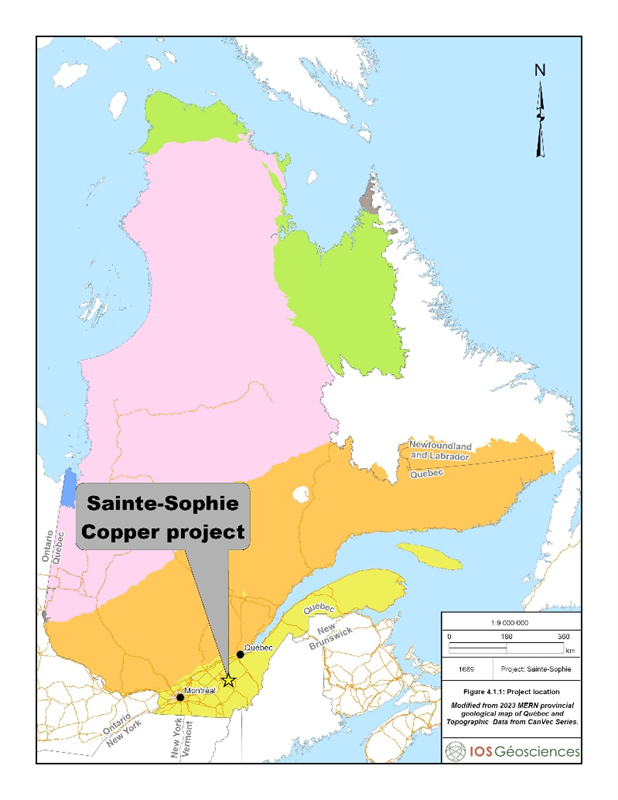

Following Admission, Richmond Hill Resources PLC will be an exploration company holding 145 map designated mineral exploration titles covering a total surface area of approximately 87 km2 located in the Centre-du-Quebec region in Canada, a region that is known to host copper mineralisation.

The Company is currently admitted to trading on AQSE and has historically had activities in the alcoholic drinks sector, operating under the name of Rogue Baron PLC. In order to move away from its historic activities and focus on the natural resources sector, the Company has been disposing of its drinks related assets and proposes to acquire the Project. Subject to and on Admission, the Company will have (i) disposed of Shinju Whiskey, one of the Company's two last remaining subsidiaries, and (ii) acquired the Project. The Disposal Agreement also relates to the Company's other remaining subsidiary, Shinju Spirits, which will be sold subject to various conditions precedent, including obtaining Shareholder and all third party consents and approvals, on or following Admission.

The Company entered into the Acquisition Agreement with Ulvestone Ltd pursuant to which the Company agreed, subject to Shareholder consent, to acquire the entire issued share capital of the Target for consideration of £3,300,000 to be satisfied through the issue of 315,000,000 Ordinary Shares and the payment of £150,000 in cash.

The Target is the owner of the Project which consists of 145 map designated mineral exploration titles covering a total surface area of approximately 87 km2. The Project is located in the Centre-du-Québec region, approximately 165 km east of Montreal and 80 km southwest of Quebec City in Canada, within a region known for copper mineralisation.

The Acquisition is subject to the approval of Shareholders at the General Meeting and further details of the terms and conditions of the Acquisition are set out in paragraph 12.1 of Part VII. A Retail Offer will be made available via the WRAP to raise further funds through the issue of new Ordinary Shares at the Placing Price, further details of which are set out in paragraph 13 of this Part I and paragraph 13 of Part VII.

The Company has conditionally raised approximately £1.4 million pursuant to the Placing, providing funding to undertake exploration activities at the Project.

The purpose of this Admission Document is to provide Shareholders with further information regarding the matters described above, the Proposals and to seek Shareholders' approval of the Resolutions at the General Meeting. The notice of General Meeting is set out at the end of this Admission Document.

The Proposals are conditional on, amongst other things, the passing of the Resolutions and Admission. If the Resolutions are approved by Shareholders, it is expected that Admission will become effective and dealings in the Enlarged Share Capital will commence on AIM on or around 15 October 2025 and withdrawal of the Company's Ordinary Shares from trading on AQSE will be effective on 15 on October 2025. The General Meeting at which the Resolutions will be proposed has been convened at the offices of Hill Dickinson LLP at The Broadgate Tower, 20 Primrose Street, London EC2A 2EW at 11 a.m. on 13 October 2025. Further details of the General Meeting are set out in Part VIII.

You should read the whole of this Admission Document and not just rely upon the information contained in this letter. In particular, you should carefully consider the Risk Factors set out in Part II of this Admission Document. Your attention is also drawn to the information set out in Part V of this Admission Document.

2. Reasons for the Acquisition

The Company has previously stated its change in strategy to focus on opportunities within the natural resources sector. The Directors and Proposed Directors of Richmond Hill believe that the proposed acquisition of the Target is in line with this strategy and provides a compelling opportunity to enter the copper exploration sector.

3. Strategy & Use of Proceeds

Strategy

From Admission, the Company's strategy is the development of the Project located in Quebec, Canada. The Company believes the Project area is anomalous in copper. The copper occurrences located on the Sainte-Sophie property have not yet been explored with modern technologies and work to date has been mostly limited to trenching and soil surveys. Drilling is sparse and has not reached depth beyond 61 m in depth. The Sainte-Sophie property remains an interesting area for copper and other commodities such as silver and molybdenum. Furthermore the Company may invest in and/or acquire further complementary mineral targets and resources.

Use of Proceeds

The net proceeds from the Placing will be used by the Company to:

• provide funding for the Enlarged Group to further explore, maintain and develop the Project as stated in this document; and

• provide the Enlarged Group with ongoing working capital to support its business operations.

The Company intends to apply a portion of the net proceeds of the Placing to the activities set out below:

• Stage 1 - autumn 2025: Preparatory Work - total approximate cost: CAD 125,000

• Digitisation of historical maps

• Reprocessing of historical geochemical data

• LiDAR survey

• Stage 2 - summer 2026: Geological Data Acquisition - total approximate cost: CAD 125,000

• Geological mapping, with an emphasis on structural geology and stratigraphy

• Stage 3 - autumn 2026: Drill Target Identification - total approximate cost: CAD 100,000

• Induced Polarisation (IP) survey on selected areas

The Company will require significant further funding to bring the Project into potential future production as well as additional funding to satisfy the cash payment of £150,000 due to Ulvestone.

The above assumes that the Company receives proceeds only from the Placing and not the Retail Offer. Any proceeds from the Retail Offer will be applied to pursuing the Company's business plan as set out in this document and for general working capital purposes.

4. Assets of the Group / Details of the Group's Tenements - Extracts from CPR

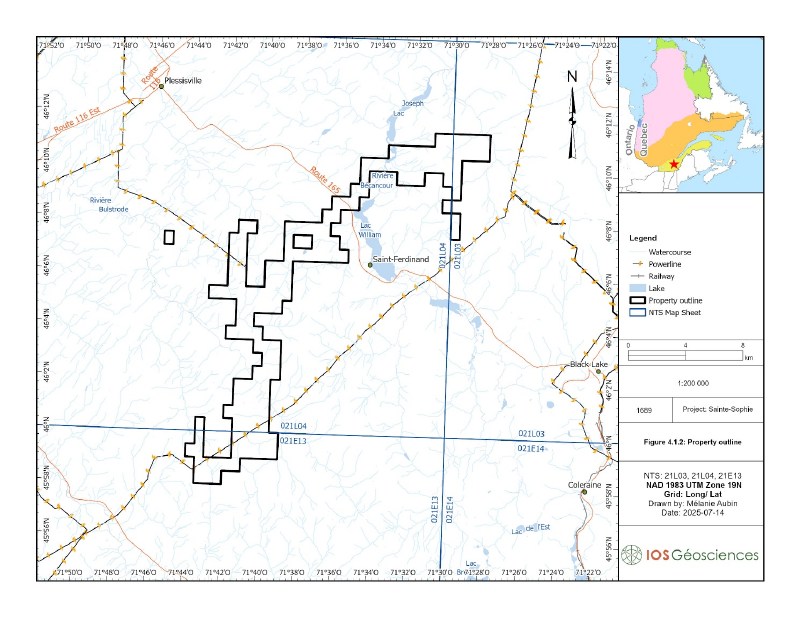

On Admission, Richmond Hill (through the Target) will hold 145 map designated mineral exploration titles covering a total surface area of approximately 87 km2 located in the Centre-du-Québec region, approximately 165 km east of Montreal and 80 km southwest of Quebec City. The region lies within the Appalachian mountain belt, featuring Cambro-Ordovician sedimentary and volcanic rocks (Humber Zone) known to host copper mineralisation. The claims to the titles were acquired by several individuals and companies through map designation and are currently owned by the Target. There is a 1% Net Smelter Return ("NSR") attached to the Project in respect of all minerals produced. At the point in time when the NSR is granted and a formal agreement is entered into, the NSR will be payable by the Target to the holder of the NSR at that time, or their successors and assigns.

Figure 1: Location map showing the Saint-Sophie Copper Project

Figure 2: Richmond Hill's designated mineral exploration titles on the Saint-Sophie Copper Project

The Project is located in the Centre-du-Québec, or Estrie-Beauce. The region has a long history of mining, especially for asbestos and chromium. Copper and alluvial gold were also sought after commodities during certain periods.

Artisanal copper mining in Upton, 100 km southwest of Sainte-Sophie, was reported by the Geological Survey of Canada in 1847 (Gauthier et al., 1989). Harvey Hill, a copper mine from which 450,000 tonnes were extracted between 1973 and 1976 and located in a similar geological environment as the Sainte-Sophie Project was discovered in 1850. The Sainte-Sophie property currently hosts fifteen copper occurrences, with more than half of them discovered by prospecting prior to 1910. The most recent discovery, the Morrissette occurrence, was found in 1999, also by prospecting.

There are no easily available written records of the early exploration in the area. The oldest document in the Quebec Government database is an exploration report dating back to 1907 on the Dussault occurrence (Robert, 1907a) in which copper mineralisation is reported over 144 metres (475 feet) along a ridge. The copper was found as chalcopyrite, bornite, chalcocite and copper-carbonate, likely malachite, hosted by schists and quartz veins. A 12 to 15 metres (40-50 feet) long and 4 metres (15 feet) deep trench exposed a 2 metres (6-8 feet) wide mineralised horizon with a 60 cm wide vein becoming a series of narrower veins at depth. A bulk sample of 6 t with an average grade of 20% to 32% Cu was sent "to the market". It was noted that the mineralisation was similar to the one of the Bruce Mines, the richest copper mine in Canada at that time.

Also in 1907, J.A. Robert (1907b) visited the Savoie occurrence which is likely the extension of the Dussault showing. There, the copper is found in a quartz vein and disseminated in the hosting calcareous and chlorite slate over a width of 4.5 to 6 metres (15-20 feet). The mineralised beds were found 400 m (1/4 mile) to the southwest on what is known as the Tessier occurrence. A grade of 8% Cu is reported at Tessier. At the same time, the Lemieux (Wolfestown) occurrence was visited, and copper (chalcopyrite and malachite) were observed but no assays are reported. The report mentions that three pits were dug on the Cloutier occurrence, and that copper (18% Cu) and silver (few oz/t) were found. This occurrence is not located in the government database but is likely located 3 km south of the Sainte-Sophie property.

A 1916 report on copper in Quebec (Bancroft, 1916) documented the geology and status of some copper mines and occurrences in the area. The Halifax and Quebec Megantic Copper showings are mentioned, but without details. There were several observations made at the Harvey Hill Mine (north of Sainte-Sophie) that can help understand the mineralisation in the broader area, identified as the Sutton Zone. Although the processes were debated, it was clearly stated that copper mineralisation occurs in veins and in some beds of the country rock. Supergene enrichment was the cause of higher grade at surface compared to the bedrock.

Mineralisation

There are fifteen mineral occurrences on the Sainte-Sophie property. The principal commodity is copper, but an array of other metals can be found. The mineralisation is associated with quartz-carbonate veins and locally spreads out into the selvages of those veins. Gauthier et al. (1987) provides a synthesis of all the then known occurrences in the area. The information is further synthesised in table 1. Information of occurrences found after 1987 is gathered from Sigeom[1] and other reports.

Table 1: Synthesis of the occurrences found on the Sainte-Sophie property.

Occurrence | Type | Metals | Copper (%) |

Option Poulina | Vein | Cu, Ag, Au, Zn | 1.4 |

Halifaxa | Stratabound, vein | Cu, Au, Ag | 2.8 |

Sainte-Sophie SSEb | Stringers | Cu, Ag, Pb | 1.11 |

Bernierville WNWa | Stratabound, vein | Cu, Ag, Au, Pb, Mo | 4.96 |

Sainte-Sophiea | Stratabound, vein | Cu | 4.38 |

Kimberleyb | Vein | Cu, Au | 0.231 |

Savoie-Tessiera | Vein | Cu, Ag, Au | 1.41 |

Megantic Talcb | Lens | Cu, Ni, Cr, Ag, Au | 0.112 |

Wolfestowna | Stratabound | Cu, Ag | 5.0 |

Quebec Megantic Coppera | Stratabound, vein | Cu, Ag, Au | 4.85 |

Noleta | Vein | Cu, Au | 0.59 |

Grille 93-F2b | Vein | Cu, Ag, Au, Zn | 0.313 |

Lac Williams SWb | Vein | Cu, Ag | 0.151 |

Lac Williams Nordb | Vein | Cu, Ag | 0.11 |

Morrissette | Vein | Cu | 11.014 |

a From Gauthier et al. (1987), b From Sigeom. 1Fecteau (1997), 2Gauthier et al. (1989), 3Roy and Dessureault (1993), 4Hébert (2001).

The size of the veins or mineralised strata are rarely mentioned in the historical reports. Veins appear to be 0.6 to 1 m thick (Graham, 1951a; 1951b; Séguin, 1963a) but quartz lenses of 2.5 m and 3 m are reported from Quebec Megantic Copper (Dufresne, 1921) and Nolet (Genn, 1963), respectively. The length of the vein and lenses can reach 9 metres (Quebec Megantic Copper; Dufresne (1921). Stringer and stratabound/banded mineralised zones can reach a thickness of 12m (Halifax; Pronovost (1990) and a length of 150 m (Nolet; Genn (1963). At Bernierville WNW, the copper soil anomaly is 350 m long. The veins are generally parallel to the schistosity/bedding with discordant veins mentioned at Nolet (Genn, 1963). The strike is toward the SW and the dip varying from shallow to 70°. Chloritic, sericitic and carbonate alteration are commonly associated with the mineralisation.

Copper is hosted by sulphides and carbonates. The supergene enrichment, as suggested by Bancroft (1916), plays a major role on copper grades and minerals found at most of the occurrences. Shallow mineralisation is richer and composed of malachite (Cu2CO3(OH)2; 57% Cu), chalcocite (Cu2S; 80% Cu) and to a lesser extent bornite (Cu5FeS4; 63% Cu). Deeper and less weathered mineralisation is mostly composed of chalcopyrite (CuFeS2; 35% Cu). Other sulphides include pyrite, locally auriferous and likely sphalerite (Zn), galena (Pb) and molybdenite (Mo). Silver was found at most of the occurrences, but there is no indication if it forms an alloy with gold or if it is present in sulphides.

The Megantic Talc occurrence is different from the other Sainte-Sophie copper occurrences. The copper is included in sulphides blebs with nickel and other metal and minerals associated with ultramafic rocks. The ultramafic unit is weathered which explains the presence of talc at that location.

5. Information on the Mining Claims

The Project comprises the following Mining Claims and will be, on Admission, wholly owned (indirectly) by the Company:

Claims | Status | Expiration date | Holder |

2826399 | Active | 2027-04-26 | Bulawayo CC Ventures Ltd. |

2826400 | Active | 2027-04-26 | Bulawayo CC Ventures Ltd. |

2826401 | Active | 2027-04-26 | Bulawayo CC Ventures Ltd. |

2826402 | Active | 2027-04-26 | Bulawayo CC Ventures Ltd. |

2826403 | Active | 2027-04-26 | Bulawayo CC Ventures Ltd. |

2826404 | Active | 2027-04-26 | Bulawayo CC Ventures Ltd. |

2826405 | Active | 2027-04-26 | Bulawayo CC Ventures Ltd. |

2826406 | Active | 2027-04-26 | Bulawayo CC Ventures Ltd. |

2826407 | Active | 2027-04-26 | Bulawayo CC Ventures Ltd. |

2826408 | Active | 2027-04-26 | Bulawayo CC Ventures Ltd. |

2826409 | Active | 2027-04-26 | Bulawayo CC Ventures Ltd. |

2826410 | Active | 2027-04-26 | Bulawayo CC Ventures Ltd. |

2826411 | Active | 2027-04-26 | Bulawayo CC Ventures Ltd. |

2826412 | Active | 2027-04-26 | Bulawayo CC Ventures Ltd. |

2826413 | Active | 2027-04-26 | Bulawayo CC Ventures Ltd. |

2826414 | Active | 2027-04-26 | Bulawayo CC Ventures Ltd. |

2826415 | Active | 2027-04-26 | Bulawayo CC Ventures Ltd. |

2826416 | Active | 2027-04-26 | Bulawayo CC Ventures Ltd. |

2826419 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826420 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826421 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826422 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826423 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826424 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826425 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826426 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826427 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826428 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826429 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826430 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826431 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826432 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826433 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826434 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826435 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826436 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826437 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826438 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826439 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826440 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826441 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826442 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826443 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826444 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826447 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826448 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826449 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826450 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826451 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826452 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826453 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826454 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826455 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826456 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826457 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826458 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826459 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826460 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826461 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826462 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826463 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826464 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826465 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826466 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826467 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826468 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826469 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826470 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826471 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826472 | Active | 2027-04-27 | Bulawayo CC Ventures Ltd. |

2826488 | Active | 2027-04-28 | Bulawayo CC Ventures Ltd. |

2826489 | Active | 2027-04-28 | Bulawayo CC Ventures Ltd. |

2826490 | Active | 2027-04-28 | Bulawayo CC Ventures Ltd. |

2826491 | Active | 2027-04-28 | Bulawayo CC Ventures Ltd. |

2826492 | Active | 2027-04-28 | Bulawayo CC Ventures Ltd. |

2826493 | Active | 2027-04-28 | Bulawayo CC Ventures Ltd. |

2826494 | Active | 2027-04-28 | Bulawayo CC Ventures Ltd. |

2826495 | Active | 2027-04-28 | Bulawayo CC Ventures Ltd. |

2826588 | Active | 2027-04-29 | Bulawayo CC Ventures Ltd. |

2826589 | Active | 2027-04-29 | Bulawayo CC Ventures Ltd. |

2826590 | Active | 2027-04-29 | Bulawayo CC Ventures Ltd. |

2826591 | Active | 2027-04-29 | Bulawayo CC Ventures Ltd. |

2826592 | Active | 2027-04-29 | Bulawayo CC Ventures Ltd. |

2826593 | Active | 2027-04-29 | Bulawayo CC Ventures Ltd. |

2826594 | Active | 2027-04-29 | Bulawayo CC Ventures Ltd. |

2826609 | Active | 2027-04-29 | Bulawayo CC Ventures Ltd. |

2826610 | Active | 2027-04-29 | Bulawayo CC Ventures Ltd. |

2826611 | Active | 2027-04-29 | Bulawayo CC Ventures Ltd. |

2826612 | Active | 2027-04-29 | Bulawayo CC Ventures Ltd. |

2826613 | Active | 2027-04-29 | Bulawayo CC Ventures Ltd. |

2826614 | Active | 2027-04-29 | Bulawayo CC Ventures Ltd. |

2826615 | Active | 2027-04-29 | Bulawayo CC Ventures Ltd. |

2826616 | Active | 2027-04-29 | Bulawayo CC Ventures Ltd. |

2826617 | Active | 2027-04-29 | Bulawayo CC Ventures Ltd. |

2826618 | Active | 2027-04-29 | Bulawayo CC Ventures Ltd. |

2826619 | Active | 2027-04-29 | Bulawayo CC Ventures Ltd. |

2826622 | Active | 2027-04-29 | Bulawayo CC Ventures Ltd. |

2826623 | Active | 2027-04-29 | Bulawayo CC Ventures Ltd. |

2826624 | Active | 2027-04-29 | Bulawayo CC Ventures Ltd. |

2826625 | Active | 2027-04-29 | Bulawayo CC Ventures Ltd. |

2826626 | Active | 2027-04-29 | Bulawayo CC Ventures Ltd. |

2826627 | Active | 2027-04-29 | Bulawayo CC Ventures Ltd. |

2826628 | Active | 2027-04-29 | Bulawayo CC Ventures Ltd. |

2826629 | Active | 2027-04-29 | Bulawayo CC Ventures Ltd. |

2826630 | Active | 2027-04-29 | Bulawayo CC Ventures Ltd. |

2826631 | Active | 2027-04-29 | Bulawayo CC Ventures Ltd. |

2826632 | Active | 2027-04-29 | Bulawayo CC Ventures Ltd. |

2826633 | Active | 2027-04-29 | Bulawayo CC Ventures Ltd. |

2826634 | Active | 2027-04-29 | Bulawayo CC Ventures Ltd. |

2826635 | Active | 2027-04-29 | Bulawayo CC Ventures Ltd. |

2826646 | Active | 2027-04-30 | Bulawayo CC Ventures Ltd. |

2826647 | Active | 2027-04-30 | Bulawayo CC Ventures Ltd. |

2826650 | Active | 2027-04-30 | Bulawayo CC Ventures Ltd. |

2826651 | Active | 2027-04-30 | Bulawayo CC Ventures Ltd. |

2826652 | Active | 2027-04-30 | Bulawayo CC Ventures Ltd. |

2826653 | Active | 2027-04-30 | Bulawayo CC Ventures Ltd. |

2826654 | Active | 2027-04-30 | Bulawayo CC Ventures Ltd. |

2826655 | Active | 2027-04-30 | Bulawayo CC Ventures Ltd. |

2826656 | Active | 2027-04-30 | Bulawayo CC Ventures Ltd. |

2826657 | Active | 2027-04-30 | Bulawayo CC Ventures Ltd. |

2826684 | Active | 2027-05-01 | Bulawayo CC Ventures Ltd. |

2826685 | Active | 2027-05-01 | Bulawayo CC Ventures Ltd. |

2826686 | Active | 2027-05-01 | Bulawayo CC Ventures Ltd. |

2826687 | Active | 2027-05-01 | Bulawayo CC Ventures Ltd. |

2826688 | Active | 2027-05-01 | Bulawayo CC Ventures Ltd. |

2826689 | Active | 2027-05-01 | Bulawayo CC Ventures Ltd. |

2826690 | Active | 2027-05-01 | Bulawayo CC Ventures Ltd. |

2826691 | Active | 2027-05-01 | Bulawayo CC Ventures Ltd. |

2826692 | Active | 2027-05-01 | Bulawayo CC Ventures Ltd. |

2826693 | Active | 2027-05-01 | Bulawayo CC Ventures Ltd. |

2826694 | Active | 2027-05-01 | Bulawayo CC Ventures Ltd. |

2826698 | Active | 2027-05-01 | Bulawayo CC Ventures Ltd. |

2826699 | Active | 2027-05-01 | Bulawayo CC Ventures Ltd. |

2826700 | Active | 2027-05-01 | Bulawayo CC Ventures Ltd. |

2826701 | Active | 2027-05-01 | Bulawayo CC Ventures Ltd. |

2826702 | Active | 2027-05-01 | Bulawayo CC Ventures Ltd. |

2826703 | Active | 2027-05-01 | Bulawayo CC Ventures Ltd. |

2826704 | Active | 2027-05-01 | Bulawayo CC Ventures Ltd. |

2826705 | Active | 2027-05-01 | Bulawayo CC Ventures Ltd. |

2826706 | Active | 2027-05-01 | Bulawayo CC Ventures Ltd. |

2826707 | Active | 2027-05-01 | Bulawayo CC Ventures Ltd. |

2826845 | Active | 2027-05-03 | Bulawayo CC Ventures Ltd. |

2826846 | Active | 2027-05-03 | Bulawayo CC Ventures Ltd. |

2826847 | Active | 2027-05-03 | Bulawayo CC Ventures Ltd. |

2826848 | Active | 2027-05-03 | Bulawayo CC Ventures Ltd. |

6. Canada - Copper Sector and Regulatory Framework

High level overview of Canada for Copper

Canada is recognised as one of the world's leading jurisdictions for mineral exploration and production, with a well-established regulatory framework, strong mining heritage, and a supportive investment environment. The country ranks among the top global producers of copper, with significant reserves located in provinces such as British Columbia, Ontario, Quebec, and Newfoundland and Labrador, with a production of approximately 476,000 metric tons in 2020, of which approximately 80% of that output was mined in Ontario and British Columbia and Quebec contributing 7.6% of Canada copper output that year.

Copper is listed as a critical mineral in Canada's critical minerals strategy, underscoring plans to expand domestic production to support clean energy supply chains and allied industrial needs.

Regulatory Regime Applicable to the Mining Industry in the Province

The following provides a general commentary on some of the principal provisions of the Mining Act. It is an overview and should not be interpreted as an exhaustive account of all factors relevant to mining exploration and development in the Province of Quebec ("Province").

Mining Act

The registration of mining rights in the Province is governed by the Mining Act. The Ministère des Ressources naturelles et des Forêts ("MRNF") is responsible for the administration of the Mining Act, including the mining register ("Mining Register") where records and maps which indicate the location and status of mining rights are kept and made accessible online.

The mining rights system in the Province is based on a first come, first served basis. The mining rights conferred by the Mining Act are immovable real rights divided in two categories: (i) exclusive exploration rights (claims) and (ii) extraction rights (mining leases, mining concessions and leases to mine surface mineral substances).

This discussion focuses on matters pertaining to exclusive exploration rights and mining leases.

Application Process for Exclusive Exploration Rights

An exclusive exploration right can be obtained by map designation.

Since November 2000, the primary means of acquiring exclusive exploration rights is map designation, based on a pre-division of lands designated by the MRNF. A map designated exclusive exploration right is acquired by the filing of a notice of map designation followed by its registration with the registrar appointed by the MRNF. The title is granted on a first come, first served basis. Once the map designation notice is accepted, the registrar makes an entry in the register and issues a registration certificate for the exclusive exploration right.

The boundaries of the regions in which exclusive exploration rights are obtained by map designation are being modified over time as staked exclusive exploration rights expire or are converted into map designated exclusive exploration rights.

Every transfer of a mining right is registered in the Mining Register on presentation of a copy of the instrument evidencing the transfer and on payment of the fees fixed by regulation. Such transfer only has effect against the State once it is registered in the Mining Register.

Rights

The exclusive exploration right gives the holder an exclusive right to search for mineral substances in the public domain, except sand, gravel, clay and other loose deposits, on the land subjected to the exclusive exploration right. An exclusive exploration right holder has access to the parcel of land subject to his exclusive exploration right and may perform any exploration work thereon.

With respect to lands granted or alienated by the State for purposes other than mining purposes, if the exclusive exploration right is in the territory of a local municipality, the holder of the exclusive exploration right must inform the municipality and the landowner of the work to be performed at least 30 days before the work begins.

The MRNF shall, within 60 days after the exclusive exploration right is registered, notify the local municipality and, as the case may be, the Indigenous nation or community concerned of the existence of that right. Where land that is subject to the exclusive exploration right is granted, alienated or leased by the State for purposes other than mining purposes or is subject to an exclusive lease to mine surface mineral substances, the MRNF shall also notify the owner, the lessee and the holder, as the case may be, of the lands.

If the exclusive exploration right is in the territory of a local municipality, the exclusive exploration right holder must also inform the municipality and the landowner, at least 30 days before the work begins, of the work to be performed.

Term and Renewal

The initial term of an exclusive exploration right is three years. It can be renewed indefinitely for two-year terms, provided the exclusive exploration right holder (i) submits a renewal application prior to the expiry date of the exclusive exploration right, (ii) pays the required fees and (iii) meets the other conditions stipulated in the Mining Act, including the carrying out of exploration work.

Required Work

An exclusive exploration right holder must carry out work on the land that is subject to the exclusive exploration right before the 60th day preceding the expiry date of the exclusive exploration rights. The nature and minimum cost of the required work are established by regulation. Amounts spent on property examination and technical assessment work may qualify as required work if the work is performed within 48 months following the date on which the exclusive exploration right was registered. Geological, geophysical or geochemical surveys and prospecting work carried out on the exclusive exploration right during the 24 months preceding the date of the application for map designation notice may be applied to the first term of the exclusive exploration right.

Excess amounts spent in respect of an exclusive exploration right may be applied towards subsequent terms or towards the renewal of an adjoining exclusive exploration right regarding which the holder has made a promise to purchase by way of an instrument registered in the Mining Register, provided the land that is the subject of the application for renewal is included within a 4.5 kilometres radius circle from the exclusive exploration right in respect of which work was performed in excess of the prescribed requirements.

The holder of the exclusive exploration right must, not later than 31 January each year, submit to the MRNF a report on the work performed during the period from 1 January to 31 December of the preceding year. The report must be presented using a form supplied by the MRNF and must contain the information determined by regulation.

A holder of an exclusive exploration right who has performed and reported, within the time prescribed, work whose cost represents at least 90% of the minimum cost required under section 72 of the Mining Act may, to enable the renewal of his exclusive exploration right, pay the MRNF an amount equal to twice the difference between the minimum cost of the work that should have been performed and the work reported.

Mining Operations

In order to mine mineral substances, a mining lease must be obtained from the MRNF.

A mining lease may be granted in respect of land that is subject to one or more exclusive exploration rights if the exclusive exploration right holder establishes the existence of indicators of the presence of a workable deposit, meets the conditions and pays the annual rental prescribed by regulation.

A mining lease cannot be granted before a rehabilitation and restoration plan is approved in accordance with the Mining Act, and a certificate of authorisation has been issued in accordance with the Environment Quality Act (R.S.Q., c. Q-2) (the "Environment Quality Act").

An application for a mining lease must be accompanied by (i) a survey of the parcel of land involved, unless it has already been entirely surveyed, (ii) a report describing the nature, extent and probable value of the deposit and (iii) a project feasibility study as well as a scoping and market study as regards processing in the Province.

In the Province, the opening and operation of a metal mine that has a production capacity of 2,000 metric tons or more per day is subject to the environmental impact assessment and review procedure provided for in the Environment Quality Act and must be the subject of a certificate of authorisation issued by the Government.

In the case of a metal mine project where the mine has a production capacity of less than 2,000 metric tons per day, the applicant for a mining lease must, before submitting the application and in the manner prescribed by regulation, hold a public consultation in the region where the project is situated.

A lessee must also establish a monitoring committee to foster the involvement of the local community in the project as a whole.

The term of a mining lease is 20 years, renewable for up to three 10-year terms, provided the lessee applies in the prescribed delays, pays the annual rental and complies with the Mining Act, the Mining Tax Act (chapter I-0.4) and any other renewal requirement prescribed by regulation.

Mining operations must be commenced within four years from the date of the lease, unless the MRNF has a valid reason for granting an extension of time. Where contiguous parcels of land with a total area not exceeding 2,000 hectares have been leased by separate leases to the same person, the MRNF may allow the work to be undertaken on one of the parcels of land only.

7. Commodities, Products and Markets

About Copper

Copper (chemical symbol: Cu) is a reddish-gold metal known for its excellent electrical and thermal conductivity, ductility, and corrosion resistance.

As the most conductive common metal, copper is used extensively in power transmission and distribution systems, renewable energy installations (wind turbines, solar panels), electric vehicles, and construction - serving as a backbone of clean energy infrastructure. Clean energy technologies and EVs require significantly more copper per unit than their conventional counterparts, driving a structural increase in demand.

Physical and Chemical Properties

• Conductivity: Second only to silver in electrical conductivity, making it indispensable for power transmission and electronics.

• Thermal conductivity: High efficiency in heat transfer makes it ideal for heat exchangers and radiators.

• Corrosion resistance: Forms a stable patina over time, providing durability in plumbing and marine applications.

• Antimicrobial: Copper naturally kills a wide range of bacteria and viruses on contact, making it useful in healthcare environments.

Copper Market

In 2023, global copper mine production was approximately 22 million tonnes of contained copper, while refined copper output (including recycled scrap) reached about 26.6 million tonnes, a 5.1% increase from 25.3 million tonnes in 2022. This growth in refined output includes roughly 22.1 million tonnes from newly mined ore and 4.5 million tonnes from recycled sources, indicating the significant contribution of recycling to copper supply.

Key Market Participants

The copper industry's supply side is dominated by a relatively concentrated group of large mining companies and state-owned enterprises. Chile's Codelco (Corporación Nacional del Cobre), the world's largest copper miner by historical output, remains a key player - producing in the order of 1.3 million tonnes of copper in 2024. Major publicly-listed producers include Freeport-McMoRan (USA) and BHP (Australia), which each reported annual mined copper output in the range of 1.8-1.9 million tonnes in 2024. Glencore Plc (Switzerland) is another leading producer (about 0.95 Mt in 2024), alongside Southern Copper (the mining arm of Grupo México). Rising producers such as Zijin Mining (China) have also joined the top ranks, with over 1 Mt of copper output attributable to its global operations. Other significant participants include Anglo American (UK), KGHM Polska Miedz (Poland), Antofagasta plc (UK/Chile), and First Quantum Minerals (Canada), each mining several hundred thousand tonnes of copper annually. Collectively, the top ten copper-producing companies account for a substantial share of world production.

In addition, a growing number of mid-tier and junior copper exploration and production companies are active globally, with significant activity in Canada, Australia, the United States, and parts of Africa. As of 2024, dozens of exploration companies are pursuing new discoveries or advancing early-stage copper projects to meet projected future demand.

While copper mining is geographically widespread, processing and smelting capacity remains concentrated in a few regions - most notably China, which accounts for a substantial portion of global refined copper production and plays a central role in global demand and pricing. Large integrated producers and commodity traders such as Glencore also exert influence across both upstream production and midstream trading and logistics.

Supply of Copper

Global copper supply is derived from a mix of mined ore and recycled material. On the primary supply side, world copper mine production has grown modestly in recent years - reaching about 22.0 million tonnes in 2023 (up from 21.2 Mt in 2018). The leading copper-producing country is Chile, which alone produced roughly 5 Mt of copper in 2023 (approximately 22-23% of world mine output), combined with Peru, the Democratic Republic of Congo, China and the USA, these five countries represent over half of global copper mine production annually.

Secondary supply (scrap recycling) is also significant: in 2023, about 4.5 Mt of copper was produced from recycled scrap, meeting roughly 17% of total refined copper demand.

Demand for Copper

Demand is driven by a wide range of sectors, with electrical applications (power grid, wiring, motors) and construction being the largest consumers of copper. Geographically, demand is highly concentrated: China is the single largest consumer, using about 13-14 Mt of copper annually (2023 estimates), which is over 50% of global copper consumption.

The rest of Asia (including Japan, South Korea, and emerging economies) is also a major consumer, followed by Europe and North America. Economic development and industrialisation have historically been key drivers of copper demand, as the metal is needed for building infrastructure and manufacturing goods.

A core trend shaping copper demand is the global energy transition and electrification. Copper is essential for renewable energy systems (solar, wind, energy storage) and electric vehicles (EVs), due to its superior electrical conductivity. Analysts project accelerated growth in copper demand over the next decade. For example, one scenario by Wood Mackenzie suggests global refined copper demand could rise by around 2% per year on average, exceeding 30 million tonnes by the early 2030s.

The International Energy Agency has warned that, under stated policies and climate targets, existing mines and committed projects will likely only supply about 80% of the copper needed by 2030, implying a significant shortfall if new capacity is not built. This anticipated "copper gap" reflects surging requirements for electrification infrastructure and EVs. For instance, the expansion of electric transport will dramatically increase copper usage: whereas a conventional car uses approximately 20 kg of copper, an average EV uses 60-80 kg, and EV charging infrastructure and grid upgrades further add to demand. Additionally, urbanisation and the buildout of electricity networks in developing countries continue to support underlying copper consumption growth.

Pricing of Copper

Copper is a globally traded commodity with prices primarily determined by supply and demand dynamics in international markets. Pricing is typically referenced against benchmark contracts on major commodity exchanges, most notably the London Metal Exchange (LME), COMEX (a division of the New York Mercantile Exchange), and the Shanghai Futures Exchange (SHFE).

In summary, the copper market's ecosystem spans mining giants, national producers, large smelters (concentrated in Asia, especially China), and global traders - all interacting to match the output of mines with the needs of fabricators and end-users across the world.

While short-term prices can be influenced by market sentiment and speculative positioning, copper pricing in recent years has hit record highs with the long-term outlook for copper pricing remains robust, underpinned by the expected growth in demand for electrification and the relative scarcity of new large-scale supply.

8. Information on the Disposal

The Company has entered into the Disposal Agreement with Intergen, pursuant to which it is proposed that the Company sells its entire interests in (i) Shinju Whiskey, LLC, and (ii) Shinju Spirits, Inc to Intergen, a company which is 50% owned by Ryan Dolder, a director of the Company. The Disposal is subject to certain conditions precedent, including the passing of the Resolutions at the General Meeting and obtaining all necessary or relevant consents and approvals from third parties. No warranties are given by the Company pursuant to the terms of the Disposal Agreement, save for limited warranties in respect of the Company's capacity to dispose of the assets. The consideration for the Disposal will be £10,000.

Should Shinju Spirits' other significant shareholder exercise its right of first refusal in connection with the Disposal, then the Company's interest in Shinju Spirits shall be sold to Shinju Spirits' other significant shareholder as opposed to Intergen. Due to the right of first refusal process to be followed, the disposal of Shinju Spirits may not complete on or prior to Admission, however, subject to obtaining Shareholder consent, the sale of Shinju Whiskey will complete on or prior to Admission in any event. For a summary of the relevant right of first refusal, please see paragraph 12.23 of Part VII of this document.

Shinju Spirits and Shinju Whiskey are both legacy, non-core subsidiaries of the Company. Should Shinju Spirits' other significant shareholder exercise its right of first refusal in respect of the sale of Shinju Spirits, or if any of the other conditions to completion of the Disposal are not satisfied by Admission, then Shinju Spirits will remain part of the Group following Admission until such conditions are satisfied, or until the right of first refusal process has been fully complied with.

9. Proposed Share Reorganisation

The Directors propose that each Existing Ordinary Share in the issued share capital of the Company at the Record Date be sub-divided and re-designated into one new Ordinary Share of £0.001 each and one Deferred Share of £0.005 each.

The issued share capital of the Company immediately following the Share Reorganisation is expected to comprise 104,649,639 Ordinary Shares and 104,649,639 Deferred Shares.

The new Ordinary Shares created upon implementation of the Share Reorganisation will have the same rights as the Existing Ordinary Shares including voting, dividend, return of capital and other rights.

10. Conversion Shares & Fee Shares

Gunsynd and certain other creditors have agreed to convert, on Admission, in aggregate, £189,633.51 in respect of accrued fees and/or loans into 18,963,351 Ordinary Shares at the Issue Price, being the Conversion Shares. In addition, the Directors have agreed with the Company to convert, in aggregate, £79,701.68 of accrued fees into 7,970,168 new Ordinary Shares at the Issue Price, being the Fee Shares. The conversion of accrued fees by the Directors is set out in the table below:

Director | Accrued fees | New Ordinary Shares to be issued in lieu of fees |

Ryan Dolder | £62,295.79 | 6,229,579 |

Hamish Harris | £17,405.89 | 1,740,589 |

11. Reasons for Admission

The Company is currently admitted to trading on the Access segment of the AQSE Growth Market. The Company is seeking Admission of its Enlarged Share Capital to trading on AIM in order to take advantage of AIM's pro?le, broad investor base, liquidity and access to institutional and other investors and to further support the achievement of its strategic objectives.

12. Details of the Placing

The Placing of 140,000,000 new Ordinary Shares will raise £1.4 million for the Company before expenses. The net proceeds of the Placing of approximately £760,000 (excluding VAT), together with the Group's existing resources, will be used as set out in paragraph 3 of this Part I.

The Placing Shares represent approximately 23.87 per cent. of the Enlarged Share Capital (excluding the Retail Offer Shares). On Admission, at the Placing Price, the Company will have a market capitalisation of approximately £5.9 million.

The Company, the Directors and Proposed Directors, Cairn and Clear Capital have entered into the Placing Agreement pursuant to which, subject to certain conditions, Clear Capital has conditionally agreed to use its reasonable endeavours to procure subscribers for the Placing Shares to be issued by the Company under the Placing. The Placing has not been underwritten. The Placing will raise approximately £1.4 million (before expenses) for the Company from the issue of the Placing Shares. The Placing Shares will be issued credited as fully paid and will, when issued, rank pari passu in all respects with the Existing Ordinary Shares, including the right to receive all dividends and other distributions declared paid or made after Admission.

The Placing Agreement is conditional upon, amongst other things, Admission having become effective by not later than 8.00 a.m. on 31 October 2025 or such later time and date, being not later than 8.00 a.m. on 15 November 2025, as the Company, Cairn and Clear Capital shall agree. Further details of the Placing Agreement are set out in paragraph 12.3, of Part VII of this document.

13. Details of the Retail Offer

The Company intends to raise further funds through the Retail Offer at the Placing Price, via the WRAP. The launch of the Retail Offer will be announced shortly. The issue of the Retail Offer Shares is conditional on the Placing and Admission, but the Placing is not conditional on the Retail Offer.

Further details of the Retail Offer are set out in paragraph 13 of Part VII.

14. Directors

The Board consists of a professional team with experience in natural resources and growing companies.

The Board

David Tink (aged 41) - Non-Executive Chairman (Proposed)

Mr Tink has almost twenty years of experience advising boards of natural resources issuers in London and Sydney, including gold, base metal and battery metal companies' AIM and ASX IPOs and secondary financings. Mr Tink also has mining related experience through his involvement as a non-executive director of Svenska Skifferoljeaktiebolaget, a 100% owned subsidiary of URU Metals Ltd. Furthermore, Mr Tink has experience advising clients in numerous sectors including in particular energy and resources. He is a dual qualified lawyer, being admitted in New South Wales and England & Wales and has worked in both Australia and the United Kingdom. Mr Tink holds a Bachelor of Science (Honours) and Laws from the University of Newcastle, Australia and is a graduate and member of the Australian Institute of Company Directors.

Hamish Harris (aged 55) - Chief Executive Officer

Mr Harris worked for over twenty years for a number of top tier investment banks in Singapore, Hong Kong and London. He has held senior financial and management positions in both publicly listed and private enterprises in Australia and Europe over the last decade, focusing on mining and exploration activities. As part of his role as Executive Director of Gunsynd, Gunsynd has developed and expanded a portfolio of copper and uranium exploration projects in Canada - notably the Falcon Lake, Merlin, and Bear-Twit projects. These have delivered high-grade copper and uranium samples in early-stage exploration. Mr Harris holds a Bachelor of Commerce from the University of Tasmania.

Ryan Dolder (aged 48) - Non-Executive Director

Mr Dolder has mining experience from his roles as co-founder and director of Corizona Mining Partners LLC and Laberinto Holdings LLC. His roles involved both strategic management and operational oversight, including direct responsibility for ground operations, legal matters, and fundraising at both companies. Mr Dolder also facilitated the acquisition and negotiation of rights for multiple exploration projects in South America, particularly in Peru. Mr Dolder played a key role in taking two mining projects public to secure additional funding and was involved in joint venture agreements and exploration operations for a gold-focused project in Peru. Mr Dolder holds a Bachelor of Science in Marketing and Computer Sciences from the University of Notre Dame.

Sheldon Modeland, P.Geo. (aged 56) - Non-Executive Director (Proposed)

Mr Modeland is an experienced geologist and mining analyst with international experience. He has spent over 20 years in the mining industry, beginning his career as an exploration geologist with prominent mining firms Falconbridge (now Glencore) and BHP Billiton. He has served as a research geoscientist and in a project geologist capacity where he managed advanced exploration programs and, since transitioning into financial analysis, has provided financial modelling, production analyses, resource evaluations, and detailed due diligence on precious and base metal mining projects globally whilst working at UK financial institutions. Mr Modeland holds a Master's of Science in Geology from McGill University and is a registered professional geoscientist.

Further details of the terms on which the Directors and the Proposed Directors are appointed are set out at paragraph 9 of Part VII of this document.

15. Financial Information

Financial Information on the Group is included in Part III and Part IV of this document. Bulawayo has no material trading history since its incorporation on 14 April 2025. However, a summary of the financial information of Bulawayo from incorporation to 30 June 2025 is included in Section B of Part III of this document.

16. Current trading, future prospects and signi?cant trends

In terms of any known trends, uncertainties, demands, commitments or events that are reasonably likely to have a material effect on the Group's prospects for at least the current ?nancial year, investors should refer to paragraph 7 of Part I above (in relation to commodities, products and markets) and Part II (in respect of risk factors).

17. Lock-ins and orderly market arrangements

The Locked-in Shareholders (a portion of which are in accordance with Rule 7 of the AIM Rules for Companies) who, on Admission, will hold in aggregate 348,452,603 Ordinary Shares (representing approximately 59.40 per cent. of the Enlarged Share Capital (excluding the Retail Offer Shares)) have undertaken not to (and to use their best endeavours to procure that their connected persons shall not), save in limited circumstances permitted by the AIM Rules for Companies, dispose of any of their interests in Ordinary Shares (including any Ordinary Shares that they may acquire through the exercise of Options or otherwise) at any time prior to the ?rst anniversary of Admission.

In addition, in order to ensure an orderly market in the Ordinary Shares, the Locked-In Shareholders have further undertaken that they shall not (and that they will use their best endeavours to procure that their connected persons shall not) for a further period of 6 months (subject to certain limited exceptions) deal or otherwise dispose of any such interests: (a) without the prior written consent of Cairn and Clear Capital; and (b) only through Clear Capital, in such manner as Clear Capital and Cairn may reasonably require so as to ensure an orderly market in the Ordinary Shares; or if Clear Capital are unable to make the disposal within five Business Days of having received a written request to do so by the Locked-In Shareholder such other reputable broking service as the Locked-In Shareholders shall, from time to time, determine.

Further details of the lock-in and orderly-market arrangements are set out in paragraphs 12.8, 12.9 and 12.10 of Part VII of this document.

18. Relationship Agreement

The Seller, the Company and Cairn have entered into a Relationship Agreement to regulate the relationship between the Seller and the Company from the time of Admission. The Relationship Agreement shall come into full force and effect on Admission, subject to the Seller holding at least 20 per cent. of the Enlarged Share Capital on Admission.

Further details of the Relationship Agreement arrangements are set out in paragraph 12.11 of Part VII of this document.

19. Corporate Governance

Corporate Governance

The Board recognises its responsibility for the proper management of the Company and is committed to maintaining a high standard of corporate governance. The Directors recognise the importance of sound corporate governance commensurate with the size and nature of the Company and the interests of its Shareholders. The Directors have decided that the Company will, from Admission, continue to adopt the QCA Code.

The Board comprises one executive director and three non-executive directors, re?ecting a blend of different skills, experiences and backgrounds. David Tink and Sheldon Moreland are considered to be independent for the purposes of the QCA Code.

The Company's schedule of matters reserved for the Board provides that the Board is responsible for formulating, reviewing and approving the Group's strategy, budgets and corporate actions. The Company will hold Board meetings every two months and at other times as and when required.

The Company will hold regular Board meetings and the Board will be responsible for formulating, reviewing and approving the Company's strategy, budget and major items of capital expenditure. The Company has established the Remuneration Committee, AIM Rules and UK MAR Compliance Committee and the Audit and Risk Committee with formally delegated duties and responsibilities and has adopted a disclosure policy, a share dealing code and an anti-bribery and corruption policy.

Audit and Risk Committee

The Audit and Risk Committee will have the primary responsibility of monitoring the quality of internal controls and ensuring that the financial performance of the Group is properly measured and reported on. It will receive and review reports from the Group's management and external auditors relating to the interim and annual accounts and the accounting and internal control systems in use throughout the Group. The Audit and Risk Committee will meet not less than twice in each financial year and will have unrestricted access to the Group's external auditors. On Admission, the Audit and Risk Committee will comprise Hamish Harris and David Tink who will chair the committee.

Remuneration Committee

The Remuneration Committee will review the performance of the executive directors and make recommendations to the Board on matters relating to their remuneration and terms of service. The Remuneration Committee will also make recommendations to the Board on proposals for the granting of share options and other equity incentives pursuant to any employee share option scheme or equity incentive plans in operation from time to time. The Remuneration Committee will meet as and when necessary. In exercising this role, the members of the Remuneration Committee shall have regard to the recommendations put forward in the UK Corporate Governance Code guidelines as a review of best practice and will apply this against the QCA Code which the Company is adopting. On Admission, the Remuneration Committee will comprise David Tink and Sheldon Modeland; David Tink will chair the committee.

AIM Rules and UK MAR Compliance Committee

The AIM Rules and UK MAR Compliance Committee will monitor the Group's compliance with the AIM Rules for Companies and AIM Rules for Nominated Advisers and MAR. Under its terms of reference, it is required to meet at least twice a year. The committee is chaired by David Tink and its other member is Hamish Harris.

Share Dealing Code

With effect from Admission, the Company will adopt a share dealing code which sets out the requirements and procedures for dealings by the Board and applicable employees in the Company's securities in accordance with the provisions of MAR and the AIM Rules for Companies.

Anti-Bribery and Corruption Policy

The Company has adopted an anti-bribery and corruption policy which applies to the Board and employees of the Group. It sets out their responsibilities in observing and upholding a zero-tolerance position on bribery and corruption in all the jurisdictions in which the Group operates as well as providing guidance to those working for the Group on how to recognise and deal with bribery and corruption issues and the potential consequences. The Company expects all employees, suppliers, contractors and consultants to conduct their day-to-day business activities in a fair, honest and ethical manner, to be aware of and refer to this policy in all of their business activities worldwide and to conduct business on the Company's behalf in compliance with it. Managers at all levels are responsible for ensuring that those reporting to them, internally and externally, are made aware of and understand this policy.

20. Options and Warrants

Options

As at the Latest Practicable Date, the Company has no existing option arrangements.

The Company intends to grant the following Options to current and proposed Directors, subject to Admission:

Option holder | Number of existing options held | Number of Options to be granted on Admission | Exercise price | Exercisable from | Exercisable to |

Hamish Harris | Nil | 23,463,326 | Placing Price | Admission | 3 years from Admission |

Ryan Dolder | Nil | 2,932,915 | Placing Price | Admission | 3 years from Admission |

David Tink | Nil | 2,932,915 | Placing Price | Admission | 3 years from Admission |

Sheldon James Modeland | Nil | 2,932,915 | Placing Price | Admission | 3 years from Admission |

Total | Nil | 32,262,071 |

|

|

|

Further details of the Options are set out in paragraph 5 of Part VII of this document.

Warrants

As at the Latest Practicable Date, the Company has warrants in issue in respect of 2,585,578 Ordinary Shares, exercisable until 12 March 2026.

In addition, on Admission:

• Cairn will be granted 5,865,831 Warrants, exercisable at the Placing Price.

• Clear Capital will be granted 140,000,000 Warrants, exercisable at the Placing Price.

Further details of the Warrants are set out in paragraph 5.4 of Part VII of this document.

21. EBT Scheme

The Directors recognise the importance of the role that staff play in contributing to the Company's overall success and the importance of the Company's ability to incentivise and motivate its current and future people. Therefore, the Directors believe that certain directors and employees should be given the opportunity to participate and take a financial interest in the success of the Company. In order to facilitate this, the Company intends to implement a long-term incentive plan ("LTIP"). The LTIP will aim to incentivise officers and employees through the award of Ordinary Shares at such times and in such quantities as may be recommended by the Company from time to time (subject to the approval of the Remuneration Committee). It is expected that Ordinary Shares under the plan will not exceed 10 per cent. of the Company's issued share capital from time to time.

In order to implement the use of a future LTIP, the Company intends to establish an employee benefit trust called the Richmond Hill Employee Benefit Trust ("EBT"). The EBT will be a discretionary trust for the benefit of directors and employees of the Company and its subsidiaries. Pursuant to an agreement to be entered into between the trustee of the EBT and the Company, the Company shall issue and allot Ordinary Shares from time to time to the EBT to be awarded to eligible employees and directors of the Company pursuant to the terms of the LTIP and for such other purposes relating to the ongoing recruitment, retention and incentivisation of employees as may be recommended by the Company from time to time (subject to the approval of the Remuneration Committee). It is expected that Ordinary Shares held in the EBT from time to time shall not exceed 10 per cent. of the Company's issued share capital from time to time.

22. Dividend Policy

The Directors do not intend to commence the payment of dividends in the immediate future. They consider that it is likely to be more prudent to retain cash generated to fund the expansion of the Group. They will reconsider the Company's dividend policy from time to time. The declaration and payment by the Company of any dividends depends on the results of the Group's operations, its financial condition, cash requirements, future prospects, profits available for distribution and other factors deemed to be relevant at the time.

23. Taxation

Information regarding certain taxation considerations for corporate, individual and trustee Shareholders in the United Kingdom with regard to Admission is set out in paragraph 20 of Part VII (Additional Information) of this document.

24. Applicability of the Takeover Code

The Takeover Code applies to the Company. Under Rule 9 of the Takeover Code, any person who acquires an interest in shares which, taken together with shares in which that person or any person acting in concert with that person is interested, carry 30% or more of the voting rights of a company which is subject to the Takeover Code is normally required to make an offer to all the remaining shareholders to acquire their shares.

Similarly, when any person, together with persons acting in concert with that person, is interested in shares which in the aggregate carry not less than 30% of the voting rights of such a company but does not hold shares carrying more than 50% of the voting rights of the company, an offer will normally be required if such person or any person acting in concert with that person acquires a further interest in shares which increases the percentage of shares carrying voting rights in which that person is interested.

An offer under Rule 9 must be made in cash at the highest price paid by the person required to make the offer, or any person acting in concert with such person, for any interest in shares of the company during the 12 months prior to the announcement of the offer.

Under Note 1 of the Notes on the Dispensations from Rule 9 of the Takeover Code, the Panel may waive the requirement for a mandatory offer to be made in accordance with Rule 9 of the Takeover Code if, inter alia, the shareholders of the Company who are independent of the person who would otherwise be required to make an offer, and any person acting in concert with him, pass an ordinary resolution on a poll at a general meeting or by way of a written resolution approving such a waiver.

The Panel has agreed, subject to the passing of the Rule 9 Waiver Resolution by Independent Shareholders on a poll at the General Meeting, to waive the requirement under Rule 9 of the Takeover Code for the Concert Party, collectively and/or individually, to make a mandatory offer for the Ordinary Shares not already owned by them or persons connected with them as would otherwise arise as a result of the issue to them of the Consideration Shares details of which are set out within this document.

To be passed, the Rule 9 Waiver Resolution will require a simple majority of the votes cast on a poll by the Independent Shareholders. For the avoidance of doubt, the Rule 9 Waiver applies only in respect of increases in shareholdings of the Concert Party resulting from the issue to them of the Consideration Shares to which they are entitled, details of which are set out below. If the Resolutions are passed, the Concert Party will not be restricted from making an offer for the Company.

The Company has agreed with the Panel that the following persons are acting in concert in relation to the Company: (1) Ulvestone, (2) Veandercross and (3) James Ikin.

Following Admission, the members of the Concert Party will be interested in 315,467,509 Ordinary Shares, representing 53.78% of the voting rights of the Company.

Concert Party Member | Number of Ordinary Shares currently held | Ordinary Shares held as a percent of the Existing Ordinary Shares (%) | Number of Ordinary Shares held on Admission | Ordinary Shares held as a percent of the Enlarged Share Capital1 (%) |

James Ikin | - | - | - | - |

Veandercross (UK) Limited | 467,509 | 0.45% | 467,509 | 0.08% |

Ulvestone Ltd | - | - | 315,000,000 | 53.70% |

Total | 467,509 | 0.45% | 315,467,509 | 53.78% |

1 excludes the Retail Offer Shares

Following Admission, the members of the Concert Party will hold shares carrying more than 50% of the voting rights of the Company and (for so long as they continue to be acting in concert) may accordingly increase their aggregate interests in shares without incurring any obligation to make an offer under Rule 9, although individual members of the Concert Party will not be able to increase their percentage interests in shares through or between a Rule 9 threshold without Panel consent.

Further information on the provisions of the Takeover Code and the Concert Party is set out in Part VI and paragraph 18 of Part VII of this document.

25. Admission, Settlement and Dealings

If all of the Resolutions are passed at the General Meeting, application will be made to the London Stock Exchange for the Ordinary Shares to be admitted to trading on AIM. It is expected that Admission will become effective and dealings will commence in the Ordinary Shares at 8.00 a.m. on 15 October 2025. No application has or will be made for the Ordinary Shares to be admitted to trading or to be listed on any other stock exchange.

No application has or will be made for the Options or Warrants to be admitted to trading or to be listed on any other stock exchange and a register of holders of Warrants will be maintained by the Registrar. Upon exercise of an Option or a Warrant, a holder will be issued new Ordinary Shares which the Company will procure to be admitted to trading on AIM. Further details of the Options and Warrants are set out in paragraph 20 of Part I and in paragraph 5 respectively of Part VII of this document.

The above-mentioned dates and times may be changed without further notice.

The Ordinary Shares are in registered form and are capable of being held in either certi?cated or uncerti?cated form (i.e. in CREST).

Cairn has been appointed as the Company's nominated adviser in relation to the Admission and Clear Capital has been appointed as the Company's Broker in relation to the Admission. Winterflood Securities has been appointed in relation to the Retail Offer.

26. CREST

CREST is a paperless settlement system enabling securities to be evidenced otherwise than by a certi?cate and transferred otherwise than by written instrument in accordance with the CREST Regulations.

The Ordinary Shares will be eligible for CREST settlement. Accordingly, following Admission, settlement of transactions in the Ordinary Shares may take place within the CREST system if a Shareholder so wishes. CREST is a voluntary system and Shareholders who wish to receive and retain share certi?cates are able to do so.

For more information concerning CREST, Shareholders should contact their stockbroker or Euroclear UK & International Limited at 33 Cannon Street, London, EC4M 5SB or by telephone on +44 (0) 20 7849 0000.

27. Risk Factors and Additional Information

Your attention is drawn to the additional information set out in Parts II to VII (inclusive) of this document. You are recommended to read all the information contained in this document and not just rely on the key or summarised information. In particular, prospective investors should read in full the Risk Factors set out in Part II of this document.

The technical information contained in this document has been reviewed and approved by the Competent Person insofar as it relates to the contents of their Competent Person's Report. The Competent Person has consented to the inclusion of the technical information in this document relating to their Competent Person's Report in the form and context in which it appears.

28. Extraction of information from the Competent Person's Report

This Part I contains cross-references to information contained in the Competent Person's Report set out in Part V of this document. The Company con?rms that such information has been accurately reproduced and that so far as the Company is aware and is able to ascertain from the Competent Person's Report, no facts have been omitted which would render such extracts inaccurate or misleading. The Competent Person has reviewed the information contained in this document which relates to information contained in their Competent Person's Report and has con?rmed in writing to the Company and Cairn that the information presented is accurate, balanced and complete and not inconsistent with the Competent Person's Report from which such information has been extracted.

29. Notice of General Meeting

The Proposals are conditional upon, amongst other things, Shareholder approval being obtained at the General Meeting.

Set out at the end of this Admission Document is a notice convening the General Meeting to be held on 13 October 2025 at 11:00 a.m., at which the Resolutions will be proposed.

In accordance with the Takeover Code, Resolution 3 will be the subject of a poll of Independent Shareholders. To be passed, Resolution 3 will require a simple majority of votes entitled to be cast to vote in favour. None of the members of the Concert Party (nor any adviser connected with them) nor any subscriber in the Placing (if they are an existing Shareholder) are permitted to exercise their voting rights in respect of Resolution 3.

The notice convening the General Meeting, to be held at The Broadgate Tower, 20 Primrose Street, London EC2A 2EW at 11:00 a.m. on 13 October 2025 to consider the Resolutions, is set out at the end of this document. A summary of the Resolutions is set out below:

• Resolution 1, which will be proposed as an ordinary resolution, and is subject to and conditional upon the passing of Resolutions 2 and 3, that the Disposal is approved;

• Resolution 2, which will be proposed as an ordinary resolution, and is subject to and conditional upon the passing of Resolutions 1 and 3, that the Acquisition is approved;

• Resolution 3, which will be proposed as an ordinary resolution and is subject to and conditional upon the passing of Resolutions 1 and 2, that the Rule 9 Waiver is approved;