DJ Alina Holdings PLC: 2025 Interim Results

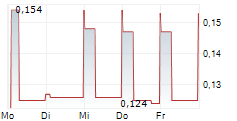

Alina Holdings PLC (ALNA)

Alina Holdings PLC: 2025 Interim Results

29-Sep-2025 / 07:30 GMT/BST

=----------------------------------------------------------------------------------------------------------------------

Alina Holdings PLC

Alina Holdings PLC

(Reuters: ALNA.L, Bloomberg: ALNA:LN)

("Alina" or the "Company")

Interim Results for the period ended 30 June 2025

The Company is pleased to announce its results for the six months ended 30 June 2025. The interim results have been

submitted to the FCA and will shortly be available on the Company's website: www.alina-holdings.com

Highlights for the 6 months ended 30 June 2025

GROUP RESULTS 1H 2025 versus 1H 2024

Group Net Profit / (Loss) for the period - GBP000 (GBP264) vs GBP348

Group Earnings / (Loss) Per Share (both basic and diluted)*1 (1.16p) vs 1.53p

Reported Book value per share*2 19.3p vs 23.4p

Net Cash - GBP000 GBP516 vs GBP1,415

Available for sale financial assets - GBP000 GBP1,683 vs GBP1,675

*1 based on weighted average number of shares in issue of 22,697,397 (1H24: 22,697,397)

*2 based on actual number of shares in issue as at 30 June 2025 of 22,697,397

Chairman's Statement

Summary of key political economic and stock market events year to date

The year to date (January to August 2025) has seen major political changes, economic shifts, and volatile stock market activity influenced by elections, trade policy, central bank maneuvers, and regional conflicts.

Key Political Events

-- U.S. Presidential Transition: Donald Trump was inaugurated as the 47th U.S. President on January 20, reigniting the

"America First" agenda, shifting global alliances, and sparking major protests across the U.S. -- Major Elections Worldwide: 2025 saw pivotal elections in Australia, Singapore, South Korea, Romania, Poland, Japan,

and other key nations, altering domestic and regional policy direction. -- European Security and Ukraine: The Trump administration proposed a controversial peace plan for Ukraine, with

discussions of territorial concessions and reduced NATO involvement; peace talks with Russia moved forward under

this new U.S. stance. -- Leadership Changes and Early Elections: High-profile resignations (such as Justin Trudeau in Canada), parliamentary

dissolutions, and early elections across Europe and the Asia-Pacific increased political uncertainty. -- Ongoing Geopolitical Tensions: Challenges around Israel-Hamas, the South China Sea, and U.S.-China rivalry

persisted, with summits and international conferences such as the AI Action Summit and Munich Security Conference

focusing on global security and technology risks.

Economic Headlines

-- Trade Policy and Tariffs: The new U.S. administration negotiated new deals with Vietnam, Japan, and the EU,

imposing tariffs that are higher than pre-2025 rates but lower than feared. Uncertainty around tariffs on Canada

and the EU contributed to volatility, though markets were initially relieved by avoidance of an all-out trade war. -- Central Bank Policy: U.S. Federal Reserve Chair Jerome Powell signaled a likely interest rate cut in September

(down from 4.25% to 4.5%), responding to persistent inflation and a softening labor market. This boosted equity and

bond markets in August. -- Inflation and Labor Markets: Inflation remains stubbornly above 2% in the U.S. and is expected to rise modestly

before stabilizing. The U.S. unemployment rate has nudged up to 4.2%, with both supply and demand for labor

weakening.

Stock Market Developments

-- Market Performance: Global developed market equities rose 1.3% in July, setting new all-time highs. Cyclical and

tech stocks led early gains, while large-cap and rate-sensitive sectors surged after dovish Fed comments in August. -- Sector Highlights: Real estate, industrials, and consumer discretionary stocks rallied post-Fed policy signals,

with U.S. mega-caps posting strong earnings. However, the Nasdaq weakened in late August amid concerns over AI

infrastructure spending. -- Bond Yields and Rate Cut Expectations: U.S. bond yields fell after the Jackson Hole summit, reflecting increased

expectations for multiple rate cuts by year end.

Ongoing Risks & Flashpoints

-- Protests and Domestic Unrest: Intense protests in the U.S. over immigration, climate, and civil rights followed the

political shift, while other countries, such as Kenya and Germany, saw social dissent and government changes. -- Regional Conflicts and Anniversaries: Continued conflict in Gaza, Russian activity in Ukraine, and expected

flashpoints like the Israel-Hamas War anniversary keep geopolitical risk elevated.

Conclusion, 2025 has been defined by political realignment, moderate economic growth countered by inflation, active central bank intervention, and a stock market marked by both record highs and high uncertainty.

Operations

Real Estate

Hastings

As previously mentioned, the Company's Hastings property has now been internally sanitised and we are actively seeking a new cornerstone tenant.

I am pleased to report that we have finally reached (at this stage verbal) settlement terms with a former tenant that vacated the premises without fulfilling their contractual obligations to return the property 'fully repaired', and in the condition they had received it.

Bristol

I am also pleased to report that we have received initial purchase offers for the Company's Bristol property on competitive terms. We will keep the Market informed upon sale completion, which we anticipate could happen within the next couple of months.

Miscellaneous

The Company now owns 6.6 million shares of Thalassa Holdings and has committed to purchase more from the proceeds of future property sales. These shares will in due course be distributed, partially or in full, to shareholders on a pro-rata basis.

Duncan Soukup

Chairman

Alina Holdings plc

26 September 2025

Financial Review

Total income for the 1H 2025 period was GBP121k (1H 2024: GBP503k).

Gross Rental Income declined by 6% to GBP109k from GBP116k as at 30 June 2024 due to the sale of Stafford in October 2024.

Cost of sales increased from GBP21k to GBP91k, driven by a service charge credit of GBP132k at Hastings within Property operating expenses in 1H24. The credit related to service charges at vacant units for required work which had been invoiced in 2022 and 2023. As the work has not yet been done, the property management company had to refund this to units that had paid, including Nos 4 Limited's vacant units.

During the period under review Book Value decreased 5.9% to 19.3p/shr from 20.5p/shr as at 31 December 2024.

Responsibility Statement

We confirm that to the best of our knowledge:

a. the condensed set of financial statements has been prepared in accordance with IAS 34 'Interim Financial Reporting'

and gives a true and fair view of the assets, liabilities, financial position and profit or loss of the Company and

the undertakings included in the consolidation as a whole as required by DTR 4.2.4 R; b. the interim management report includes a fair review of the information required by DTR 4.2.7R (indication of

important events during the first six months and description of principal risks and uncertainties for the remaining

six months of the year); and c. the interim management report includes a fair review of the information required by DTR 4.2.8R (disclosure of

related parties' transactions and changes therein).

Cautionary statement

This Interim Management Report (IMR) has been prepared solely to provide additional information to shareholders to assess the Company's strategies and the potential for those strategies to succeed. The IMR should not be relied on by any other party or for any other purpose.

Duncan Soukup

Chairman

Alina Holdings plc

26 September 2025

Interim Condensed Consolidated Statement of Income

For the six months ended 30 June 2025

Six months Six months Year

ended ended ended

30 Jun 25 30 Jun 24 31 Dec 24

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

Gross rental income 109 116 232

Net gains/(losses) on investments at fair value 45 375 46

Interest income 11 12 30

Dividend income - 3 10

Profit/(Loss) on disposal of investment properties - - 2

Currency losses (44) (3) 1

Total Income 121 503 321

Property operating expenses (89) (14) (139)

Financial holdings expenses (2) (7) (10)

Total Cost of Sales (91) (21) (149)

Gross profit 30 482 172

Administrative expenses including non-recurring items (282) (321) (693)

Gain from change in fair value of investment properties - 200 200

Operating loss before net financing costs (252) 361 (321)

Depreciation (1) (2) (3)

Net financial income/(expense) (11) (11) (22)

Share of profits/(losses) of associated entities - - 19

Loss before tax (264) 348 (327)

Taxation - - -

Profit/(loss) for the year from continuing operations (264) 348 (327)

Attributable to:

Equity shareholders of the parent (264) 348 (327)

(264) 348 (327)

Earnings per share - GBP- pence (using weighted average

number of shares)

Basic and Diluted 3 (1.16) 1.53 (1.44)

The notes on pages 14 to 17 form an integral part of this consolidated interim financial information.

Interim Condensed Consolidated Statement of Comprehensive Income

For the six months ended 30 June 2025

Six months Six months Year

ended ended ended

30 Jun 25 30 Jun 24 31 Dec 24

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Profit/(loss) for the financial year (264) 348 (327)

Total comprehensive income (264) 348 (327)

Attributable to:

Equity shareholders of the parent (264) 348 (327)

Total Comprehensive income (264) 348 (327)

The notes on pages 14 to 17 form an integral part of this consolidated interim financial information

Interim Condensed Consolidated Statement of Financial Position

As at 30 June 2025

As at As at As at

30 Jun 25 30 Jun 24 31 Dec 24

Note Unaudited Unaudited Audited

Assets GBP'000 GBP'000 GBP'000

Non-current assets

Investment properties 4 315 2,569 317

Investments in associated entities 36 17 1,686

Total non-current assets 351 2,586 2,003

Current assets

Trade and other receivables 382 423 353

Investments at fair value through profit and loss 5 1,683 1,675 -

Investment properties held for sale 2,238 130 2,238

Cash and cash equivalents 516 1,415 850

Total current assets 4,819 3,643 3,441

Total assets 5,170 6,229 5,444

Liabilities

Current liabilities

Trade and other payables 477 584 487

Total current liabilities 477 584 487

Finance lease liabilities 6 310 323 310

Total non-current liabilities 310 323 310

Total liabilities 787 907 797

Net assets 4,383 5,322 4,647

Shareholders' Equity

Share capital 9 319 319 319

Capital redemption reserve 598 598 598

Retained earnings 3,466 4,405 3,730

Total shareholders' equity 4,383 5,322 4,647

Total equity 4,383 5,322 4,647

The notes on pages 14 to 17 form an integral part of this consolidated interim financial information.

These financial statements were approved by the board on 26 September 2025.

Signed on behalf of the board by:

Duncan Soukup

Interim Condensed Consolidated Statement of Cash Flows

For the six months ended 30 June 2025

As at As at As at

30 Jun 25 30 Jun 24 31 Dec 24

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Profit/(Loss) for the year before financing (252) 361 (321)

Gain from change in fair value of investment properties - (200) (200)

Finance costs 32 (11) -

Disposals - - 1

(Profit)/Loss from change in fair value of head leases - - (14)

(Profit)/Loss on disposal of investment properties - - (2)

Decrease/(Increase) in trade and other receivables (29) (56) 13

(Decrease)/Increase in trade and other payables (10) (134) (229)

Gain/(loss) on foreign exchange (44) (3) 2

Lease liability interest (11) (11) (23)

Depreciation 2 2 3

Fair value movement on portfolio investments (33) 198 -

(Profit)/Loss from change in fair value of investments held for sale (12) (573) (43)

Cash generated by operations (357) (427) (813)

Taxation - - -

Net cash flow from operating activities (357) (427) (813)

Net (purchase)/sale of portfolio investments 12 713 2,056

Net (purchase)/sale of associate investments - - (1,650)

Net Proceeds from sale of investment properties - - 132

Net cash flow in investing activities 12 713 538

Cash flows from financing activities

Interest received 11 12 -

(Increase)/reduction on head lease liabilities - - 8

Net cash flow from financing activities 11 12 8

Net increase in cash and cash equivalents (334) 298 (267)

Cash and cash equivalents at the start of the year 850 1,117 1,117

Cash and cash equivalents at the end of the year 516 1,415 850

The notes on pages 14 to 17 form an integral part of this consolidated interim financial information.

Interim Condensed Consolidated Statement of Changes in Equity

For the six months ended 30 June 2025

Capital

Share redemption Retained

Capital reserve Earnings Total

GBP'000 GBP'000 GBP'000 GBP'000

Balance as at 31 December 2023 319 598 4,057 4,974

Total comprehensive income for the year - - 348 348

Balance as at 30 June 2024 319 598 4,405 5,322

Total comprehensive income for the year - - (675) (675)

Balance as at 31 December 2024 319 598 3,730 4,647

Total comprehensive income for the year - - (264) (264)

Balance as at 30 June 2025 319 598 3,466 4,383

The notes on pages 14 to 17 form an integral part of this consolidated interim financial information.

Notes to the Interim Condensed Consolidated Financial Information

1. General information

Alina Holdings PLC ("Alina" or the "Company") is a company registered on the Main Market of the London Stock Exchange.

2. Significant Accounting policies

The Group prepares its accounts in accordance with applicable UK Adopted International Accounting Standards (IFRSs).

The accounting policies applied by the Company in this unaudited consolidated interim financial information are the same as those applied by the Company in its consolidated financial statements as at and for the period ended 31 December 2024 except as detailed below.

The financial information has been prepared under the historical cost convention, as modified by the accounting standard for financial instruments at fair value.

Estimates

There are no changes to the estimates since last reporting period.

Segmental reporting

IFRS 8 requires operating segments to be identified on the basis of internal reports that are regularly reported to the chief operating decision maker to allocate resources to the segments and to assess their performance. The Group's reportable segments under IFRS 8 are: a portfolio of UK property; and other investment assets, which are reported to the Board of directors on a quarterly basis. The Board of directors is considered to be the chief operating decision maker.

2.1. Basis of preparation

The condensed consolidated interim financial information for the six months ended 30 June 2025 has been prepared in accordance with International Accounting Standard No. 34, 'Interim Financial Reporting'. They do not include all of the information required for full annual financial statements and should be read in conjunction with the consolidated financial statements of the Company as at and for the year ended 31 December 2024. Prior year comparatives have been reclassified to conform to current year presentation.

These condensed interim financial statements for the six months ended 30 June 2025 and 30 June 2024 are unaudited and do not constitute full accounts. The comparative figures for the period ended 31 December 2024 are extracted from the 2024 audited financial statements. The independent auditor's report on the 2024 financial statements was not qualified.

All intra-group transactions, balances, income and expenses are eliminated in full on consolidation.

2.2. Going concern

The financial information has been prepared on the going concern basis as management consider that the Group has sufficient cash to fund its current commitments for the foreseeable future.

3. Earnings per share

Six months Six months Year

ended ended ended

30 Jun 25 30 Jun 24 31 Dec 24

Unaudited Unaudited Audited

The calculation of earnings per share is based on the following loss and

number of shares:

Profit/(loss) for the period (GBP'000) (264) 348 (327)

Weighted average number of shares of the Company ('000) 22,697 22,697 22,697

Earnings per share:

Basic and Diluted (GBP - pence) (1.16) 1.53 (1.44)

Number of shares outstanding at the period end: 22,697,397 22,697,397 22,697,397

Notes to the Interim Condensed Consolidated Financial Information Continued

4. Investment Properties

Leasehold Investment

Investment Properties

Properties Held for sale Total

GBP000 GBP000 GBP000

At 31 December 2023 2,371 130 2,501

Depreciation - head leases (2) - (2)

Fair value adjustment - property 200 - 200

At 30 June 2024 2,569 130 2,699

Depreciation - head leases (1) - (1)

Sale of property (13) (130) (143)

Reclassification of property held for sale (2,238) 2,238 -

At 31 December 2024 317 2,238 2,555

Depreciation - head leases (2) - (2)

At 30 June 2025 315 2,238 2,553

As at As at As at

30 Jun 25 30 Jun 24 31 Dec 24

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Portfolio valuation - 2,238 2,238

Investment Properties held for sale - - (2,238)

Head leases treated as investment properties per IFRS 16 315 331 317

Total per Balance Sheet 315 2,569 317

5. Investment Holdings

The Group classifies the following financial assets at fair value through profit or loss (FVPL):

Equity investments that are held for trading

As at As at As at

30 Jun 25 30 Jun 24 31 Dec 24

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Securities investments

At the beginning of the period - 2,013 2,013

Additions 11 848 1,021

Reclassification of associate 1,650 - -

Unrealised gain/(losses) 42 371 43

Disposals (20) (1,557) (3,077)

1,683 1,675 -

The reclassification is from investment in associates, as referred to in the "Miscellaneous" section of the Chairman's Report.

Investments have been valued incorporating Level 1 inputs in accordance with IFRS7. They are a combination of cash and securities held with the listed broker.

Financial instruments require classification of fair value as determined by reference to the source of inputs used to derive the fair value. This classification uses the following three-level hierarchy:

Level 1 - quoted prices (unadjusted) in active markets for identical assets or liabilities;

Level 2 - inputs other than quoted prices included within level 1 that are observable for the asset or liability, either directly (i.e., as prices) or indirectly (i.e., derived from prices);

Level 3 - inputs for the asset or liability that are not based on observable market data (unobservable inputs). Notes to the Interim Condensed Consolidated Financial Information Continued

6. Lease liabilities

Minimum

Finance lease liabilities on head rents are payable as follows: Lease

Payment Interest Principal

GBP000 GBP000 GBP000

At 30 June 2024 2,973 (2,626) 347

Movement in value (11) 11 -

Sale of property - lease disposal (83) 68 (15)

At 31 December 2024 2,879 (2,547) 332

Movement in value (11) 11 -

At 30 June 2025 2,868 (2,536) 332

Short term liabilities 23 - 23

Long term liabilities 2,950 (2,626) 324

At 30 June 2024 2,973 (2,626) 347

Short term liabilities 22 - 22

Long term liabilities 2,857 (2,547) 310

At 31 December 2024 2,879 (2,547) 332

Short term liabilities 22 - 22

Long term liabilities 2,846 (2,536) 310

At 30 June 2025 2,868 (2,536) 332

In the above table, interest represents the difference between the carrying amount and the contractual liability/ cash flow. All leases expire in more than five years.

7. Taxation

The tax charge for the period under review was nil (1H 2024: nil). The Group has substantial carried forward trading losses and capital losses available. Accordingly, no provision for corporation tax has been made in these accounts.

It is not anticipated that sufficient profits from the residual business will be generated in the foreseeable future to utilise the losses carried forward, therefore no asset for unrelieved tax losses has been recognised in these accounts. Unrelieved tax losses and other deferred tax assets are recognised only to the extent that is it probable that they will be recovered against the reversal of deferred tax liabilities or other future taxable profits.

Notes to the Interim Condensed Consolidated Financial Information Continued

8. Related party balances and transactions

As at the period end the Group owed GBP47,456 (December 2024: GBP49,703, June 2024: GBP44,380) to Thalassa Holdings Limited ("Thalassa"), a company under common directorship. The balance relates to administration fees, accounting and registered office services supplied to the Group by Thalassa at cost. The total amount is treated as an unsecured, interest free loan made repayable on demand.

During the period the Group accrued GBP58,869 (December 2024: GBP125,791 plus GBP54,728 expenses, June 2024: GBP64,712) for consultancy and administrative services provided to the Group by a company, Fleur De Lys, in which the Chairman has a beneficial interest. The balance owed by the Group at the period end date was GBP37,629 including expenses (December 2024: GBP54,728, June 2024: GBP37,076).

Athenium Consultancy Ltd, a company in which the Group owns shares invoiced the group for financial and corporate administration services totalling GBP90,750 for the period (December 2024: GBP181,500, June 2024: GBP90,750).

9. Share capital

As at As at As at

30 Jun 25 30 Jun 24 31 Dec 24

Unaudited Unaudited Audited

GBP GBP GBP

Allotted, issued and fully paid:

22,697,397 ordinary shares of GBP0.01 each 226,970 226,970 226,970

9,164,017 treasury shares of GBP0.01 each 91,640 91,640 91,640

Total Share Capital 318,610 318,610 318,610

During the year to 30 September 2019, the Company underwent a Court approved restructure of capital and buy back of shares. Under this action the issued 20p shares were converted to 1p; capital reserves were transferred to distributable reserves; 59,808,456 shares were repurchased, and a new Capital Redemption Reserve of GBP0.598m was established.

Investment in Own Shares

At the year-end, 9,164,017 shares were held in treasury (June 2024: 9,164,017), and at the date of this report 9,164,017 were held in treasury.

10. Subsequent events

There were no subsequent events.

11. Copies of the Interim Report

The interim report is available on the Company's website: www.alina-holdings.com.

END

Investor Enquiries: enquiries@alina-holdings.com Alina Holdings PLC

www.alina-holdings.com

-----------------------------------------------------------------------------------------------------------------------

Dissemination of a Regulatory Announcement that contains inside information in accordance with the Market Abuse Regulation (MAR), transmitted by EQS Group. The issuer is solely responsible for the content of this announcement.

-----------------------------------------------------------------------------------------------------------------------

ISIN: GB00B1VS7G47 Category Code: IR TIDM: ALNA LEI Code: 213800SOAIB9JVCV4D57 Sequence No.: 403415 EQS News ID: 2204620 End of Announcement EQS News Service =------------------------------------------------------------------------------------

Image link: https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=2204620&application_name=news&site_id=dow_jones%7e%7e%7ebed8b539-0373-42bd-8d0e-f3efeec9bbed

(END) Dow Jones Newswires

September 29, 2025 02:30 ET (06:30 GMT)