Posti Group Corporation Stock exchange release 29 September 2025 at 9.45 p.m. EEST

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES, AUSTRALIA, CANADA, HONG KONG, JAPAN, NEW ZEALAND, SINGAPORE OR SOUTH AFRICA OR ANY OTHER JURISDICTION IN WHICH THE RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL.

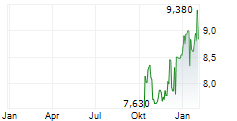

Posti Group Corporation ("Posti") has today submitted a listing application with Nasdaq Helsinki Ltd ("Nasdaq Helsinki") to list Posti's shares first on the prelist and then on the Official List of Nasdaq Helsinki. Trading in Posti's shares is expected to commence on the prelist of Nasdaq Helsinki on or about 10 October 2025 and on the Official List of Nasdaq Helsinki on or about 14 October 2025 under the trading code "POSTI".

Posti announced on 19 September 2025 that it is planning a listing on the Official List of Nasdaq Helsinki. The subscription period for the offering will commence tomorrow, on 30 September 2025 at 10:00 a.m. EEST.

For further information, please contact

Timo Karppinen, Chief Financial Officer, tel. +358 50 356 6405

Important information

This release is not being made in and copies of it may not be distributed or sent into the United States, Australia, Canada, Hong Kong, Japan, New Zealand, Singapore, South Africa or any other jurisdiction in which the distribution or release would be unlawful.

The securities referred to herein may not be sold in the United States absent registration or an exemption from registration under the U.S. Securities Act of 1933, as amended. The Company does not intend to register any of the securities in the United States or to conduct a public offering of the securities in the United States.

The issue, purchase or sale of securities in the Offering are subject to specific legal or regulatory restrictions in certain jurisdictions. The Company and the Managers assume no responsibility in the event there is a violation by any person of such restrictions.

This release is not an offer to sell or a solicitation of any offer to buy any securities issued by the Company in any jurisdiction where such offer or sale would be unlawful. The distribution of this release may be restricted by law in certain jurisdictions and persons into whose possession any document or other information referred to herein comes should inform themselves about and observe any such restriction. Any failure to comply with these restrictions may constitute a violation of the securities laws of any such jurisdiction.

In any EEA Member State other than Finland and in the United Kingdom, this release is only addressed to and is only directed at qualified investors in that Member State within the meaning of Regulation (EU) 2017/1129 ("Prospectus Regulation") and Regulation (EU) 2017/1129 as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018.

This release does not constitute an offer of securities to the public in the United Kingdom. No prospectus has been or will be approved in the United Kingdom in respect of the securities referred to herein. In the United Kingdom, this release is being distributed to and is directed only at persons (i) who have professional experience in matters relating to investments within the meaning of Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended, the "Order"), (ii) who are high net worth entities falling within Article 49(2)(a) to (d) of the Order or (iii) to whom this release may otherwise lawfully be communicated (all such persons together being referred to as "Relevant Persons"). Any investments or investment activity to which this release relates will only be available to, and will only be engaged with, Relevant Persons. Any person who is not a Relevant Person should not act or rely on this release or any of its contents.

Any potential offering of the securities referred to in this release will be made by means of a prospectus. This release is not a prospectus as set out in the Prospectus Regulation. Investors should not subscribe for or purchase any securities referred to in this release except on the basis of information contained in the aforementioned prospectus.

The information contained in this release is for background purposes only and does not purport to be full or complete. No reliance may be placed by any person for any purpose on the information contained in this release or its accuracy, fairness or completeness. The information in this release is subject to change.

This release is for information purposes only and under no circumstances shall constitute an offer or invitation, or form the basis for a decision, to invest in any securities of the Company. Each of the Managers is acting exclusively for the Company and the selling shareholder and no one else in connection with the Offering. They will not regard any other person as their respective clients in relation to the Offering and will not be responsible to any other person for providing the protections afforded to their respective clients, nor for providing advice in relation to the Offering, the contents of this release or any transaction, arrangement or other matter referred to herein.

The contents of this release have been prepared by, and are the sole responsibility of, the Company. None of the Managers or any of their respective directors, officers, employees, advisers or agents accepts any responsibility or liability whatsoever for or makes any representation or warranty, express or implied, as to the completeness, accuracy or truthfulness of the information in this release (or whether any information has been omitted from this release) or any other information relating to the Company, its subsidiaries or associated companies, whether written, oral or in a visual or electronic form, and howsoever transmitted or made available or for any loss howsoever arising from any use of this release or its contents or otherwise arising in connection therewith.

Forward-looking statements

Matters discussed in this release may constitute forward-looking statements. Forward-looking statements are statements that are not historical facts and may be identified by words such as "believe", "expect", "anticipate", "intend", "may", "plan", "estimate", "will", "should", "could", "aim" or "might", or, in each case, their negative, or similar expressions. The forward-looking statements in this release are based upon various assumptions, many of which are based, in turn, upon further assumptions. Although the Company believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurances that they will materialize or prove to be correct. Because these forward-looking statements are based on assumptions or estimates and are subject to risks and uncertainties, the actual results or outcome could differ materially from those set out in the forward-looking statements as a result of many factors. The Company does not guarantee that the assumptions underlying the forward-looking statements in this release are free from errors nor does it accept any responsibility for the future accuracy of the opinions expressed in this release or any obligation to update or revise the statements in this release to reflect subsequent events or circumstances. Readers are advised to view the forward-looking statements contained in this release with caution. The forward-looking statements contained in this release are based on the views and assumptions of the Company's management and the facts known by the Company's management as at the date of the release and are subject to change without notice. The Company does not undertake any obligation to review, update, confirm or release publicly any forward-looking statements to reflect events that occur or circumstances that arise in relation to the content of this release.

Information to Distributors

Solely for the purposes of the product governance requirements contained within: (a) EU Directive 2014/65/EU on markets in financial instruments, as amended ("MiFID II"); (b) Articles 9 and 10 of Commission Delegated Directive (EU) 2017/593 supplementing MiFID II; and (c) local implementing measures (together the "MiFID II Product Governance Requirements"), and disclaiming all and any liability, whether arising in tort, contract or otherwise, which any "manufacturer" (for the purposes of the MiFID II Product Governance Requirements) may otherwise have with respect thereto, the shares have been subject to a product approval process, which has determined that the shares are: (i) compatible with an end target market of retail investors and investors who meet the criteria of professional clients and eligible counterparties, each as defined in MiFID II (the "Target Market Assessment"); and (ii) eligible for distribution through all distribution channels as are permitted by MiFID II. Notwithstanding the Target Market Assessment, distributors should note that: the price of the shares may decline and investors could lose all or part of their investment; the shares offer no guaranteed income and no capital protection; and an investment in the shares is compatible only with investors who do not need a guaranteed income or capital protection, who (either alone or in conjunction with an appropriate financial or other adviser) are capable of evaluating the merits and risks of such an investment and who have sufficient resources to be able to bear any losses that may result therefrom. The Target Market Assessment is without prejudice to the requirements of any contractual, legal or regulatory selling restrictions in relation to the Offering. For the avoidance of doubt, the Target Market Assessment does not constitute: (a) an assessment of suitability or appropriateness for the purposes of MiFID II; or (b) a recommendation to any investor or group of investors to invest in, or purchase, or take any other action whatsoever with respect to the shares. Each distributor is responsible for undertaking its own Target Market Assessment with respect to the shares and determining appropriate distribution channels.