Sitka Gold and Banyan Gold Have Renewed Exploration and Investor Interest in Intrusion Related Gold Systems in the Mayo-Keno Segment Of the YTB

Mayo Has Initiated Exploration Program at Dawn Gulch, Anderson Gold Trend

Highlights1

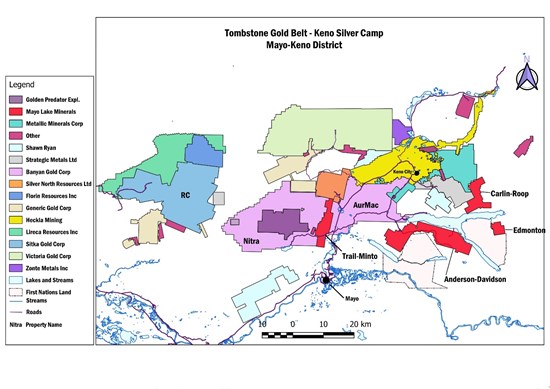

- All of Mayo's properties are located in the Mayo-Keno part of Tombstone Gold Belt / Keno Silver Camp (Figure 2), an area characterized by Intrusion Related Gold Systems, many of which are Reduced Intrusion Related Gold Systems.

- Recent exploration and development have rejuvenated the Mayo-Keno area with (i) Banyan Gold's reporting of Ind. Resources - 2.27M ounces Au (112.5M tonnes at 0.63g /t); and Inf. Resources - 5.45M oz of Au (280.5M tonnes t 0.6 g/t) with enough higher-grade ore for a starter pit at its AurMac Project; and

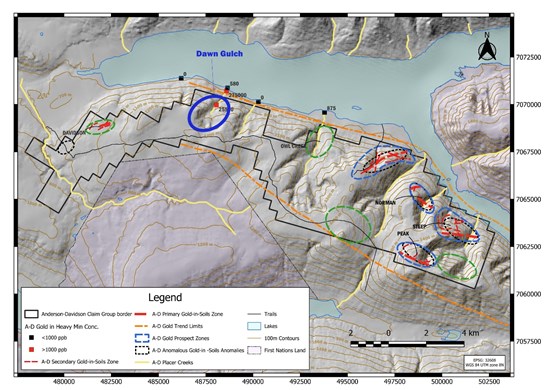

(ii) Sitka Gold's reporting of Ind. Resources - 1.29M ounces gold (39.96 tonnes of 1.01g/t) at Blackjack and Eiger; and - 1.04M ounces gold (34.60M tonnes at 0.94g/t) at Blackjack and 0.44M ounces gold (27.36M tonnes at 0.50 g/t) at Eiger. - Four drill-ready prospects in Anderson Gold Trend with over 13,300 metres of linear gold in soils anomalies will provide guidance for drilling of Intrusion Related Gold Systems (Figure 1), commonly reduced (RIRGS) in the Tombstone Gold Belt (Figure 1).

- Investor interest has returned to properties in the Mayo-Keno area with just over two to five times increases over 3 to 9 month intervals in Banyan's and Sitka's share prices and market caps, respectively.1

- Completed geochemical soils and SGH sampling programs at Dawn Gulch in the Anderson Gold Trend; focused on delineating drill targets for gold mineralization related to Intrusion Related Gold Systems

Full technical description of mines and advanced projects are given in a following section titled, "The Mayo-Keno Segment of the Tombstone Gold Belt."

Ottawa, Ontario--(Newsfile Corp. - September 30, 2025) - Dr. Vern Rampton, President and CEO of Mayo Lake Minerals Inc. (CSE: MLKM) ("Mayo" or "Company"), is pleased to announce that Truepoint Exploration of Vancouver has successfully completed the field component of Mayo Lake's soil sampling program at Dawn Gulch in the Anderson Gold Trend ("AGT") (Figure 1). Samples have been expedited to Actlabs in Whitehorse and will be forwarded to different Actlabs facilities for analyses of gold in soil and Soil Gas Hydrocarbon ("SGH"). The latter analysis is designed to provide vectors to the location of subsurface gold deposits.

Figure 1. Dawn Gulch prospect, Anderson Gold Trend and Anderson-Davidson property

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5471/268467_9ae1daa2e4d1ca46_002full.jpg

Dr. Rampton commented 1, "We are pleased that we were able to complete the exploration program at Dawn Gulch in the Anderson Gold Trend so late in the season as it follows our strategy of maximizing the drill targets available before launching a major drilling campaign.

"Recently Banyan has continued to increase the quality and quantity of its resources and move its AurMac Project forward to becoming a mine, and at the same time assembling a large land package where there is great potential for large Reduced Intrusion Related Gold Systems. Sitka is also rapidly increasing its resources and has demonstrated that there is a great deal of potential for large high-grade (+ 1g Au/t)) sheeted vein deposits for open pit development on its RC project. Mayo's properties are all well located relative to Banyan's. Airborne geophysics and historic results from soil sampling indicate that Banyan's Nitra project and Mayo's Trail-Minto property suggest that they share an Intrusion Related Gold System along a common boundary, most probably a Reduced Intrusion Related Gold System.

"Recent successes of Banyan and Sitka in advancing their projects has led to a rise in Banyan's share price of over 200 percent in 3 months and Sitka's share price of over 500 percent in about 9 months. Together with Hecla Mining's on-going silver production from its high-grade silver deposits at its Keno mines, this has caught the attention of investors and has created a better environment for financing exploration and development in the Mayo-Keno area. This will benefit all property owners within the area, including ourselves for all of Mayo Lake's projects lie in the Mayo-Keno area of Tombstone Gold Belt. One is also included in the Keno Hill Silver District. All of Mayo Lake's prospects have been identified as Intrusion Related. They have the potential for high-grade veins or low-grade sheeted veins, common to igneous intrusions, in some instances reduced igneous intrusions. Funding the drilling of deposits with similar geology to that of Banyan and Sitka's will be easier. We look forward to funding our future drilling campaigns with this new investor interest. I must remind, that although all of Mayo Lake's numerous prospects are within the Mayo-Keno segment of the Tombstone Gold Belt and have some similarities to deposits such as Banyan's AurMac's Project; and Sitka's RC deposits, I can not give any assurances that Mayo's prospects contain similar mineralization and resources to Banyan and Sitka's as defined in their N.I. 43-101 Technical Reports. The drill bit will determine the final tally."

Dr. Rampton continued, "We are confident that our late fall program at Dawn Gulch will identify a number of drill ready gold targets. Our work during the last twelve year long junior mining recession with reduced available funding, was focused on locating as many gold targets as possible. We will be able to upgrade an old bulldozer trail from the Yukon's Road network to near the eastern end of our Anderson-Davidson property as permitted under our Class 3 Work Permit with increased funding expected now. The presence of a vehicle accessible camp will be beneficial to reducing the costs of drilling programs in the Anderson Gold Trend."

Figure 2. Property Ownership in the Mayo-Keno District

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5471/268467_9ae1daa2e4d1ca46_003full.jpg

Dawn Gulch. Mayo has identified Dawn Gulch as a primary prospect for gold mineralization following an internal review of high-quality airborne magnetics as interpreted by Roman Tejada of GVX (Mayo press release (PR) dated May 29, 2012) and compelling results from previous soil and stream sediment sampling, including heavy minerals (Mayo PR dated July 241, 2014). Heavy mineral samples collected from the stream at Dawn Gulch are highly anomalous, testing up to 275,000 and 25,680 ppb Au. Additional anomalous stream sediment and surface samples throughout Dawn Gulch's drainage basin are well above background. The presence of gold placer mines along the stream at Dawn Gulch and nearby Owl Creek (Figure 1) add to the overall potential of the Dawn Gulch prospect.

Anderson Gold Trend (AGT) is a 16 by 3 km long belt characterized by gold placer creeks, including Steep, Anderson and Owl as well as a number of unnamed creeks. Eight prospects have been identified in the AGT, of which four are drill-ready through reconnaissance geochemical soil sampling and from the interpretation of high-quality airborne magnetics (Figure 1). Most of the previous work for the AGT was detailed in a Technical Report on the "Mineral Exploration and Mineral Potential of the Anderson- Davidson Claim Group, Mayo Mining district, Yukon Territory, Canada" by C. Tucker Barrie, Ph.D., P.Geo., effective October 20, 2017. (See also Mayo PR dated May 26 2022; October 25, 2022).

The airborne magnetics also point to subsurface intrusions, which are probably the gold source for the vein systems. As discussed in Barrie's Report of 2017, they are simply distal components of IRGS (Hart et al, 2002, Geology, Exploration and Discovery in the Tintina Gold Province, Alaska and Yukon; Soc. Economic Geologists, Special Publication, v. 9, pp 241274). IRGS can be characterized by high-grade vein systems and low-grade disseminated and sheeted vein systems (0.5 - 1.5± g Au/t). The character of most Au in soil anomalies indicate high-grade vein systems. Results from reverse circulation drill holes (RC) at the Anderson-Owl prospect suggest the possibility that low-grade sheeted veining was encountered there.

Four drill-ready prospects have been identified to date in the AGT.

1) Anderson-Owl - Four Zones

- A 3,000-metre zone, consisting of linear gold in soil anomalies marking gold mineralization (veins) is present. This zone is marked by gold values of up to 527 ppb Au.

- Three other zones, totalling 1,080 m in length, are marked by gold values of up to 101 ppb.

- One gold in soil anomaly has been drilled by reverse circulation. One hole assayed 0.77g Au/t over 6.1 metres, including 0.9g Au/t over 3.1 metres and a second hole 50 metres along strike assayed 0.55g Au/t over 3.1 metres. It is suspected that this represents either disseminated or sheeted veining mineralization. Notably, only a minimum width was determined as both holes were collared in mineralization.

2) Peak - Six Zones

- A 1,600-metre zone of linear gold in soil anomalies marking gold mineralization is present and marked by gold values up to 272 ppb Au. This zone is open in one direction.

- Five other zones, totalling 2,630 metres in length, are marked by gold values of up to 340 ppb.

3) Steep Creek - Six Zones

- A 1,700-metre zone of linear gold in soil anomalies marking gold mineralization is present and is marked by gold values up to 142 ppb.

- Five other zones, totalling 2,140 metres in length, are marked by gold value of up to 140 ppb.

4)Norman - Two Zones

- Nearly 1,270 metres of linear gold in soil anomalies marking gold mineralization are present and are marked by gold values up to 87 ppb Au.

Other prospects have been identified from reconnaissance soil and stream sediment sampling and airborne magnetics, Dawn Gulch included (Figure 1).

Four properties with excellent potential for Intrusive Related Gold System in the Mayo-Keno TGB.

- Anderson-Davidson (A-D) consists of 434 claims totalling 86.8 sq. km. in area. The attributes and probable relationship of gold prospects to IRGS have been expanded upon in the previous section on the Anderson Gold Trend. Davidson Creek is the site of one of the larger placer operations in the local area. Numerous anomalous stream sediment and till samples point to extensive mineralization on the uplands in its vicinity. Soil geochemical and SGH sampling has identified one highly prospective drill-ready prospect in the Davidson Creek drainage basin. The AGT has potential to become a large gold camp based on its large size and number of gold prospects. Eight prospects have been identified to date, and only one was the subject of a small scout drilling campaign. Much of the A -D remains open for new discoveries.

- Carlin-Roop lies within the Keno Silver Camp. It consists of 215 claims totalling 43.0 sq. km. in size. Most of the work completed at Carlin-Roop has been described in "Carlin-Roop, NI43-191 Technical Report, Carlin-Roop Silver Project, Mayo Lake district, Yukon-Territory, Canada" by Clinton F. Davis, P.Geo., effective date 20 Sep 2021." Latter results are described in Mayo's PR dated July 15, October 28, and December 19, 2022 and April 17, 2023. Two high grade silver zones have been defined at its western extremity, Carlin West and AJ. At Carlin West grab samples of rocks along the defined silver anomaly have assayed up to 3,994 ppm silver. Similarly at AJ, grab samples have assayed up to 412 ppm. At Carlin West, soil samples in a core area, measuring 1,450 sq. metres, all yielded results exceeding > 30g Ag/t (~ 1 oz Ag/t). "The Carlin West zone has a footprint and characteristics that match those of the Elsa Mine, which was the second largest producer in the Keno Silver Camp. (Elsa's production would have been worth US$900K at today's prices)" (Cathro, R. J., 2006; Excerpts from Great Mining Camps of Canada). In situ high grade vein material can probably be identified by relatively inexpensive trenching or shallow drilling of zones where much altered core from drill holes was lost. Trifecta Gold, drilling on land owned by Strategic Metals (Figure 2) just to north of the West Carlin prospect, discovered sheeted veining similar to that at Banyan's AurMac (Trifecta PR dated June 17, 2025).

Other potential prospects have been identified for drilling targets. The most notable being the Roop anomaly near the northern edge of Carlin-Roop. Soil geochemistry and SGH surveys plus magnetic patterns suggest the presence of significant Au±Ag±Cu±Zn mineralization under the Roop anomaly and an intrusion as the source of mineralization.

- Trail-Minto consists of 230 claims totalling 46.0 sq. km in size. A 700m wide zone of north-trending parallel gold anomalies are defined along the margin of the Roaring Fork Stock (RFS) for a distance around 4 km. Patterns shown on Analytic Signal plots suggest that much of the property in the vicinity of the RFS has potential for gold in soil anomalies (zones) paralleling its edges. The geology and the presence of gold mineralization appear associated with an intrusive indicative of sheeted veining. In addition, anomalous gold in soils and broad magnetic low, indicative of RIRGS characterize the north part of Trail-Minto (Mayo PR dated December 12 and May 19, 2012; and October 25,2022 plus Mayolakminerals.com/trail-minto.html). The AurMac project lies within ground adjacent to the east border of Trail-Minto (Figure 2). Similarly, Banyan appears to have staked ground tight to Trail-Minto's western border upon receiving its ZTEM results from 2024 (Banyan PR dated January 7,2025). The broad magnetic low crossing the north end of Trail-Minto showing sporadic high gold values can be traced on to Banyan's Nitra project to the west. (Mayo PR dated May 19, 2012 and Becker, T.C. 2000, Assessment Report 094179 on the Black Property, Black Creek, Mayo Mining District, Yukon Territory).

- Edmonton consists of 70 claims totalling approximately 14 sq. km in area. It shows a large magnetic low, 6sq. km in size. This large magnetic low is interpreted to be an igneous intrusion at depth with an associated alteration zone. In spite of much of the area being covered by glacial pond sediments, results from soils geochemical and soil gas sampling suggest the presence of gold mineralization within and flanking the magnetic low. This suggests the presence of a IRS, if not a RIRS, either gold (G) or gold and base metals (G ± Cu, Zn, Pb) (Mayo PR dated December 13 and, May 29,2012; Mayolakeminerals.com/Edmonton.html).

The Mayo - Keno Segment of Tombstone Gold Belt (TGB). The TGB is relatively unexplored, but the positive results of exploration by Snowline, Golden Predator, Seabridge, Rackla, Onyx, Stratabound, Sitka and Banyan have led to discoveries that have revitalized exploration for gold in the TGB. It has also piqued the interest of institutional and retail investors. This interest has recently increased in that portion of the TGB between Dawson City and the east end of Mayo Lake where Banyan and Sitka are active. Hecla's producing silver mine at Keno and the Eagle gold mine to the north of Keno, where production has been suspended, are also present here. A list of these mine and most advanced projects follows in this section.

The details of the reserves and resources and mineralization of the mines and advance stage projects described below are all within the Mayo-Keno segment of the Tombstone Gold Belt and are set out in order that the reader can understand the potential of the Mayo properties. The author can not guarantee that any of Mayo's properties will achieve the resources and quality of mineralization that characterize these deposits, only the potential of Mayo's properties.

- Hecla Mining has reported as of December 31, 2024, Proven Reserves of 0.36M ounces silver (0.013M tons at 24.3 oz./ton), Probable Reserves of 64.0M ounces silver (2.63M tons at 24.3 oz./ton), and Inf. Resources of 19.24M ounces silver (1.30M tons of at 14.8 oz./ ton). Hecla's Proven and Probable Resources will exceed the estimated total amount of silver mined at the Keno mines prior to Hecla taking ownership if the reported Inf Resources are turned into Reserves.

- Victoria Gold reported Measured, Indicated and Inferred Resources for its Eagle, Olive and Shamrock deposits from a report entitled, "Technical Report Eagle Gold Mine" prepared by Nico Harvey, P.Eng., Paull Gray, P.Geo., and Jeff Winterton. P. E.: Marc Jutras, P. Eng. Of Ginto Consulting Ltd.; and Michael Levey P. E. of JDS Energy and Mining Inc., effective date December 31, 2022. For the Eagle deposit they reported Measured Resources of 0.70M ounces gold (36.24 tonnes at 0.62 g/t); Ind. Resources of 3.95M ounces gold (197.96M tones at 0.56g/t); Inf. Resources of gold (29.6M tonnes at 0.52 g/t). At the Olive and Shamrock deposits, they reported Measured Resources of 0.11M ounces gold (3.48M tones at 1.01 g/t); Ind. Resources of 0.25M ounces (8.15M tonnes at 0.56 g/t) and Inf. Resources of 0.21M ounces gold (29.60M tonnes at 0.52 g/t)." Thes resources were calculated with gold being priced at US$1,700 per ounce. Victoria Gold continued mining during 2023 until operations were suspended because of a leach pad failure.

- Banyan Gold has received a report entitled, "Technical Report, AurMac Property, Mayo Mining District, Yukon Territory, Canada by Marc Jutras, P.Eng. Ginto Consulting Services Inc.; Tysen Hantelmann, P. Eng., of JDS Energy and Mining Inc. and Deepak Malhotra, Ph.D. of Forte Dynamics; effective August 20, 2025". They reported that the AurMac deposit contained pit constrainted Ind. Resources of 2.27M ounces gold (112.5M tonnes at 0.63 g/t) and Inf Resources of 5.45M ounces gold (260.6M tonnes at 0.60 g/t). Banyan is working toward defining 5M ounces of gold from rock averaging plus 1g Au/t in an area with a low strip ratio (Banyan PR dated Sept.15, 2025).

- Sitka Gold has received a report entitled, "Clear Creek Property, RC Gold Project, NI 43-101 Technical Report, Dawson Mining district, Yukon Territory", prepared by Ronald G. Simpson, P. Geo., of GeoSim Services Inc., effective date January 21, 2025. Simpson reported pit constrained resources of Ind. Resources of 1.29M ounces gold (34,60M tonnes at O.94 g/t) for the Blackjack and Eiger deposits); Inf. Resources of 1.04 M ounces gold (34.60M tonnes at 0.9 g/t) at Blackjack; and 0.44M ounces gold (27.36M tonnes ay 0.5 g/t gold). These resources do not include results from extension and scout drilling throughout the RC project. Prospective intrusives have been delineated over much of the RC project (Sitka PR dated August 5 and 19, 2025 and September 18, 2025).

Incentive Awards. On September 10, as part of its efforts to reward its personnel without depleting cash resources, the board passed a resolution granting a variety of compensation securities totaling 3,585,600 to certain officers, employees and consultants for their services and sacrifices from January 1, 2024 to June 30, 2025.

The compensation securities include: 1,460,600 options to buy common shares at $0.06 per share for a period of five years from the date of the grant, of which 980,600 were granted to three senior officers and/or directors; 1,275,000 Restricted Share Units which vest into common shares 6 months from the date of the grant; as well as 850,000 Deferred Share Units granted to independent directors, which vest into common shares on the retirement of the grantee director from the board. All issuances detailed in this release are subject to the consent of the Canadian Securities Exchange.

About Mayo Lake Minerals Inc. Mayo is actively engaged in the exploration and development of four precious metal projects in the Tombstone Gold (Plutonic) Belt of the Tintina Gold Province. The properties cover 188 square kilometres in the Yukon's Mayo Mining District and lie within the traditional territory of the Na-Cho Nyäk Dun First Nation. Mayo is presently focusing on two of its properties; the Trail-Minto Project lying between ground owned by Banyan Gold and the Anderson-Davidson gold property lying within Mayo-Keno segment of the Tombstone Gold Belt. Two mines; Victoria Gold's Eagle Gold Mine and Hecla Mining's Keno Silver mines and two advanced projects, Sitka Gold's RC and Banyan Gold's AurMac project lie within this segment of the Tombstone Gold Belt. Readers can access property news and descriptions at https://www.mayolakeminerals.com/.

Qualified Person. The technical and scientific information contained within this news release was written by Dr. Vern Rampton, P.Eng., CEO, President and Director of Mayo in his capacity as a Qualified Person as defined by National Instrument 43-101 - Standard of Disclosure for Mineral Projects.

The QP has been unable to verify all of the information provide herein for mines and advanced stage projects in the Mayo-Keno segment of the Tombstone Gold Belt, however all reports appear to of been professionally prepared by reputable experts in their field and the QP has no reason to dispute the observations and conclusions presented. The information provided in these reports are not necessarily indicative the mineralization on Mayo's properties.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For additional information, please contact:

Vern Rampton, Ph.D., P.Eng. CEO; vrampton@mayolakeminerals.com; Tel. 613-836-2594

Lee Bowles, Director: lbowles@ironstonecapital.ca. Tel 011 3462 466 9063 or 416-561-7474

NOT TO BE DISTRIBUTED TO NEWS WIRE SERVICES OR DISSEMINATED

IN THE UNITED STATES

Cautionary Statement Regarding Forward-Looking Information. This news release contains forward-looking statements and forward-looking information within the meaning of applicable securities laws. These statements relate to future events or future performance. All statements other than statements of historical fact may be forward-looking statements or information. The forward-looking statements and information are based on certain key expectations and assumptions made by management of Mayo. Although management of Mayo believe that the expectations and assumptions on which such forward-looking statements and information are based are reasonable, undue reliance should not be placed on the forward-looking statements and information since no assurance can be given that they will prove to be correct. Forward-looking statements and information are provided for the purpose of providing information about the current expectations and plans of management of Mayo relating to the future. Readers are cautioned that reliance on such statements and information may not be appropriate for other purposes, such as making investment decisions. Since forward-looking statements and information address future events and conditions, by their very nature, they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this news release.

The forward-looking statements and information contained in this news release are made as of the date hereof and no undertaking is given to update publicly or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws. The forward-looking statements or information contained in this news release are expressly qualified by this cautionary statement.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/268467

SOURCE: Mayo Lake Minerals Inc.