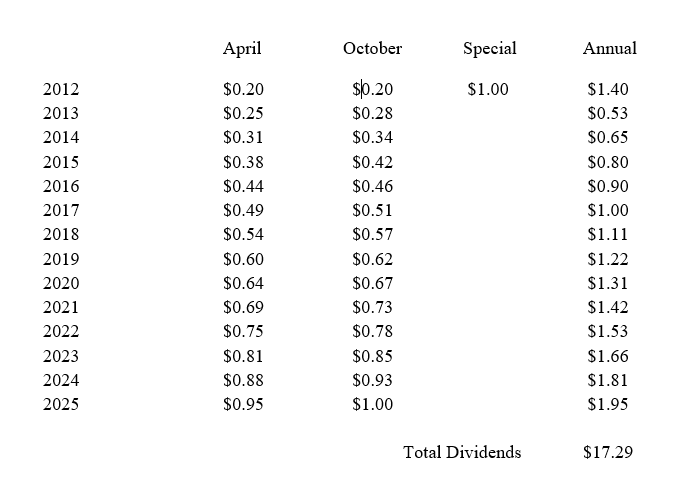

FORT WORTH, TX / ACCESS Newswire / September 30, 2025 / Trinity Bank, N.A. (OTC Bulletin Board:TYBT) announced that on September 23, 2025, the Board of Directors declared a cash dividend of $1.00 per share. The dividend will be paid on October 31, 2025, to shareholders of record as of the close of business on October 15, 2025.

COO Todd Crookshank stated, "The management team is pleased to announce the bank's 28th semiannual cash dividend. The dividend of $1.00 per share payable on October 31, 2025 represents a 5.3% increase over the $0.95 per share dividend that was paid in April 2025."

Co-Chairman and CEO Matt R. Opitz further stated, "We are pleased with the results that have made this 28th consecutive increase to Trinity Bank's semi-annual dividend possible. We remain focused on generating continued, sustainable growth that positively impacts the markets we serve. We have added key employees during the first half of 2025 that have contributed significantly to the bank's performance. Further, the new, quality customer relationships we have added and the strong loan growth we have experienced, both from existing customers as well as these new relationships, demonstrate that our strategy is working."

"Our exceptional staff, customer base and investors along with significant liquidity and strong capital have continued to position Trinity Bank for continued growth and success."

Trinity Bank, N.A. is a commercial bank that began operations May 28, 2003. For a full financial statement, visit Trinity Bank's website: www.trinitybk.com click on "About Us" and then click on "Investor Information". Financial information in regulatory reporting format is also available at www.fdic.gov.

For information contact:

Richard Burt

817-763-9966

This Press Release may contain certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 regarding future financial conditions, results of operations and the Bank's business operations. Such forward-looking statements involve risks, uncertainties and assumptions, including, but not limited to, monetary policy and general economic conditions in Texas and the greater Dallas-Fort Worth metropolitan area, the risks of changes in interest rates on the level and composition of deposits, loan demand and the values of loan collateral, securities and interest rate protection agreements, the actions of competitors and customers, the success of the Bank in implementing its strategic plan, the failure of the assumptions underlying the reserves for loan losses and the estimations of values of collateral and various financial assets and liabilities, that the costs of technological changes are more difficult or expensive than anticipated, the effects of regulatory restrictions imposed on banks generally, any changes in fiscal, monetary or regulatory policies and other uncertainties as discussed in the Bank's Registration Statement on Form SB-1 filed with the Office of the Comptroller of the Currency. Should one or more of these risks or uncertainties materialize, or should these underlying assumptions prove incorrect, actual outcomes may vary materially from outcomes expected or anticipated by the Bank. A forward-looking statement may include a statement of the assumptions or bases underlying the forward-looking statement. The Bank believes it has chosen these assumptions or bases in good faith and that they are reasonable. However, the Bank cautions you that assumptions or bases almost always vary from actual results, and the differences between assumptions or bases and actual results can be material. The Bank undertakes no obligation to publicly update or otherwise revise any forward-looking statements, whether as a result of new information, future events or otherwise, unless the securities laws require the Bank to do so.

SOURCE: Trinity Bank N.A.

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/banking-and-financial-services/trinity-bank-increases-cash-dividend-5.3-1080261