Latest data analytics solutions to help energy and mining companies build resilient portfolios in an increasingly volatile market

LONDON, HOUSTON, SINGAPORE, 01 October 2025 - Wood Mackenzie, a global insight business for renewables, energy and natural resources, is to unveil three additions to its Lens Metals & Mining platformat Wood Mackenzie's LME Forum 2025, delivering Assets Valuations, Markets Scenarios, and Supply Chain. Together, these latest solutions provide the industry an interconnected global view incorporating assets and market analysis that empowers capital allocation decisions.

"Critical minerals are strategic assets that shape global power and the future of the energy transition. These minerals are needed to meet growing demand from data centres, electric cars, and power grids. However, supply chains are disrupted, and global politics are getting more complicated," said Lindsay Grant, Vice President, Head of Metals & Mining Research at Wood Mackenzie. "Our latest release of Lens Metals & Mining Assets Valuations, Supply Chain and Markets Scenarios helps companies to value mining assets to allocate capital with confidence and give companies the transparency and clarity across the metals supply chain respectively."

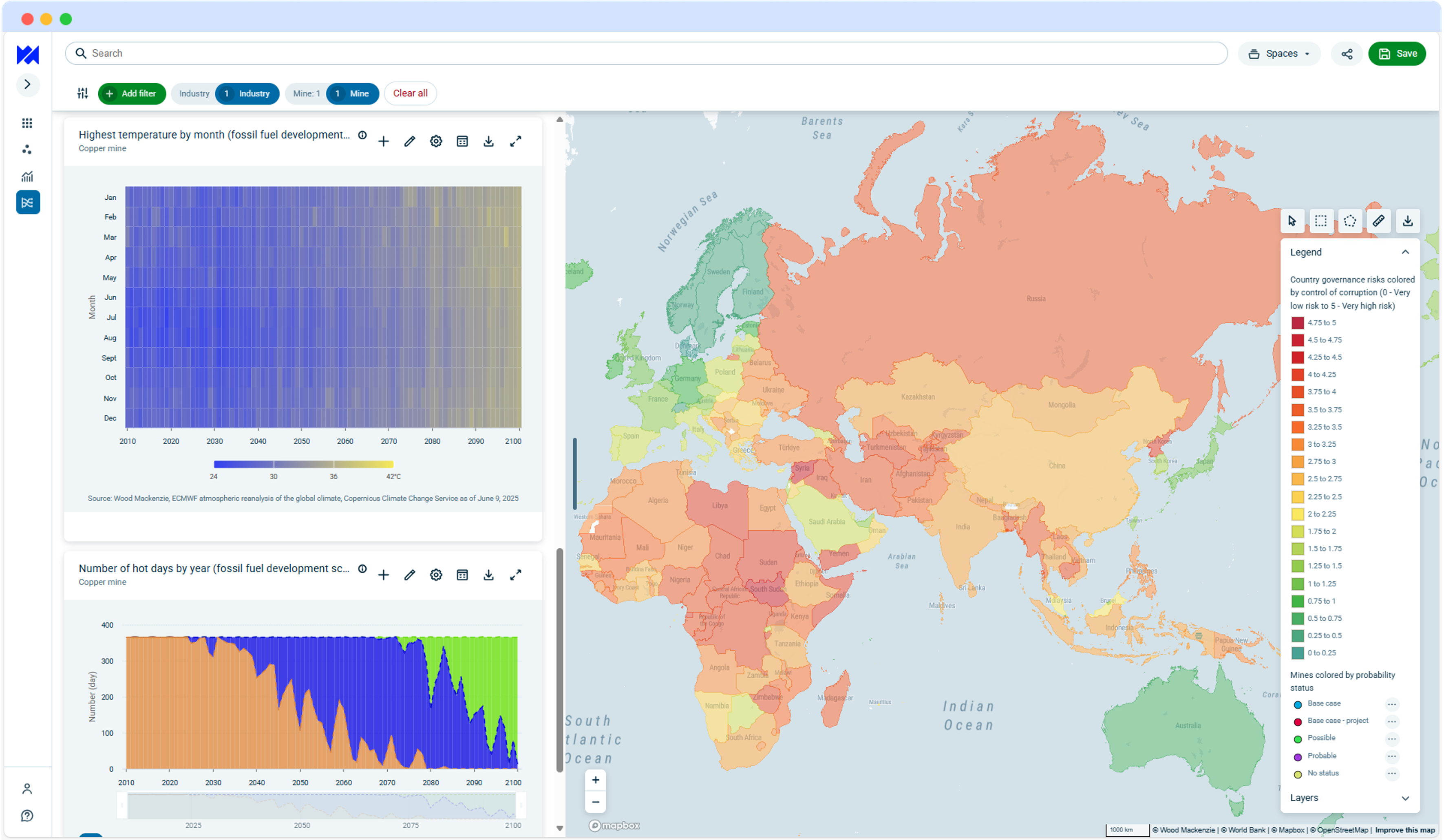

Wood Mackenzie's latest solutions - Lens Metals and Mining Supply Chain

Source: Wood Mackenzie

Assets Valuations

Delivers customisable mining asset and portfolio valuations with industry-leading depth and accuracy. Portfolio managers can run valuations for mining assets, conduct sensitivity analysis and export models, including formulae and fiscal regimes for full auditability and transparency of the valuation model.

Markets Scenarios

Provides the interconnected, cross-commodity view of the global energy and critical minerals landscape, covering copper, lithium, aluminium, nickel and more. Markets Scenarios integrates supply, demand, trade flows and price forecasts under Wood Mackenzie's Energy Transition scenarios, enabling companies to stress-test portfolios against multiple decarbonisation pathways.

Supply Chain

Bringing clarity to opaque and vulnerable supply chains, this AI-enabled solution leverages Wood Mackenzie's proprietary datasets and deep industry expertise to reveal how climate governance, environmental risks, trade dynamics, and policy shifts could reshape supply chains - from mines and smelters to refiners and end users.

"Volatility is now the norm. Record lead times, concentrated downstream processing capacity, and policy uncertainty mean a single disruption can ripple across industries," said Charles Cooper, Research Director, Head of Copper Research at Wood Mackenzie. "By combining technical expertise with advanced analytics and commercial insight, we're helping clients make smarter decisions on where to allocate capital, mitigate risk, and secure long-term value."

These new capabilities are now available via the Wood Mackenzie Lens platform, with further enhancements planned for 2026.

Wood Mackenzie at LME 2025

Wood Mackenzie is hosting the LME Forum 2025 in London on 15 October, bringing together our research analysts and leading industry voices to debate the strategic opportunities and challenges shaping the future of metals and mining industry.

Agenda highlights include:

- TNT: Transition, Nationalism and Trump, an explosive combination for metals?

- Copper: navigating tight concentrate markets and geopolitically influenced supply chains

- Tariffs, trade and technology: Macro trends shaping our economic future

- Battery Raw Materials: when will the industry see a return to balance?

- Act or wait? Strategic decision-making reshaping midstream value creation

- Reality Check: Implications for Copper, Aluminium and Zinc

About Wood Mackenzie

Wood Mackenzie is the global insight business for renewables, energy and natural resources. Driven by data. Powered by people. In the middle of an energy revolution, businesses and governments need reliable and actionable insight to lead the transition to a sustainable future. That's why we cover the entire supply chain with unparalleled breadth and depth, backed by over 50 years' experience in natural resources. Today, our team of over 2,000 experts operate across 30 global locations, inspiring customers' decisions through real-time analytics, consultancy, events and thought leadership. Together, we deliver the insight they need to separate risk from opportunity and make bold decisions when it matters most. For more information, visit woodmac.com.