TORONTO, ON / ACCESS Newswire / October 1, 2025 / Aclara Resources Inc. ("Aclara" or the "Company") (TSX:ARA) is pleased to announce an updated mineral resource estimate ("MRE") for the Carina Project, the Company's flagship ion adsorption clay project located in Goiás, Brazil ("Carina", "Carina Project" or the "Project"). The MRE represents a key component of the Carina pre-feasibility study ("PFS") and reflects considerable geological and technical advancements compared to the previously reported inferred mineral resource statement (the "2024 Resource Statement"). The MRE has been prepared in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") Definition Standards (2019) and National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101").

Highlights

Updated MRE from "inferred" to "indicated" mineral resource category: By applying the principles of Reasonable Prospects for Economic Extraction (RPEE) and constraining the estimate within an optimized pit shell, the mineral resources have been refined and upgraded, resulting in 236 million tonnes (Mt) of indicated mineral resources and 48 Mt of inferred mineral resources, compared with the 297 Mt of inferred mineral resources as reported in the 2024 Resource Statement.

Consistent grades of magnetic rare earths: Indicated mineral resources report stable and consistent magnetic element grades, including dysprosium oxide (Dy2O3) at 42.7 ppm, terbium oxide (Tb4O7) at 6.8 ppm, and NdPr oxide (Nd2O3 & Pr6O11) at 292.6 ppm, closely aligned with the 2024 Resource Statement (Dy2O3: 42.1 ppm, Tb4O7: 6.9 ppm, NdPr: 296.5 ppm).

Significantly improved geological confidence: The MRE is supported by 24,564 meters (m) of drilling across 1,682 drillholes, representing approximately a 500% increase in drilling compared to the 2024 Resource Statement, which was based on 4,104 m of drilling across 363 drillholes.

Strong geo-metallurgical database supports robust process: The MRE is supported by 14,001 samples analysed for total rare earth oxides (TREO), desorbable rare earth oxides (DREO), and impurities, providing a granular understanding of the Project's geo-metallurgical behaviour compared to 2024 Resource Statement, which was based on 3,789 samples.

High conversion rate of mineral resources demonstrates consistent mineralization: Approximately 79% of inferred mineral resources have been successfully upgraded to the indicated mineral resource category.

Declaration of reserves expected with PFS: The indicated mineral resources serve as the foundation for the PFS mine plan and the subsequent estimation of mineral reserves.

Aclara COO, Hugh Broadhurst, commented:

"Following a major drilling campaign, we have successfully converted the majority of our inferred mineral resources into the indicated mineral resource category. This is an important step as we prepare for their assessment as mineral reserves upon completion of the PFS in the coming weeks.

The quality of the Carina deposit has been affirmed. Grades of both heavy and light rare earths remain strong, tonnage is consistent, and results continue to demonstrate the stability and continuity of mineralization. At the same time, our knowledge of Carina has advanced considerably, with metallurgical confidence strengthened by a comprehensive new database of more than 10,000 data points. This strong foundation will be essential to optimizing the mine plan, reducing costs, and ensuring efficient management of operations into the future.

We are now fully focused on delivering the PFS within 45 days of the date of this news release and the feasibility study in the second quarter of next year-key milestones in unlocking the full economic potential of this unique heavy rare earths resource."

Mineral Resource Statement

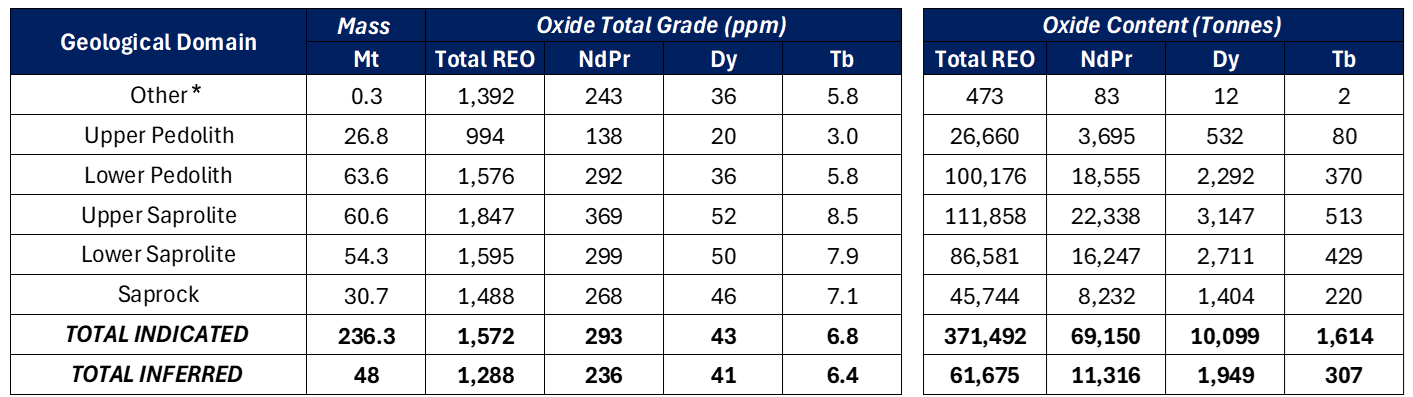

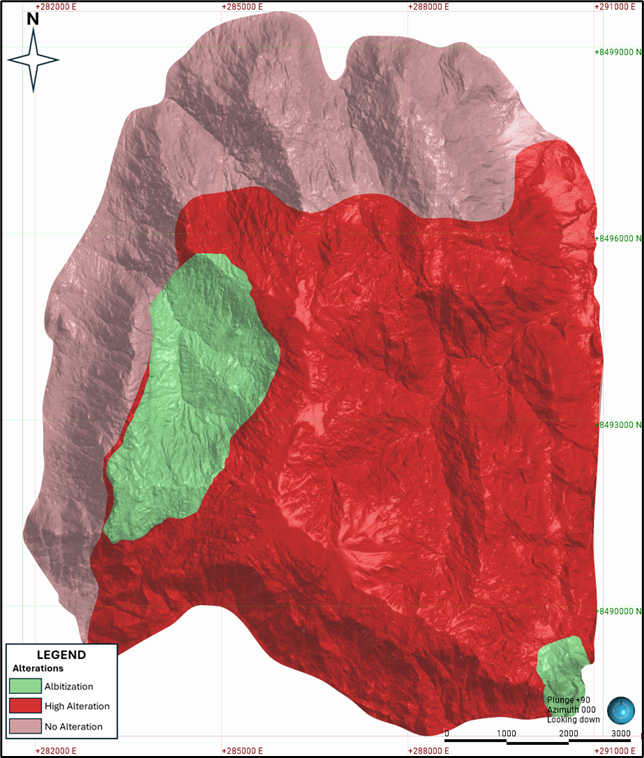

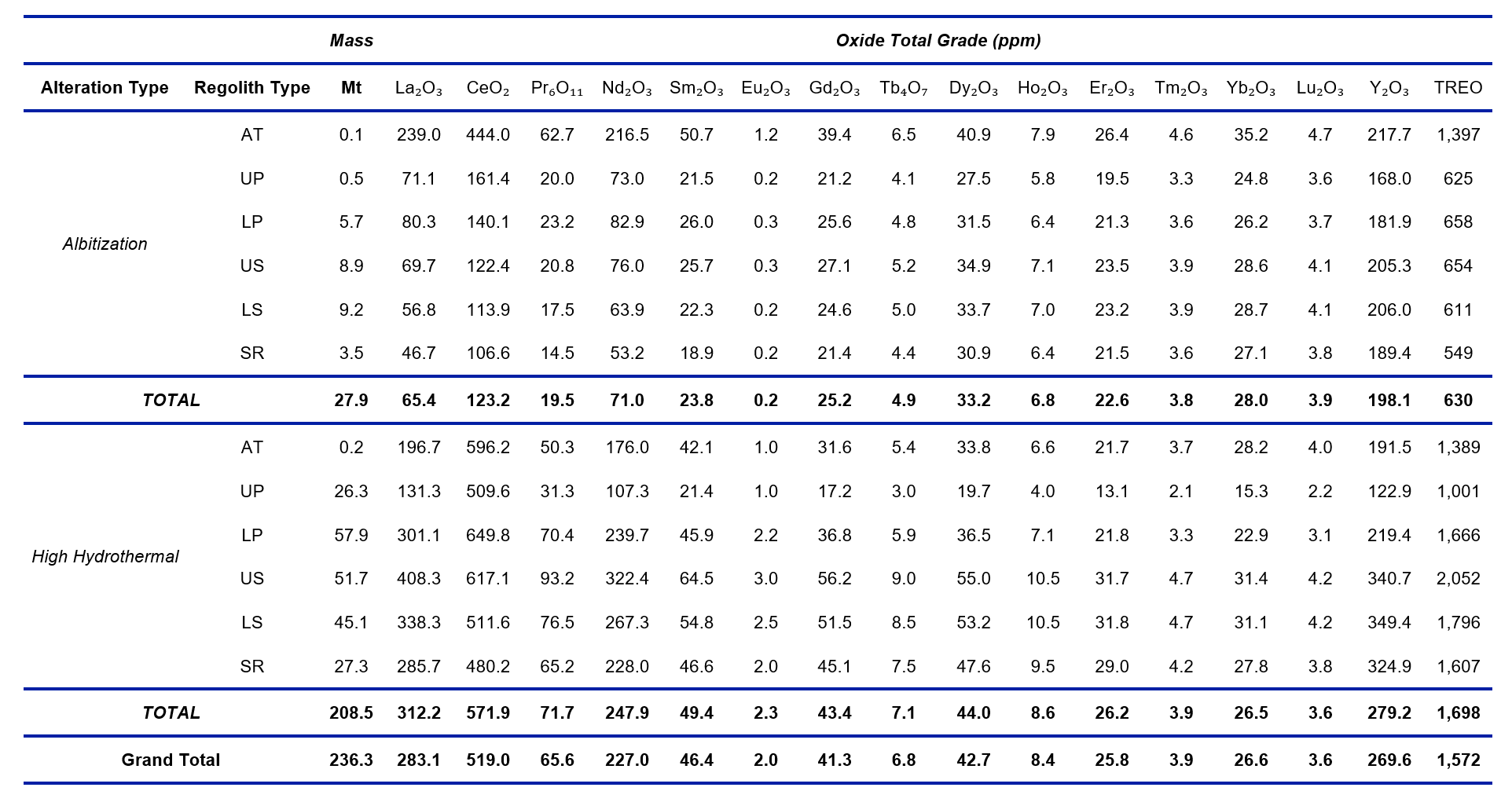

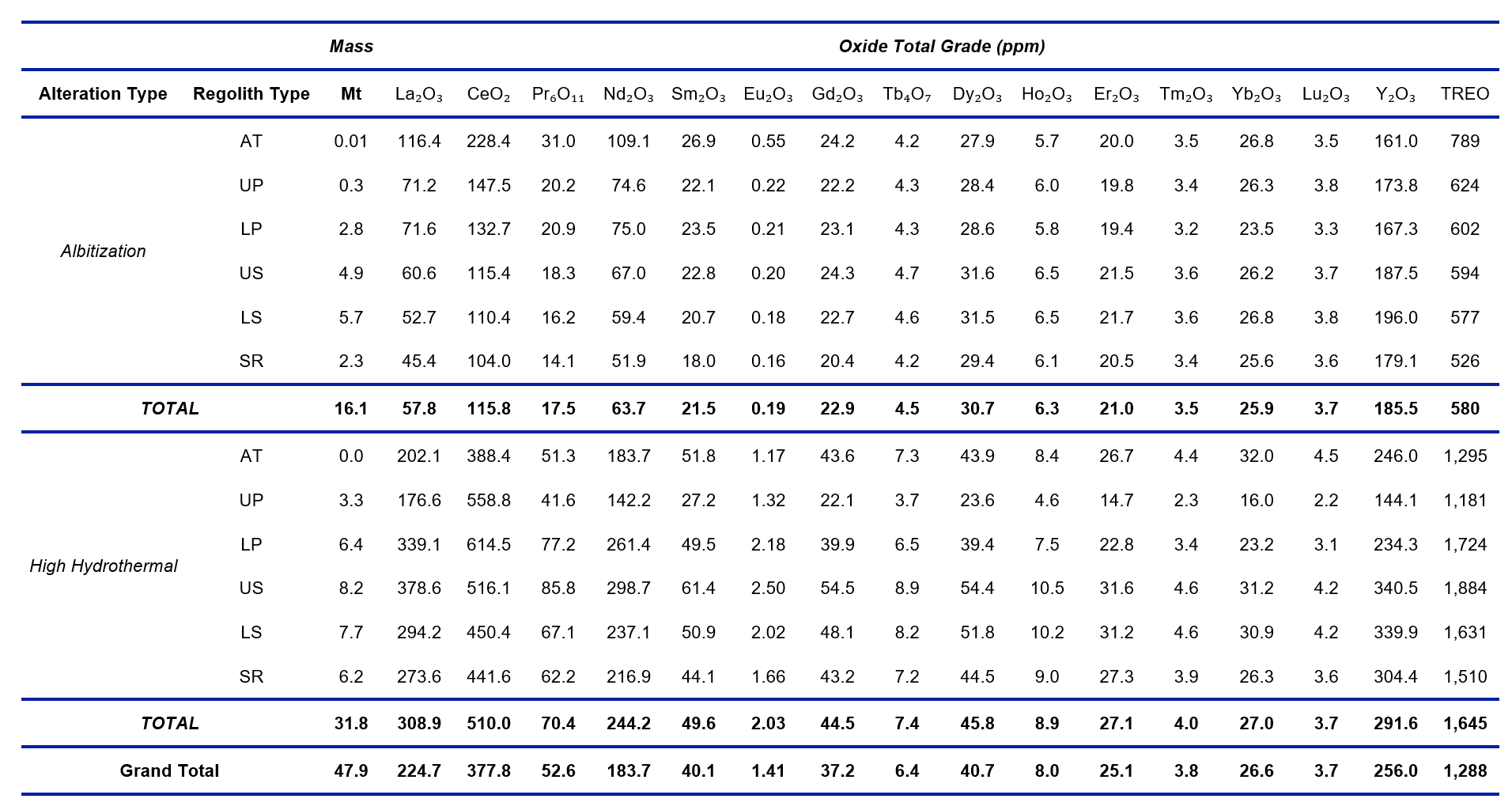

Table 1 summarizes the MRE, including TREO, NdPr, Dy, and Tb contents by geological domain. Further details of the MRE are provided in Tables 7 and 8.

Table 1. Carina Project MRE (as of July 29, 2025) compared to the 2024 Resource Statement (asof May 3, 2024)

Updated MRE (PFS 2025)

2024 Resource Statement (PEA 2024)

Notes:

TREO means total rare earth oxides (La2O3, CeO2, Pr6O11, Nd2O3, Sm2O3, Eu2O3, Gd2O3, Tb4O7, Dy2O3, Ho2O3, Er2O3, Tm2O3, Yb2O3, Lu2O3, and Y2O3).

NdPr means neodymium and praseodymium (Nd2O3 and Pr6O11).

Dy means dysprosium (Dy2O3) and Tb means terbium (Tb4O7).

Updated mineral resources were estimated above an NSR cut-off of 10.0 US$/t, using average long term metal prices and metallurgical recoveries outlined below under "Mineral Resource Determination and Selection".

The 2024 Resource Statement was estimated above an NSR cut-off of 7.4 US$/t, using average long term metal prices and metallurgical recoveries reported on the 2024 Resource Statement on August 9, 2024.

PEA means Preliminary Economic Assessment.

PFS means Pre-Feasibility Study.

Totals may not be balanced due to rounding of figures.

Geological Model and Estimation Domains

Aclara developed the geological model for the Carina Project based on 1,682 drillholes totalling 24,564 m of auger, reverse circulation (RC), and sonic drilling, using Leapfrog Geo (v2024.1.3). The model integrates lithological alteration and regolith logging, ensuring consistency with the block model resolution and supporting robust mineral resource estimation.

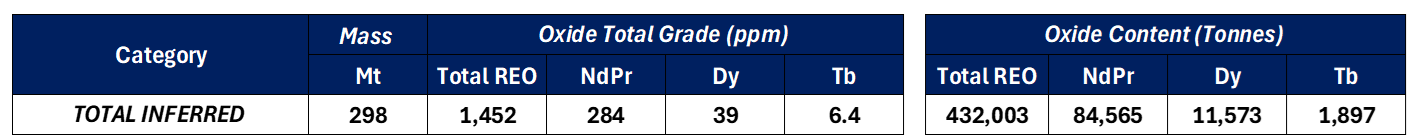

The vertical weathering profile, interpreted from geological logging and supported by geochemical transitions, comprises seven distinct horizons: Stacked Material (AT), Upper Pedolith (UP), Lower Pedolith (LP), Upper Saprolite (US), Lower Saprolite (LS), Saprock (SR), and BR. The regolith model (Figure 1) was constructed as a sequential stack of erosive surfaces, honouring the natural weathering progression. The LS-SR interface was key to defining the base of REE-enriched horizons.

Figure 1. Three-dimensional regolith model; UP: Upper Pedolit; LP: Lower Pedolith; US: Upper Saprolite; LS: Lower Saprolite (Source: Aclara, 2025).

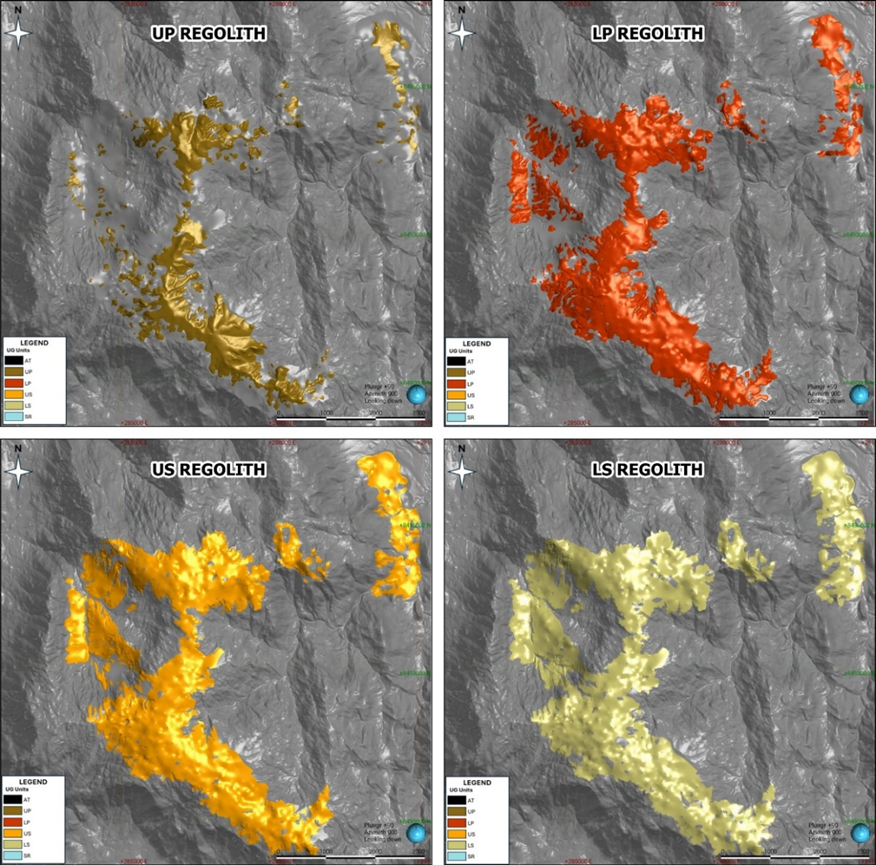

Three alteration domains (Figure 2) were modeled using visual logging and elemental proxies (Na2O, Fe2O3, CaO):

High Hydrothermal Alteration (HH), typically associated with the highest REE enrichment;

Albitization (ALB), characterized by elevated Na2O and partial preservation of feldspar textures; and

No Hydrothermal Alteration (NH), representing unaltered granite. The NH domain, together with BR, was excluded from the resource estimation process.

Figure 2. Plan view of interpreted alteration model (Source: Aclara, 2025).

The MRE is constrained to domains that combine favourable regolith horizons with either HH or ALB alteration. The intersection of both models resulted in 12 estimation units: HH_AT, HH_UP, HH_LP, HH_US, HH_LS, HH_SR, ALB_AT, ALB_UP, ALB_LP, ALB_US, ALB_LS, and ALB_SR. NH and BR zones were excluded due to lack of enrichment or insufficient geostatistical support.

For statistical analysis and reporting purposes, REEs were grouped into light REEs (LREEs), defined as the sum of La, Pr, Nd, Sm, Eu, and Ce; and heavy REEs (HREEs), defined as the sum of Gd, Tb, Dy, Ho, Er, Tm, Yb, Lu, and Y. The total REE (TREE) content is the sum of LREEs and HREEs. All chemical assay data were originally provided in elemental form (pure metal content, in ppm), not as oxides. This distinction is important, as oxide grades are typically higher due to the added molecular weight of the oxygen component.

Assay data were composited to 2 m intervals, with approximately 75% of samples meeting target length. Shorter intervals, mostly near unit boundaries, did not materially affect the overall estimate. Each estimation unit was assigned a numerical code for consistent tracking in statistical analysis and final reporting.

Estimation Methodology

Mineral resource estimation was conducted using ordinary kriging (OK) to interpolate 18 variables (15 individual REEs, Al2O3, Th, and U) across the 12 estimation units. Each unit was estimated independently using strict geological boundaries and a 2 × 2 × 2 node block model. A two-pass estimation approach was applied consistently, with a short-range search in the first pass and an extended search in the second, limiting the number of composites per drillhole to ensure data quality.

Different variogram models were applied depending on the alteration type of each unit, and a high-grade spatial constraint was implemented. Units with lower drill density had adjusted composite selection criteria to maintain accuracy.

A detailed kriging neighbourhood analysis demonstrated that using between 5 to 16 composites in the first pass and 4 to 20 in the second pass balances local variability preservation and model robustness effectively. Using fewer than 12 neighbours increased estimation bias and variability, while more than 20 neighbours offered minimal improvements.

Statistical validation metrics confirmed high kriging efficiency (~0.90) and low bias, supporting the chosen estimation parameters as optimal for accurate, reliable resource modelling with manageable computational demands.

Mineral Resource Classification

Mineral resources were classified following international reporting standards, including NI 43-101 and CIM definitions, ensuring transparency, materiality and competence. The classification is based on geological continuity, grade consistency and data quality, using a geometric approach known as the "three drillhole rule," which evaluates the average distance from each block to its three nearest drillholes.

The following classification criteria were applied:

Inferred Mineral Resources: Blocks supported by drill spacing up to 250 m, indicating reasonable but lower confidence geological continuity.

Indicated Mineral Resources: Blocks within a tighter 125 m × 125 m drill spacing, providing sufficient confidence for geological and grade assumptions; many blocks were upgraded from Inferred to Indicated.

Measured Mineral Resources: Although the nominal 60 m grid meets geometric requirements, current drilling only defines small, isolated sectors in the southwestern portion of the deposit, lacking sufficient lateral continuity. In line with CIM guidelines, no measured mineral resources are reported in this update. Blocks with theoretically adequate spacing were conservatively classified as indicated mineral resources.

Updated drilling and improved geological understanding enabled the reclassification of 236 Mt as indicated, while 48 Mt remain inferred. Drill spacing thresholds align with variogram analyses showing spatial continuity of 200-500 m depending on alteration zones, supporting the adopted classification standards.

Areas lacking sufficient drill support remain unclassified, with detailed spatial distribution reflecting drill density and confidence levels.

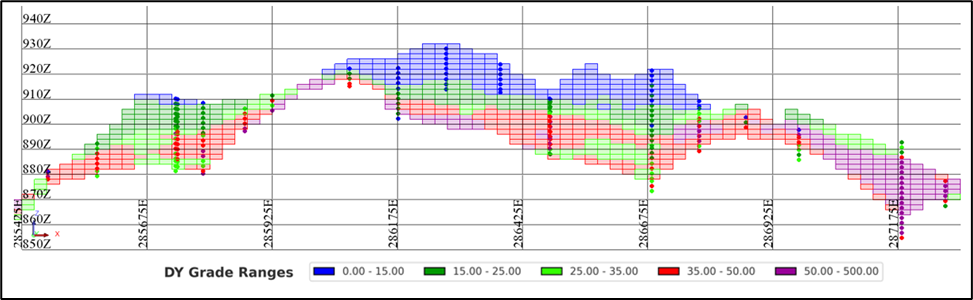

In Figure 3, the estimated block model grades for the DY variable are displayed along section NS = 8495000, coloured by grade ranges. The Z-axis has been vertically exaggerated by a factor of five to enhance visualization of the stratigraphy and grade distribution. Composites are shown as points with matching colour ranges, allowing a direct visual comparison. This section illustrates the spatial relationship between them. A strong visual correlation is observed between composite values and their corresponding block estimates.

Figure 3: Estimated block model grade distribution for dysprosium along section NS = 8495000; Z-axis has been vertically exaggerated by a factor of five to enhance visualization of the stratigraphy and grade distribution. (Source: ABelco, 2025)

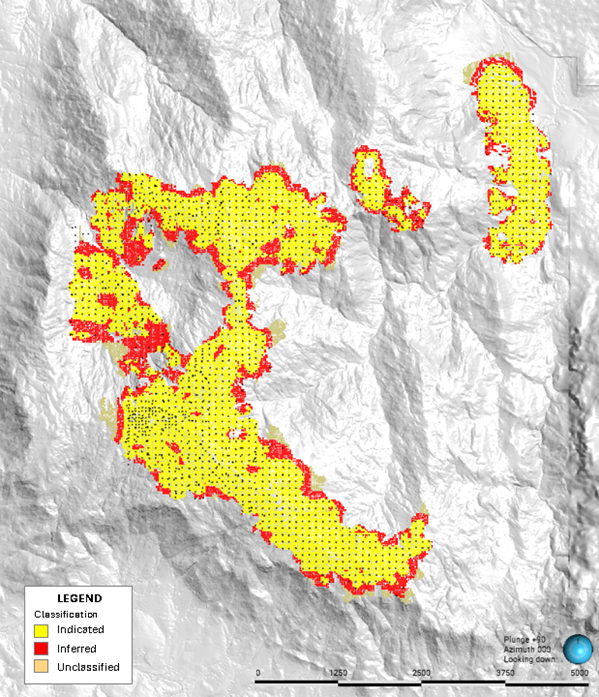

Figure 4: Plan view of resource classification map; yellow: indicated mineral resource blocks; red: inferred mineral resource blocks; light brown: blocks that remain unclassified due to insufficient drill support; black dots: drillhole composites used in the estimation. (Source: Aclara, 2025)

Mineral Resource Determination & Selection

The MRE for the Carina Project has been prepared in accordance with the CRIRSCO International Reporting Template, applying the principle of Reasonable Prospects for Economic Extraction (RPEE). The reported resources are constrained within a Lerchs-Grossmann optimized pit shell ensuring that only mineralized material with a credible potential for economic recovery is classified as mineral resources.

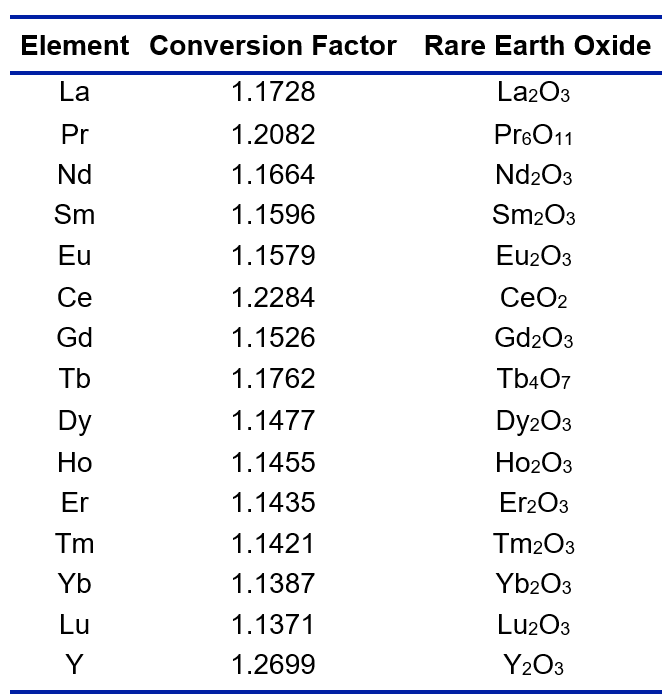

Grades were initially reported in elemental form (ppm of La, Ce, Nd, etc.) but were converted to their equivalent oxides (REO) to align with industry standards and market comparisons. This was achieved by applying stoichiometric oxide factors for each element, a standard practice supported by published technical literature (see Table 4). The conversion was applied directly to the block model, ensuring consistency in grade reporting.

Table 4. Conversion factors from elemental rare earth elements to rare earth oxides.

Pit Optimization

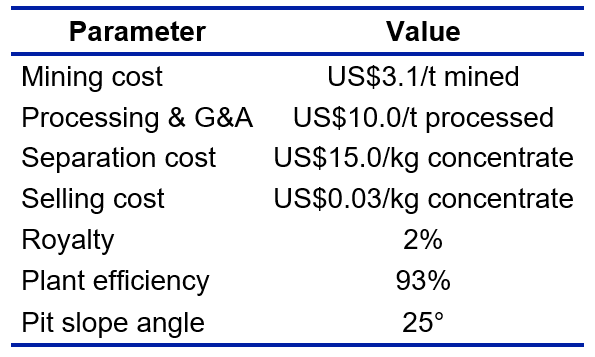

Conducted with Geovia Whittle, the optimization used cost assumptions and metallurgical recoveries representative of the deposit.

Economic inputs were validated by ABelco Consulting SpA and shown in Table 5.

Table 5. Key economic inputs to the Lerchs-Grossmann pit optimization model.

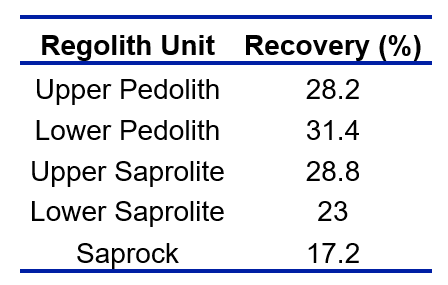

Recoveries were calculated as the median of the ratio desorbable to total grade for each REE within each regolith unit and shown in Table 6. Metallurgical recovery results were obtained from analyses performed by AGS Laboratory in La Serena, Chile, and SGS Geosol Laboratory in Vespasiano Minas Gerais, Brazil from a total of 14,001 drilling samples.

Table 6. Metallurgical recoveries per regolith.

Only blocks with NSR = US$10.0/t and within the optimized pit are reported. Average recoveries per domain are considered appropriate for PFS-level evaluation.

The selling prices applied in this MRE are based on long-term assumptions, ensuring that all resources with potential future economic viability are captured. For pit optimization, price estimates (reported in US$/kg on an oxide basis) were applied only to the magnetic rare earth elements-dysprosium (Dy), terbium (Tb), and neodymium-praseodymium (NdPr)-as follows:

Dy = 1,302

Tb = 3,826

NdPr = 151

All other REEs were assigned a zero value. For the eventual conversion of Indicated mineral resources into mineral reserves, the Company intends to apply more conservative price assumptions.

Importantly, since the 2024 Resource Statement in which ~15% of the mineral resources were located outside of Aclara's mineral concessions, the current update confirms that 100% of the reported mineral resources are now within titled properties fully owned by the Company, eliminating this previous constraint and notably reducing risks associated with the Project.

Qualified Persons and Review of Technical Information

The MRE has been prepared by Mr. Andrés Beluzán, Mining Civil Engineer and General Manager of ABelco Consulting SpA, an independent consultancy specialized in geostatistics and mineral resource estimation. Mr. Beluzán has over 18 years of international experience covering copper, gold, iron, silver, rare earths, lithium, limestone and other commodities across the Americas. He is a Qualified Person registered with the Chilean Mining Commission (Code CH 20235, Register No. 0215, certified in Geostatistics), a professional organization recognized by CRIRSCO. Mr. Beluzán is responsible for the MRE and has reviewed and approved the scientific and technical information related to it contained in this news release.

The scientific and technical information related to geology, drilling, mineralization and geological modeling in this news release has been reviewed and approved by Luis Oviedo (General Manager, L&M Geociencias SPA), an independent Consulting Geologist with more than 45 years' experience. Mr. Oviedo is a member of the Colegio de Geólogos de Chile and the Institute of Mining Engineers of Chile, is registered under the Chilean Mining Commission and is an independent Qualified Person under NI 43-101.

Permitting Update

The Secretariat of the Environment and Sustainable Development ("SEMAD") in the State of Goiás, Brazil has completed the update of its new and innovative environmental licensing system, known as the IPE system. As such, as previously anticipated and disclosed in its news release dated May 29, 2025, the Company has refiled its application for the Environmental Impact Assessment (the "EIA" or "Previous License", as it is commonly known in Brazil) for its Carina Project, to conform to the new procedural and formatting requirements implemented by SEMAD. The Company will continue to work with the authorities and local stakeholders to complete the EIA evaluation process as soon as possible to be able to achieve our objective of making an investment decision with respect to the Carina Project in Q1/Q2 2026.

About Aclara

Aclara Resources Inc. (TSX: ARA), a Toronto Stock Exchange listed company, is focused on building a vertically integrated supply chain for rare earths alloys used in permanent magnets. This strategy is supported by Aclara's development of rare earth mineral resources hosted in ionic clay deposits, which contain high concentrations of the scarce heavy rare earths, providing the Company with a long-term, reliable source of these critical materials. The Company's rare earth mineral resource development projects include the Carina Project in the State of Goiás, Brazil as its flagship project and the Penco Module in the Biobío Region of Chile. Both projects feature Aclara's patented technology named Circular Mineral Harvesting, which offers a sustainable and energy-efficient extraction process for rare earths from ionic clay deposits. The Circular Mineral Harvesting process has been designed to minimize the water consumption and overall environmental impact through recycling and circular economy principles. Through its wholly-owned subsidiary, Aclara Technologies Inc., the Company is further enhancing its product value by developing a rare earths separation plant in the United States. This facility will process mixed rare earth carbonates sourced from Aclara's mineral resource projects, separating them into pure individual rare earth oxides. Additionally, Aclara through a joint venture with CAP, is advancing its alloy-making capabilities to convert these refined oxides into the alloys needed for fabricating permanent magnets. This joint venture leverages CAP's extensive expertise in metal refining and special ferro-alloyed steels. Beyond the Carina Project and the Penco Module, Aclara is committed to expanding its mineral resource portfolio by exploring greenfield opportunities and further developing projects within its existing concessions in Brazil, and Chile, aiming to increase future production of heavy rare earths.

Forward-Looking Statements

This news release contains "forward-looking information" within the meaning of applicable securities legislation, which reflects the Company's current expectations regarding future events, including statements with regard to: mineral continuity, grade, metallurgical recoveries, methodology, production timing and upside at the Carina Project, the Company's exploration plan, drilling campaigns and activities in Brazil and the expectations of the Company's management as to the timing, cost, scope and results of such exploration works and drilling activities in Brazil, the results and interpretations of the MRE relating to and the timing and issuance of a prefeasibility study and feasibility study relating to the Carina Project, the expected timing of approval of the EIA and the expected timing and approval process of the permitting process of the Carina Project. Forward-looking information is based on a number of assumptions and is subject to a number of risks and uncertainties, many of which are beyond the Company's control. Such risks and uncertainties include, but are not limited to risks related to operating in a foreign jurisdiction, including political and economic problems in Brazil; risks related to changes to mining laws and regulations and the termination or non-renewal of mining rights by governmental authorities; risks related to failure to comply with the law or obtain necessary permits and licenses or renew them; compliance with environmental regulations can be costly; actual production, capital and operating costs may be different than those anticipated; the Company may be not able to successfully complete the development, construction and start-up of mines and new development projects; risks related to mining operations; and dependence on the Carina Project. Aclara cautions that the foregoing list of factors is not exhaustive. For a detailed discussion of the foregoing factors, among others, please refer to the risk factors discussed under "Risk Factors" in the Company's annual information form dated as of March 20, 2025, filed on the Company's SEDAR+ profile. Actual results and timing could differ materially from those projected herein. Unless otherwise noted or the context otherwise indicates, the forward-looking information contained in this press release is provided as of the date of this press release and the Company does not undertake any obligation to update such forward-looking information, whether as a result of new information, future events or otherwise, except as expressly required under applicable securities laws.

For further information, please contact:

Ramon Barua Costa

Chief Executive Officer

investorrelations@aclara-re.com

Table 7. Indicated Mineral Resources by alteration type and regolith horizon in the Carina Project pit shell; AT: Transported Material; UP: Upper Pedolith; LP: Lower Pedolith; US: Upper Saprolite; LS: Lower Saprolite; SR: Saprock.

Table 8. Inferred Mineral Resources by alteration type and regolith horizon in the Carina Project pit shell; AT: Transported Material; UP: Upper Pedolith; LP: Lower Pedolith; US: Upper Saprolite; LS: Lower Saprolite; SR: Saprock.

SOURCE: Aclara Resources Inc.

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/metals-and-mining/carina-project-robust-mineral-resource-upgrade-supported-by-extensive-drilling-1080566