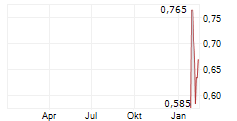

Since our last note on 12 May, Barton has continued to aggressively develop its assets in pursuit of its ambition to produce 150koz gold per year in a two-stage 'hub and spoke' model, leveraging its Central Gawler Mill (CGM) and a new future Tunkillia mill. To this end, it has a) continued extensive drilling at Tarcoola-Tolmer, b) acquired the Wudinna prospect for a likely consideration of A$7.5m, or A$15/oz (plus a further potential A$7.5m if it goes into production), c) completed a A$3.0m placing to fund reserve conversion upgrade drilling at Tunkillia as well as a JORC resource upgrade at Tarcoola and d) announced two resource upgrades at its Challenger mine adjacent to the CGM to increase its resource to over 300koz, including 194koz at 3.2g/t Au on existing open pit and underground development. Consequently, Barton has now commenced a definitive feasibility study on 'Stage 1' production at the CGM as well as resource upgrade drilling at Tunkillia's 'Starter Pits' and the necessary baseline water monitoring programme to support a mining licence application in late CY26. As a result, its market capitalisation has increased from A$49m in January to A$282m now, and it has been accepted for inclusion into the S&P Dow Jones ASX All Ordinaries Index of the 500 largest companies in Australia.Den vollständigen Artikel lesen ...

© 2025 Edison Investment Research