Toronto, Ontario--(Newsfile Corp. - October 3, 2025) - Happy Belly Food Group Inc. (CSE: HBFG) (OTCQB: HBFGF) ("Happy Belly" or the "Company"), a leader in acquiring and scaling emerging food brands, today announced the approval and adoption of its 2026-2031 Compensation Growth Plans, designed to retain and incentivize the executive team while aligning compensation directly with long-term shareholder value creation.

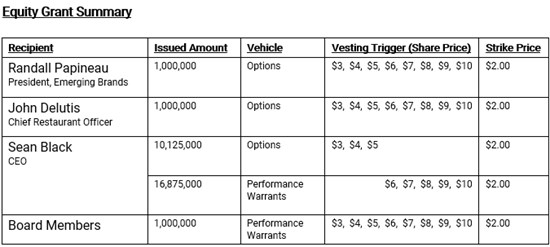

As the Company nears the successful completion of its five year Phase I growth plan, originally launched in June 2021, Happy Belly is moving forward with planning and implementing Phase II, focused on scaling the current brands, acquiring additional businesses as a part of its consolidation strategy within existing categories, and potentially expanding to new categories to deliver long-term shareholder value. Happy Belly's Compensation Committee, and Board of Directors has designed and approved the issuance of a combination of stock options and performance warrants that again aligns executive incentives to shareholder objectives. These options and warrants are structured to reward executives and board members only upon the achievement of sustained business performance and the achievement of significant share price milestones.

Key Highlights of the Plan

- Alignment with Shareholders: Executives and board members will only earn performance incentives if shareholders realize meaningful value creation, including achievement of a share price progression at vesting targets at each dollar up to $10 per share, which would represent a market capitalization of significant value for shareholders.

- Performance-Driven Vesting: Equity grants are tied to both share price triggers and continued positive business performance, including year-over-year growth in royalty and franchise income and sustained positive adjusted EBITDA.

- Long-Term Retention: Vesting provisions require executives and board members to remain actively employed or serving on the board at the time of milestone achievement, reinforcing commitment to the Company's growth journey.

- Capital Commitment: At full vesting, executives and directors would be required to invest over $60 million back into Happy Belly to exercise their options and warrants, further aligning leadership's success with shareholders.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6625/269006_82c8830d444a1833_001full.jpg

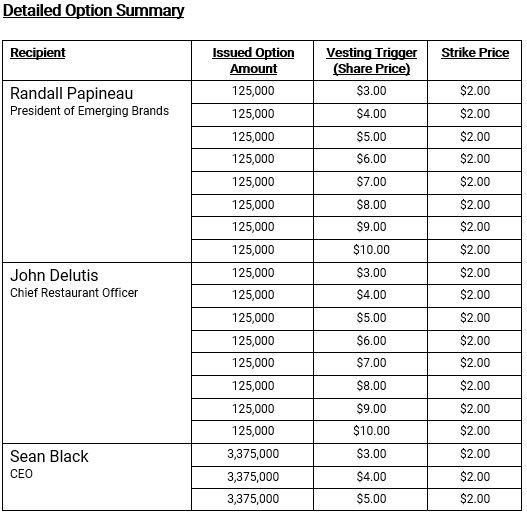

In accordance with the Company's stock option plan, the Company is granting an aggregate of 12,125,500 stock options to certain directors and officers of the Company. The options are exercisable for a period of five years at a strike price of $2.00 per share, subject to the vesting triggers and business performance requirements outlined.

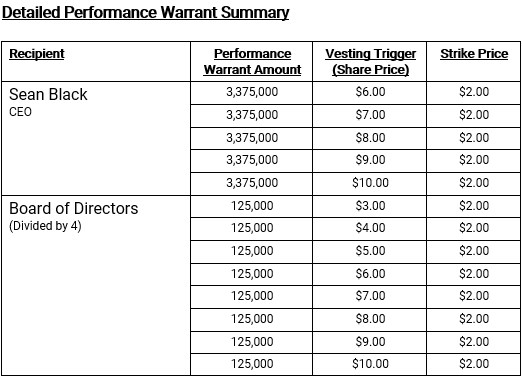

The Company is also issuing an aggregate of 17,875,000 performance warrants to certain directors and officers of the Company. Each performance warrant will entitle the holder to acquire one common share of the Company for a period of five years at a strike price of $2.00 per share, subject to the vesting triggers and business performance requirements outlined.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6625/269006_82c8830d444a1833_002full.jpg

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6625/269006_82c8830d444a1833_003full.jpg

"We believe we are just getting started and want more for shareholders. By tying the leadership team's rewards directly to long-term business performance and sustained share price appreciation, we ensure that our leadership team is fully aligned with shareholders as we execute the next phase of our growth plan. We have transformed Happy Belly into a disciplined growth company with 13 consecutive record quarters of growth, and this plan sets the foundation for scaling to new heights," said Sean Black, Chief Executive Officer of Happy Belly.

"Our Compensation Committee and Board have been diligent in ensuring this plan retains, and motivates our leadership team while aligning to shareholder objectives. We have an incredible team that are successfully delivering on Phase I of our growth plans, and we trust all shareholders will agree that as we shift to Phase II we want to retain our current team and motivate them to scale Happy Belly to new heights. Happy Belly is a pay for performance company and there is an opportunity for significant compensation for our key leaders and that is only achieved after building value for shareholders. Our Leaders' Compensation is linked to business performance and ambitious share price milestones, we believe this plan strengthens our ability to retain, and reward current talent and enable Happy Belly to attract future talent that will contribute to shareholders success," said Kevin Cole, Independent Director and Chair of the Compensation Committee.

"We are just getting started", said Sean Black.

Franchising

For franchising inquiries please see www.happybellyfg.com/franchise-with-us/ or contact us at hello@happybellyfg.com.

About Happy Belly Food Group

Happy Belly Food Group Inc. (CSE: HBFG) (OTCQB: HBFGF) ("Happy Belly" or the "Company") is a leader in acquiring and scaling emerging food brands across Canada.

Happy Belly Food Group

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6625/269006_82c8830d444a1833_004full.jpg

Sean Black

Co-founder, Chief Executive Officer

Shawn Moniz

Co-founder, Chief Operating Officer

FOR FURTHER INFORMATION, PLEASE VISIT:

www: www.happybellyfg.com or email: hello@happybellyfg.com

If you wish to contact us please call: 1-877-589-8805

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this press release, which has been prepared by management.

Cautionary Note Regarding Forward-Looking Statements

All statements in this press release, other than statements of historical fact, are "forward-looking information" with respect to the Company within the meaning of applicable securities laws. Forward-Looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur and include the future performance of Happy Belly and her subsidiaries. Forward-Looking statements are based on the opinions and estimates at the date the statements are made and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking statements. There are uncertainties inherent in forward-looking information, including factors beyond the Company's control. There are no assurances that the business plans for Happy Belly described in this news release will come into effect on the terms or time frame described herein. The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change except as required by law. The reader is cautioned not to place undue reliance on forward-looking statements. For a description of the risks and uncertainties facing the Company and its business and affairs, readers should refer to the Company's Management's Discussion and Analysis and other disclosure filings with Canadian securities regulators, which are posted on www.sedarplus.ca.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/269006

SOURCE: Happy Belly Food Group Inc.