BUKIT MERTAJAM, MALAYSIA, Oct. 06, 2025 (GLOBE NEWSWIRE) -- CCH Holdings Ltd (the "Company"), a Malaysia-based specialty hotpot restaurant chain, today announced the closing of its initial public offering (the "Offering") of 1,250,000 ordinary shares at a public offering price of US$4.00 per ordinary share, for total gross proceeds of US$5,000,000, before deducting estimated underwriting discounts, non-accountable expense allowance, and estimated offering expenses payable by the Company.

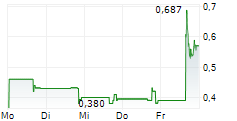

The Company has granted to the underwriters an over-allotment option, which is exercisable within 45 days from the date of closing of this Offering, to purchase up to an additional 187,500 ordinary shares at the initial public offering price less the underwriting discounts and commissions. The Company's ordinary shares began trading on the Nasdaq Capital Market under the symbol "CCHH" on October 3, 2025.

The Offering was conducted on a firm commitment basis. The Company plans to use the proceeds from the Offering for expansion of its restaurant network, strategic investments or acquisitions, brand building and marketing, diversification of its peripheral products of food ingredients and condiments and/or sales channels of such products, and general corporate purposes.

Cathay Securities, Inc. acted as the representative of the underwriters to the Offering. Hogan Lovells acted as U.S. counsel to the Company, and Lucosky Brookman LLP acted as U.S. counsel to Cathay Securities, Inc., in connection with the Offering.

A registration statement on Form F-1 relating to the Offering (File No. 333-289878), as amended, was filed with the Securities and Exchange Commission ("SEC") and was declared effective by the SEC. The Offering was made only by means of a prospectus, forming a part of the registration statement. A final prospectus relating to the Offering was filed with the SEC and are available on the SEC's website at www.sec.gov. Electronic copies of the final prospectus relating to this Offering, when available, may be obtained from Cathay Securities, Inc., 40 Wall St Suite 3600, New York, NY 10005, Telephone: +1 (855) 939-3888; Email: service@cathaysecurities.com.

Before you invest, you should read the prospectus and other documents the Company has filed or will file with the SEC for more information about the Company and the Offering. This press release shall not constitute an offer to sell, or the solicitation of an offer to buy, or will there be any sale of the Company's securities in any state or other jurisdiction in which such offer, solicitation, or sale would be unlawful prior to the registration or qualification under the securities laws of such state or jurisdiction.

About CCH Holdings Ltd

CCH Holdings Ltd commenced operations in 2015 with roots in George Town, Penang, Malaysia. The Company is one of the leading specialty hotpot restaurant chains in Malaysia, specializing in chicken hotpot and fish head hotpot. The Company offer catering services in Malaysia and outside Malaysia mainly under two brands, namely Chicken Claypot House (????) for our chicken hotpot restaurants and Zi Wei Yuan (???) for our fish head hotpot restaurants through a combination of company-owned restaurant outlets and franchised restaurant outlets.

For more information, please visit the Company's website: https://ir.chickenclaypothouse.com.my

Cautionary Note Regarding Forward-Looking Statements

This announcement contains forward-looking statements. These statements are made under the "safe harbor" provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as "will," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates," "confident" and similar statements. Among other things, the description of the proposed offering in this announcement contain forward-looking statements. The Company may also make written or oral forward-looking statements in its periodic reports to the SEC, in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including statements about the Company's beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following: (i) the Company's goals and strategies; (ii) the Company's future business development, financial condition, and results of operations; (iii) general economic and business conditions in Malaysia; and (iv) the outlook of specialty hotpot market in Malaysia, Southeast Asia, Hong Kong, Taiwan, and the U.S., including competition, government policies and regulations. Further information regarding these and other risks is included in the Company's filings with the SEC. All information provided in this press release is as of the date of this press release, and the Company undertakes no obligation to update any forward-looking statement, except as required under applicable law.

For investor and media inquiries, please contact:

CCH Holdings Ltd

Investor Relations

Email: cch_ir@cchasia.com.my