WASHINGTON, Oct. 13, 2025 /PRNewswire/ -- Public Policy Holding Company, Inc. a leading global strategic communications provider offering a comprehensive range of advisory services in the areas of Government Relations, Public Affairs and Corporate Communications, has publicly filed a registration statement on Form S-1 (the "Registration Statement") with the U.S. Securities and Exchange Commission (the "SEC") relating to a proposed public offering of its common stock in the United States.

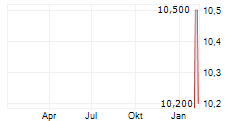

To date, there has been no public market for PPHC's common stock in the United States. The Company has applied to list its common stock on the Nasdaq Global Market ("Nasdaq") under the symbol "PPHC". Following the proposed U.S. offering and listing, PPHC's shares will be dual-listed on Nasdaq and on the Alternative Investment Market of the London Stock Exchange ("AIM"), where they trade under the same symbol. It is anticipated that the shares will be fully fungible.

The number of shares to be offered and the price range for the proposed offering have not yet been determined. The offering is expected to consist of predominantly newly issued shares and the proceeds from the issue of new shares are intended to support working capital and general corporate purposes, including future acquisition opportunities consistent with the Company's growth strategy.

Oppenheimer & Co. and Canaccord Genuity are acting as lead bookrunning managers for the proposed offering. Texas Capital Securities is also acting as a joint bookrunner.

The proposed offering will be made only by means of a prospectus forming part of the Registration Statement. Copies of the Registration Statement and the preliminary prospectus, when available, may be obtained for free by visiting the SEC's website at www.sec.gov.

Alternatively, copies of the prospectus, when available, may be obtained from:

Oppenheimer & Co. Inc., Attention: Syndicate Prospectus Department, 85 Broad Street, 26th Floor, New York, NY 10004, or by telephone at (212) 667-8055, or by email at EquityProspectus@opco.com.

Canaccord Genuity LLC, Attention: Syndication Department, One Post Office Square, Suite 3000, Boston, Massachusetts 02109, or by telephone at (617) 371-3900, or by email at prospectus@cgf.com.

Texas Capital Securities, Attention: Syndicate Prospectus Department, 2000 McKinney Avenue, Suite 700, Dallas, TX 75201, or by telephone at (866) 355-6329 or by email at EquityProspectus@texascapital.com.

The Registration Statement relating to the proposed offering has been filed with the SEC but has not yet become effective. These securities may not be sold, nor may offers to buy be accepted, prior to the time the Registration Statement becomes effective.

This press release does not constitute an offer to sell or the solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. Any offers, solicitations or offers to buy, or any sales of securities will be made in accordance with the registration requirements of the Securities Act of 1933, as amended.

The offering is subject to market conditions, and there can be no assurance as to either the terms or the timing of the offering.

## About PPHC

Incorporated in 2014, PPHC is a global government relations, public affairs and strategic communications group providing clients with a fully integrated and comprehensive range of services including government and public relations, research, and digital advocacy campaigns. Engaged by approximately 1,300 clients, including companies, trade associations and non-governmental organizations, the Group is active in all major sectors of the economy, including healthcare and pharmaceuticals, financial services, energy, technology, telecoms and transportation. PPHC's services support clients to enhance and defend their reputations, advance policy goals, manage regulatory risk, and engage with federal and state-level policy makers, stakeholders, media, and the public.

For more information, see www.pphcompany.com.

Media Contact:

PPHC: inquiries@pphcompany.com

## Cautionary Statement

Forward-looking statements

Certain statements in this announcement constitute, or may be deemed to constitute, forward-looking statements, projections and information (including beliefs or opinions) with respect to the Group. An investor can identify these statements by the fact that they do not relate strictly to historical or current facts. They include, without limitation, statements regarding the Group's future expectations, operations, financial performance, financial condition and business. Such forward-looking statements are based on current expectations and are subject to a number of risks, uncertainties and assumptions that may cause actual results to differ materially from any expected future results in forward-looking statements.

These risks and uncertainties include, among other factors, changing economic, financial, business or other market conditions. These and other factors could adversely affect the outcome and financial effects of the plans and events described in this announcement.

Other than in accordance with its legal or regulatory obligations (including under the Market Abuse Regulation) no undertaking is given by the Group to update any forward-looking statements contained in this announcement, whether as a result of new information, future events or otherwise. Accordingly, no assurance can be given that any particular expectation will be met and investors are cautioned not to place undue reliance on the forward-looking statements.

Logo - https://mma.prnewswire.com/media/2794242/Public_Policy_Holding_Company.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/public-policy-holding-company-inc-pphc-the-group-or-the-company-notification-of-registration-statement-filing-pphc-files-for-proposed-us-ipo-nasdaq-listing-302581706.html

View original content:https://www.prnewswire.co.uk/news-releases/public-policy-holding-company-inc-pphc-the-group-or-the-company-notification-of-registration-statement-filing-pphc-files-for-proposed-us-ipo-nasdaq-listing-302581706.html