Stockholm, October 13, 2025- The Disciplinary Committee of Nasdaq Stockholm (the "Exchange") has found that Hedera Group AB (publ) (the "Company") has breached the rules of Nasdaq First North Growth Market (the "Rulebook") and therefore ordered the Company to pay a fine of three annual fees, corresponding to an amount of SEK 375,000.

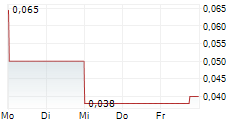

On 14 November 2024, the Company published a press release stating that it had received two separate decisions from the Swedish Social Insurance Agency (Försäkringskassan) regarding repayment claims for assistance compensation, amounting to a total of SEK 26.8 million. The press release included a reference indicating that the information was of the type the Company was obliged to disclose under the EU Market Abuse Regulation ("MAR").

The repayment claims were received by the Company on 27 August and 31 October 2024, respectively, with amounts of SEK 8.5 million and SEK 18.4 million. Upon receiving the second repayment claim, the Company assessed that, combined with the earlier claim, the information constituted inside information. On the same day, the Company established an insider list and decided to delay the disclosure of the inside information.

The issue considered by the Disciplinary Committee was whether the conditions for delayed disclosure under Article 17.4(a) of MAR were met-specifically, whether immediate disclosure of the inside information would likely have prejudiced the Company's legitimate interests.

In the Committee's opinion, uncertainty regarding the information in this case did not justify the Company waiting a full two weeks before disclosing it, without releasing any information about the repayment claims during that time. Based on this, the Committee concluded that the Company's decision to delay disclosure of the inside information was not in compliance with Article 17.4 of MAR, and the information was therefore not disclosed in a timely manner.

The Disciplinary Committee considered the breach to be serious and therefore imposed a sanction. The fine was set at three annual fees.

The Disciplinary Committee's decision is available at:

https://www.nasdaq.com/market-regulation/nordic/stockholm/disciplinary/decisions-sanctions

About the Disciplinary Committee

The role of Nasdaq Stockholm's Disciplinary Committee is to consider suspicions regarding whether Exchange Members or listed companies have breached the rules and regulations applying on the Exchange. If the Exchange suspects that a member or company has acted in breach of the rules, the matter is referred to the Disciplinary Committee. Nasdaq Stockholm investigates the suspicions and pursues the matter and the Disciplinary Committee issues a ruling regarding possible sanctions. The sanctions possible for listed companies are a warning, a fine or delisting. The sanctions possible for Exchange Members are a warning, a fine or debarment. Fines paid are not included in the Exchange's business but are attributed to a foundation supporting research in the securities market. The Disciplinary Committee's Chairman and Deputy Chairman must be lawyers with experience of serving as judges. At least two of the other members of the Committee must have in-depth insight into the workings of the securities market.

Members: Former Supreme Court Justice Marianne Lundius (Chairman), Supreme Court Justice Petter Asp (Deputy Chairman), Supreme Court Justice Johan Danelius (Deputy Chairman), Company Director Anders Oscarsson, Company Director Joakim Strid, Lawyer Wilhelm Lüning, Lawyer Patrik Marcelius, Lawyer Erik Sjöman, MBA Carl Johan Högbom, Authorized Public Accountant Magnus Svensson Henryson, Former Authorized Public Accountant Svante Forsberg, Lawyer Magnus Lindstedt and director Kristina Schauman.

About Nasdaq

Nasdaq (Nasdaq: NDAQ) is a leading global technology company serving corporate clients, investment managers, banks, brokers, and exchange operators as they navigate and interact with the global capital markets and the broader financial system. We aspire to deliver world-leading platforms that improve the liquidity, transparency, and integrity of the global economy. Our diverse offering of data, analytics, software, exchange capabilities, and client-centric services enables clients to optimize and execute their business vision with confidence. To learn more about the company, technology solutions, and career opportunities, visit us on LinkedIn, on X @Nasdaq, or at www.nasdaq.com.

Nasdaq Media Contact

Erik Gruvfors

+46 73 449 78 12

erik.gruvfors@nasdaq.com