Reporting Gap Between Large-Cap and Mid-Cap Companies Narrows with 90% Reporting Among Smaller Half of Russell 1000® Companies

NEW YORK, NY / ACCESS Newswire / October 15, 2025 / Governance & Accountability Institute, Inc. (G&A), a leading corporate sustainability consulting and research firm, today announced the findings of its 2025 Sustainability Reporting in Focus research report, focused on corporate reporting trends in the 2024 publication year for companies in the S&P 500® Index and the Russell 1000® Index. The research shows continued increases in sustainability reporting for both large-cap and mid-cap U.S. public companies[1], as publishing an annual sustainability report is now widely recognized as a best practice for U.S. public companies. The 14th edition of G&A's annual research report is available here.

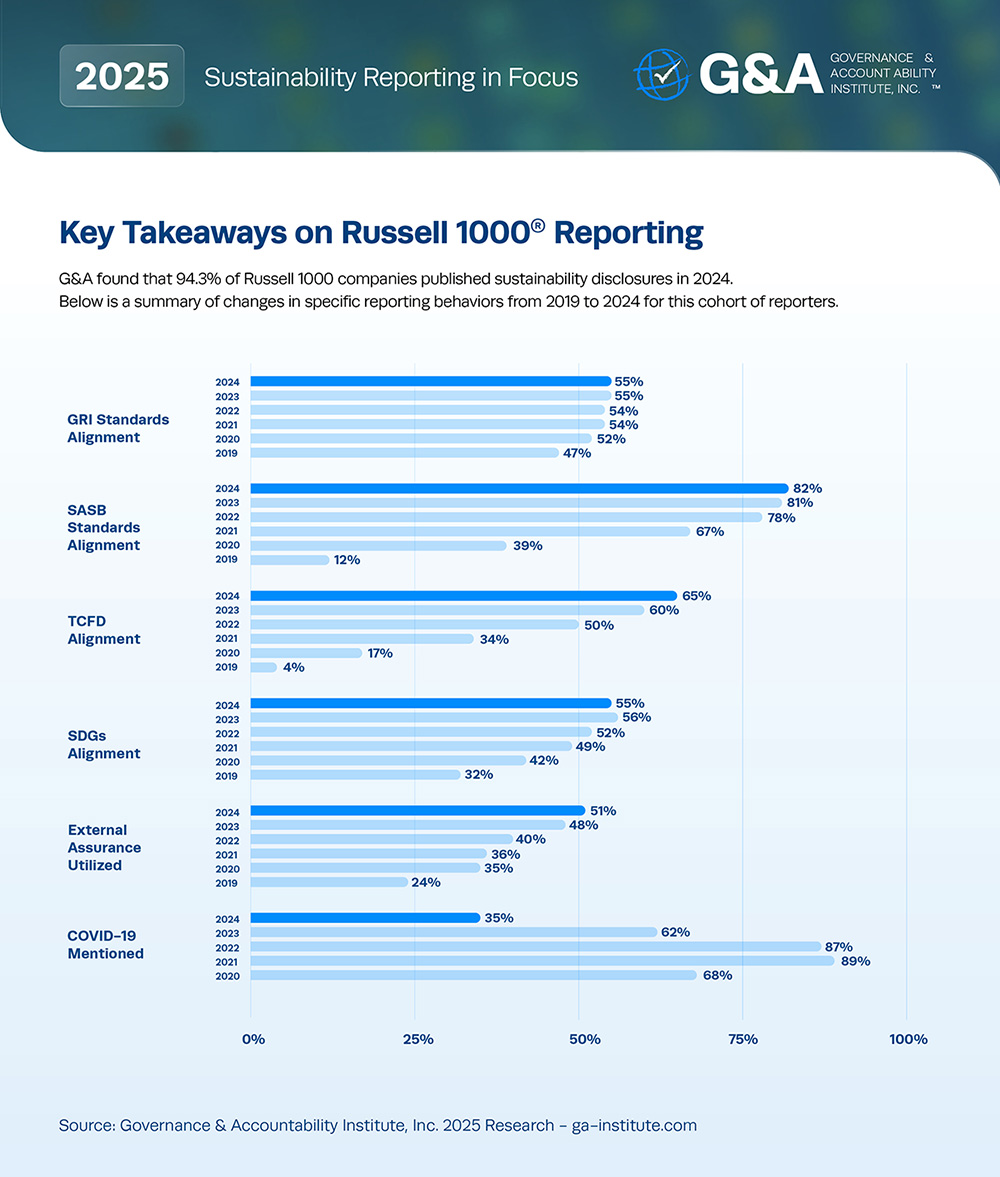

2025Sustainability Reporting in Focus provides detailed data and findings from G&A's research into U.S. company reporting on sustainability (also called ESG, corporate responsibility, corporate citizenship, or social impact reports). G&A's team analyzes corporate reporting content including frameworks and standards used - such as the Global Reporting Initiative (GRI), Sustainable Accounting Standards Board (SASB), Task Force on Climate-Related Financial Disclosures (TCFD) - as well as alignment with initiatives such as the UN Sustainable Development Goals (SDGs), trends in external assurance, and CDP reporting. For this year's research, we also began tracking alignment with new reporting initiatives: the International Financial Reporting Standards (IFRS) Sustainability Standards, the European Sustainability Reporting Standards (ESRS), and the Task Force for Nature-related Disclosures (TNFD).

G&A's 2025 research includes sector-specific analysis of reporting trends within all 11 sectors of the Global Industry Classification Standard (GICS®), to provide additional insights into reporting behavior per industry sector.

Key takeaways from G&A's new research report include:

A record 94% of Russell 1000 companies reported on sustainability in 2024, up from 93% in 2023.

The smaller half by market cap of the Russell 1000 (mid-cap companies with approximately $2 billion-$4 billion in market cap) had the greatest alignment in reporting in 2024 - reaching 90% compared to 87% in 2023.

The larger half by market cap of the Russell 1000 (i.e., the S&P 500) are nearing 100% reporters with a record 99% reporting on sustainability in 2024, compared to 98.6% in 2023.

SASB continued to be the most widely used sustainability standard, with 82% of Russell 1000 reporters aligning with SASB in 2024, compared to 81% in 2023 and only 12% in 2019.

TCFD reporting continued to increase, with 65% of Russell 1000 reporters aligning with TCFD in 2024, compared to 60% in 2023 and only 4% in 2019.

GRI reporters remained consistent among the Russell 1000 with 55% aligning with GRI in 2024 - the same compared to 2023.

Click here to view a graphical representation of the data noted above.

Louis Coppola, G&A's Chief Executive Officer and Co-Founder, commented, "Over the past 14 years, our Trends research has chronicled how America's largest public companies adopted sustainability reporting as a best practice because stakeholders demanded it, not because regulators required it. While policies may shift in Washington or Brussels, the fundamental reasons for sustainability reporting do not: the reporting process helps leaders sharpen strategy, strengthen resilience, understand risk, allocate capital, create value and build trust. That's why the best companies keep going - and why G&A stands ready to help."

Hank Boerner, G&A's Chairman, Chief Strategist and Co-Founder, added, "At the heart of sustainability disclosure is a better understanding of risk and reward - something investors and stakeholders deeply appreciate. Despite the anti-ESG pushback in some quarters, Corporate America continues to innovate and push forward with more detailed and informative reporting on a widening range of topics. Companies on the leading edge of this trend are well positioned for upcoming shifts from voluntary to mandatory sustainability reporting in a growing number of jurisdictions."

G&A proudly recognizes our research team of talented analysts who made significant contributions to this study:

G&A Research Supervisors: Elizabeth Peterson, SVP, Sustainability Consulting

G&A Research Team Leader: Natali Alsunna, Senior Sustainability Analyst

G&A Research Team:

Madeline Blankenship, Senior Sustainability Analyst

Grace Cusack, Sustainability Analyst

Neva Modric, Sustainability Analyst

Amelia Veleber, Intern Analyst

Zevid Lawrence, Intern Analyst

For more information on our team of research analysts please click here.

ABOUT G&A'S 2025 SUSTAINABILITY REPORTING IN FOCUS

This new report marks the 14th annual edition in G&A's annual research series tracking the publication of sustainability reports by the largest U.S. publicly-traded companies. In 2012, G&A published its first annual research on 2011 sustainability reporting trends of the S&P 500 companies, which at the time showed just 20% of these companies were publicly reporting on sustainability. In 2019, G&A expanded this research to include all companies in the Russell 1000 Index, and in 2024, it further expanded to provide detailed analysis by the 11 GCIS sectors.

ABOUT G&A INSTITUTE, INC.

G&A Institute is a leading sustainability consulting and research firm headquartered in New York City. Founded in 2006, G&A helps corporate and investor clients recognize, understand, and develop winning strategies for sustainability and ESG issues to address stakeholder and shareholder concerns. G&A's proprietary, comprehensive full-suite process for sustainability reporting is designed to help organizations achieve sustainability leadership in their industry and sector and maximize return on investment for sustainability initiatives.

Since 2011, G&A has been building and expanding a comprehensive database of corporate sustainability reporting data based on analysis of thousands of ESG and sustainability reports to help steer strategy for our clients and improve their disclosure and reporting.

More information is available on our website at ga-institute.com.

ABOUT THE S&P 500®

The S&P 500 is widely regarded as one of the best gauges of large-cap U.S. equity market performance, measuring the stock performance of approximately 500 large-cap companies covering approximately 80% of the total U.S. equity market capitalization. For 2024, S&P Dow Jones Indices estimated that $20 trillion in assets was indexed or benchmarked to the index. More information is available here.

ABOUT THE RUSSELL 1000®

The Russell U.S. indices are market-weighted indices that serve as leading benchmarks for institutional investors to track current and historical market performance by specific market segment (large/mid/small/micro-cap) or investment style (growth/value/defensive/dynamic). The Russell 1000 Index includes the largest publicly-traded U.S. companies by market cap, which comprise approximately 93% of the total market capitalization of all listed stocks in the U.S. equity market. The index is provided by FTSE Russell, a wholly owned subsidiary of

the London Stock Exchange Group (LSEG). More information is available here.

CONTACT:

Louis D. Coppola, Chief Executive Officer & Co-Founder

Governance & Accountability Institute, Inc.

Tel 646.430.8230 ext. 14

Email: lcoppola@ga-institute.com

[1] Definitions of market cap sizes: https://www.finra.org/investors/insights/market-cap

Key Takeaways on Russell 1000 Reporting

View additional multimedia and more ESG storytelling from Governance & Accountability Institute on 3blmedia.com.

Contact Info:

Spokesperson: Governance & Accountability Institute

Website: https://www.3blmedia.com/profiles/governance-accountability-institute-inc

Email: info@3blmedia.com

SOURCE: Governance & Accountability Institute

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/business-and-professional-services/ganda-institutes-new-research-shows-2024-sustainability-reportin-1087141