TORONTO, Oct. 20, 2025 (GLOBE NEWSWIRE) -- Churchill Resources Inc. ("Churchill" or the "Company") (TSXV: CRI) is pleased to provide an update on its ongoing exploration at the Black Raven Property in Central Newfoundland, host to the historic Frost Cove Antimony and Stewart Gold mines. The program, part of the first comprehensive exploration for antimony, gold, and silver on the property, commenced on September 15, 2025, and includes 5,000m of drilling and extensive trenching,

The program is progressing rapidly and systematically as planned, targeting first the historic Frost Cove Antimony Mine, to be followed by the historic Stewart Gold Mine and then the Taylor's Room Gold-Silver-Lead-Zinc prospect. Concurrently, comprehensive 50m spaced soil sampling is covering a large portion of the entire property to identify potential strike extensions to the known prospects as well as possible new discoveries.

In particular:

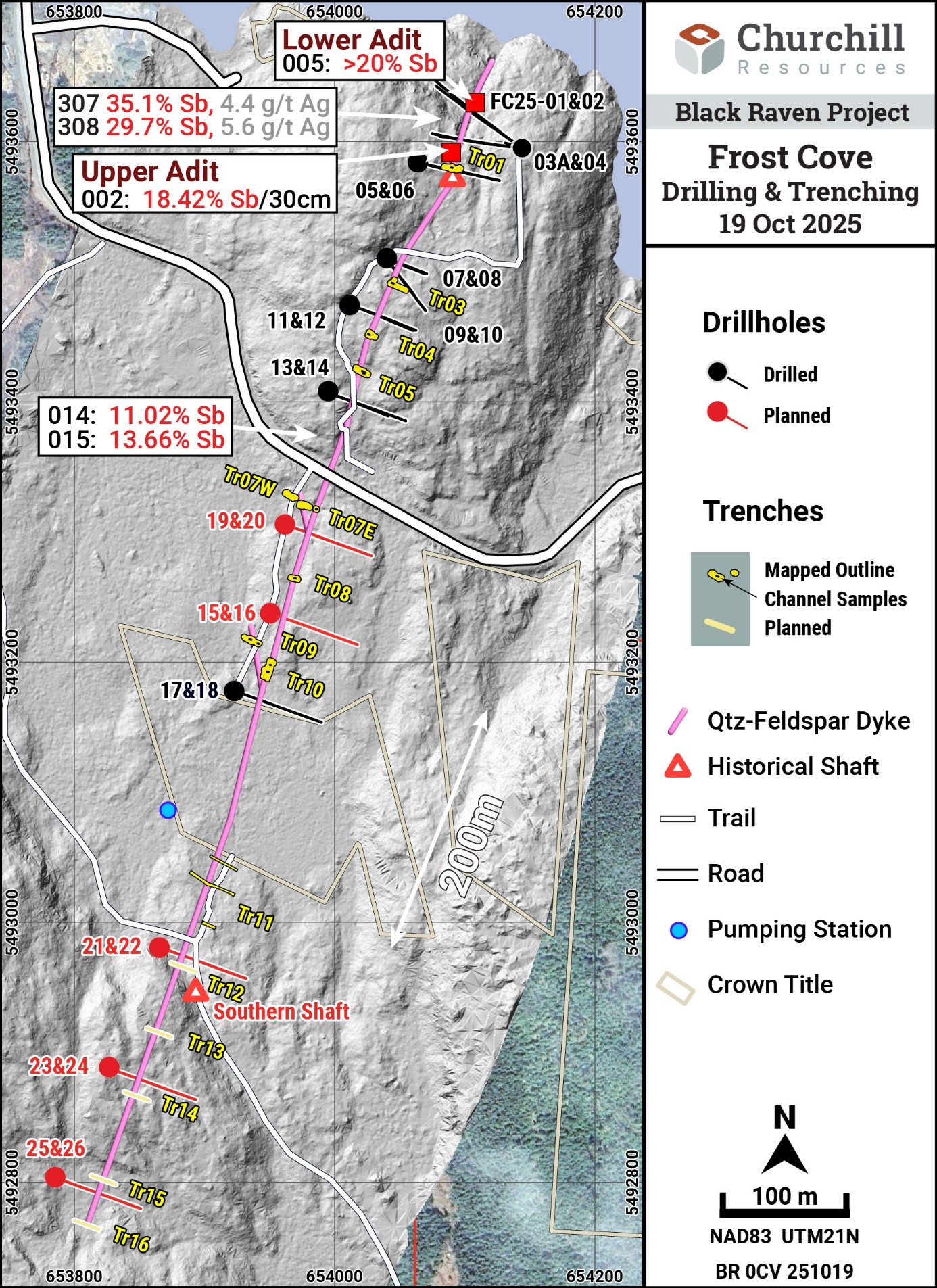

- Churchill mobilized a second drill rig to the property on October 14th and as of October 18th has completed 16 core holes with a cumulative depth of 1470m, targeting the northern 500m strike length at the Frost Cove site, and working southwards from the historical adits. Ten surface trenches have also been dug, examined, and sampled within this strike length. Five to seven more holes are to be drilled within this interval to complete initial delineation of this section.

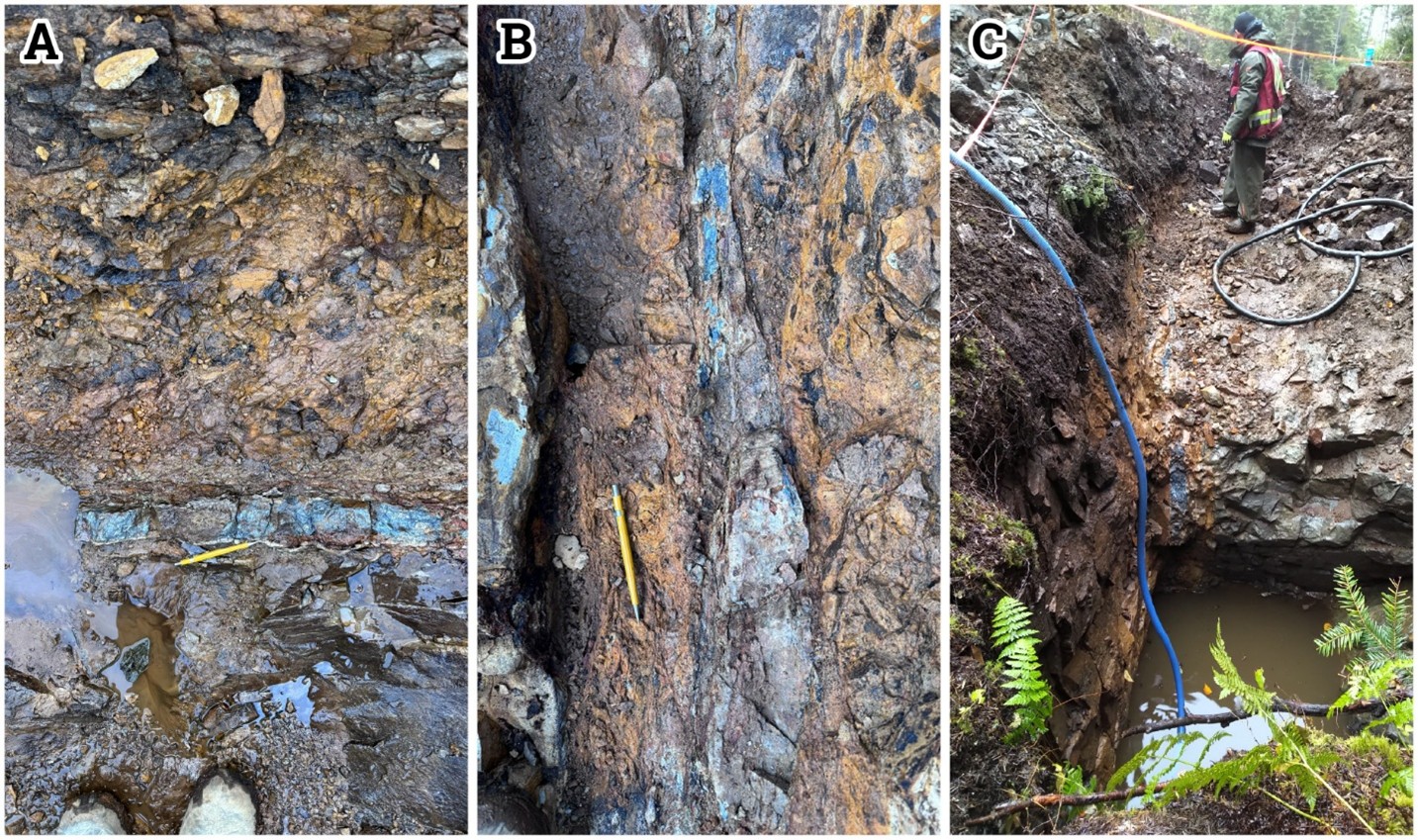

- Semi-massive to massive and stringer antimony mineralization has been intercepted in fourteen of sixteen drillholes, and in nine of the ten surface trenches, in all cases hosted by shear zones along the footwall of a prominent quartz-feldspar porphyry dyke which mapping has indicated to extend further to the south. Massive stibnite seams within the shear zone are typically 10-20cm thick as can be seen in figures a and b below from Trenches 3 and 10, occurring some 200m and 480m, to the south respectively, from the lower mine adit entrance.

- Further reinforcing the project's potential, Churchill's exploration team has identified massive stibnite seam mineralization in a recently rediscovered, second historic shaft located approximately 780 meters to the south of the entrance to the lower mine adits at the Frost Cove site (see figure c below). Trenching along the shear zone adjacent to the second historic shaft has traced the massive antimony seam on surface for approximately 80 meters north from the southern shaft to date. One drill rig will begin delineating this 200-300m southern portion of the Frost Cove strike length on October 20th and some 8-12 holes will likely be completed over this southern extent.

Massive Stibnite Mineralization Exposed in a) Trench 3 b) Trench 10 c) South Shaft

"Churchill has now established massive antimony over a substantial strike length of the Frost Cove shear zone, including the recently rediscovered south shaft located 780 metres south of the mine entrance." commented Paul Sobie, President of Churchill. "The host shear zone is open to both the south and the north, and we've sampled a vein 1.2 kms north of the mine which graded 9.46% antimony and 2.7 g/t gold which may be an extension of the Frost Cove structure. We are very pleased to see antimony in many of the drill holes and trenches, and eagerly await the assay results."

Ninety-three (93) core samples from holes FC25-01 to 05, and 48 channel and grab samples from Trenches 1-10 were submitted to SGS Lakefield in early October. A second and larger shipment of core and trench samples will be shipped in the coming days. As well, 673 soil samples were submitted for antimony, gold and multi-element analysis at Eastern Analytical in Springdale, Newfoundland Soil analysis is an important regional exploration tool for the property, as the Beaver Brook Mine antimony deposits, located 100km to the south of the Black Raven Project, were discovered and outlined using this technique. Churchill intends to submit a further approximately 1,000 samples at the end of October.

Metallurgical studies of composite Frost Cove antimony vein material continue at SGS Lakefield and have demonstrated excellent antimony recoveries from conventional gravity - flotation flowsheet techniques to date, with final work in progress and expected to be reported upon in the coming weeks.

Churchill's evaluation program at Frost Cove is designed to define known mineralization at depth and along strike, with surface trenches across vein structures at 50 meter intervals and drill pads every 100 meters, allowing for multiple holes at each site. The drill holes are targeted to intersect the vein structures at approximately -50m and -100m below surface.

The overarching goal of Churchill's evaluation program at Frost Cove is to assess its potential as a small-footprint, high-grade underground mine, positioning it as a crucial primary supply source for North American and European markets. Currently, North America lacks sources of high-grade, primary antimony supply, making a potential domestic source at Frost Cove critically important.

Antimony is recognized as a vital critical mineral, essential for Canada's national and economic security. It is a key component in military applications, flame retardants, strengthening alloys in batteries, and emerging energy storage technologies. Securing a reliable domestic supply chain for antimony is paramount for a "Fortress North America" approach to critical mineral supply chains, bolstering both economic resilience and strategic independence.

Churchill's objective is to gather sufficient data to support the preparation of initial resource estimates and advance towards a National Instrument 43-101 compliant maiden resource. The past-producing Frost Cove Antimony Mine and the Stewart Gold Mine, both on Churchill's Black Raven project, operated intermittently at the turn of the last century, an era which predates the modern regulatory and capital market regimes governing economic resource definition and delineation.

Black Raven is located approximately 60km northwest of Gander, Newfoundland, and approximately 100km north of the Beaver Brook Antimony Mine, which is currently on care and maintenance. Black Raven hosts a high-grade polymetallic stockworks vein system, including antimony, gold, silver lead and zinc, with multiple veins confirmed from prospecting by Churchill in 2025. Recent gab sample results include 35.1% antimony, 35.5 g/t gold and 1,118 g/t silver (See June 12th and August 6th, 2025 news releases). The project benefits from excellent infrastructure, including roads, power, proximity to tidewater and ports, and locally integrated operational and technical teams.

The technical and scientific information in this news release has been reviewed and approved by Dr. Derek H.C Wilton, P.Geo., FGC, who is a "qualified person" as defined under National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101"). Dr. Wilton is an honorary research professor of Economic Geology at Memorial University in St. John's and is independent of the Company for the purposes of NI 43-101.

About Churchill Resources

Churchill Resources Inc. is a Canadian exploration company focused on strategic, critical minerals in Canada, principally at its prospective Black Raven, Taylor Brook and Florence Lake properties in Newfoundland & Labrador. The Churchill management team, board, and advisors have decades of combined experience in mineral exploration and in the establishment of successful publicly listed mining companies, both in Canada and around the world. Churchill's Newfoundland and Labrador projects have the potential to benefit from the province's large and diversified minerals industry, which includes world class mines and processing facilities, and a well-developed mineral exploration sector with locally based drilling and geological expertise.

Further Information

For further information regarding Churchill, please contact:

Churchill Resources Inc.

Conan McIntyre, Chief Executive Officer

Tel. 416.272.4738

Email: cmcintyre@churchillresources.com

Paul Sobie, President

Tel. 416.365.0930 (o) 647.988.0930 (m)

Email: psobie@churchillresources.com

FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including, but not limited to, statements about Churchill's objectives, goals and exploration activities proposed to be conducted on its properties; future growth potential of Churchill, including whether any proposed exploration programs at any of its properties will be successful; exploration results; and future exploration plans and costs. Wherever possible, words such as "may", "will", "should", "could", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict" or "potential" or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. In particular, this release contains forward-looking information relating to, among other things, the Company's goals and objectives, and future exploration work to be conducted on the Company's Black Raven Antimony Property. These statements reflect management's current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. These factors should be considered carefully and readers should not place undue reliance on the forward-looking statements. Such factors, among other things, include: exploration results on the Black Raven Antimony Property; the expected benefits to Churchill relating to the exploration proposed to be conducted on its properties; receipt of all regulatory approvals in connection with the transaction contemplated herein; failure to identify any additional mineral resources or significant mineralization; the preliminary nature of metallurgical test results; uncertainties relating to the availability and costs of financing needed in the future, including to fund any exploration programs on the Churchill's properties, if required; fluctuations in general macroeconomic conditions; fluctuations in securities markets; fluctuations in spot and forward prices of gold, silver, base metals or certain other commodities; change in national and local government, legislation, taxation, controls, regulations and political or economic developments; risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, industrial accidents, unusual or unexpected formations pressures, cave-ins and flooding); inability to obtain adequate insurance to cover risks and hazards; the presence of laws and regulations that may impose restrictions on mining and mineral exploration; employee relations; relationships with and claims by local communities and indigenous populations; availability of increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development (including the risks of obtaining necessary licenses, permits and approvals from government authorities); the unlikelihood that properties that are explored are ultimately developed into producing mines; geological factors; actual results of current and future exploration; changes in project parameters as plans continue to be evaluated; soil sampling results being preliminary in nature and are not conclusive evidence of the likelihood of a mineral deposit; and title to properties. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Churchill cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and the Churchill assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law. Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/c104e605-3381-4c57-bf30-bfd30a371e07

https://www.globenewswire.com/NewsRoom/AttachmentNg/3b62d93b-06a7-44c6-bae7-a83609e4591b