Brossard, Québec--(Newsfile Corp. - October 20, 2025) - Mines d'Or Orbec Inc. (TSXV: BLUE) (OTC Pink: BLTMF) ("Orbec" or the "Company") is pleased to announce that it has entered into a definitive arrangement agreement dated October 19, 2025 (the "Arrangement Agreement") with IAMGOLD Corporation (NYSE: IAG) (TSX: IMG) ("IAMGOLD") pursuant to which IAMGOLD has agreed to acquire all of the issued and outstanding common shares of Orbec (each, an "Orbec Share") by way of a court-approved plan of arrangement under the Business Corporations Act (Ontario) (the "Transaction").

Under the terms of the Arrangement Agreement, Orbec shareholders will receive total consideration representing a value of C$0.125 per Orbec Share in a cash and shares transaction comprised of C$0.0625 per Orbec Share in cash and 0.003466 of an IAMGOLD common share ("IAMGOLD Shares") for each Orbec Share, implying a total equity value, based on all of the issued and outstanding Orbec Shares on a fully diluted basis, of approximately C$18.1 million, and representing a premium of approximately 25% to the closing price of the Orbec Shares on the TSX Venture Exchange ("TSXV") as of market close on October 17, 2025. IAMGOLD currently owns 7,142,857 Orbec Shares, representing approximately 6.70% of the Orbec Shares outstanding. Pursuant to the Transaction, IAMGOLD expects to issue to holders of Orbec Shares (other than IAMGOLD) approximately 369,341 IAMGOLD Shares.

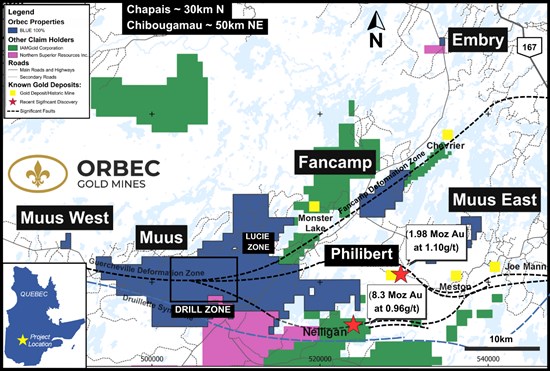

John Tait, Chief Executive Officer of Orbec, commented: "This Transaction represents an exceptional outcome for Orbec shareholders. Over the past several years, we have advanced the Muus Project into one of Quebec's most promising gold exploration plays, with early drilling confirming a strong geological connection to IAMGOLD's adjacent Nelligan and Monster Lake deposits. Through this Transaction, Orbec shareholders will realize immediate value of $0.125 per Orbec share through a 50% cash payment ($0.0625 per Orbec share) and will continue to benefit from the district's significant exploration upside through the 50% share consideration in IAMGOLD. We are confident that under IAMGOLD's stewardship, the Muus Project will be advanced with the technical expertise, operational excellence, and financial capacity required to unlock its full potential within this leading gold district."

Highlights of the Transaction

- Provides an immediate premium of approximately 25% to Orbec shareholders based on the closing price of Orbec's common shares on October 17, 2025.

- Positions the Muus Project alongside IAMGOLD's Nelligan and Monster Lake Projects, forming one of the most significant pre-production gold land packages in Quebec's Chibougamau district.

- Consolidates a highly prospective 24,979 hectare land position within the Guercheville and Fancamp Deformation Zones, known for hosting major regional gold discoveries.

- Offers Orbec shareholders access to IAMGOLD's financial strength, high share liquidity, and continued exposure to the region's exploration upside through IAMGOLD's larger regional program.

Transaction Details

Under the terms of the Arrangement Agreement, each of the issued and outstanding Orbec Share (other than the Orbec Shares held by IAMGOLD) will be exchanged for C$0.0625 per Orbec Share in cash and 0.003466 of an IAMGOLD Share for each Orbec Share. In-the-money options of Orbec ("Orbec Options"), whether vested or unvested, will be deemed to be surrendered, assigned and transferred for a cash payment made by or on behalf of Orbec, equal to the difference between their strike price and $0.125 multiplied by the number of Orbec Shares such Orbec Options entitles the holder thereof to purchase, and in-the-money common share purchase warrants ("Orbec Warrants") will be deemed to be surrendered, assigned and transferred for a cash payment made by or on behalf of Orbec, equal to the difference between their strike price and $0.125 multiplied by the number of Orbec Shares such Orbec Warrant entitles the holder thereof to purchase. All out-of-the money Orbec Options and Orbec Warrants will be cancelled without any payment therefor.

The board of directors of Orbec (the "Orbec Board"), after consultation with its financial and legal advisors, and on the recommendation of a special committee of independent directors (the "Special Committee"), unanimously determined that the Transaction is in the best interests of the Company and recommends that shareholders of Orbec vote in favour of the Transaction. Evans & Evans, Inc. provided a fairness opinion to the Orbec Board stating that, subject to the assumptions, limitations and qualifications set out therein, the consideration to be received by shareholders of Orbec in connection with the Transaction is fair, from a financial point of view, to such shareholders.

In connection with the Transcation, certain shareholders as well as directors and executive officers of Orbec entered into voting support agreements with IAMGOLD pursuant to which they have agreed to vote their Orbec Shares in favour of the Transaction, in each case subject to customary exceptions and the terms and conditions of their respective agreements.

The Transaction will be effected by way of a court-approved plan of arrangement under the Business Corporations Act (Ontario), will constitute a "business combination" for purposes of Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI 61-101"), and will require the approval of at least (i) 66 2/3% of the votes cast by shareholders of Orbec, (ii) 66 2/3% of the votes cast by shareholders of Orbec and holders of Orbec Options and Orbec Warrants (voting together as a single class), and (iii) a simple majority of the votes cast by shareholders of Orbec, excluding certain related parties as prescribed by MI 61-101, at a special meeting of securityholders of Orbec that will be called to consider the Transaction. Orbec will be exempt from the requirement to obtain a formal valuation for the Transaction in reliance of section 5.5(b) of MI 61-101, which will be further detailed in the management information circular of Orbec to be prepared and filed with regulatory authorities in accordance with applicable securities laws, and expected to be mailed to securityholders in November 2025 (the "Circular").

In addition to securityholder and court approvals, completion of the Transaction is subject to applicable regulatory approvals, including the approval of the TSXV and the Toronto Stock Exchange, and the satisfaction of certain other closing conditions customary in transactions of this nature. The Arrangment Agreement contains customary provisions, including representations and warranties of each party, non-solicitation covenants of Orbec and "fiduciary out" provisions, as well as "right-to-match" provisions in favour of IAMGOLD. The Company has also agreed to pay a termination fee of $660,000 to IAMGOLD in the case of certain terminating events. The Agreement Agreement, which describes the full particulars of the Transaction, will be made available under Orbec's issuer profile on SEDAR+ at www.sedarplus.ca and on Orbec's website at www.orbec.ca.

Complete details of the Transaction will be included in the Circular and made available under Orbec's issuer profile on SEDAR+ at www.sedarplus.ca and on Orbec's website at www.orbec.ca. The Transaction is expected to be completed by the end of 2025.

Convertible Debenture

In connection with the Transaction, IAMGOLD agreed to make available to Orbec an unsecured convertible debenture in the principal amount of C$500,000 (the "Loan"). The proceeds of the Loan will be used by the Company to fund working capital requirements. Orbec will have the right, in accordance with the terms of the Loan, to convert the whole or any portion of the outstanding principal amount (and accrued interest, if any) into Orbec Shares at a conversion price based on the closing price of the Orbec Shares on the TSXV on the business day after the announcement of the Transaction, or such other date as may be required by the TSXV in order to comply with its policies. The outstanding principal amount of the Loan will be repayable on the earlier of: (a) March 20, 2026; (b) the date on which the Arrangement Agreement is terminated; and (c) the occurrence of an event of default.

Advisors

Evans & Evans, Inc. acted as the Special Committee's financial advisor and Cassels Brock & Blackwell LLP acted as legal counsel to the Company.

About the Muus Project

The Muus Project covers approxmiately 24,979 hectares, is located approximately 50 kilometres southwest of Chibougamau, Quebec, and is prospective for both gold and base metals at the intersection of two major mineralized structural breaks: including the northeast-trending Fancamp Deformation Zone (hosting IAMGOLD's Monster Lake deposit and Orbec's Fancamp Property) and the east-west-trending Guercheville Deformation Zone (hosting IAMGOLD's Nelligan deposit). Limited modern exploration has occurred since the mid-1990s, providing significant discovery potential through systematic drilling and structural targeting.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6951/271085_2345a551c432cbdd_001full.jpg

Qualified Person and Technical Information

The scientific and technical information contained in this news release has been reviewed and approved by Lucie Tremblay, P.Geo., Exploration Manager for Orbec, who is a "qualified person" within the meaning of National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

ON BEHALF OF THE BOARD

John Tait, CEO and Director

For more information, please visit our website www.orbec.ca or contact Mr. John Tait, info@orbec.ca.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

This news release contains "forward-looking information" and "forward-looking statements" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements. In this news release, forward-looking statements relate, among other things, to the completion of the Transaction, the anticipated benefits of the Transaction to securityholders of Orbec, the consideration to be to be paid and the treatment of options and warrants pursuant to the Transaction, the timing for the special meeting to consider the Transaction, and the timing for completion of the Transaction.

These forward-looking statements are based on reasonable assumptions and estimates of management of the Company at the time such statements were made. Actual future results may differ materially as forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to materially differ from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors, among other things, include: fluctuations in general macroeconomic conditions; fluctuations in securities markets; fluctuations in spot and forward prices of gold, silver, base metals or certain other commodities; fluctuations in currency markets (such as the Canadian dollar to United States dollar exchange rate); change in national and local government, legislation, taxation, controls, regulations and political or economic developments; risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, industrial accidents, unusual or unexpected formations pressures, cave-ins and flooding); inability to obtain adequate insurance to cover risks and hazards; the presence of laws and regulations that may impose restrictions on mining; employee relations; relationships with and claims by local communities and indigenous populations; availability of increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development (including the risks of obtaining necessary licenses, permits and approvals from government authorities); and title to properties. Although the forward-looking statements contained in this news release are based upon what management of the Company believes, or believed at the time, to be reasonable assumptions, the Company cannot assure shareholders that actual results will be consistent with such forward-looking statements, as there may be other factors that cause results not to be as anticipated, estimated or intended. Readers should not place undue reliance on the forward-looking statements and information contained in this news release. The Company assumes no obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change, except as required by law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/271085

SOURCE: Mines D'Or Orbec Inc.