NORWELL, Mass., Oct. 20, 2025 (GLOBE NEWSWIRE) -- DIH Holding US, Inc. ("DIH" or the "Company") (NASDAQ:DHAI), a global provider of advanced robotic devices used in physical rehabilitation, which incorporate visual stimulation in an interactive manner to enable clinical research and intensive functional rehabilitation and training in patients with walking impairments, reduced balance and/or impaired arm and hand functions, today announced financial results for the fiscal 2025 fourth quarter and fiscal year ended March 31, 2025.

Recent Highlights

- Revenue of $62.9 million for the fiscal year ended March 31, 2025, representing a decrease of 2.5% over the prior year

- Device revenue of $49.7 million and service revenue of $12.0 million for the fiscal year ended March 31, 2025, representing a decrease of 2.8% and an increase of 8.4%, respectively over the prior year

- Negative operating cash flow of $4.1 million for the year ended March 31, 2025

"DIH remains committed to driving innovation and delivering value for patients and healthcare providers," said Jason Chen, Chairman and CEO of DIH. "During this year, we made meaningful progress across our key strategic initiatives while maintaining our focus on operational discipline. As we look forward to the results of the NASDAQ hearing panel regarding our listing status held on October 16, 2025, our team is committed to positioning DIH for long-term success."

Financial Results for the Fiscal Year Ended March 31, 2025

The overall decrease in revenue was primarily due to a change in product mix, where many customers purchased a similar number of devices but with a lower average sales price than the prior year mix. This change in mix was offset by a price increase implemented during fiscal year 2024, and effective for devices sold in fiscal year 2025. Services revenues increased slightly during the year, as the Company continues to focus on expanding its service department in established regions. Overall, as the product mix shifted to smaller and lower priced products, the revenues decreased slightly, year over year.

Changes in foreign currency exchange rates had an unfavorable impact on our net sales for the year ended March 31, 2025, resulting in a decrease of approximately $0.2 million. This was mainly driven by fluctuations in Euro valuations throughout the period.

Gross profit for the fiscal year ended March 31, 2025, was $32.2 million, an increase of 8.2% compared to the prior period. The increase was driven by a cost of goods decrease of $4.1 million, of which $5.3 million was due to the change in product mix, as the devices produced for delivery to customers had a lesser cost basis, and the impact of a lesser inventory reserve recorded in the current fiscal year, as compared to the prior year. The decreased reserve in the current year is the result of a stabilized current inventory on hand, with significantly less identified materials where excess inventory was identified. The decrease in devices costs was offset by an increase cost of services for providing routine and on demand service requests of $1.2 million between periods.

Selling, general and administrative expense for the year ended March 31, 2025 increased by $4.2 million, or 16.3%, to $30.0 million. The increase was driven by a $1.9 million increase in personnel expenses related to compensation including an increase in performance-based compensation, merit increases to salaries, and additions in headcount as well as a $0.5 million increase in stock compensation. In addition, there was a $1.1 million in impairment of related party receivable in the year ended March 31, 2025 due to a settlement of related party balances. The provision for credit losses reflected a $0.3 million release in fiscal 2025 compared to a $1.0 million release in fiscal 2024, resulting in a $0.7 million increase in total expense in the year ended March 31, 2025.

Research and development costs for the year ended March 31, 2025 increased by $0.5 million, or 7.4%, to $7.1 million primarily due to increase in software costs.

During the fourth quarter of fiscal year 2025, we discontinued the development and commercialization of the SafeGait product, resulting in an impairment loss of $0.6 million. We also ceased further development of capitalized software related to the HocoNet platform, resulting in an additional impairment loss of $1.5 million. There were no such impairments recognized during fiscal year 2024

Cash and cash equivalents at March 31, 2025 totaled $1.9 million.

Financial Results for the Fourth Quarter Ended March 31, 2025

Revenue for the three months ended March 31, 2025 was $12.6 million, a decrease of 34.7% compared to the prior year period. The decrease in devices revenue was primarily driven by lower sales volume in EMEA. In EMEA, we sell our equipment through a distributor network across Europe. One of our largest sales partners, which primarily operates in Eastern Europe, has been impacted by wartime import restrictions resulting from the ongoing conflict between Russia and Ukraine.

Changes in foreign currency exchange rates had a minor unfavorable impact on our net sales in the three months ended March 31, 2025, resulting in a decrease of approximately $0.3 million.

Gross profit for the three months ended March 31, 2025 was $6.0 million, a 30.4% decrease compared to the prior period which directly correlated to the product mix changes.

Selling, general and administrative expenses were $7.4 million for the three months ended March 31, 2025, a decrease of 8.7% compared to the prior-year period. The decrease was primarily due to $1.4 million of transaction costs incurred during the three months ended March 31, 2024 in connection with the business combination that did not recur, as well as $0.7 million of cost reductions from efficiency initiatives. These decreases were partially offset by a $1.1 million increase due to the impairment on related party receivables and a $0.5 million increase in performance-based compensation, merit increases to salaries, and additions in headcount.

Research and development expenses were $1.8 million for the three months ended March 31, 2025, consistent with $1.9 million in the prior-year period. The slight decrease was due to lower personnel expenses related to salary and benefit partially offset by higher depreciation and amortization expenses.

During the fourth quarter of fiscal year 2025, we discontinued the development and commercialization of the SafeGait product, resulting in an impairment loss of $0.6 million. We also ceased further development of capitalized software related to the HocoNet platform, resulting in an additional impairment loss of $1.5 million.

Subsequent Events

After March 31, 2025, the Company paid the April 2025 scheduled redemption of the Original Debentures. On May 29, 2025, the Company and Five Narrow Lane amended the Securities Purchase Agreement. Under the amendment, the deferred May 1, 2025 redemption was settled through the issuance of 1,540,277 shares of Class A common stock, and the June 2025 redemption was settled in shares as provided in the Original Debentures. The amendment permits future monthly redemptions and interest to be settled in cash or in shares, and the holder waived the default related to the deferred May payment. Separately, the Company made a partial redemption in July 2025 and deferred later scheduled redemptions while finalizing its Annual Report on Form 10-K.

On August 7, 2025, the Company entered into a Securities Purchase Agreement pursuant to which it issued, in a private placement, senior secured convertible debentures with an aggregate principal amount of $2.2 million on an original-issue-discount basis, resulting in expected net proceeds of $1.9 million after estimated offering expenses. The debentures were structured to be funded in four tranches of gross proceeds. As of the date of these financial statements, $1.4 million has been funded under the first three tranches, and the remaining $0.5 million is expected to fund upon (a) the filing of this Annual Report on Form 10-K, (b) delivery of a substantially complete draft Form 10-Q for the quarter ended June 30, 2025, and (c) appointment of one additional independent director.

The debentures mature on September 21, 2026. No interest accrues during the first year; beginning the first day of the month after the first anniversary, interest is 8% per annum, payable monthly. The Company may extend the maturity by six months if specified conditions are met and six months of interest is prepaid and credited against future interest. The debentures are initially convertible at $0.25 per share, subject to adjustment and a 9.99% beneficial-ownership cap. Beginning October 1, 2025, monthly redemptions of $171 thousand are required; each monthly redemption may be satisfied in cash or, if conditions are met, in shares priced at the lesser of the then-current conversion price and 90% of the average of the five lowest VWAPs for the 10 consecutive trading days prior to the applicable monthly redemption date. The debentures are secured under the Company's existing June 6, 2024 security arrangements. In connection with the financing, the Company issued warrants to purchase 8,888,888 shares of common stock at an initial exercise price of $0.25 per share, exercisable beginning February 1, 2026 and expiring February 1, 2030.

The agreements include a resale registration undertaking with filing and effectiveness timelines and liquidated damages if missed; a 90-day limitation on new issuances or registration filings after the resale registration becomes effective; a prohibition on variable-rate transactions while the debentures remain outstanding; an obligation to seek shareholder approval under Nasdaq rules to permit additional share issuances in connection with the debentures and warrants; and a commitment to include in the proxy proposals authorizing a reverse stock split to support listing compliance and amending certain June 6, 2024 and March 20, 2025 debentures to align their minimum base conversion price with the new debentures.

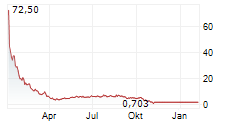

A 1-for-25 reverse stock split of the Company's Class A common stock was approved by stockholders at a Special Meeting held on September 25, 2025. The final ratio was determined by the Board on September 26, 2025. The Company legally effected by filing a certificate of amendment with the Delaware Secretary of State on October 17, 2025. The Common Stock began trading on a split-adjusted basis on the Nasdaq Stock Market at market open on October 20, 2025. As a result, every twenty-five shares of Common Stock were converted into one share, decreasing issued and outstanding shares from approximately 52.3 million to 2.1 million as of the effective date. The par value and authorized shares remained unchanged.

On October 15, 2025 the Company entered into an equity line of credit agreement with Five Narrow Lane, L.P. (the "investor") whereby the Company can issue and sell up to up to the lesser of (i) $22,000,000 in aggregate gross purchase price of duly authorized, validly issued, fully paid and non-assessable shares of Class A common stock of the Company, par value $0.0001 per share, but shall not exceed 10,458,031 Common Shares (representing 19.99% of the voting power or number of Common Shares, issued and outstanding immediately prior to the execution of this Agreement). The shares can be purchased at 94% of the VWAP on the Business Day immediately preceding the VWAP Purchase Date but not less than $0.10 or such higher price as set forth by the Company in the VWAP Purchase Notice. In exchange for entering into the equity line of credit, the company agreed to an upfront commitment fee equal to 2,500,000 shares of Common Stock and a pre-funded warrant to purchase up to an additional 2,500,000. In the event the company does not retain listing status as a result of the NASDAQ hearings panel meeting on October 16, 2025, the shares will be returned to the Company.

About DIH Holding US, Inc.

DIH stands for the vision to "Deliver Inspiration & Health" to improve the daily lives of millions of people with disabilities and functional impairments through providing devices and solutions enabling intensive rehabilitation. DIH is a global provider of advanced robotic devices used in physical rehabilitation, which incorporate visual stimulation in an interactive manner to enable clinical research and intensive functional rehabilitation and training in patients with walking impairments, reduced balance and/or impaired arm and hand functions. Built through the mergers of global-leading niche technology providers, DIH is a transformative rehabilitation solutions provider and consolidator of a largely fragmented and manual-labor-driven industry.

Caution Regarding Forward-Looking Statements

This press release contains certain statements which are not historical facts, which are forward-looking statements within the meaning of the federal securities laws, for the purposes of the safe harbor provisions under The Private Securities Litigation Reform Act of 1995. These forward-looking statements include certain statements made with respect to the business combination, the services offered by DIH and the markets in which it operates, and DIH's projected future results. These forward-looking statements generally are identified by the words "believe," "project," "expect," "anticipate," "estimate," "intend," "strategy," "future," "opportunity," "plan," "may," "should," "will," "would," "will be," "will continue," "will likely result," and similar expressions. Forward-looking statements are predictions provided for illustrative purposes only, and projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties that could cause the actual results to differ materially from the expected results. These risks and uncertainties include, but are not limited to: general economic, political and business conditions; the ability of DIH to achieve its projected revenue, the failure of DIH realize the anticipated benefits of the recently-completed business combination and access to sources of additional debt or equity capital if needed. While DIH may elect to update these forward-looking statements at some point in the future, DIH specifically disclaims any obligation to do so.

Investor Contact

Greg Chodaczek

332-895-3230

Investor.relations@dih.com

DIH HOLDING US, INC. CONSOLIDATED BALANCE SHEETS (in thousands, except share and per share data, unaudited) | ||||||||

| As of March 31, | ||||||||

| 2025 | 2024 | |||||||

| Assets | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 1,939 | $ | 3,225 | ||||

| Accounts receivable, net of allowances of $161 and $667, respectively | 3,249 | 5,197 | ||||||

| Inventories | 7,048 | 7,830 | ||||||

| Due from related party | 3,468 | 5,688 | ||||||

| Other current assets | 5,461 | 5,116 | ||||||

| Total current assets | 21,165 | 27,056 | ||||||

| Property, and equipment, net | 553 | 530 | ||||||

| Capitalized software, net | - | 2,131 | ||||||

| Other intangible assets, net | - | 380 | ||||||

| Operating lease, right-of-use assets, net | 3,802 | 4,466 | ||||||

| Other tax assets | 131 | 267 | ||||||

| Other assets | 1,101 | 905 | ||||||

| Total assets | $ | 26,752 | $ | 35,735 | ||||

| Liabilities and Stockholders' Deficit | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 3,356 | $ | 4,305 | ||||

| Due to related party | 7,919 | 10,192 | ||||||

| Advance payments from customers | 6,814 | 10,562 | ||||||

| Current portion of deferred revenue | 8,045 | 5,211 | ||||||

| Employee compensation | 3,341 | 2,664 | ||||||

| Current maturities of convertible debt, at fair value | 2,214 | - | ||||||

| Current portion of operating lease | 904 | 1,572 | ||||||

| Manufacturing warranty obligation | 544 | 513 | ||||||

| Accrued expenses and other current liabilities ($1,048 and $0, respectively measured at fair value) | 9,720 | 9,935 | ||||||

| Total current liabilities | 42,857 | 44,954 | ||||||

| Notes payable - related party | 8,601 | 11,457 | ||||||

| Non-current deferred revenue | 4,781 | 4,670 | ||||||

| Long-term operating lease | 2,931 | 2,917 | ||||||

| Convertible debt, net of current maturities, at fair value | 241 | - | ||||||

| Deferred tax liabilities | 221 | 112 | ||||||

| Other non-current liabilities | 4,255 | 4,171 | ||||||

| Total liabilities | 63,887 | 68,281 | ||||||

| Commitments and contingencies | ||||||||

| Stockholders' Deficit: | ||||||||

| Preferred stock, $0.00001 par value; 10,000,000 shares authorized; no shares issued and outstanding at March 31, 2025 and 2024 | - | - | ||||||

| Common stock, $0.0001 par value; 100,000,000 shares authorized; 1,690,356 shares issued and outstanding at March 31, 2025; 1,381,797 shares issued and outstanding at March 31, 2024 | - | - | ||||||

| Additional paid-in-capital | 5,274 | 2,616 | ||||||

| Accumulated deficit | (43,888 | ) | (35,212 | ) | ||||

| Accumulated other comprehensive income | 1,479 | 50 | ||||||

| Total stockholders' deficit | (37,135 | ) | (32,546 | ) | ||||

| Total liabilities and stockholders' deficit | $ | 26,752 | $ | 35,735 | ||||

| DIH HOLDING US, INC. CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands, except share and per share data, unaudited) | ||||||||||||||||

| Three Months Ended March 31, | Years Ended March 31, | |||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Revenue | $ | 12,648 | $ | 19,357 | $ | 62,864 | $ | 64,473 | ||||||||

| Cost of sales | 6,682 | 10,791 | 30,650 | 34,702 | ||||||||||||

| Gross profit | 5,966 | 8,566 | 32,214 | 29,771 | ||||||||||||

| Operating expenses: | ||||||||||||||||

| Selling, general, and administrative expense | 7,418 | 8,124 | 29,982 | 25,776 | ||||||||||||

| Research and development | 1,755 | 1,928 | 7,096 | 6,609 | ||||||||||||

| Impairment of long-lived assets | 2,160 | - | 2,160 | - | ||||||||||||

| Total operating expenses | 11,333 | 10,052 | 39,238 | 32,385 | ||||||||||||

| Operating loss | (5,367 | ) | (1,486 | ) | (7,024 | ) | (2,614 | ) | ||||||||

| Other income (expense), net: | ||||||||||||||||

| Interest expense | (131 | ) | (233 | ) | (317 | ) | (693 | ) | ||||||||

| Other income (expense), net | 79 | (3,709 | ) | (925 | ) | (3,890 | ) | |||||||||

| Total other income (expense), net | (52 | ) | (3,942 | ) | (1,242 | ) | (4,583 | ) | ||||||||

| Loss before income taxes | (5,419 | ) | (5,428 | ) | (8,266 | ) | (7,197 | ) | ||||||||

| Income tax expense (benefit) | (1,015 | ) | 587 | 410 | 1,246 | |||||||||||

| Net loss | $ | (4,404 | ) | $ | (6,015 | ) | $ | (8,676 | ) | $ | (8,443 | ) | ||||

| Net loss per share, basic and diluted | $ | (2.80 | ) | $ | (4.92 | ) | $ | (6.07 | ) | $ | (8.00 | ) | ||||

| Weighted-average shares outstanding, basic and diluted | 1,584,140 | 1,222,366 | 1,430,197 | 1,055,288 | ||||||||||||

| DIH HOLDING US, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS (in thousands, unaudited) | ||||||||||||||||

| Three Months Ended March 31, | Years Ended March 31, | |||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Net loss | $ | (4,404 | ) | $ | (6,015 | ) | $ | (8,676 | ) | $ | (8,443 | ) | ||||

| Other comprehensive income (loss) | ||||||||||||||||

| Foreign currency translation adjustments | (221 | ) | 579 | (1,300 | ) | 1,455 | ||||||||||

| Pension liability adjustments | 658 | (52 | ) | (487 | ) | (1,116 | ) | |||||||||

| Other comprehensive income (loss) | 437 | 527 | (1,787 | ) | 339 | |||||||||||

| Comprehensive loss | $ | (3,967 | ) | $ | (5,488 | ) | $ | (10,463 | ) | $ | (8,104 | ) | ||||

| DIH HOLDING US, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS (in thousands, unaudited) | ||||||||||||||||||||||||

| Years Ended March 31, | ||||||||||||||||||||||||

| Common Stock | Accumulated | |||||||||||||||||||||||

| Shares(1) | Amount | Additional Paid-In Capital | Accumulated Deficit | Other Comprehensive Income (Loss) | Total Equity (Deficit) | |||||||||||||||||||

| Balance, March 31, 2023 | 1,000,000 | $ | - | $ | (1,896 | ) | $ | (26,769 | ) | $ | (289 | ) | $ | (28,954 | ) | |||||||||

| Net loss | - | - | - | (8,443 | ) | - | (8,443 | ) | ||||||||||||||||

| Issuance of common stock upon reverse capitalization | 381,797 | - | 4,512 | - | - | 4,512 | ||||||||||||||||||

| Other comprehensive income | - | - | - | - | 339 | 339 | ||||||||||||||||||

| Balance, March 31, 2024 | 1,381,797 | $ | - | $ | 2,616 | $ | (35,212 | ) | $ | 50 | $ | (32,546 | ) | |||||||||||

| Net loss | - | - | - | (8,676 | ) | - | (8,676 | ) | ||||||||||||||||

| Issuance of common stock and warrants, net of issuance costs | 58,399 | - | 3,911 | - | - | 3,911 | ||||||||||||||||||

| Issuance of common stock upon redemption of convertible note | 12,676 | - | 803 | - | - | 803 | ||||||||||||||||||

| Stock Compensation | - | - | 450 | - | - | 450 | ||||||||||||||||||

| Reclassification of prior-period equity classification error | - | - | (3,216 | ) | - | 3,216 | - | |||||||||||||||||

| Out of period adjustment related to reverse recapitalization | - | - | 710 | - | - | 710 | ||||||||||||||||||

| Other comprehensive loss | - | - | - | (1,787 | ) | (1,787 | ) | |||||||||||||||||

| Balance, March 31, 2025 | 1,690,356 | $ | - | $ | 5,274 | $ | (43,888 | ) | $ | 1,479 | $ | (37,135 | ) | |||||||||||

| DIH HOLDING US, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands, unaudited) | ||||||||

| Years Ended March 31, | ||||||||

| 2025 | 2024 | |||||||

| Cash flows from operating activities: | ||||||||

| Net loss | $ | (8,676 | ) | $ | (8,443 | ) | ||

| Adjustments to reconcile net loss to net cash (used in) provided by operating activities: | ||||||||

| Depreciation and amortization | 842 | 302 | ||||||

| Provision for credit losses on accounts receivable | (264 | ) | (1,016 | ) | ||||

| Impairment of related-party receivables | 1,111 | - | ||||||

| Impairment of long-lived assets | 2,160 | - | ||||||

| Inventory write-offs and adjustments | 973 | 617 | ||||||

| Noncash business combination expense | - | 3,514 | ||||||

| Stock compensation | 450 | - | ||||||

| Pension contribution | (653 | ) | (530 | ) | ||||

| Pension expense | (69 | ) | (75 | ) | ||||

| Change in fair value of convertible debt and warrant liability | 1,478 | - | ||||||

| Foreign exchange (gain) loss | (604 | ) | 376 | |||||

| Noncash lease expense | 1,747 | 1,590 | ||||||

| Noncash interest expense | 17 | 28 | ||||||

| Change in manufacturing warranty obligation estimate | - | (626 | ) | |||||

| Deferred and other noncash income tax expense (income) | 261 | (304 | ) | |||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable, net | 2,204 | 1,853 | ||||||

| Inventories | (242 | ) | (3,259 | ) | ||||

| Due from related party | (768 | ) | 1,018 | |||||

| Due to related party | (849 | ) | 3,337 | |||||

| Other assets | (665 | ) | (229 | ) | ||||

| Operating lease liabilities | (1,738 | ) | (1,782 | ) | ||||

| Accounts payable | (920 | ) | 2,920 | |||||

| Employee compensation | 701 | (551 | ) | |||||

| Other liabilities | 362 | 970 | ||||||

| Deferred revenue | 3,005 | (90 | ) | |||||

| Manufacturing warranty obligation | 34 | 163 | ||||||

| Advance payments from customers | (3,767 | ) | 4,338 | |||||

| Accrued expense and other current liabilities | (274 | ) | 1,071 | |||||

| Net cash (used in) provided by operating activities | (4,144 | ) | 5,192 | |||||

| Cash flows from investing activities: | ||||||||

| Purchases of property and equipment | (536 | ) | (202 | ) | ||||

| Net cash used in investing activities | (536 | ) | (202 | ) | ||||

| Cash flows from financing activities: | ||||||||

| Proceeds from reverse recapitalization | - | 899 | ||||||

| Proceeds from issuance of common stock and warrants, net of issuance costs | 3,911 | - | ||||||

| Proceeds from issuance of convertible debt, net of issuance costs | 3,109 | - | ||||||

| Payments on convertible debt | (471 | ) | - | |||||

| Payments on related party notes payable | (3,156 | ) | (5,844 | ) | ||||

| Net cash provided by (used in) financing activities | 3,393 | (4,945 | ) | |||||

| Effect of currency translation on cash and cash equivalents | 1 | 5 | ||||||

| Net (decrease) increase in cash and cash equivalents | (1,314 | ) | 50 | |||||

| Cash and cash equivalents - beginning of period | 3,225 | 3,175 | ||||||

| Cash and cash equivalents - end of period | $ | 1,939 | $ | 3,225 | ||||

| Supplemental disclosure of cash flow information: | ||||||||

| Interest paid | $ | 298 | $ | 665 | ||||

| Income tax paid | $ | 25 | $ | - | ||||

| Supplemental disclosure of non-cash activity: | ||||||||

| Redemption of convertible note in common stock | $ | 803 | $ | - | ||||

| Settlement of related party receivables and payables | $ | 1,455 | $ | - | ||||

| Out of period adjustment related to reverse recapitalization (Note 2) | $ | 710 | $ | - | ||||

| Accounts payable settled through escrow account upon reverse recapitalization | $ | - | $ | 1,439 | ||||