VANCOUVER, British Columbia, Oct. 21, 2025 (GLOBE NEWSWIRE) -- Anfield Energy Inc. (TSX.V: AEC; NASDAQ: AEC; FRANKFURT: 0AD) ("Anfield" or "the Company") is pleased to announce the completion of a 20-hole, 8,000-foot confirmation drill program at its JD-7 mine, one of the five mines (JD5, JD-6, JD-7, JD-8 and JD-9) which make up the Company's Paradox Mine Complex. The drill results will be incorporated into a new uranium and vanadium resource report in Q1/26, alongside the additional drilling to be completed at the other JD mines.

Significant intercepts of mineralization from the program include:

- 17.0 ft grading an average of 5,190 ppm (0.519%) eU3O8 in Hole JD7-25-004B, with a peak of 14,850 ppm (1.485%) eU3O8 at 153.5 ft;

- 19.0 ft grading an average of 2,380 ppm (0.238%) eU3O8 in Hole JD7-25-005, with a peak of 9,240 ppm (0.924%) eU3O8 at 170.0 ft;

- 17.0 ft grading an average of 1,620 ppm (0.162%) eU3O8 in Hole JD7-25-012, with a peak of 5,990 ppm (0.599%) eU3O8 at 185.0 ft; and

- 21.0 ft grading an average of 2,500 ppm (0.250%) eU3O8 in Hole JD7-25-014B, with a peak of 7,770 ppm (0.777%) eU3O8 at 212.5 ft.

Corey Dias, Anfield's CEO, commented: "We are very pleased with the drill results as they not only underscore the potential for resource confirmation and possible expansion at JD-7 but also align with Anfield's broader strategy to advance its portfolio of near-term uranium and vanadium projects toward production. To that end, the creation of the Paradox Mine Complex reflects our plans to create specific targeted uranium and vanadium production centers as we advance these grouped assets through mine planning and, ultimately, production through Anfield's Shootaring Canyon mill.

Following the success of the Company's drill program at JD-7, Anfield will commence underground drilling at its remaining JD mines, after which the Company will aim to issue an updated uranium resource for the Paradox Mine Complex which will now also incorporate the more-recently acquired JD-5 mine."

Drill program results

Drilling commenced on September 15th, 2025, and preliminary downhole gamma results have been highly encouraging. A total of 23 drill holes were performed over the 20 planned drilling targets. All drilling activities were completed on October 9th, 2025, with reclamation activities ongoing to date. A total of 7,564 ft of drilling was performed of which 149 ft was performed by split barrel coring and the remainder was air rotary.

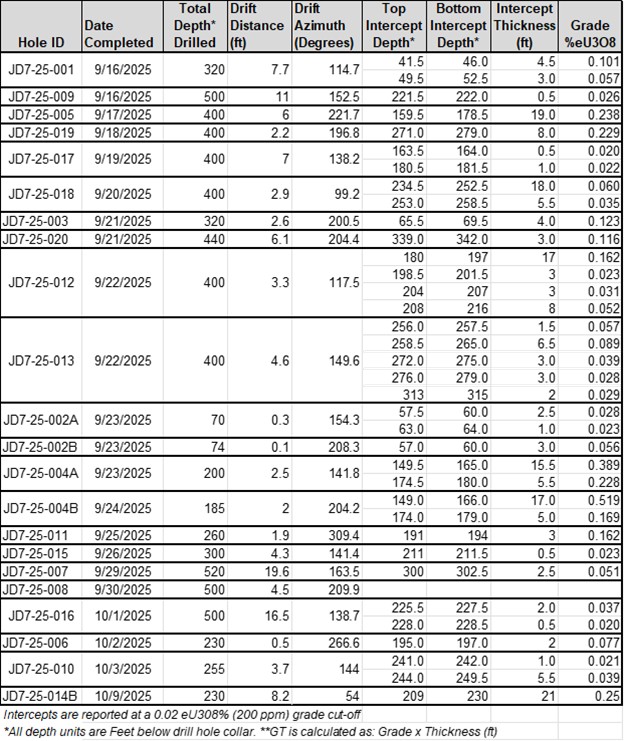

Drill hole results including Depth, Thickness and Grade, as determined by downhole geophysical logging, are shown on Figure 1. Uranium grade is reported as equivalent weight per cent. For sandstone hosted uranium the Grade Thickness product (GT) is commonly used as an indication of the intensity of mineralization. Gamma ray logging results indicate elevated uranium mineralization exceeding the typical minimum cutoff grade of 0.02 %eU3O8 (200 ppm) eU3O8 and minimum Grade Thickness (GT) of 0.2 in 15 of the 23 drill holes completed. These findings verify the presence of uranium mineralization at depths and locations consistent with the historical drilling dataset for the JD-7 mine.

The drilling results demonstrate robust uranium mineralization across the targeted areas, with eleven holes yielding a Grade Thickness (GT) over 0.5, indicating high-potential zones; six holes showing GT values between 0.1 and 0.5, reflecting moderate mineralization; five holes containing only trace mineralization, and one drill hole containing no mineralization over the 0.02% eU3O8 grade cutoff. The lower-strength intercepts are associated with the program's objective to delineate the outer boundaries of the mineralization, providing valuable data for refining resource models and supporting future mine planning and development at JD-7.

Next steps include obtaining assay of the core sample for closed can (radiometric) and chemical uranium and vanadium grades. This data will be used along with correlation to downhole geophysical logging to assess radiometric equilibrium and to verify the vanadium to uranium ratio (V:U).

The verification of the historic drill data, confirmation of radiometric equilibrium and verification of the vanadium uranium ratio will allow re-assessment of the uranium and associated vanadium mineral resources at JD-7. The drill results will provide a higher level of confidence in the uranium and vanadium resource estimates.

Figure 1: Drill results

Split barrel core intervals were obtained from 5 of the 23 drill holes at 5 of the 20 planned drilling locations. These corings will be employed to provide physical samples of mineralized material. Cored intervals were completed using split-barrel core aimed at drilling through the mineralized zones. Four of the five cored locations intercepted mineralization above the minimum grade cutoff.

The core samples were analyzed by two arms-length laboratories: Pace Analytical of Sheridan, Wyoming and Hazen Research of Golden, Colorado. These labs used chemical methods to: 1) determine both uranium and vanadium content to evaluate the vanadium-to-uranium ratio of the mineralization; 2) to provide data to validate the uranium gamma ray logging results; and 3) further refine the uranium and vanadium resource estimates for JD-7 lease. The cores can also be used for mineralogical and metallurgical testing. This data will enhance the accuracy of the geological model and supports Anfield's efforts to advance the project toward production readiness.

Qualified Persons

Douglas L. Beahm, P.E., P.G., principal engineer at BRS Inc., is a Qualified Person as defined in NI 43-101 and has reviewed and approved the technical content of this news release.

About Anfield

Anfield is a uranium and vanadium development company that is committed to becoming a top-tier energy-related fuels supplier by creating value through sustainable, efficient growth in its assets. Anfield is a publicly traded corporation listed on the NASDAQ (AEC-Q), the TSX-Venture Exchange (AEC-V) and the Frankfurt Stock Exchange (0AD).

On behalf of the Board of Directors

ANFIELD ENERGY INC.

Corey Dias, Chief Executive Officer

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Contact:

Anfield Energy, Inc.

Corporate Communications

604-669-5762

contact@anfieldenergy.com

www.anfieldenergy.com

Safe Harbor Statement

THIS NEWS RELEASE CONTAINS "FORWARD-LOOKING STATEMENTS" and "FORWARD-LOOKING INFORMATION" WITHIN THE MEANING OF APPLICABLE SECURITIES LEGISLATION (COLLECTIVELY, "FORWARD-LOOKING STATEMENTS"). STATEMENTS IN THIS NEWS RELEASE THAT ARE NOT PURELY HISTORICAL ARE FORWARD-LOOKING STATEMENTS AND INCLUDE ANY STATEMENTS REGARDING BELIEFS, PLANS, EXPECTATIONS OR INTENTIONS REGARDING THE FUTURE. FORWARD-LOOKING STATEMENTS IN THIS PRESS RELEASE INCLUDE, WITHOUT LIMITATION, STATEMENTS RELATING TO THE TIMING OF COMPLETION OF THE DRILL PROGRAM.

EXCEPT FOR THE HISTORICAL INFORMATION PRESENTED HEREIN, MATTERS DISCUSSED IN THIS NEWS RELEASE CONTAIN FORWARD-LOOKING STATEMENTS THAT ARE SUBJECT TO CERTAIN RISKS AND UNCERTAINTIES THAT COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM ANY FUTURE RESULTS, PERFORMANCE OR ACHIEVEMENTS EXPRESSED OR IMPLIED BY SUCH STATEMENTS. STATEMENTS THAT ARE NOT HISTORICAL FACTS, INCLUDING STATEMENTS THAT ARE PRECEDED BY, FOLLOWED BY, OR THAT INCLUDE SUCH WORDS AS "ESTIMATE," "ANTICIPATE," "BELIEVE," "PLAN" OR "EXPECT" OR SIMILAR STATEMENTS ARE FORWARD-LOOKING STATEMENTS. RISKS AND UNCERTAINTIES FOR THE COMPANY INCLUDE, BUT ARE NOT LIMITED TO, THE RISKS ASSOCIATED WITH MINERAL EXPLORATION AND FUNDING AS WELL AS THE RISKS SHOWN IN THE COMPANY'S MOST RECENT ANNUAL AND QUARTERLY REPORTS AND FROM TIME-TO-TIME IN OTHER PUBLICLY AVAILABLE INFORMATION REGARDING THE COMPANY. OTHER RISKS INCLUDE RISKS ASSOCIATED FUTURE CAPITAL REQUIREMENTS AND THE COMPANY'S ABILITY AND LEVEL OF SUPPORT FOR ITS EXPLORATION AND DEVELOPMENT ACTIVITIES. THERE CAN BE NO ASSURANCE THAT THE COMPANY'S EXPLORATION EFFORTS WILL SUCCEED OR THE COMPANY WILL ULTIMATELY ACHIEVE COMMERCIAL SUCCESS. THESE FORWARD-LOOKING STATEMENTS ARE MADE AS OF THE DATE OF THIS NEWS RELEASE, AND THE COMPANY ASSUMES NO OBLIGATION TO UPDATE THE FORWARD-LOOKING STATEMENTS, OR TO UPDATE THE REASONS WHY ACTUAL RESULTS COULD DIFFER FROM THOSE PROJECTED IN THE FORWARD-LOOKING STATEMENTS. ALTHOUGH THE COMPANY BELIEVES THAT THE BELIEFS, PLANS, EXPECTATIONS AND INTENTIONS CONTAINED IN THIS NEWS RELEASE ARE REASONABLE, THERE CAN BE NO ASSURANCE THOSE BELIEFS, PLANS, EXPECTATIONS OR INTENTIONS WILL PROVE TO BE ACCURATE. INVESTORS SHOULD CONSIDER ALL OF THE INFORMATION SET FORTH HEREIN AND SHOULD ALSO REFER TO THE RISK FACTORS DISCLOSED IN THE COMPANY'S PERIODIC REPORTS FILED FROM TIME-TO-TIME.

THIS NEWS RELEASE HAS BEEN PREPARED BY MANAGEMENT OF THE COMPANY WHO TAKES FULL RESPONSIBILITY FOR ITS CONTENTS.

A table accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/42ef4858-0c61-49f2-b995-9eafa5b4bd40