- LEO revenues up 70.7%1, driving Connectivity growth

- Operating Verticals revenues of €283 million, down 1.2%1

- All financial objectives confirmed

- All resolutions relating to contemplated €1.5 billion capital increase approved by Shareholders

Regulatory News:

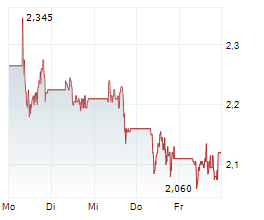

Eutelsat Communications (ISIN: FR0010221234 Euronext Paris London Stock Exchange: ETL) reports revenues for the First Quarter ended 30 September 2025.

In millions | Q1 2024-25 | Q1 2025-26 | Change | |

Reported | Like-for-like2 | |||

Video | 151.8 | 133.6 | -12.0% | -10.5% |

Government Services | 46.4 | 52.4 | 13.0% | 18.5% |

Mobile Connectivity | 42.0 | 34.7 | -17.4% | -12.1% |

Fixed Connectivity | 56.5 | 62.3 | 10.2% | 15.9% |

Connectivity | 144.9 | 149.4 | 3.1% | 8.6% |

o/w LEO | 33.6 | 54.1 | 61.0% | 70.7% |

o/w GEO | 111.3 | 95.3 | -14.4% | -10.1% |

Total Operating Verticals | 296.7 | 283.0 | -4.6% | -1.2% |

Other Revenues | 3.0 | 10.2 | n.a. | n.a |

Total | 299.7 | 293.2 | -2.2% | -0.3% |

EUR/USD exchange rate | 1.09 | 1.16 |

FIRST QUARTER REVENUES3

Total revenues for the First Quarter stood at €293 million, down 2.2% on a reported basis, and stable (-0.3%) like-for-like.

Revenues of the four Operating Verticals (ie, excluding 'Other Revenues') stood at €283 million. They were down 1.2% on a like-for-like basis excluding a negative currency effect of €10 million. Quarter-on-quarter, revenues of the four Operating Verticals were down by 11% like-for-like.

Note: Unless otherwise stated, all variations indicated hereunder are expressed on a like-for-like basis, ie, at constant currency and perimeter.

Video (47% of revenues)

Video revenues amounted to €134 million, down 10.5% year-on-year, reflecting the secular market decline, as well as the negative effect of the latest sanctions imposed on Russian channels, with an impact of c. €16m expected in FY 2025-26.

On a quarter-on-quarter basis, revenues were down by 8.3%, notably reflecting the above-mentioned sanctions.

On the commercial front, Eutelsat secured contract renewals, confirming the 7/8° West video neighbourhood as the leading satellite position in MENA, notably the renewals of its longstanding partnership with key regional player, BHS Telecommunications.

Connectivity (53% of revenues)

First Quarter Connectivity revenues stood at €149.4 million, up 8.6% like-for-like year-on-year. They reflected a 70.7% rise in LEO revenues to €54.1 million, partially offset by a 10.1% decline in GEO revenues.

Quarter-on-quarter revenues were down by 13.2%. This sequential decline was mainly the reflection of an exceptionally high level of LEO terminal sales in Q4 2024-25 across all three verticals. LEO revenues were down 20.1%, reflecting the above-mentioned terminal sales as well as catch-up revenues recorded in Q4 FY25.

Fixed Connectivity

Fixed Connectivity revenues stood at €62 million, up 15.9% year-on-year, reflecting continuing growth in LEO services. Revenues were impacted by the cessation of revenue recognition from TIM on KONNECT-VHTS since January 2025.

On a quarter-on-quarter basis, revenues were down by 6%. This reflected in particular more challenging conditions for GEO-enabled solutions.

On the commercial front, Eutelsat signed a strategic partnership agreement with Tussas, Greenland's national provider of telecommunications services, to deliver secure and resilient communications across the territory. Elsewhere, Eutelsat and Nelco (part of the Tata Group) signed an agreement to deliver OneWeb low Earth orbit satellite connectivity services across India.

Government Services

Government Services revenues stood at €52 million, up 18.5% year-on-year. This rise reflected the growing demand LEO-enabled connectivity solutions for governmental applications, notably with services delivered in Ukraine.

On a quarter-on-quarter basis, revenues were down 17%, reflecting mainly the above-mentioned terminal impact.

Mobile Connectivity

Mobile Connectivity revenues stood at €35 million, down 12.1% year-on-year. They mainly reflected lower GEO revenues as well as the non-recurrence of a one-off contract in aviation for c.€3 million in Q1 FY 2024-25.

On a quarter-on-quarter basis, revenues were down by 19%, reflecting revenue catch-up in Q4 FY25, and a slowdown in GEO in addition to the above-mentioned terminal impact.

Other Revenues

'Other Revenues' amounted to €10 million in the First Quarter versus €3 million a year earlier and €12 million in the Fourth Quarter of FY 2024-25. They included a €5 million positive impact from hedging operations in the First Quarter as well as revenue recognition from IRIS2 related to Eutelsat's involvement as Consortium System Development Prime.

BACKLOG

The backlog stood at €3.5 billion at 30 September 2025, stable versus end-June 2025. It was equivalent to 2.8 times FY 2024-25 revenues, with Connectivity representing 58% of the total.

30 Sep 2024 | 30 Jun 2025 | 30 Sep 2025 | |

Value of contracts (in billions of euros) | 3.9 | 3.5 | 3.5 |

In years of annual revenues | 3.2 | 2.8 | 2.8 |

Share of Connectivity | 55% | 57% | 58% |

Note: The backlog represents future revenues from capacity or service agreements and can include contracts for satellites under procurement. Managed services are not included in the backlog.

OUTLOOK AND FINANCIAL TARGETS

The First Quarter performance was in line with our expectations enabling us to confirm our FY 2025-26 financial objectives4

- Revenues of the four operating verticals in line with the level of FY 2024-25.

- LEO revenues to grow by 50% year-on-year.

- Adjusted EBITDA margin slightly below the level of FY 2024-25.

Gross capital expenditure is expected in a range of €1.0-1.1 billion.

Following the contemplated capital increases announced in June 2025 and due to be completed by the end of calendar 2025, Net Debt/ Adjusted EBITDA is estimated at c.2.5x5 by year-end FY 2025-26.

Our longer-term objectives are also confirmed:

- Revenues of the four operating verticals between €1.5 and €1.7 billion6 by the end of FY 2028-29, with LEO revenues significantly outperforming the market.

- Operating leverage driving a mid-to-high single-digit percentage point improvement in the EBITDA margin7, resulting in a margin of at least 60% by FY 2028-29.

In the longer term (post FY 2028-29), the B2B connectivity market is expected to pursue its growth at a double-digit rate, mostly driven by LEO market expansion.

Note: Financial objectives assume: (i) no additional impact on revenues due to sanctions imposed on channels broadcast on the group's fleet (ii) the nominal launch and entry into operation of satellites in course of construction in accordance with the timetable envisaged by the Group; (iii) no incidents affecting any of the satellites in-orbit.

CORPORATE GOVERNANCE

The General Shareholders' Meeting held on 30th September 2025 approved all of the resolutions submitted for approval.

Ordinary Resolutions

The General Meeting ratified and confirmed the following appointments to the Board of Directors:

- 1st resolution: Ratification of the appointment of Mr. Michel Combes as Director of the Company.

- 2nd resolution: Ratification of the appointment of Ms. Lucia Sinapi-Thomas as Director of the Company.

- 3rd resolution: Ratification of the appointment of Mr. Eric Labaye as Director of the Company.

- 4th resolution: Appointment of Mr. Jean-Baptiste Massignon as Director of the Company, subject to the satisfaction of conditions precedent.

- 5th resolution: Appointment of Mr. Jérémie Gué as Director of the Company, subject to the satisfaction of conditions precedent.

Extraordinary Resolutions

The General Meeting approved the following resolutions:

- 6th and 7th resolutions: Delegation of authority to the Board of Directors to issue ordinary shares in the Company, without preferential subscription rights for existing shareholders, for the benefit of the French State for a total nominal amount of €137,685,395, and waiver of shareholders' preferential subscription rights in favor of the French State.

- 8th and 9th resolutions: Delegation of authority to the Board of Directors to issue ordinary shares in the Company, without preferential subscription rights for existing shareholders, for the benefit of Bharti Space Limited for a total nominal amount of €7,467,500, and waiver of shareholders' preferential subscription rights in favor of Bharti Space Limited.

- 10th and 11th resolutions: Delegation of authority to the Board of Directors to issue ordinary shares in the Company, without preferential subscription rights for existing shareholders, for the benefit of the Secretary of State for Science, Innovation and Technology (the "UK Government") for a total nominal amount of €22,537,105, and waiver of shareholders' preferential subscription rights in favor of the UK Government.

- 12th and 13th resolutions: Delegation of authority to the Board of Directors to issue ordinary shares in the Company, without preferential subscription rights for existing shareholders, for the benefit of CMA CGM Participations for a total nominal amount of €24,955,000, and waiver of shareholders' preferential subscription rights in favor of CMA CGM Participations.

- 14th and 15th resolutions: Delegation of authority to the Board of Directors to issue ordinary shares in the Company, without preferential subscription rights for existing shareholders, for the benefit of the Fonds Stratégique de Participations for a total nominal amount of €14,355,000, and waiver of shareholders' preferential subscription rights in favor of the Fonds Stratégique de Participations.

- 16th resolution: Delegation of authority to the Board of Directors to issue ordinary shares in the Company, maintaining shareholders' preferential subscription rights.

- 17th resolution: Restating of the overall cap on capital increases and the overall cap on debt security issuance provided for in paragraphs 4 and 5 of the 18th resolution of the general shareholders' meeting held on 23 November 2023.

- 18th resolution: Authorization for the Board of Directors to increase the number of shares to be issued in the event of a capital increase with or without preferential subscription rights, decided pursuant to the 16th resolution of this General Shareholders' Meeting.

- 19th resolution: Delegation of authority to the Board of Directors to increase the Company's share capital by issuing ordinary shares and/or securities giving immediate and/or future entitlement to the Company's share capital, with waiver of shareholders' preferential subscription rights, reserved for members of a Company or Group savings plan.

- 20th resolution: Allocation of the deficit "Retained Earnings" account to the reserves' account and share capital reduction resulting from losses, by reducing the nominal value of shares; delegation of powers to the Board of Directors to carry out the share capital reduction.

The full results of the votes on each resolution are available on the Company's website in accordance with applicable legal and regulatory requirements.

First Quarter 2025-26 revenues conference call webcast

A conference call webcast will be held on Tuesday, 21 October at 18:30 CET.

Please register here to access the webcast presentation

(replay will be available on same link)

Or register here for the conference call.

Financial calendar

Note: The financial calendar is provided for information purposes only. It is subject to change and will be regularly updated.

- 20 November 2025: Annual General Shareholders' Meeting

- 13 February 2026: First Half 2025-26 results

About Eutelsat Communications

Eutelsat is a global leader in satellite communications, delivering connectivity and broadcast services worldwide. Eutelsat was formed through the combination of the Company and OneWeb in 2023, becoming the first fully integrated GEO-LEO satellite operator with a fleet of 34 Geostationary (GEO) satellites and a Low Earth Orbit (LEO) constellation of more than 600 satellites. Eutelsat addresses the needs of customers in four key verticals of Video, where it distributes around 6,400 television channels, and the high-growth connectivity markets of Mobile Connectivity, Fixed Connectivity, and Government Services. Eutelsat's unique suite of in-orbit assets and ground infrastructure enables it to deliver integrated solutions to meet the needs of global customers. The Company is headquartered in Paris and Eutelsat employs more than 1,600 people across more than 75 countries. Eutelsat is committed to delivering safe, resilient, and environmentally sustainable connectivity to help bridge the digital divide. The Company is listed on the Euronext Paris Stock Exchange (ticker: ETL) and the London Stock Exchange (ticker: ETL).

Find out more at www.eutelsat.com

Disclaimer

The forward-looking statements included herein are for illustrative purposes only and are based on management's views and assumptions as of the date of this document.

Such forward-looking statements involve known and unknown risks. For illustrative purposes only, such risks include but are not limited to: risks related to the health crisis; operational risks related to satellite failures or impaired satellite performance, or failure to roll out the deployment plan as planned and within the expected timeframe; risks related to the trend in the satellite telecommunications market resulting from increased competition or technological changes affecting the market; risks related to the international dimension of the Group's customers and activities; risks related to the adoption of international rules on frequency coordination and financial risks related, inter alia, to the financial guarantee granted to the Intergovernmental Organization's closed pension fund, and foreign exchange risk.

Eutelsat Communications expressly disclaims any obligation or undertaking to update or revise any projections, forecasts or estimates contained in this document to reflect any change in events, conditions, assumptions, or circumstances on which any such statements are based, unless so required by applicable law.

The information contained in this document is not based on historical fact and should not be construed as a guarantee that the facts or data mentioned will occur. This information is based on data, assumptions and estimates that the Group considers as reasonable.

APPENDIX

Quarterly Reported revenues

The table below shows quarterly reported revenues.

In millions | Q1 | Q2 | Q3 | Q4 | FY | Q1 |

2024-25 | 2024-25 | 2024-25 | 2024-25 | 2024-25 | 2025-26 | |

Video | 151.8 | 157.4 | 151.7 | 147.3 | 608.2 | 133.6 |

Government Services | 46.4 | 50.1 | 49.5 | 65.0 | 211.0 | 52.4 |

Mobile Connectivity | 42.0 | 33.3 | 39.7 | 44.7 | 159.7 | 34.7 |

Fixed Connectivity | 56.5 | 62.3 | 59.7 | 68.8 | 247.3 | 62.3 |

Connectivity | 144.9 | 145.7 | 148.9 | 178.5 | 618.1 | 149.4 |

o/w LEO | 33.6 | 40.3 | 42.3 | 70.5 | 186.8 | 54.1 |

o/w GEO | 111.3 | 105.4 | 106.7 | 107.9 | 431.3 | 95.3 |

Total Operating Verticals | 296.7 | 303.2 | 300.6 | 325.7 | 1,226.3 | 283.0 |

Other Revenues | 3.0 | 3.3 | -0.7 | 11.8 | 17.5 | 10.2 |

Total | 299.7 | 306.5 | 300.0 | 337.5 | 1,243.7 | 293.2 |

1 Like-for-like change at constant currency and perimeter.

2 Change at constant currency and perimeter. The variation is calculated as follows: i) Q1 FY 2025-26 USD revenues are converted at Q1 2024-25 rates; ii) Hedging revenues are excluded. There is no perimeter effect in the first quarter.

3 The share of each application as a percentage of total revenues is calculated excluding "Other Revenues".

4 Before impact from passive ground segment partial disposal.

5 After impact from passive ground segment partial disposal of €0.5bn.

6 Data at eur/usd rate of 1.12x and After impact from passive ground segment partial disposal.

7 Including an estimated annualized adjusted EBITDA impact of €(75-80)m due to passive ground segment partial disposal

View source version on businesswire.com: https://www.businesswire.com/news/home/20251021850584/en/

Contacts:

Media enquiries

Joanna Darlington

Tel. +33 674 521 531

joanna.darlington@eutelsat.net

Anita Baltagi

Tel. +33 643 930 178

anita.baltagi@eutelsat.net

Katie Dowd

Tel. +1 202 271 2209

katie.dowd@eutelsat.net

Investors

Joanna Darlington

Tel. +33 674 521 531

joanna.darlington@eutelsat.net

Hugo Laurens-Berge

Tel. +33 670 80 95 58

hugo.laurens-berge@eutelsat.net